Borrow

Case Study

Podcasts

Awards

About

Not only did our survey, the largest ever undertaken with SME property professionals like you, highlight the importance to you of speed, ease and certainty of finance, but also your need for transparency from your property project lender. These are all the backbone of the CrowdProperty proposition and it’s never been more important (and advantageous) to have a lender who really understands your needs.

Borrowing for professional property purposes is unregulated and as such a loan contract can contain anything. It’s absolutely critical to read and understand your contract in full as we’ve seen some pretty unscrupulous terms in the small print (i.e. failing to deliver transparency), and borrowers are not always aware of them.

In the survey, 25% of property professionals did not know the late (penalty) interest rates of their last project finance facility. The reason this is scary is that of those who did know, 32% knew it was over 2% per month and 18% knew that it was over 3% per month. Entwined in this, and typical of the self-interested and transactional approaches of many lenders in this market, they’re happy to set tight timelines on your facility, increasing the chances of you facing those onerous penalty rates. There is a strong tendency amongst most lenders to seek to profit as much as possible from a single facility, rather than be building a long-term trusted partnership, founded on your needs.

Furthermore, we’ve seen a remarkable array of hidden fees in loan contracts. We’ve seen arrangement, setup and admin fees on the same offer (aren’t they the same thing?!), arrangement fee percentages quoted as p.a. (meaning an 18 month project is 50% higher arrangement fee than at first sight), exit fees as a % of GDV (a good project can be paying double the amount than at first sight), interest charged quarterly (1 day into the next quarter and you’re liable for 3 months more interest), the recharging of a lender’s broker fee (in additional to the fee you’ll also be paying your broker) and many, many more. The problem is that it’s in the tougher markets or where you’re facing project challenges that many of these terms bite… and bite hard.

Right now, not only are we seeing many applications from those who have had their offers reneged upon by other lenders who have just stopped lending, we are also (shockingly) receiving applications from projects where drawdowns have been refused by other lenders. Furthermore, the proactive property professionals, who are staring down the barrel of onerous penalty fees and rates where experiencing delays on site or in exiting through sale or refinance, are coming to CrowdProperty for our ‘Development Exit’ and ‘Development Finish & Exit’ products to give themselves time to exit without excessive costs.

Our ‘Development Exit’ and ‘Development Finish & Exit’ products are designed to help you to bridge the period between finishing (or almost finishing) and exiting a development project, releasing the commitments of an expiring development finance loan and providing breathing space to achieve the most successful exit for your project (whether a sale or a refinance onto term finance). This takes the stress of recourse from the existing facility away and with CrowdProperty you can pay back early at no cost – meaning that we can grant you a facility that provides plenty of breathing space so you can focus on your project. As one of the only lenders lending through the Covid-19 lockdown, we’re very well placed to help.

Be proactive to mitigate these costs – you can apply to CrowdProperty in just 5 minutes and we’ll get you terms within 24 hours. We can move quicker than any other lender to transition you to a CrowdProperty facility - apply now at www.crowdproperty.com/apply

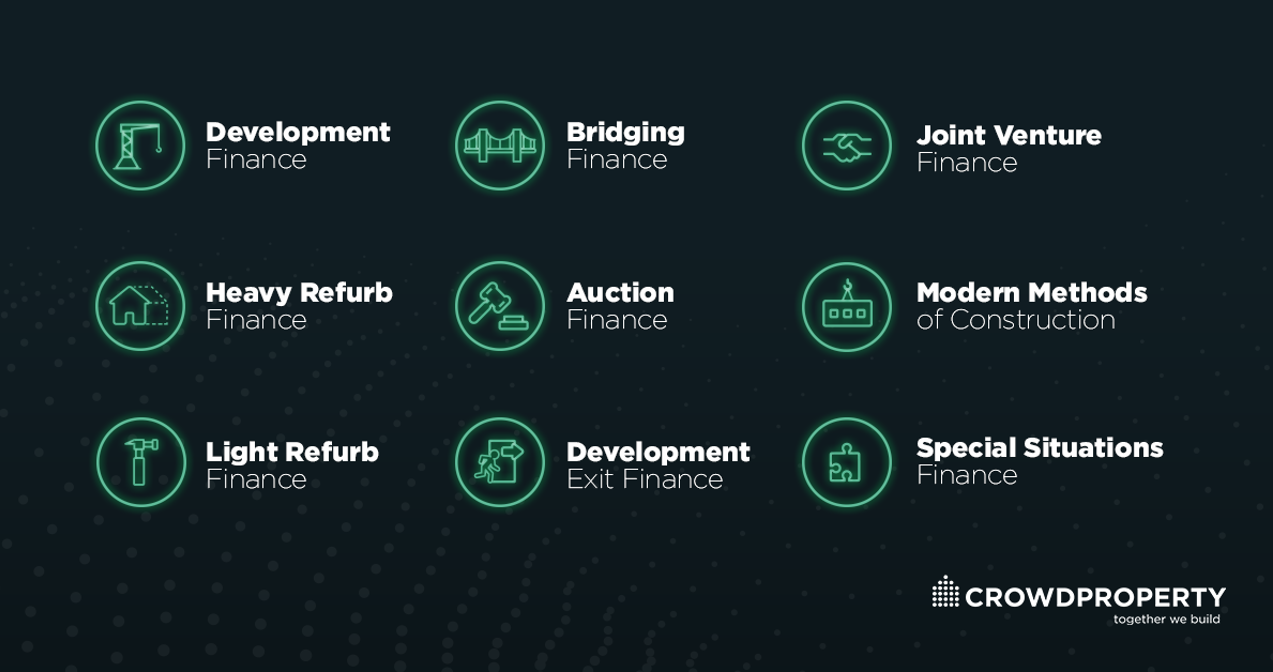

We have solutions for all your property project funding needs, providing you with speed, ease, certainty and transparency. This includes a ‘Special Situations’ product where our experts will structure a lending product for you, no matter how complex the project:

Having built the best property project lender in the market, partnering with our borrowers throughout their project, as property finance by property people we are continuously building stronger systems, processes and capabilities to help you grow your property business quicker. Covid-19 is a human tragedy of global proportions. It is, in turn, producing turmoil in financial markets but as a sector, building and construction can be a key part of the recovery. Now, more than ever, there is no reason to accept the failings of funding providers that have only ever acted in their own self-interests, and every reason to work with people who have been in your shoes.

We’re changing the game of property project finance, very much open for business and here to help. Let’s get talking even if you haven’t got a project right now such that as the market opens up and opportunities arise, you’ve got the best of the best on your team. Together we build.

As featured in...