Borrow

Case Study

Podcasts

Awards

About

As part of our last update, we looked at the state of the property market as a result of Covid-19 and what we might expect going forward. With the lockdown lifting and restrictions continuing to ease, we share the latest industry views on the outlook for GDP and the housing market.

The latest (June 2020) viewpoints on both GDP and the housing market continue to predict a significant dip in 2020 with significant recovery in 2021. According to Capital Economics, the estimated scale of the peak-to-trough fall in real GDP is 25-30% in the UK (Q4 2019 – Q2 2020) – with the severity of lockdown measures given as one major factor for larger falls in output than countries such as Sweden. Similarly, EY ITEM Club has downgraded its forecasts since its last report – with a record estimated UK GDP contraction of 15% for Q2 2020 (previously 13%) and 8% for 2020 (previously 6.8%). Whilst the prediction for year-on-year GDP growth has risen to 5.6% (from 4.5%) in 2021, EY does not expect the UK economy to return to its Q4 2019 size until early 2023.

Of course, uncertainty remains in the market as the situation is rapidly evolving - the ICAEW’s summary of ex-chancellors’ views on the post-Covid economy notes that ‘until the government gets control of… the spread of the virus’ it will be ‘difficult to see how you can… get the economy going again’. Whilst the UK is able to bear more debt on account of its ‘credit-worthy, larger economy’, the issue of managing this long term needs to be addressed. However, measures such as time-limited VAT reductions have been suggested in an effort to boost the economy and it is widely recognised that, for now at least, an increase in taxes is not the answer.

In terms of the housing market, we look at the market in a deconstructed way given what we have seen in the past. Firstly, we think about whether there is a correction waiting to happen given recent growth. Next, we think about the outlook for supply and demand. Thirdly, we carefully watch all activity indicators and finally we ensure that our focus, lending criteria and security are appropriate to uphold the high-quality lending we offer.

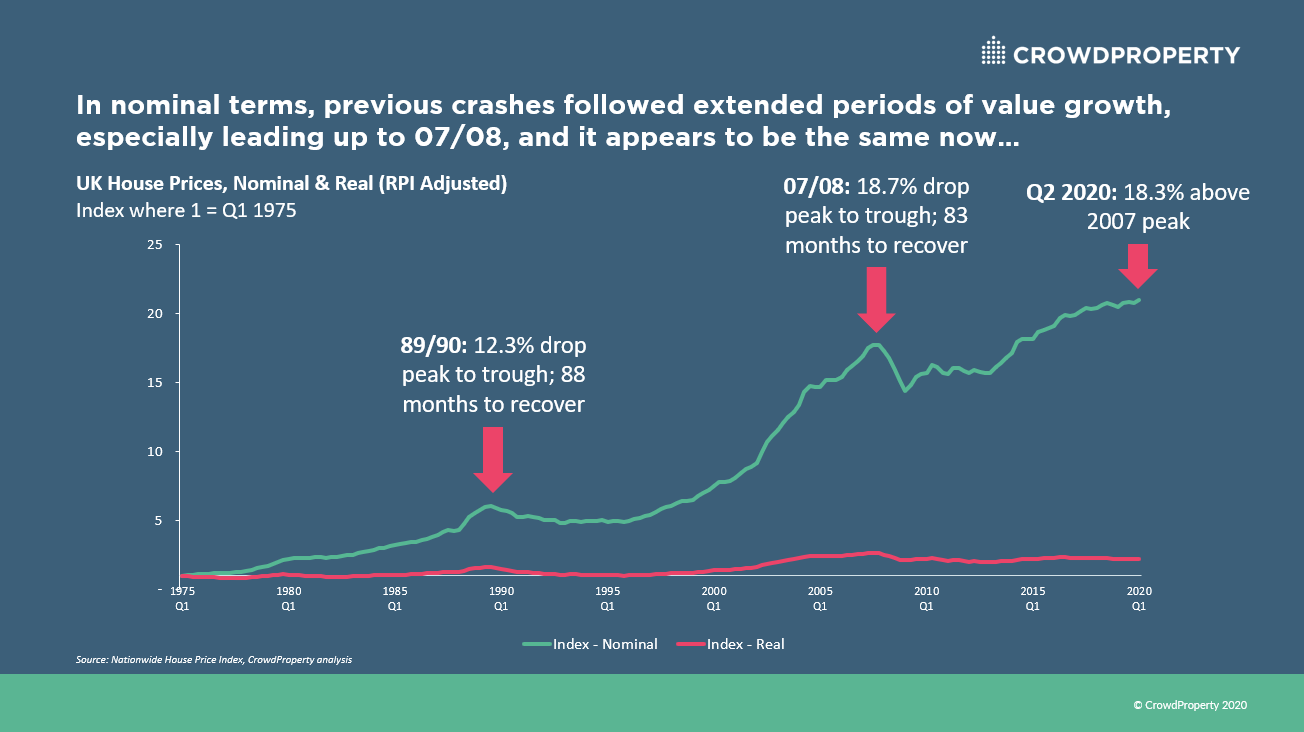

We believe that this shock will not lead to the correction of excessive growth that has been long-awaited. In the below chart, showing the Nationwide House Price Index since 1975, you can see that both 89/90 and 07/08 experienced long periods of housing market growth before economic shocks drove double-digit percentage declines, taking years to recover. At first glance, one might think the signs are here again:

But this is where it is critical to separate real from nominal growth. In other words, let’s take the effects of inflation out of the nominal (unadjusted for inflation) data. In the above chart, the green line shows the Nationwide House Price Index in nominal terms, whereas the pink line shows it in real terms, adjusted for inflation (RPI-adjusted). This reflects the real value growth in UK housing. Clearly on the above chart, it’s difficult to see the movements (although interesting to note the extent of the difference), so below shows just the Nationwide House Price Index in real terms:

This shows a very different story to the nominal picture – average values today are 16% below the 2007 peak, have been pretty much flat since early 2015 and are currently at the same real value as in 2010 and 2005. This is a very different context to the extended periods of high growth in values that led into the 89/90 and 08/09 market falls.

The balance of supply and demand for housing is again very different to 08/09. Back then, many needed to sell (including banks who adopted wholesale repossess and sell policies) and very few could buy given the protracted state of the debt markets (which was the underlying shock) or were prepared to buy (due to long-term prospects of the debt markets holding back recovery).

Whilst the Job Retention Scheme has undoubtedly helped many households (as of 14 June, it was reported that 9.1m jobs had been furloughed by 1.1m employers, with the total value of claims at £20.8bn), Knight Frank reports that unemployment data has varied from the claimant count measure at 7.8% in May, and the ILO unemployment rate at a 45-year low of 3.9%. At the beginning of the month, Alistair Darling claimed the country should prepare for ‘1980s levels of employment’ – around 7–10%. With such uncertainty around job security and personal finances, dwindling demand could be expected.

It's been a month since the housing transactions market ‘reopened’ and according to a recent RICS survey, the market is due a short-term surge in activity, with an increase in sales but fall in prices.

Zoopla claims that property sales in England have already rebounded to the same levels as pre-lockdown – with the ‘number of new sales agreed rising by 137% since the market reopened’. London remains the exception, due to a growing desire for homes in the countryside with good transport links and gardens according to search data – a likely reaction to the national increase in working from home and threat of a second wave.

Zoopla’s report goes on to say that pent-up demand has firmed up prices, with a 6% increase in average asking prices compared to June 2019. This is echoed by Rightmove, reporting that sellers were so optimistic in May that asking prices were 1.9% higher than in March.

On the supply-side, whilst unfortunately there will be many more probate listings this year, there will be a greater decrease in construction completions in 2020, which has been under-supplying the market for decades. More materially, given the nature of shorter-term market expectations, many would-be sellers will hold off from listing their properties onto the market. As in any market, there will be those that need to sell, but those with discretion on when to sell will naturally wait for evidence of more transaction liquidity and stability in the market, which will be partly driven by a quicker return of mortgage markets following this shock vs 08/09.

Despite the uncertainty, CrowdProperty has continued to perform exceptionally over the last few months. Our strong pipeline of quality projects by quality professionals continues to grow (with May 2020 being a record in the number of applications for finance), even as our criteria become even tighter during these unprecedented times. Our continued sole focus is quality small to medium sized residential development projects throughout the UK serving domestic under-supplied demand in liquid markets at mainstream, affordable price points, where there is enduring demand. We are therefore seeing very high levels of demand on the lending side, and as such we continue to operate pledge limits in order to give lenders the greatest opportunity possible to successfully pledge.

We’ve built the best property project lender in the market to attract the very best lending opportunities, which we evaluate, secure and monitor with decades of expertise in order to protect our investors’ funds. We take a long-term, strategic perspective on the business to ensure that it is robust and sustainable through all market cycles and that we continue to deliver exceptionally for all our customers.

As featured in...