Borrow

Case Study

Podcasts

Awards

About

In this latest State of the Market round-up, CrowdProperty summarises the property market news and insights from the last month which will impact the future development plans of small and medium sized property developers.

Key takeaway 1: Pressure on property prices

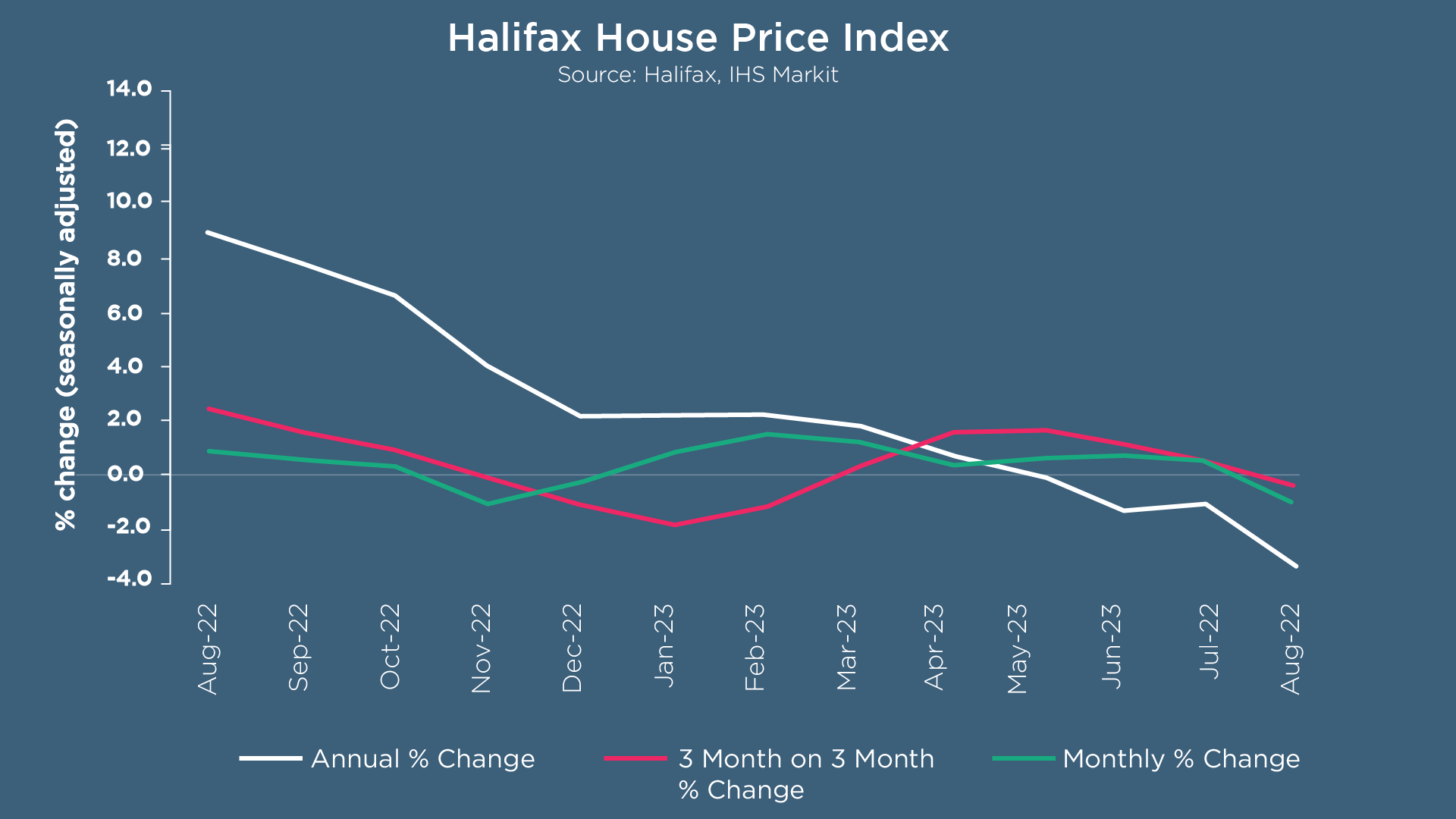

According to the latest Halifax House Price Index, property prices fell by -1.9% in August – the largest monthly fall since November 2022, attributed to the impact of higher interest rates. Property prices also reportedly dropped by -4.6% on an annual basis, the biggest year-on-year decrease since 2009. However, these latest figures should be understood in the context that prices were at a record peak last summer and remain around +17% above pre-pandemic levels.

A typical UK home now costs £279,569, similar to levels last seen in early 2022. All UK nations registered a decline in house prices over the last year, with northern locations generally proving to be more resilient than areas in the south. This is proven by the downward pressure seen in the South East and Wales, with house prices falling by -5.0% and -4.7% respectively on an annual basis. London has also seen property prices fall by -4.1% over the last year, yet remains the most expensive place in the UK to purchase a home. In contrast, prices in Scotland showed greater resilience with an annual decrease of -0.6%.

The RICS UK Residential Survey reports that sales activity and prices remain under pressure, again citing elevated mortgage rates as the cause. The newly agreed sales net balance registered at -47%, the weakest reading since the early stages of the pandemic. In addition, home buyer demand also saw a -47% decline in enquiries over the last month – the third negative result for this metric over as many surveys. Near-term price expectations are, unsurprisingly, signaling further falls to come over the next few months with a sustained downward shift in house prices also anticipated at the national level for the next 12 months.

Key takeaway 2: Contrasting construction trends

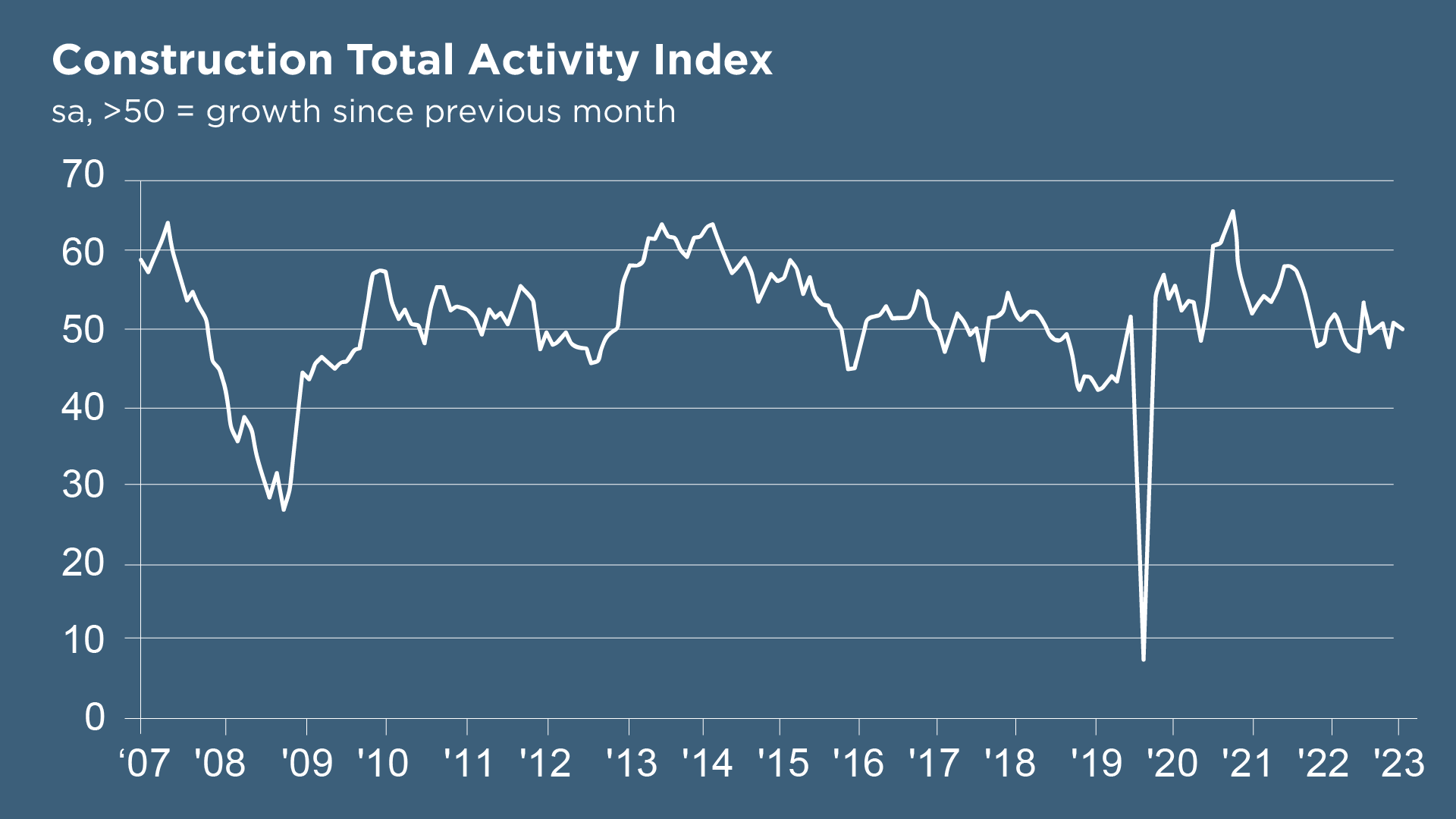

The headline S&P Global / CIPS UK Construction PMI Index signalled only a slight increase in overall construction output in August (index at 50.8). Resilient demand for commercial work helped lift overall activity, with growth in the commercial building (54.2) and civil engineering (52.4) segments offsetting a slump in house building (40.7).

August’s data signalled a further decline in total new order volumes, the steepest since May 2020. Survey respondents noted that rising interest rates and concerns about the near-term economic outlook had resulted in more cautious spending among clients, especially within the residential building segment.

Supplier delivery times for construction products and materials in August showed the second-highest improvement in 14 years, as pressure on stock availability and supplier capacity eased. An improved balance between demand and supply also helped stabilise overall input costs across the sector. While a marginal rise in purchasing prices was noted, competitive market conditions and successful price negotiations with suppliers are credited with falling raw material costs.

Key takeaway 3: Constant interest rates and inflation rates coming down

Following a run of 14 consecutive interest rate increases, the Bank of England surprised analysts with an interest rate freeze this month. Experts had speculated that the bank would raise rates to 5.5% in September, with markets and economists expecting this to be the final increase in the current cycle. Instead, rates were held at 5.25% - already their highest for 15 years. The decision could bring relief to homeowners with tracker mortgages who have seen their monthly repayments escalate consistently.

Rates remained unchanged due to unemployment figures rising, weaker than expected economic growth and a surprise slowdown in inflation. Chancellor Jeremy Hunt had suggested that there would most likely be a temporary increase to inflation in the latest Office for National Statistics data due to recent oil price rises, with Capital Economics predicting a rise from 6.8% in July to 7.1% in August. As it stands, inflation continues to fall - moving from 10.1% in October to 6.7% in August and the government claims it is on course to hit its target of halving inflation this year.

Bank of England governor Andrew Bailey expects inflation will continue to fall but cautioned there was “no room for complacency” with officials not ruling out another rate rise in future. Indeed, the central bank wants the public to be clear that interest rates will not come down soon with the chief economist suggesting that rates would remain on hold until the inflation threat had passed. This strategy is being termed “Table Mountain”, providing a visual cue for the forecast: rates have risen quickly and will remain flat ahead of gradually coming down. This will keep borrowing costs high, raise the return on savings and restrict growth in the economy – with the result of keeping downward pressure on inflation.

Key takeaway 4: The ‘Green Price Premium’

Research by Rightmove has shown there is an additional ‘green premium’ attached to houses with higher EPC ratings. This claim follows analysis of 300,000 properties that have sold twice in the last 15 years and have had a new EPC certificate issued. A home improving from an EPC rating of D to C could see an increase in value of 3%, whilst moving from an F to a C rating could add 15% to a property’s value.

An increasing number of estate agents are highlighting green features and improved EPC ratings when listing properties on Rightmove. The number of property listings that mention electric car charging points has also increased by 40% compared to 2022, and is up overall by 592% since 2019. Similarly, the number of listings noting an EPC rating between A and C in the key selling points has risen by 24% in the last year, and 59% versus 2019.

94% of homeowners surveyed by Rightmove think it is worth paying more for an energy efficient home. This comes as no surprise given the cost of living crisis: saving money on energy bills continues to be the main driver for people making green improvements to their homes. In defining specifications for their new builds, it’s critically important for developers to have the achievable value uplift quantified for the additional investment they must make for a higher rated end product.

Biodiversity Net Gain comes into force in November 2023 for developments in the Town and Country Planning Act 1990, and will apply to small sites from April 2024. There is some concern from developers that the government’s sustainability efforts will require them to incur further cost and effort – however, this approach could improve property attractiveness for those with green values through on-site features such as wildflower meadows, ponds, vegetated gardens and green roofs.

Key takeaway 5: Expectations for the economy

The EY ITEM Club predicted further interest rate rises from the Bank of England in its Spring Forecast (published in July), when the bank rate was expected to peak at 5.5%. The Club’s model indicates that every 25-basis point increase in bank rate reduces GDP growth by 0.1% to 0.2% after around 18 months. As such, the impact from the recent rate-raising cycle is expected to be significant and long-lasting. According to the Financial Times, the Bank of England will find it hard to commit to keeping rates high for a prolonged period. If an economic downturn were to gather pace, it would come under pressure to cut rates quickly. Martin Beck, chief economic adviser to the EY Item Club, says the Bank might well be bluffing with its higher-for-longer language – if another surprise drop in inflation and improvement in pay growth occurred, he believes the committee could change its stance with cuts beginning in early 2024.

The Spring Forecast also expected inflation to average 7.6% this year (up from April’s 6.2% forecast) before falling to 3.4% in 2024 (up from 2.5%) and 1.7% in 2025. Despite falling inflation, the Bank of England isn’t expected to reach its 2% inflation target until late 2024 or even early 2025.

At CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership. As such, our team of property experts continues to actively visit sites to discuss project progress and offer input on any barriers which need to be overcome:

CrowdProperty is a leading specialist property development finance business having funded £790m worth of property projects to date. With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means that we understand what developers are looking to achieve and help those developers succeed. Apply in just 5 minutes at www.crowdproperty.com/apply - our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

As featured in...