Borrow

Case Study

Podcasts

Awards

About

The results of the latest CrowdProperty Property Developer and Investor Index are now available.

These latest findings are set against a backdrop of stubborn inflation, which is coming down far slower than expected - causing the Bank of England to consider further interest rate rises. Various factors have been driving inflation over time: it started with fuel prices, then energy costs, now the food and leisure sectors are seeing price-led inflation as well as wages being impacted due to a tight labour market.

The MPC is more bearish than the markets when it comes to projections around GDP and inflation, although not expecting a recession. This is a significant change from their November 2022 report, when the narrative was very much around how deep a recession would be.

According to responses from our most recent Property Developer & Investor Index survey: investors expect Bank of England base rates of c. 5% in the next quarter, with both investors and developers expecting rates to fall to c. 4% in 12 months and continue to drop over the next three years. Major economic commentators are forecasting higher rates in the short term, with the Bank of England setting expectations of rates at 5.5% by September 2023 and through 2024.

Transactions in the residential property sector remaining historically low, with Q1 2023 recording the lowest number of completions since Q2 2020. Affordability is a key issue: interest rates on new mortgage lending in the UK rose sharply between January and October 2022, peaking at c. 6% - the same average rate reported this month.

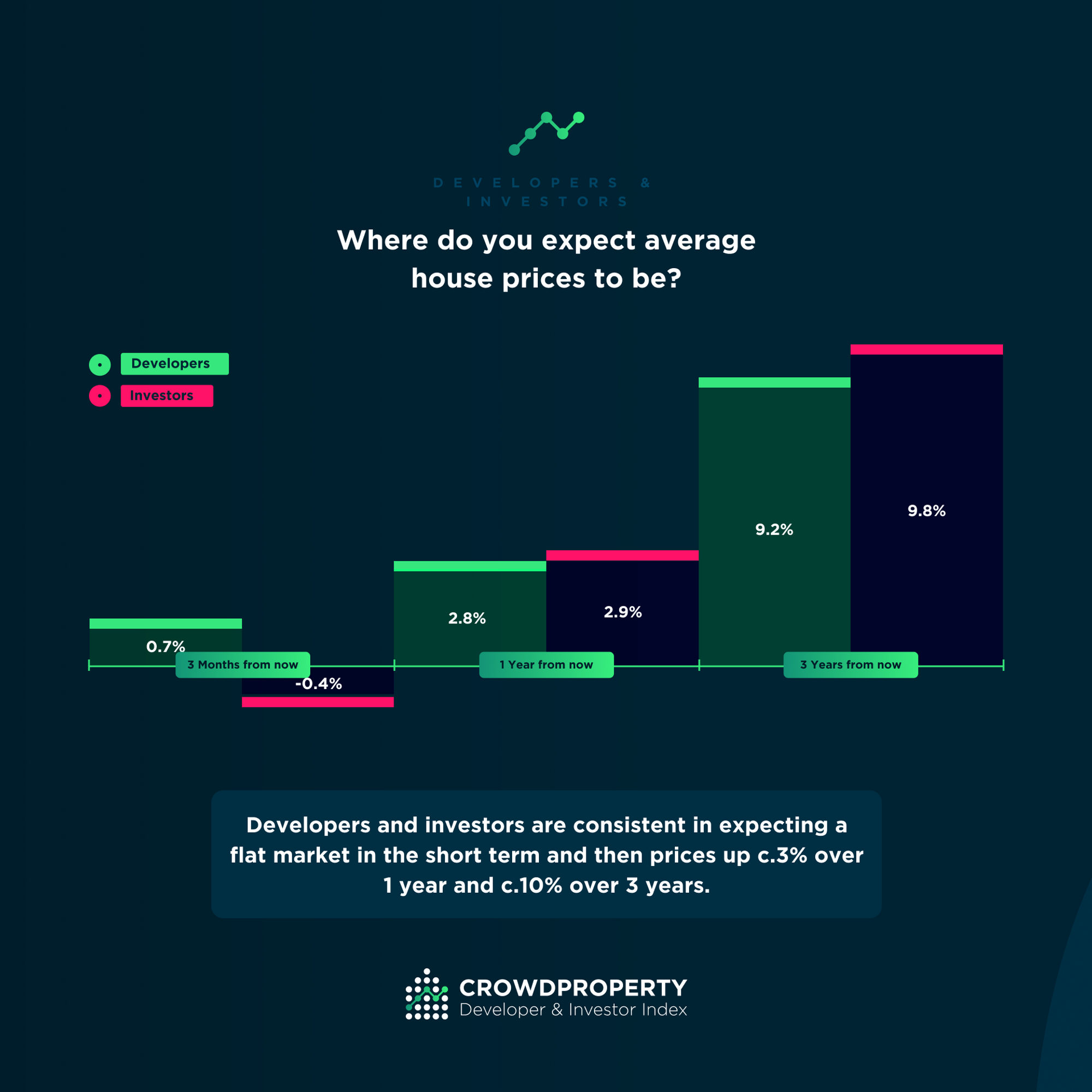

Developer and investors are expecting a flat market in the short term with average house prices up c. 3% over the next 12 months and increasing c. 10% in three years' time. This is a more confident outlook than survey responses from six months ago, although market commentators are of the opinion that prices over the same periods will fall. However, market commentators disagree - with key commentators forecasting that residential property prices will grow by between 4% and 7% by 2026.

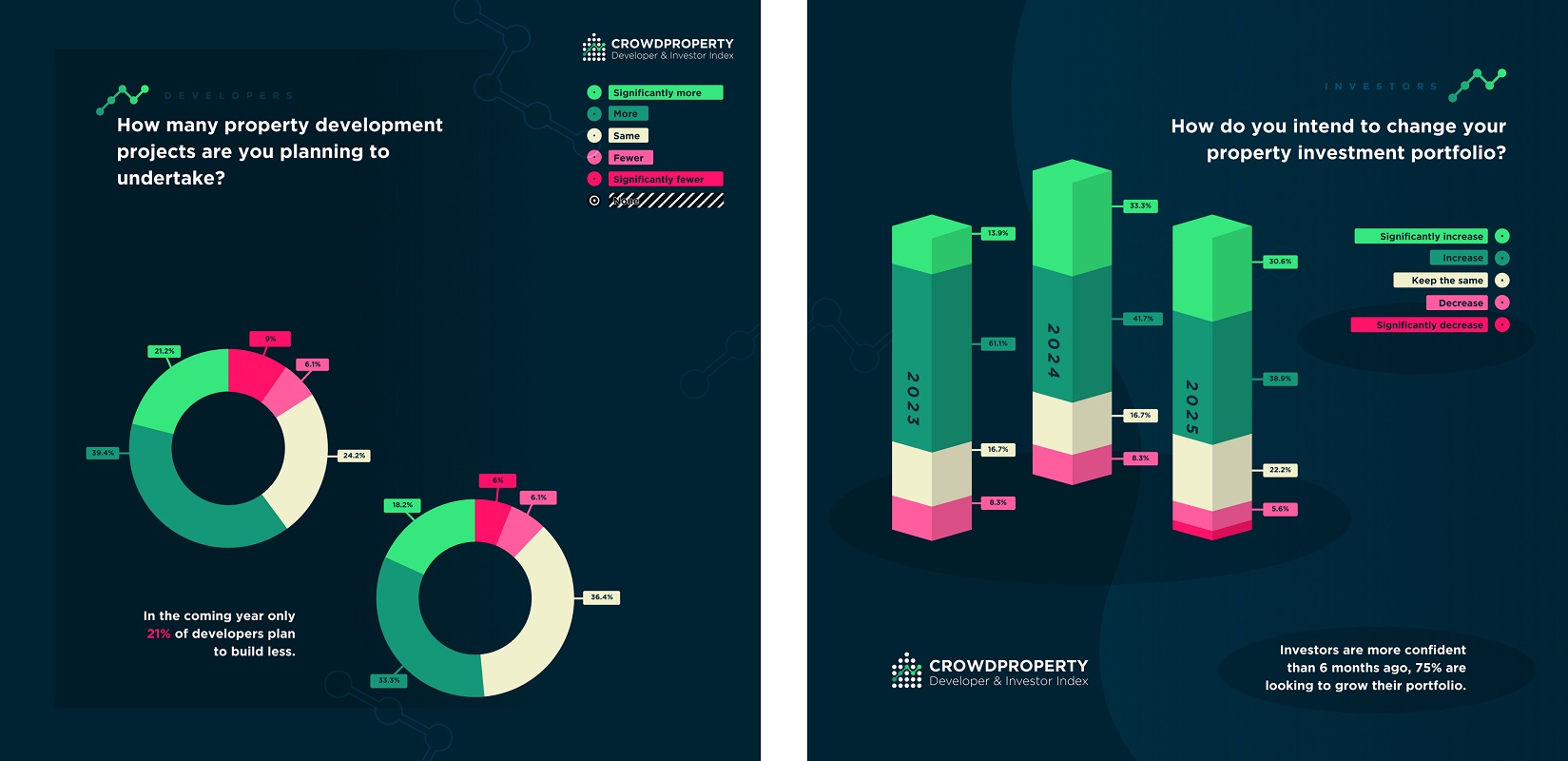

Developers expect to continue with projects in spite of headwinds, with the majority having significant medium term growth ambitions. Of those surveyed, only 21% of developers aim to build less in the coming year. Investors are also more confident than six months ago with 75% looking to grow their portfolio.

This represents an interesting lift in confidence since the last survey (December 2022) with 58% of developers looking to build either ‘more’ or ‘significantly more’ in the coming year (vs 41% previously) and 75% of investors looking to invest ‘more’ or ‘significantly more’ this time around (vs 59% previously).

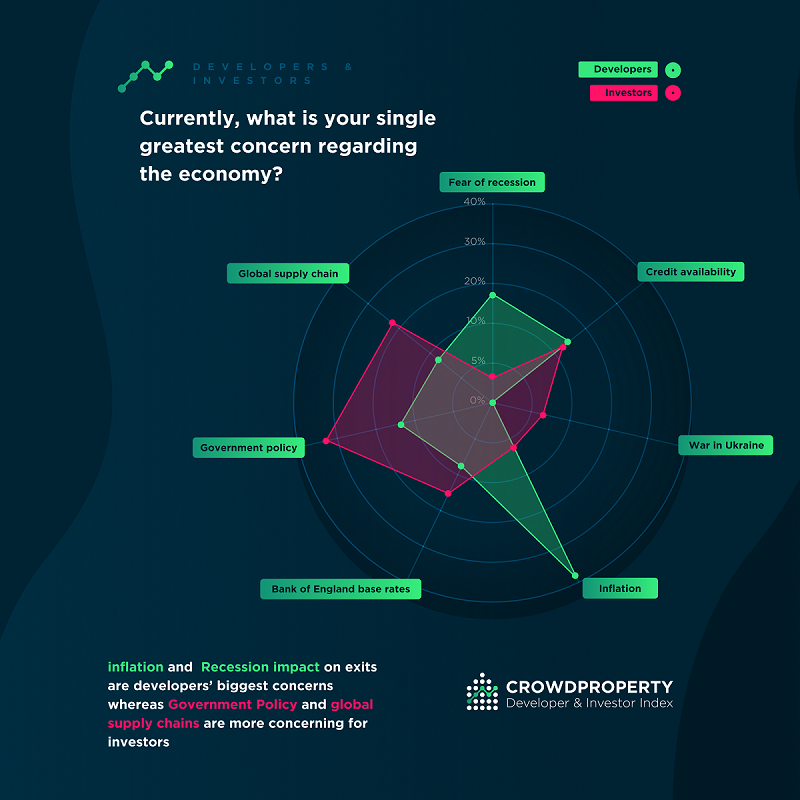

That said, inflation and the impact of a recession on exits are developers' biggest concerns regarding the economy whereas Bank of England Base rates are more concerning for investors.

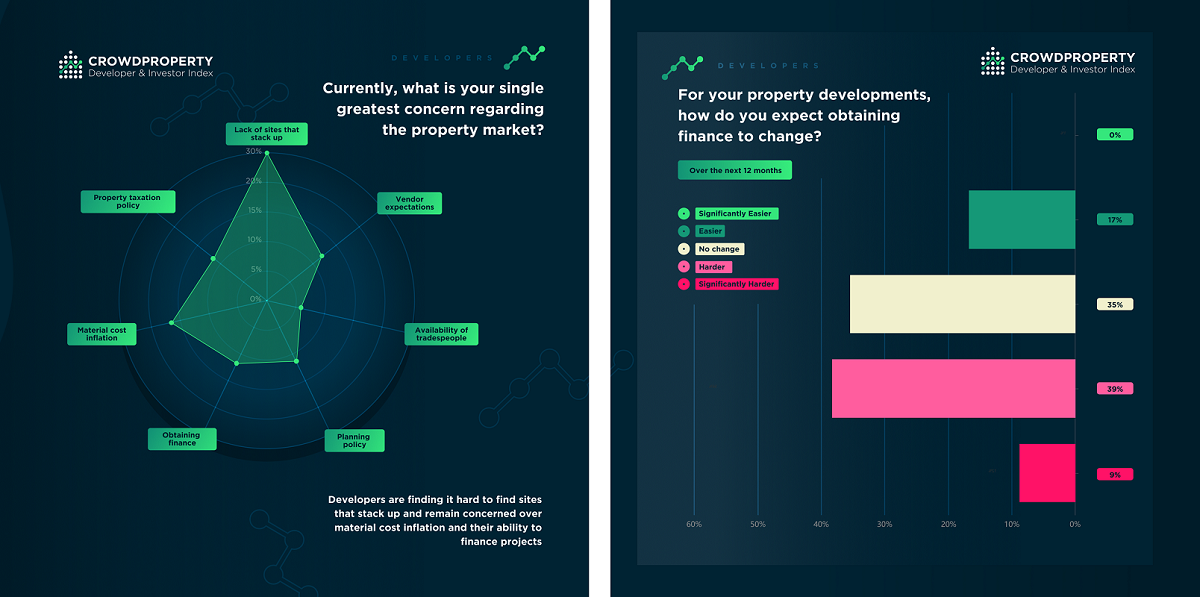

Developers are finding it difficult to find sites that stack up and remain concerned over material cost inflation and their ability to finance projects.

CrowdProperty offers fixed rate loans from £100,000 to £10m+, with multiple institutional funding lines providing reliable sources of capital. For an initial project review, apply in 5 minutes at www.crowdproperty.com/apply.

As featured in...