Borrow

Case Study

Podcasts

Awards

About

As inflation rates start to drop significantly, a number of other economic factors continue to influence the Monetary Policy Committee’s decisions on increasing interest rates. In our latest blog, CrowdProperty comments on the impact for house building, house buying and the housing market.

The price of property

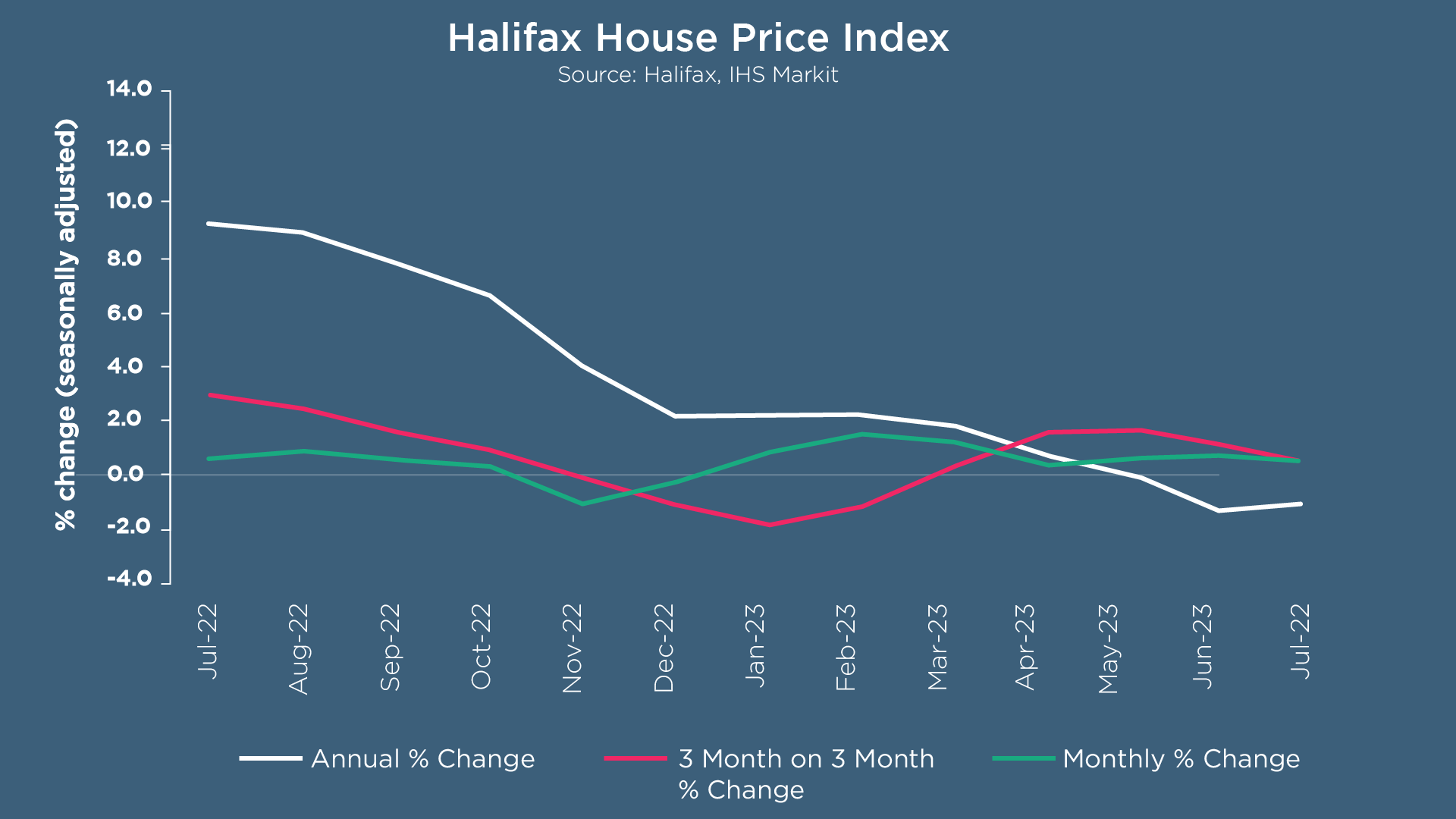

Average UK house prices have decreased for a fourth consecutive month according to Halifax’s latest House Price Index, falling by -0.3% in July. House prices dropped by -2.4% on an annual basis last month, with a typical property now costing £285,044. Whilst this may seem a far cry from the £293,992 peak of last August, there has been little change in pricing over the last six months – with the average price for February 2023 recorded as £285,660.

The West Midlands was the only exception to the nationwide fall in house prices, with the cost of residential property remaining effectively flat (+0.0%). Southern England experienced the most downward pressure on property prices, with the largest reductions in the South East (-3.9%) and Greater London (-3.5%) over the last year. Despite seeing some of the most rapid growth in house prices during the pandemic, Wales also saw a drop of -3.3% in house prices on an annual basis.

The market continues to show resilience despite economic headwinds, with industry data showing increased activity. Many first-time buyers are continuing their purchasing plans, with indications that some are now searching for smaller homes in order to offset higher borrowing costs. However, the buy-to-let sector appears to be under pressure as landlords consider the impact of elevated interest rates and future rental market reforms on their businesses.

Kim Kinnaird, Director at Halifax Mortgages, said: “Expectations of further Base Rate increases from the Bank of England were tempered by a better-than-expected inflation report for June. However, while there have been recent signs of borrowing costs stabilising or even falling, they will likely remain much higher than homeowners have become used to over the last decade.

“The continued affordability squeeze will mean constrained market activity persists, and we expect house prices to continue to fall into next year. Based on our current economic assumptions, we anticipate that being a gradual rather than a precipitous decline. And one that is unlikely to fully reverse the house price growth recorded over recent years, with average property prices still some £45,000 (+19%) above pre-Covid levels.”

Construction sector summary

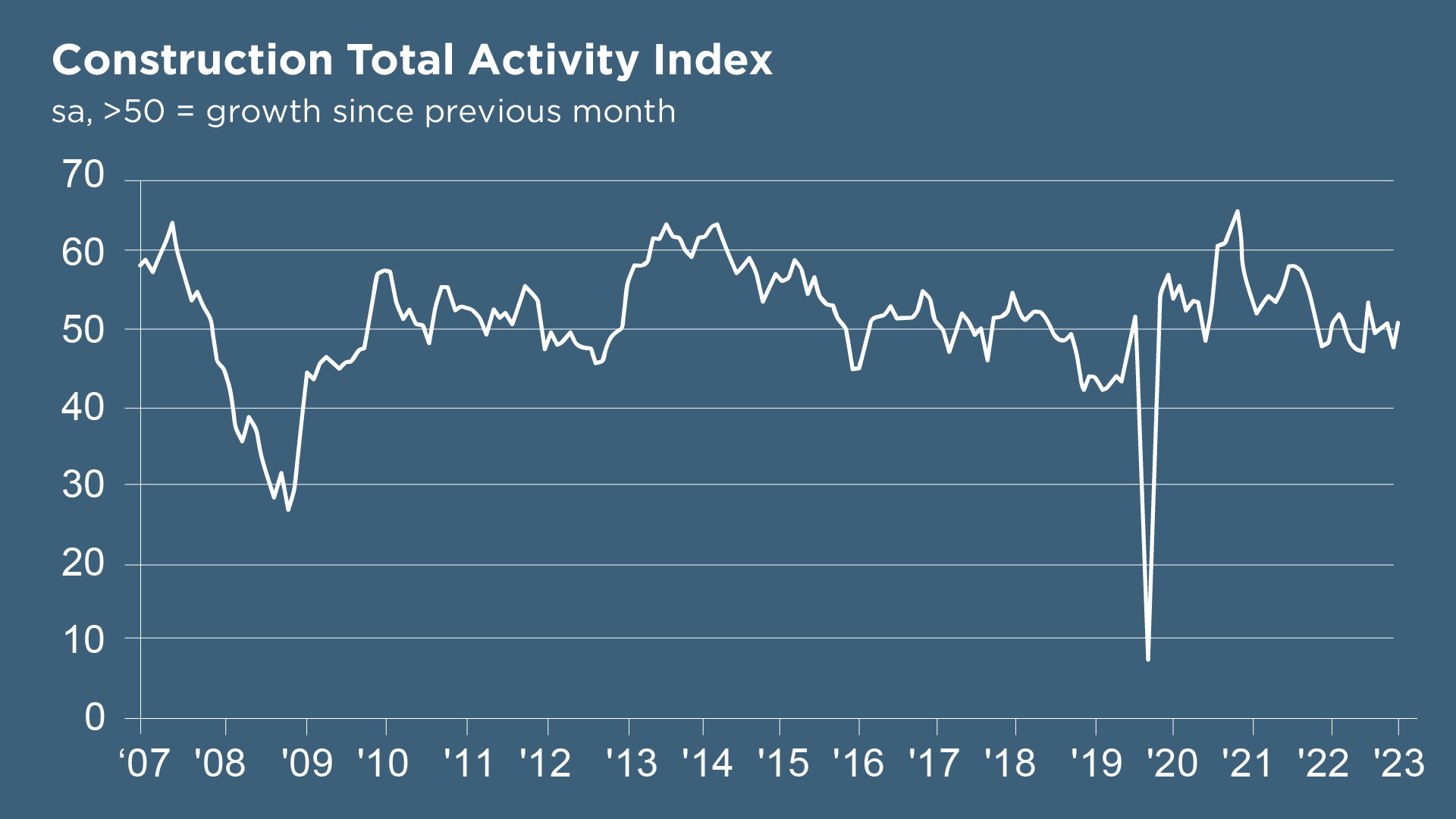

The July S&P Global / CIPS UK Construction PMI reported that total construction output returned to growth last month, following a marginal decline in June. Robust increases in commercial building (index at 54.4) and civil engineering (53.9) were offset by another sharp fall in house building (43.0). Rising borrowing costs have led to fewer sales enquiries and slower decision-making among clients, although some firms have seen demand for refurbishment projects and infrastructure work.

The pace of job creation accelerated to its strongest since October 2022, with improved candidate availability and long-term business expansion plans influencing a boost in workforce numbers. Purchasing activity, however, has decreased over the past two months as a result of destocking efforts and subdued order books. Lower demand and rising material availability contributed to a sharp improvement in supplier performance, with lead times shortened to the greatest extent for nearly 14.5 years.

Tim Moore, Economics Director at S&P Global Market Intelligence, said: “Another steep reduction in house building acted as a severe constraint on construction growth. Around 35% of the survey panel reported a decline in residential work during July, while only 18% signalled a rise. Lower volumes of housing activity have been recorded in each month since December 2022, with construction companies widely reporting subdued sales due to rising interest rates and worries about the economic outlook.”

The impacts of interest rates and inflation

As predicted, the Bank of England raised its official rate to 5.25% this month. This marks the 14th successive increase since January 2022 with experts now predicting that the base rate will peak at around 5.75% in 2023, lower than previously forecast at over 6%. Reuters reports that the latest predictions from financial markets showed a two-thirds chance that the Bank Rate will hit 6% in February. Despite these forecasts, average mortgage rates have started to fall since the start of August, following the release of lower-than-anticipated inflation figures for June 2023. With the Office for National Statistics (ONS) reporting a sharp fall in inflation for July 2023 - down to 6.8%, the lowest rate since February 2022 - it is expected that mortgage lenders will continue to cut rates. This is partly due to falling inflation giving banks and building societies more confidence to lend money to borrowers at a cheaper rate, but also a result of the housing market slowing down, a rising number of people struggling to meet repayments and the fact that high rates are off-putting to borrowers. Rightmove mortgage expert Matt Smith commented: “We expect mortgage rates to continue to fall slowly over the next few weeks. June’s more positive inflation numbers have given the market renewed confidence that inflation will continue to fall, and that Base Rate won’t have to go as high as previously feared, meaning lenders can tentatively start to reduce rates… More positive news could accelerate rate drops, while any surprises would temper the current renewed market optimism.”

The Mortgage Charter

Whilst mortgage rates look set to decrease, the Base Rate remains at its highest for 15 years. In response to rising costs for borrowers, a Mortgage Charter has been agreed between the government, the Financial Conduct Authority (FCA) and the majority of mortgage lenders. The FCA has also published some new rules to support the Mortgage Charter which apply to the whole mortgage market in the UK.

Previously, support for mortgage loan repayments has varied between lenders and been subject to individual circumstances. The Mortgage Charter clearly sets out the measures that are available to any home-owners experiencing difficulties, and those anxious about the impact of higher monthly repayments. This consistent package of support options across the market aims to encourage those who are struggling to reach out to their lenders without fear of impact on their credit score. According to Rightmove, those who can continue to make monthly mortgage repayments in the usual way should do so as it will mean paying back less money to the lender overall.

At the opposite end of the spectrum, Zoopla reports that 42% of British adults under the age of 40 who do not currently own a home are “Guppies” – young people who have “Given Up on Property”. A survey of 2,000 adults aged 18 – 39 revealed that even among those earning £60,000+ per year, 38% have given up on the idea of affording a home in the next decade. The three main reasons given for this outlook were the cost of living crisis (64%); increasing house prices (51%) and higher mortgage rates (49%).

Of those who are planning to buy (35% of those surveyed), 85% claim they have made financial sacrifices to do so including foregoing holidays, giving up socializing and stopping saving for their future. Many have also needed to adjust their expectations in order to get on the housing ladder, such as looking at alternative locations, buying homes which require improvement and compromising on property features such as spare rooms.

Expectations for the economy

Whilst the news for headline inflation is positive, the drop is largely attributed to lower energy bills than an easing of price pressures with core inflation remaining unchanged at an annual rate of 6.9% in July. Additionally, wage and employment data released by the ONS this month showed record annual wage growth of 7.8% in the three months to June – the highest growth since comparable records began in 2001. These stronger-than-expected increases to wages will not only cause concerns that price rises will take longer to ease, but also maintain pressure on the Bank of England to keep monetary policy tight in order to restore price stability. The ONS also announced that the UK economy grew by 0.2% between April and June 2023, with June alone showing a 0.5% increase – reducing the risk of recession and showing resilience against rising rates. However, Ruth Gregory, deputy chief UK economist at Capital Economics, said: “With wage growth and services inflation both stronger than the bank had expected, it seems clear that the bank has more work to do.”

In its Summer Forecast, EY ITEM Club states that the UK economy is predicted to grow 0.4% in 2023, up from the 0.2% projected in April’s Spring Forecast. However, it has more than halved its UK growth forecast for 2024: the impact of rising interest rates, which have a delayed effect on economic growth, means the UK economy is now expected to grow just 0.8% in 2024 compared to April’s forecast of 1.9%. Inflation is still expected to fall at pace in H2 2023 and the UK remains on course to avoid recession – although the 2025 GDP growth forecast has also been downgraded, from 2.3% to 1.7%.

When the Summer Forecast was published in July, the EY ITEM Club predicted two further interest rate rises from the Bank of England, in August and September, with the Bank Rate forecast to peak at 5.5%. Inflation is predicted to end the year at just below 5% – in April, it had been expected to end 2023 around 3%.

Hywel Ball, EY UK Chair, said: “The economy is moving past the series of shocks which have buffeted it in recent years, but their repercussions are long-lasting and holding back UK growth.

“While the UK workforce may be smaller than past trends would imply, it has grown back to its pre-pandemic size. Energy costs are falling and supply chain problems are easing. Business investment, which has been disappointing for some time, is starting to outpace the wider economy too. The foundation for growth is there, but the big question mark is the future path of inflation and interest rates.”

At CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership. As such, our team of property experts continues to actively visit sites to discuss project progress and offer input on any barriers which need to be overcome:

CrowdProperty is a leading specialist property development finance business having funded over £780m worth of property projects to date. With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means that we understand what developers are looking to achieve and help those developers succeed. Apply in just 5 minutes at www.crowdproperty.com/apply - our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

As featured in...