Borrow

Case Study

Podcasts

Awards

About

With the announcement that UK inflation fell to a 15-month low of 7.9% in June, shares in UK property groups and housebuilders surged as investors predict mortgage rates will rise less than previously expected. In our latest blog, CrowdProperty comments on the recent activity in the economy and property market – and the outlook for both.

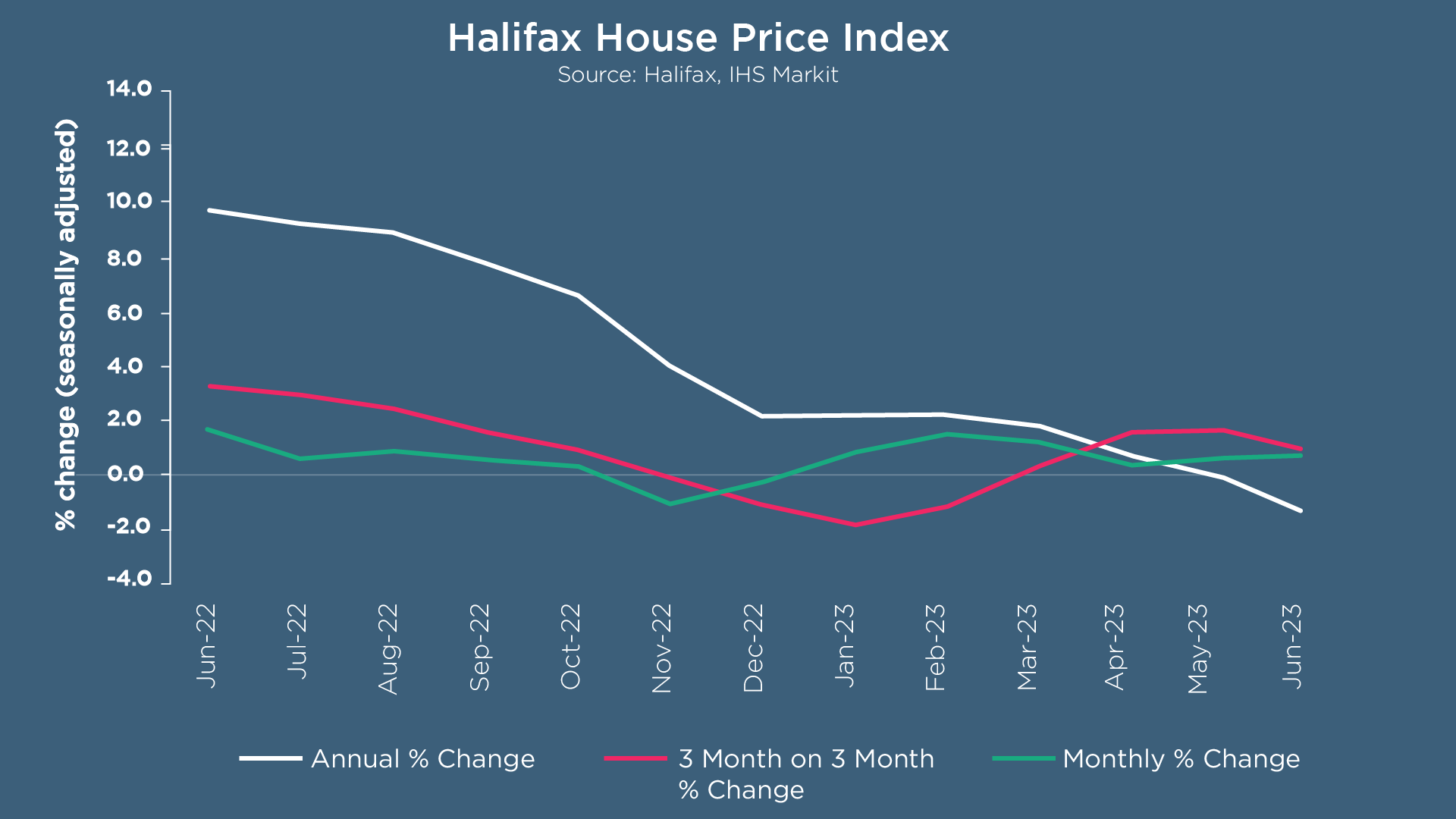

The latest Halifax House Price Index reports that average house prices fell by -0.1% in June, with a typical UK property now costing £285,932 versus a peak of £293,992 last August. The annual rate of house price growth fell to -2.6%, the largest year-on-year decrease since June 2011. According to Halifax, this rate of decline largely reflects the impact of historically high house prices during last summer, when annual growth peaked at +12.5% in June 2022.

Average house prices are falling on an annual basis across most of the UK, with the exception of the West Midlands (+1.5%), Yorkshire & Humber (+0.2%) and Northern Ireland (+0.2%). The South of England continues to face the most downward pressure: the -3.0% annual fall in the South East was the largest since July 2011. Similarly, London recorded a annual decline of -2.6%, its weakest performance since October 2009. Wales saw the nation’s first year-on-year fall since March 2013 (-1.8%); meanwhile, Scotland experienced the first annual contraction in property prices in the last three years (-0.1%).

The housing market remains sensitive to volatility in borrowing costs. Concerns about persistent inflation have led to a significant increase in the cost of funding, causing a jump in average mortgage rates over the last month. Kim Kinnaird, Director at Halifax Mortgages, said: “The resulting squeeze on affordability will inevitably act as a brake on demand, as buyers consider what they can realistically afford to offer. While there’s always a lag effect when rates go up, many existing mortgage holders with variable deals or rolling off fixed rates will likely face an increase in the next year.

“The recently announced Mortgage Charter provides important reassurance that mortgage holders have a range of options if they’re concerned about making repayments, and that lenders will be flexible when supporting anyone in difficulty. Extended terms, affordable repayment plans and alternative fixed rate deals are among the choices for existing borrowers seeking to mitigate the impact of higher interest rates.”

The responses to June’s RICS UK Residential Market Survey also suggest that rising interest rate expectations are placing renewed downward pressure on housing market activity. Indicators on new buyer enquiries and agreed sales slipped deeper into negative territory - buyer demand reached an eight month low, with the national net balance falling from -20% last month to -45% in June; the net balance for newly agreed sales fell to -34%, notably weaker than the -8% recorded in the previous month and the most downbeat figure since December 2022. Looking ahead, sales expectations have deteriorated for both the three- and twelve-month view. This brings to an end a three-month run of largely stable sales expectations for the year ahead, adding further evidence of the negative impact of rising interest rate expectations on market sentiment.

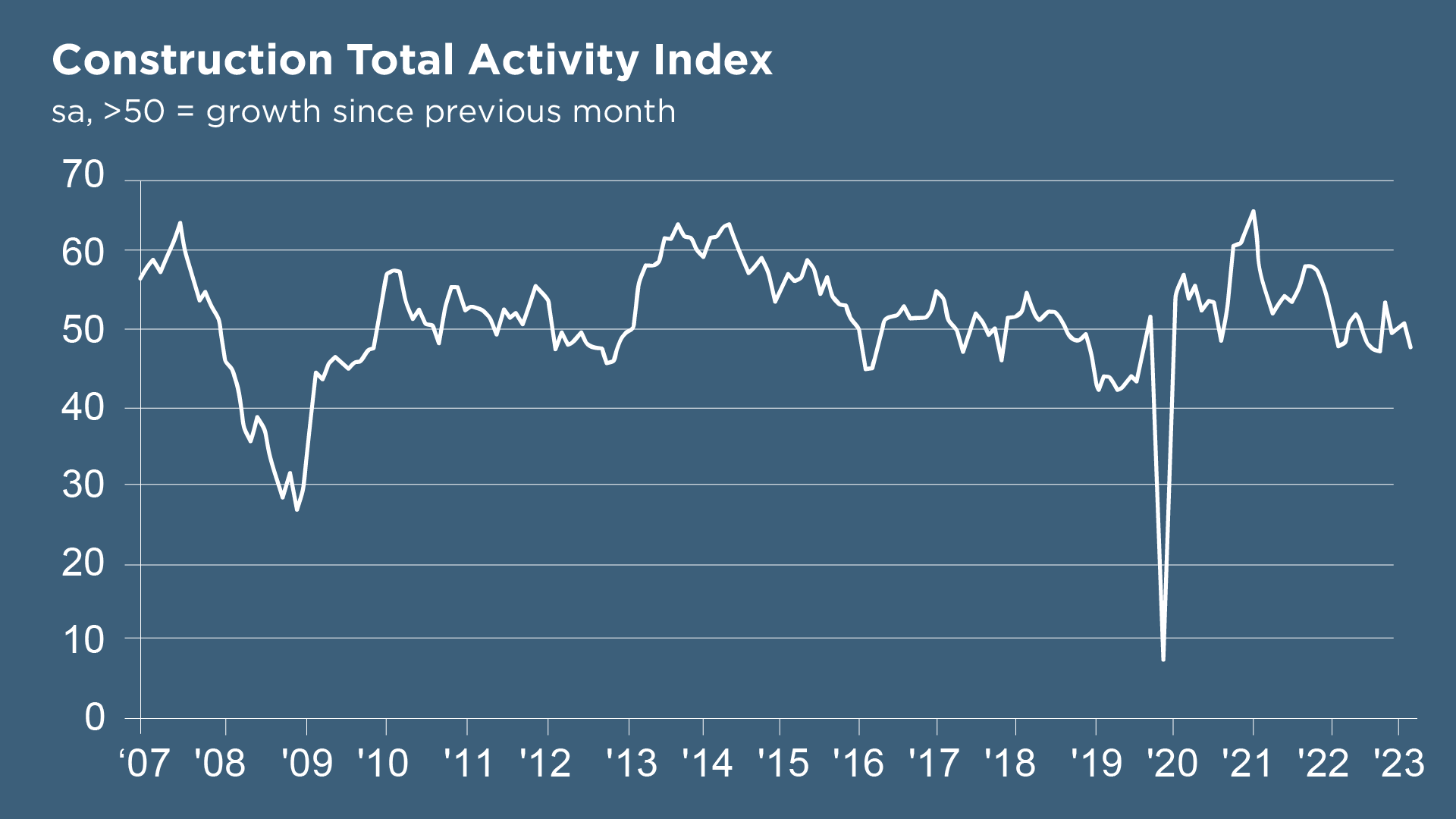

“A steep and accelerated downturn in house building” was cited as a key factor in the fall in overall construction output for the first time in five months, according to the S&P Global / CIPS UK Construction PMI. Residential work (index at 39.6) declined at the fastest pace since May 2020, with respondents commenting on weaker demand due to rising borrowing costs and a subdued outlook for the housing market. Civil engineering was the best-performing segment (index at 53.1) and commercial building also expanded in June (index at 53.0).

A slump in house prices is not expected despite the decline in demand. Thomas Pugh, economist at RSM UK, cites three key reasons why house prices are unlikely to fall:

- higher interest rates will be partially offset by an easing in the cost-of-living crisis as inflation falls back rapidly over the rest of the year – enabling households’ real incomes to start growing again;

- the labour market is likely to stay tight with unemployment rates probably rising over the rest of the year but not surging - meaning there is unlikely to be a wave of forced selling; and

- the drop in housebuilding as noted by the construction PMI means the supply of new housing is constrained – “given the chronic shortage of homes in the UK, this structural imbalance is unlikely to allow large falls in prices”.

New order volumes decreased for the first time since January, with subdued demand linked to the impact of rising rates on house building projects and concerns about the general economic outlook. This softer demand and rising stocks meant that vendor performance was the strongest for c. 14 years – with shortened delivery times and improved availability of inputs. June data regarding overall input pricing signals the first outright reduction in average cost burdens since January 2010. Construction companies noted lower fuel, steel and timber prices, alongside more competitive market conditions in response to falling demand.

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply (CIPS), commented: "The construction sector became rooted in contraction territory in June as interest rate rises and squeezed affordability rates impacted on residential building output which fell to its greatest extent since 2009 outside the pandemic years.

"Looking ahead, there were few reasons to be cheerful as optimism fell to its lowest since January. A large blot on the landscape was the fall in employment growth. With interest rates at the highest for 15 years and inflation four times over the Bank of England target, the sudden reduction in construction sector hiring is one of the red flags facing the UK economy at the moment."

The latest figures from the Office for National Statistics (ONS) report that inflation has fallen from 8.7% in May to 7.9% in June. This is below the 8.2% predicted by a Reuters poll of economists and ends a four-month run during which inflation outstripped forecasts. The ONS revealed that the headline rate of increase had “slowed substantially” to its lowest annual level since March 2022. ‘Core’ inflation (excluding energy, food, alcohol and tobacco) fell slightly to 6.9% in June. Falling prices for motor fuel led to the largest downward contribution to the monthly change in CPIH and CPI annual rates; food price inflation eased slightly but remains high (from 18.7% in May to 17.3% in June).

Markets are now predicting a 60% probability that the Bank of England will increase the benchmark rate from 5% to 5.25% in August. Representatives of the Monetary Policy Committee have cautioned that inflation remains much too high, with concerns around wage growth and labour market tightness. Despite this, shares in UK property groups and housebuilders surged as investors concluded that mortgage rates would now also rise less than they previously expected.

Whilst the easing inflation rates may appear to bring welcome news for both Rishi Sunak and those struggling with the cost of living crisis, the latest housing statistics from the ONS paint a different picture. Private rents rose faster last month than they have since records began in January 2016. The cost of renting rose 5.8% in Wales, 5.5% in Scotland and 5.1% in England in the 12 months to June 2023. With housing costs usually accounting for the largest part of people’s monthly outlay, sharp increases have a significant impact on budgets. Following regulatory changes and the impact of interest rate rises over the last 18 months on mortgage rates, the increase in rents is understood to be a direct result of landlords’ inability to continue absorbing their own rising costs. The RICS UK Residential Market Survey reported +40% of respondents saw an increase in tenant demand during June whilst landlord instructions sunk to -36%, the most negative reading since May 2020. With rising demand and weakening supply, +53% of contributors anticipate rental prices being driven higher over the near-term. Zoopla’s latest Rental Market Report reveals that rental inflation continued to register double digit growth for the 15th month in a row. With rents growing faster than earnings since October 2021, rental affordability pressures are set to continue unless supply increases or demand weakens. This seems unlikely given rising mortgage rates impacting first time buyers, the strength of the labour market, high immigration and the start of the busiest period for rental demand - between July and September.

Whilst rumours of a ‘landlord exodus’ have been rife, Zoopla’s sales data continues to show a steady, constant flow of private landlords selling up – which has been the case since 2018 and is not accelerating. At the same time, there remains continued new investment in rented homes from corporate and institutional landlords. The net result is no change in the number of private rented homes since 2016.

For those who continue to invest, 58% of RICS survey participants note that homes with better energy efficiency credentials are holding their value in the current market. Similarly, for those looking to exit, 34% of respondents reported seeing greater interest from buyers in homes that are more energy efficient. As the nation becomes increasingly environmentally conscious, new-build developers are now looking beyond energy performance to also consider carbon emissions. The Climate Change Committee states that all buildings in the UK are the second highest contributor to carbon emissions, with residential properties making up a large proportion of this. According to the July Watt a Save Report from the Home Builders Federation, the average new-build property consumes 55% less energy – cutting energy bills by £135 a month and reducing carbon emissions by 60%. With 247,000 new-build homes issued with an EPC in the year to 31 March 2023, last year’s new-build homeowners helped to reduce emissions by a collective 500,000 tonnes, compared to if they had been built to the same standards as the average older property. As improved energy efficiency is embedded from the point of design through to construction, with the ability to use modern building practices, technologies and materials, new-build homes have long been considered a cheaper and more environmentally friendly option.

With changes to building regulations regarding the energy performance of buildings, research from the Home Builders Federation found that homes built to these standards will emit 71% less carbon than the average older property. In 2025, the Future Homes Standard is due to come into force which will require new homes to reduce carbon emissions by a further 75% to 80% on current building regulations. Therefore, homes built from 2023 will emit 29% of the amount of carbon of the average exiting property and homes built from 2025 will emit just 10%.

The above considerations are worth keeping in mind as insights from our Spring Property Developer & Investor Index show developers expect to continue with projects in spite of headwinds, with the majority having significant medium term growth ambitions. We expect concerns over inflation, the impact of a recession and Bank of England base rates among developers and investors to remain the same despite recent economic reports.

At CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership. As such, our team of property experts continues to actively visit sites to discuss project progress and offer input on any barriers which need to be overcome:

CrowdProperty is a leading specialist property development finance business having funded over £720m worth of property projects to date. With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means that we understand what developers are looking to achieve and help those developers succeed. Apply in just 5 minutes at www.crowdproperty.com/apply - our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

As featured in...