As inflation remains persistently high, the Bank of England has raised rates to the highest level in 15 years with a larger than expected 0.5% increase to 5%. In our latest blog, CrowdProperty reviews how these measures will impact mortgage rates, the rental market, housebuilding activity, property developer confidence and the wider economy.

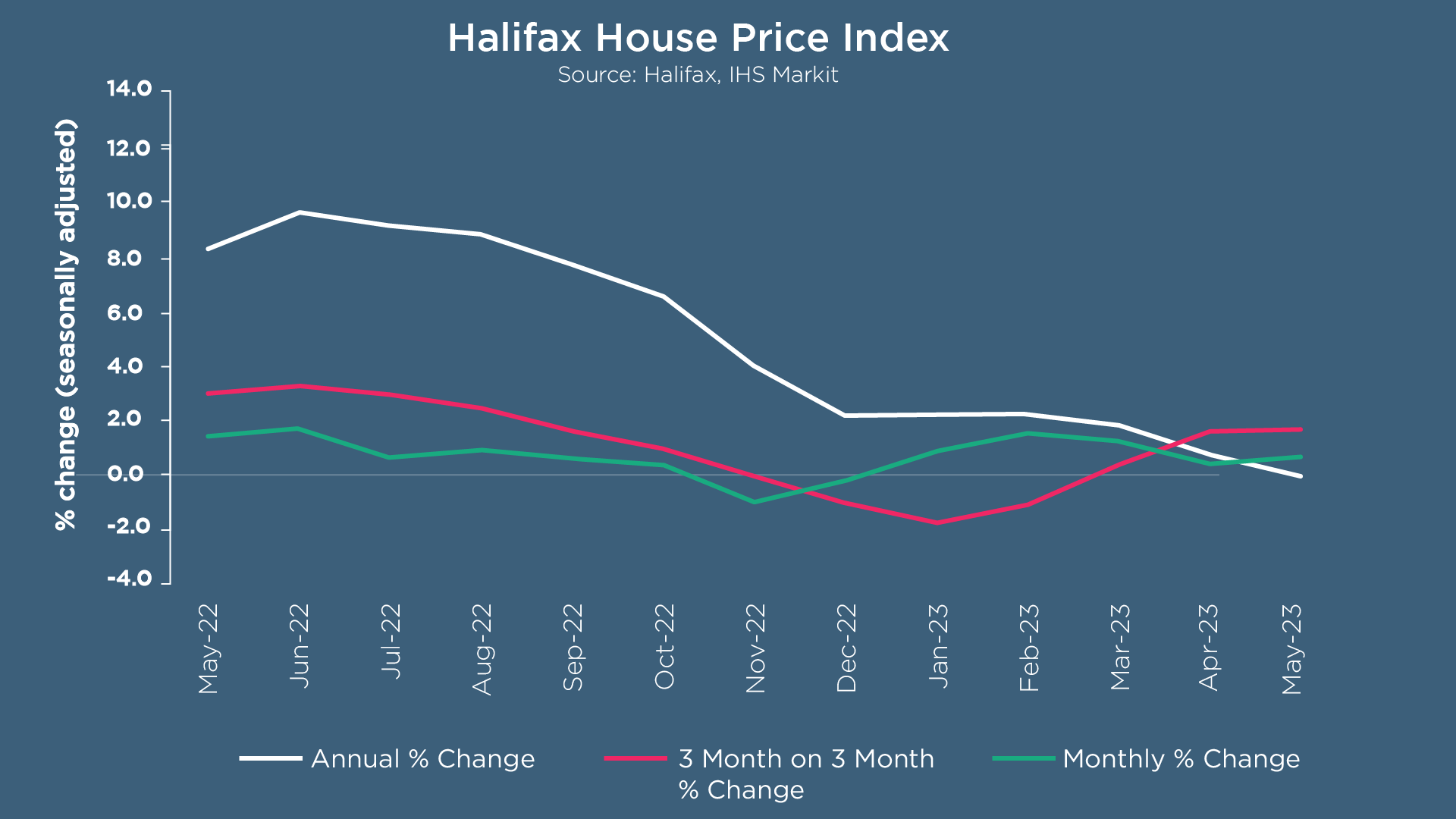

Average house prices in the UK were unchanged for May, following a -0.4% fall the previous month, as the annual growth rate turned negative (falling to -1.0% vs +0.1% in April). This marks the first time since December 2012 that house prices have fallen year-on-year, with the annual decline largely reflecting a comparison with strong house prices this time last year according to Halifax.

A typical UK property now costs £286,532 (compared to £286,662 in April). Existing houses continue to fall in value while prices for new build properties are still rising (annual growth of -1.9% vs +2.8% respectively). All property types except detached houses have seen a year-on-year drop in value: the sharpest decline is for flats, followed by terraced and semi-detached houses. House prices across the south of England remain under the greatest pressure, with the South East (-1.6%), South West (-1.4%) and Greater London (-1.2%) all experiencing a decrease in average prices.

Except for Wales (unchanged at +1.1%), all areas of the UK have seen annual house price growth weaken – with most now recording a low single-digit rate of property price inflation. The West Midlands (+2.7%) remains the best performing region, followed by Yorkshire and Humberside (+2.3%).

Kim Kinnaird, Director at Halifax Mortgages, said: “As expected the brief upturn we saw in the housing market in the first quarter of this year has faded, with the impact of higher interest rates gradually feeding through to household budgets, and in particular those with fixed rate mortgage deals coming to an end.

“With consumer price inflation remaining stubbornly high, markets are pricing in several more rate rises that would take Base Rate above 5% for the first time since the start of 2008. Those expectations have led fixed mortgage rates to start rising again across the market.

“This will inevitably impact confidence in the housing market as both buyers and sellers adjust their expectations.”

The latest RICS UK Residential Market Survey reported new buyer enquiries and agreed sales were the least negative readings in twelve months, posting at -18% (vs -34% in April) and -7% (vs -18% in April) respectively. New instructions rose by a net balance of +14%, moving into positive territory for the first time since early 2022. Despite these results, RICS expects the “upward shift in interest rate expectations prompted by disappointingly high consumer price inflation data” to place renewed pressure on the sales market in the coming months.

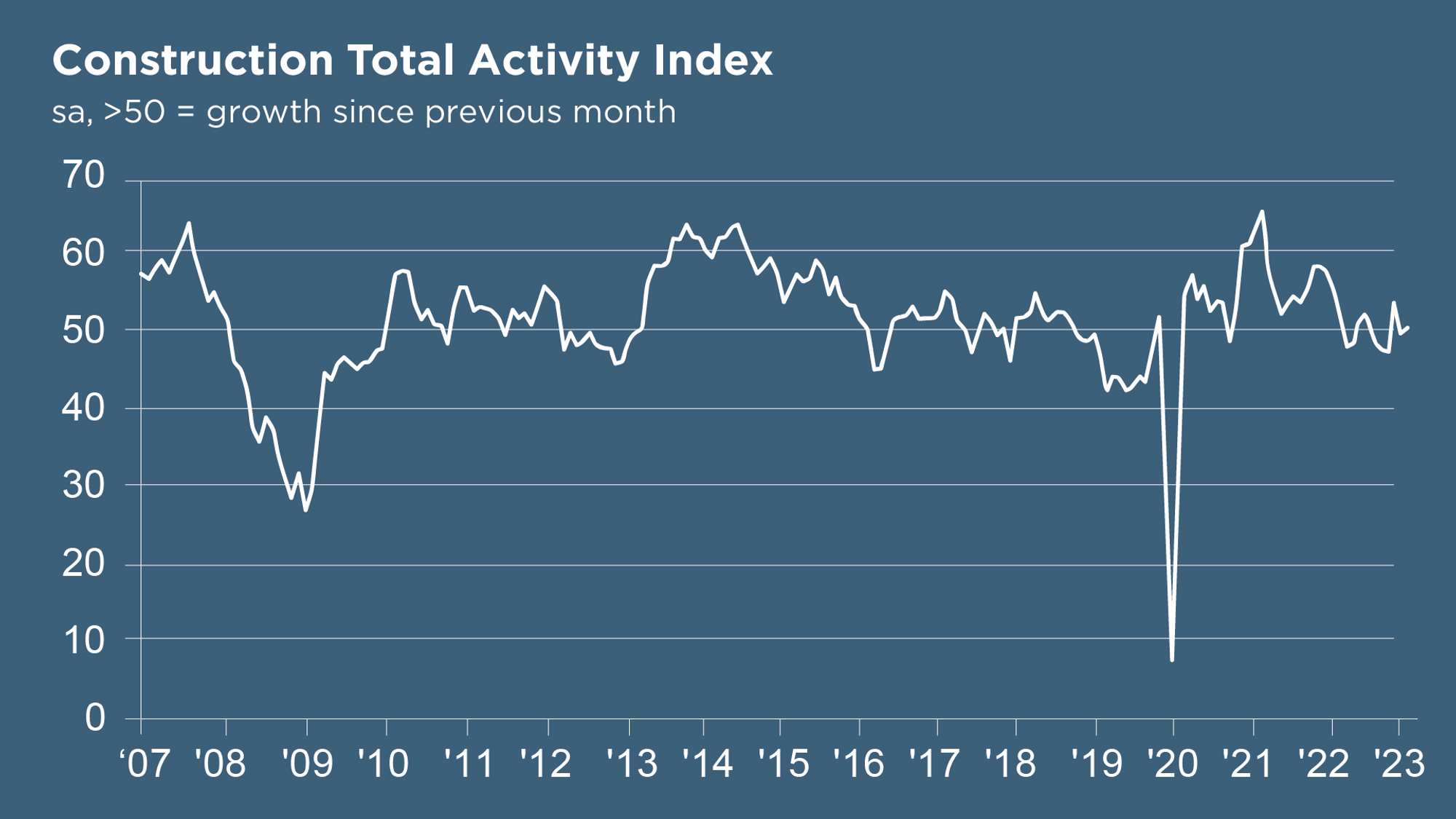

The S&P Global / CIPS UK Construction PMI signalled a modest upturn in overall UK construction output in May (index at 51.6), driven by faster rises in commercial building and civil engineering activity. Worries about the impact of higher interest rates and subdued market conditions continued to dampen housing activity, with output declining at the steepest pace for three years. The latest reading for the housebuilding category of construction activity (42.7) was the lowest for c. 14 years (aside from the pandemic-related downturn).

Supply conditions improved considerably in May, with average lead times for the delivery of construction products seeing the greatest improvement since August 2009. The rate of purchase price inflation eased to its weakest for 32 months, with rising competition among suppliers and softer demand for construction inputs cited as contributing factors. Input buying remained broadly unchanged since the last Construction PMI survey, reflecting efforts to reduce excess inventories.

Tim Moore, Economics Director at S&P Global Market Intelligence, commented: “Cutbacks to new residential building projects in response to rising interest rates and subdued housing market conditions resulted in the sharpest drop in housing activity for three years. This meant that residential work underperformed the rest of the construction sector by the greatest margin since October 2008. Survey respondents also commented on concerns about the broader UK economic outlook, which contributed to an overall drop in output growth projections to the lowest for four months.”

Recent headlines have focused heavily on efforts from the Government and Bank of England to manage the UK economy, as stagnating inflation figures and rising interest rates cause experts to warn of an increased likelihood of recession. Bank of England governor Andrew Bailey believes “the rate of inflation is going to come down, but it’s taking a lot longer than expected” - a reaction to figures showing headline Consumer Prices Inflation had stalled at 8.7% and core inflation increased to 7.1% in May, marking a new 31-year high. According to Zoopla, the data caught economists by surprise as both the Bank of England and markets had expected the figures to show a fall in inflation. Despite inflation falling in the US and Eurozone, it remains stubbornly high in the UK as it is now being driven by wage increases rather than external factors. To this point: fuel price inflation, which had previously driven inflation up, fell from -8.9% to -13.1% in May, while the rate at which food prices are rising eased from 19.1% to 18.3%.

With inflation in the UK becoming more entrenched, it will take longer to tackle, and this means interest rates are likely to have to rise higher than previously expected – as shown by the Monetary Policy Committee’s decision to raise the base rate by 0.5% this month, rather than 0.25%. Rightmove’s mortgage expert Matt Smith noted: “The Bank appears to have opted for a larger Base Rate rise this month to try to address the underlying issues driving inflation, and it continues to forecast that inflation will drop sharply in the second half of the year. Based on this message and the action taken, we wait to see the impact this has on swap rates, as this will have a direct impact on mortgage interest rates, and whether or not we see further increases in the coming weeks.”

The mortgage market has already responded to higher than expected inflation with lenders withdrawing nearly 400 products for repricing during the past month. This large-scale repricing means anticipated base rate increases have already been factored in to mortgage rates, with Moneyfacts reporting an average rate of 6.19% for a two-year fixed mortgage and 5.82% for a five-year fixed mortgage. According to housing market analyst Neal Hudson, rates of 6% now will cause the equivalent ‘stress’ of the 13% interest rates seen in the 1980s. This is due to homeowners now borrowing far greater amounts relative to their income, with many taking out mortgages equivalent to four times their income or above. If rates remain high, experts suggest that property prices will have to drop significantly: Richard Donnell, Executive Director at Zoopla, asserts “if mortgage rates stay at 5.5% or 6% for any period of time then you start to see a big hit to buying power. Volumes of transactions drop first – that might be for three or four months – then you might start to see a renewed downwards pressure on prices.”

Capital Economics has declared that this return to mortgage rates of c. 6% for the first time since 2007 guarantees a renewed slump in mortgage lending and a decrease in house prices. This has caused Capital Economics to revise down its 2023 and 2024 housing market activity forecasts, with the expectation of a c. 25% year-on-year drop in transactions this year that will not recover until 2025. According to its valuation framework, house prices are currently twice the level that would be sustainable with mortgage rates at 6% - if rates were sustained at this level for several years, a 25% peak-to-trough drop in nominal house prices (almost 50% in real terms) would be likely. As it stands, Capital Economics believes a bank rate of over 5% and mortgage rates of 6% will bring inflation back to target next year. This should allow for interest rates to be cut in Q3 2024, leading to mortgage rates settling to 4% by 2025 and limiting the total fall in house prices to c. 12%. House prices have declined by 4% so far – in real terms, that is a 20% correction comparable with the downturn in 2008 – 2010. In real (inflation adjusted) terms, it should be noted that today’s average price is c.21% below the 07/08 peak (when base rates were 5.5%) and equivalent to 2003 price levels (when base rates were 4%) and 2011 levels.

Capital Economics’ mortgage rate forecast implies that total mortgage interest costs will rise from 8.5% of household disposable income at the end of 2021 to 16.6% by 2025. While the overall impact of higher mortgage rates is expected to be smaller than in the past, it will also be less widely distributed. This is partly due to the share of households that have a mortgage falling from 40% in the 1990s to 30%, as owning outright and renting have become more common.

Speaking of renting, rising interest rates are also impacting on landlords. According to the Financial Times, there is growing concern that the supply of rental homes could get even worse as higher mortgage costs hit landlords and make buy-to-let investments less attractive – or, in some cases, economically unviable. More than a third of landlords own their properties outright, while another third have loan to value mortgages of less than 50%. The remaining 20-30% of landlords, whose mortgages have a loan to value of 50-75%, are seeing a reduction in income and squeezes on cashflow as mortgage rates increase according to Zoopla. The government’s aim for landlords to increase the energy efficiency of their properties to EPC grade C by 2030 adds further cost considerations, with investment needed to make the necessary upgrades. Private landlords are also having to contend with the effects of measures brought in between 2017 and 2020, which have increased many landlords’ tax bills by removing the ability to deduct mortgage interest and instead providing a tax credit. The impact of these measures has been deferred or hidden due to the very low interest rate environment at the time of introduction. Alongside an increase in the stamp duty payable on rental properties, these tax changes have meant that some landlords are already unable to turn a profit.

The net result is an increased likelihood of landlords exiting the market, with almost two-thirds of RICS UK Residential Market Survey participants witnessing an increase in the number of buy-to-let landlords looking to sell their properties. Additionally, c. 66% of respondents reported a decline in the level of interest from new UK based buy-to-let investors over the past six months, with 30% citing a decline in interest from overseas buy-to-let investors.

London and the South East currently account for 51% of all landlord sales. As the two most expensive property regions in the UK, homes in these areas are expensive to buy and therefore offer low rental yields once the monthly mortgage is paid – making the economics of being a landlord tougher than in other areas. Sales data from Zoopla shows a steady flow of private landlords selling up – however, this has been the case since 2018. A worsening of supply is not expected, however the market does need significant investment from more private and corporate landlords to help with the demand for rental homes. Currently, there are 33% less homes available to rent than the five year average, yet demand is currently running at 50 – 85% above average.

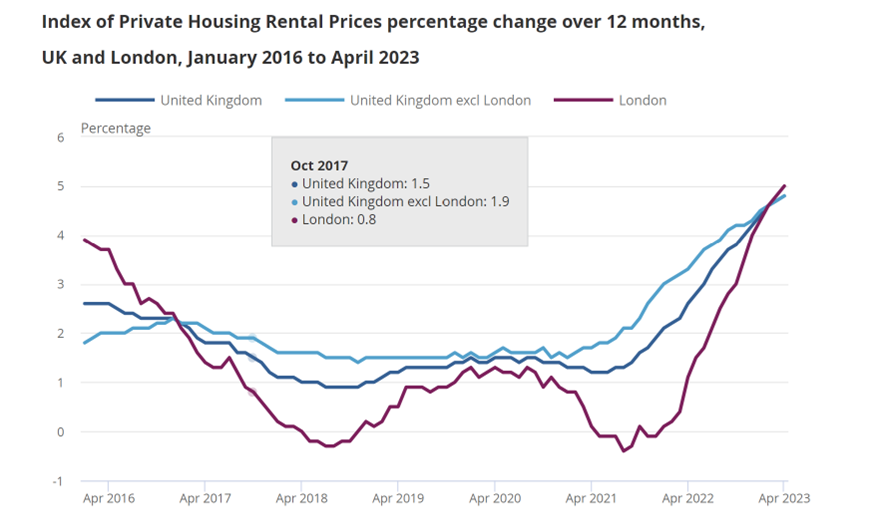

For those landlords looking to retain their buy-to-let properties, there is upward pressure on rental market prices in order to mitigate increasing costs. According to Hamptons estate agents, newly let properties are 25% more expensive than before the Covid-19 pandemic hit in 2020 and still rising at 9% in May compared with the year before. RICS expects rental price growth to average c. 6% per annum over the course of the next five years.

Private rental prices paid by tenants in the UK increased by 5.0% in the 12 months to May 2023, representing the largest annual percentage change since the Office for National Statistics started collecting data in 2016.

Rental income is increasing and expected to far outperform forecasts, with Savills predicting an increase of +18.3% (vs +10% in 2022) and Knight Frank suggesting a +18.2% rise in UK rental prices 2023 – 2027. With the lack of rental supply becoming a chronic problem, there is little relief in sight for tenants who feel stuck because high rents make saving for a deposit difficult. Zoopla’s Richard Donnell says steep rent rises will probably continue through this year and possibly into 2024 unless there is a major rise in joblessness, a fall in immigration levels or an increase in the supply of rental homes.

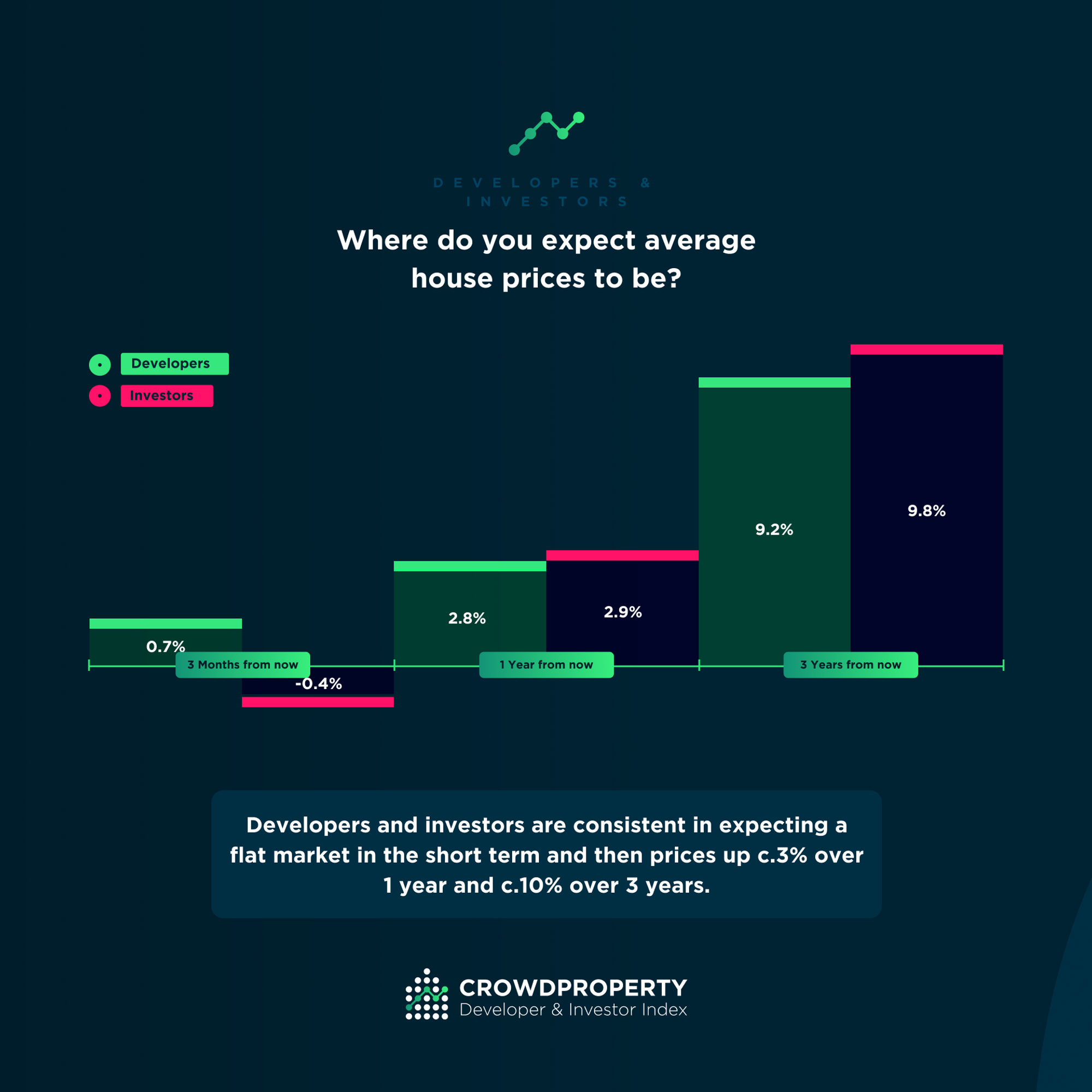

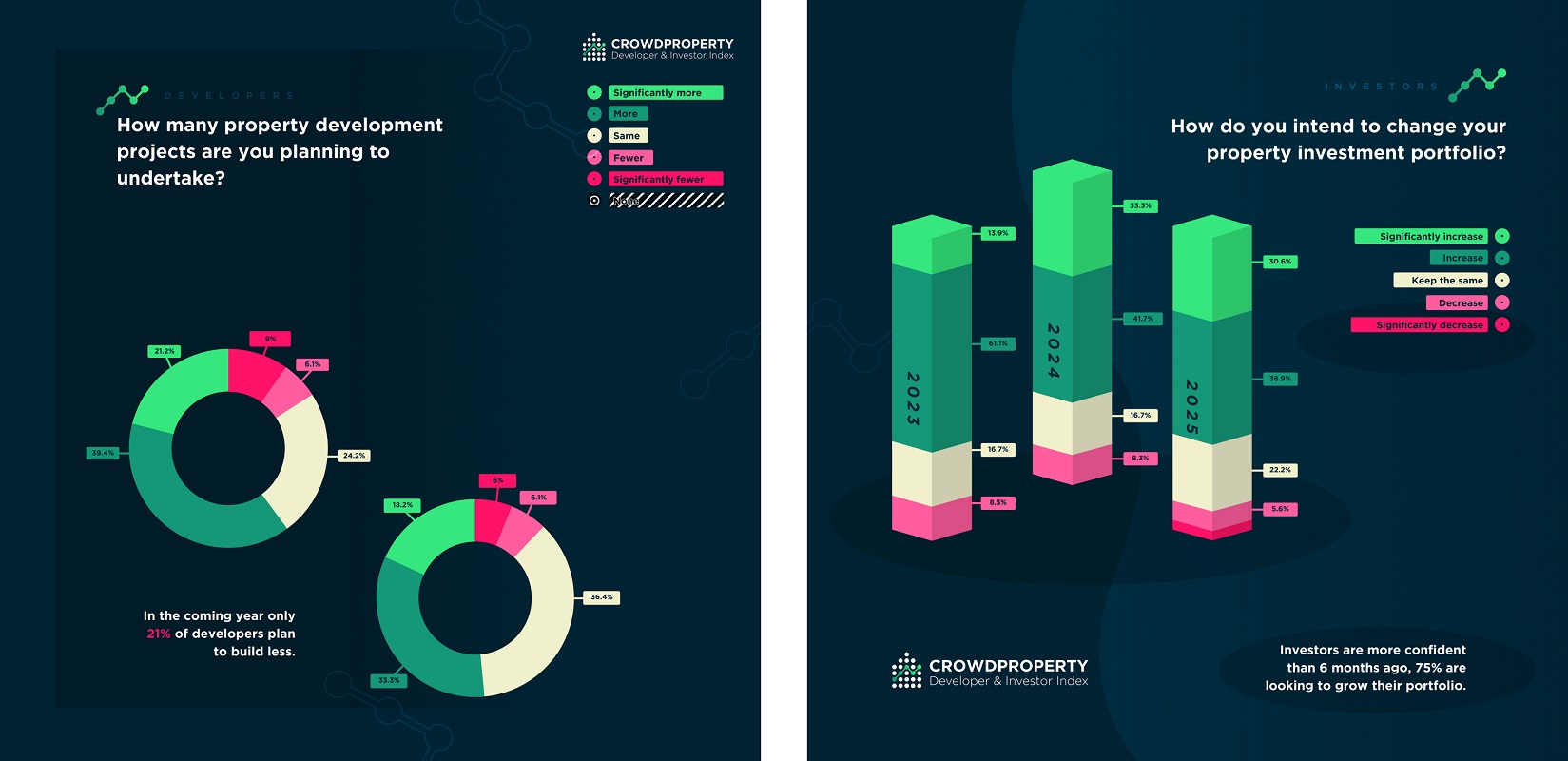

In terms of how this is impacting developer confidence, the results of our latest Property Developer & Investor Index survey show that both developer and investors are expecting a flat market in the short term with prices up c. 3% over the next 12 months and increasing c. 10% in three years' time. This is a more confident outlook than survey responses from six months ago, although market commentators are of the opinion that prices over the same periods will fall.

Developers expect to continue with projects in spite of headwinds, with the majority having significant medium term growth ambitions. Of those surveyed, only 21% of developers aim to build less in the coming year. Investors are also more confident than six months ago with 75% looking to grow their portfolio.

This represents an interesting lift in confidence since the last survey (December 2022) with 58% of developers looking to build either ‘more’ or ‘significantly more’ in the coming year (vs 41% previously) and 75% of investors looking to invest ‘more’ or ‘significantly more’ this time around (vs 59% previously).

At CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership. As such, our team of property experts continues to actively visit sites to discuss project progress and offer input on any barriers which need to be overcome:

CrowdProperty is a leading specialist property development finance business having funded over £700m worth of property projects to date. With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means that we understand what developers are looking to achieve and help those developers succeed. Apply in just 5 minutes at www.crowdproperty.com/apply - our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.