Borrow

Case Study

Podcasts

Awards

About

Keep reading for an overview of the property market updates and insights from October 2023 and how they could impact the plans of small and medium-sized property developers.

The five key takeaways covered in this report are:

- House prices dropped for the sixth consecutive month

- Construction output saw the steepest decline since May 2020

- Inflation remains unchanged (with interest rates expected to do the same)

- Permitted Development Rights continue to court speculation

- The economic outlook is starting to improve

Key takeaway 1: House prices are continuing to fall, albeit slower

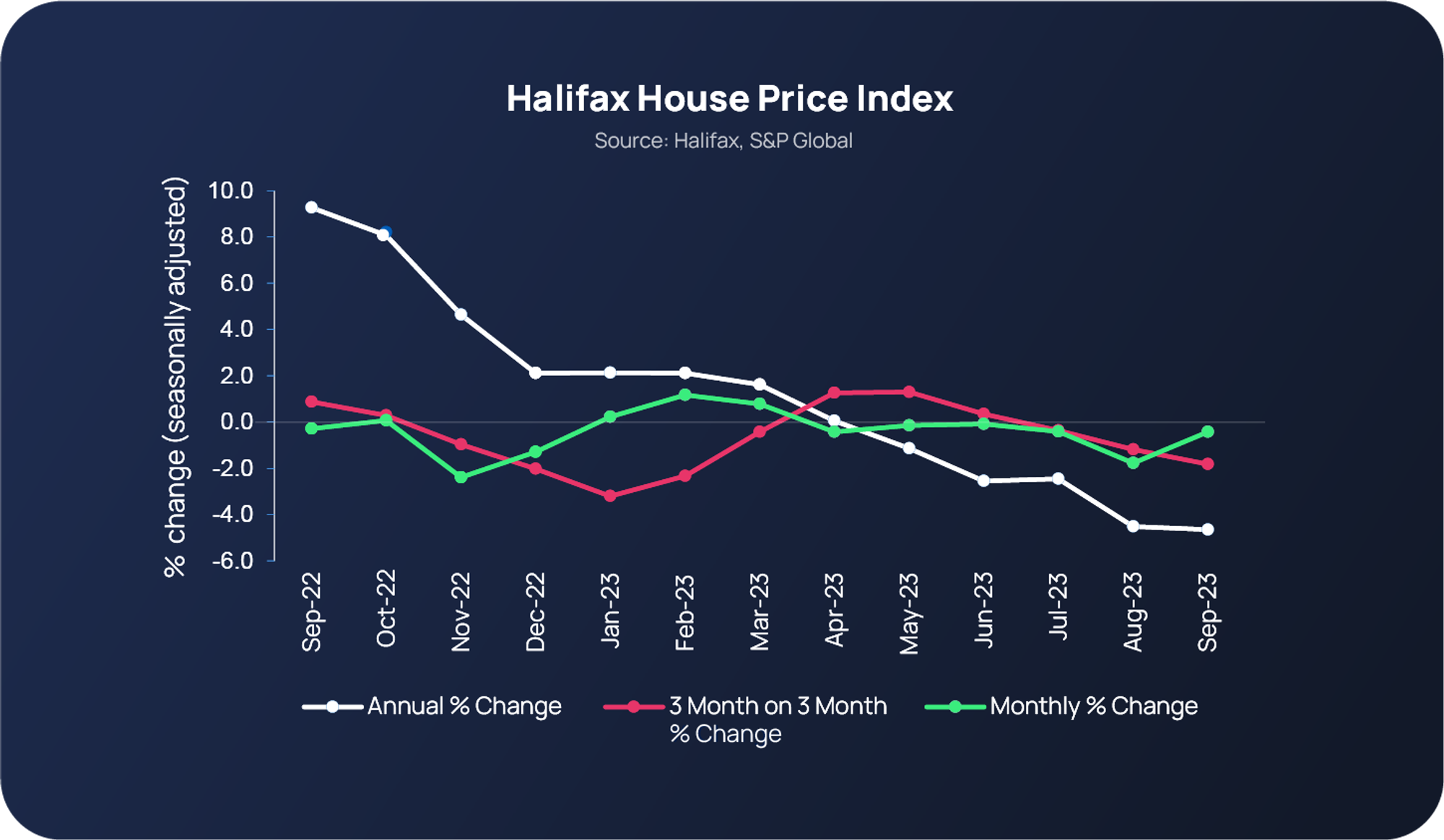

September’s Halifax House Price Index revealed the decline in property prices had slowed noticeably compared to August (-0.4% vs -1.8%). This marked the sixth consecutive monthly fall, bringing the cost of an average home to £278,601. While this is comparable to values seen in early 2022, Halifax notes that prices remain £39,400 higher than in March 2020 – a reminder of the extraordinary growth seen during the pandemic.

However, house prices have proven more resilient than expected, despite interest rate increases. Higher borrowing costs tend to impact mortgage affordability which, in turn, influences levels of market activity. As such, homeowners have become more realistic about their target selling price – reflecting what has increasingly become a buyers’ market. London remains the most expensive area to purchase a home in the UK, yet has seen the biggest fall of any region in cash terms, with prices down -4.8%. Prices in the South East of England have seen the most downward pressure, falling by -5.7% over the last year. Interestingly, Northern Ireland’s house prices have been the most resilient – down by just -0.2%. In real terms, average house prices today are the same as in 2003 (when the BoE base rate was at 4%) and 20% below the 2007 peak (when it was 5.5%).

The Bank of England’s decision to hold interest rates at 5.25% last month leads many economists to believe that interest rates are now likely at or around their peak, with predictions that the Base Rate will remain higher for longer. This could mean mortgage rates remain elevated, constraining buyer demand and putting downward pressure on house prices into 2024. However, it’s worth noting that fixed rate mortgage deals are easing and wage growth remains strong, which has helped with affordability.

Challenging conditions across the sales market continue to be reported by the RICS UK Residential Survey, with indicators on demand, sales, instructions and prices all remaining in negative territory. While the near-term outlook is still downbeat, 12-month sales expectations are now stable, with some respondents citing the Bank of England’s decision to pause monetary policy tightening as the reason for improved market sentiment.

Agreed sales figures produced a national net balance of -37%, which is more positive than the readings for the previous two months of -46% and -45% respectively. 12-month sales expectations returned a net balance of +3% (up from -5% in August), signalling a more stable trend in sales volumes emerging over the year ahead.

Meanwhile, in the lettings market, the mismatch between rising tenant demand and falling supply continues to push rental costs higher. A net balance of +43% of survey participants saw an increase in tenant demand in September. At the same time, a net balance of -24% for landlord instructions highlighted the scarcity of available listings. This backdrop is expected to cause rents to be squeezed higher, with respondents predicting close to 5% growth in rental prices across the UK (on average) over the next 12 months.

Key takeaway 2: Construction activity has fallen sharply

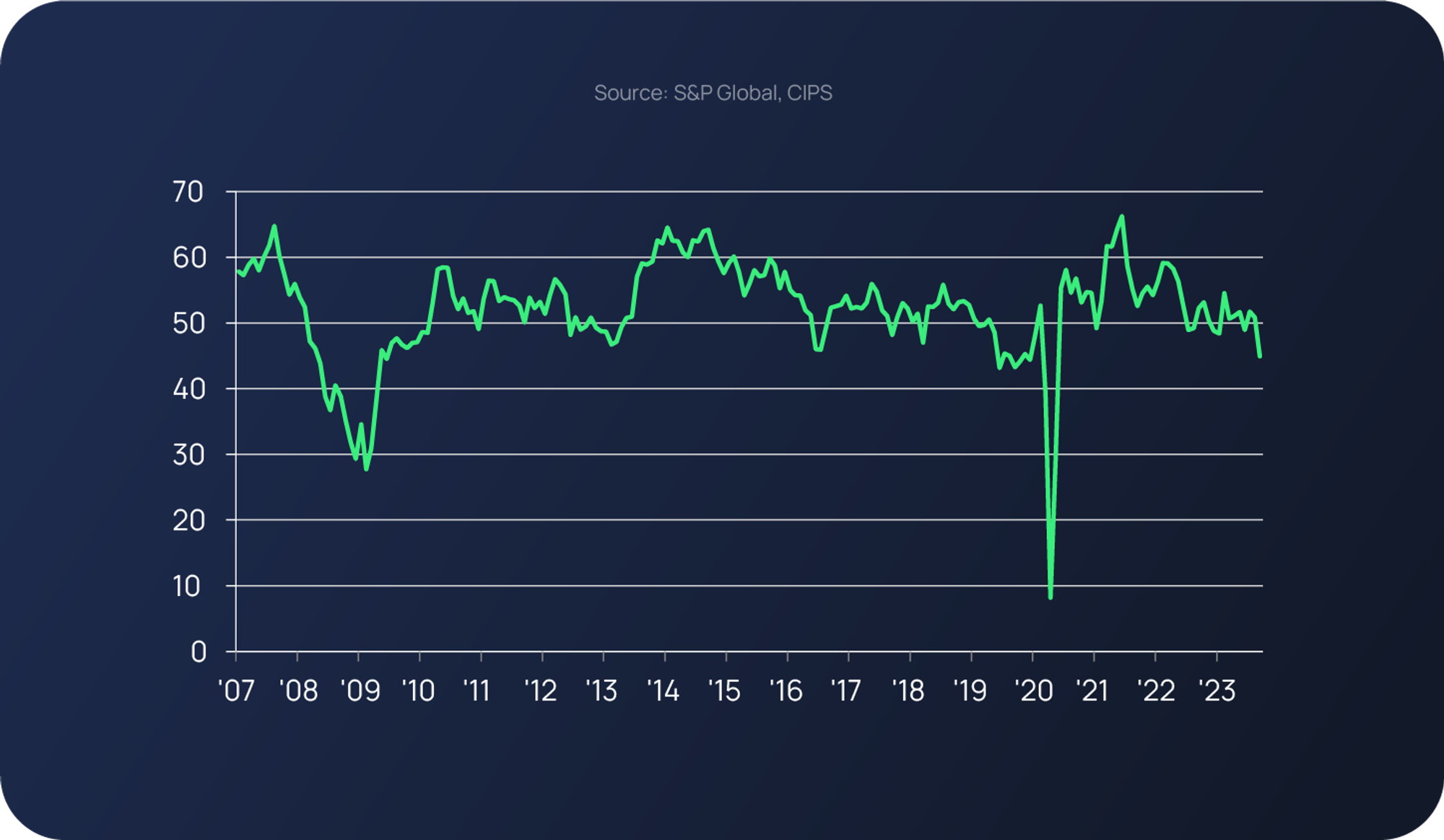

The impact of high mortgage rates and low house-buying demand continues to flow through the supply chain and negatively hit the UK construction industry. This has led to the steepest decline in construction output since May 2020 and is largely a result of the continued and accelerated slump in housebuilding activity, according to the S&P Global / CIPS UK Construction PMI Index. Total industry activity decreased for the first time in three months, registering at 45.0 in September – a sharp fall from 50.8 in August. Residential work (index at 38.1) was by far the worst-performing area of construction output, with this latest drop in activity the steepest since April 2009 (aside from the pandemic). Survey respondents widely commented on cutbacks to housebuilding projects amid rising borrowing costs and weak demand conditions.

The knock-on effect of this reduced workload saw the overall rate of employment growth at its weakest since June, with sub-contractor usage decreasing for the first time since January. Purchasing activity also decreased at a solid pace due to the lack of new projects and efforts to reduce inventories. This lower demand contributed to improved supplier performance, with delivery times for construction products and materials shortening for the seventh time in as many months.

Despite the latest data, 41% of construction firms predict a rise in output over the year ahead – linked to long-term business expansion plans and hopes of a turnaround in customer demand. Whilst only 17% of respondents forecast a decline in output in the next 12 months, overall business confidence has dropped to its lowest since December 2022.

This will result further periods of low housebuilding starts, meaning constrained housing completions in 2024 and beyond, by definition restricting the supply side of the UK property market. It’s already clear that housebuilding, as a significant driver of spend in the economy and critical to meet the country’s housing needs, will be an election battleground, so expect plenty of column inches as policies to drive housebuilding emerge.

Key takeaway 3: Inflation and interest rates remain unchanged

The latest figures from the Office for National Statistics show that inflation held steady at 6.7% in the year to September. City economists had forecast a modest fall to 6.6%, but soaring fuel costs offset the first monthly fall in food prices for two years. That said, prices remain significantly higher than a year ago, with the cost of an average food shop still up by more than 12% on an annual basis. Falling energy bills, easing food price inflation and weaker pipeline price pressures mean inflation is expected to drop to around 4.5% by the end of 2023, before declining to the Bank of England’s 2% target in the second half of 2024 and even hitting 1.7% in 2025. However, higher oil prices, frozen income tax thresholds, still-high inflation, and a deteriorating labour market look set to put pressure on consumer spending. Unemployment is now forecast to peak at 4.8% next year, up from July’s forecast of a 4% to 4.5% peak in 2023.

Taking the above into account, consumer spending is expected to grow 0.7% this year (vs. July’s prediction of 0%), 0.7% in 2024 (up slightly from 0.6%) and 1.7% in 2025 (no change) according to EY ITEM Club.

Economists predict that the outlook for inflation is more positive for the coming months, with inflation on track to fall below 5.1% by December. Alongside a return to growth for the UK economy in August (+0.2%) following a sharp fall in July, financial markets speculate that this could be sufficient for the Bank of England to hold interest rates again in November’s announcement. The Bank Rate is not expected to increase beyond its current level of 5.25%, and the EY ITEM Club believes the Monetary Policy Committee (MPC) may start to cut interest rates from May 2024.

Key takeaway 4: PDR speculation continues to mount

In July, the Government enforced changes to Permitted Development Rights (PDR) that provide greater flexibility to those in the leisure, media and defence industries. It also launched a further consultation on additional flexibilities to support housing delivery through commercial and agricultural conversions in the GPDO which closed in late September, with the feedback now being analysed.

Government plans to allow hotels to convert to housing under permitted development rights are intended to boost the delivery of homes in cities, but are likely to see greater uptake in seaside towns rather than town centres, practitioners suggest. Hotels are ideal for conversions as they are normally in good locations, with services already in place and spread around the building, but there are fears that the loss of such facilities could damage local tourism economies and create demand for more short-term lets.

Premises, such as offices, barns and shops are not always suitable and there are concerns that allowing developers to convert empty properties into flats and houses without applying for planning permission could risk creating poor quality residential environments that negatively impact people’s health and wellbeing, as well as a lack of affordable housing or suitable infrastructure.

Key takeaway 5: The economic outlook is starting to improve

A likely end to rate increases at the MPC’s last meeting, combined with falling inflation and a return to real pay growth, should keep the economy from falling into recession. It is predicted the UK economy will grow 0.6% in 2023, up from the 0.4% growth projected in July’s Summer Forecast. However, GDP growth expectations for 2024 have been downgraded slightly from 0.8% to 0.7%, as the impact of the recent interest rate rising cycle continues to feed through. The economy is still forecast to grow 1.7% in 2025 as lower inflation lifts real incomes and interest rates are cut.

Business investment growth prospects for 2023 have been significantly upgraded, despite the higher cost of debt, with forecasts upgraded to 5.9% (vs. 1.4% growth expected in the Summer Forecast). This would be the fastest rate of growth since 2016, excluding the post-pandemic bounceback seen in 2022 – however, high interest rates and a low-growth economy mean the pace of investment growth seen in the first half of 2023 is unlikely to be sustained. As such, a modest fall in investment is expected in 2024 with a contraction of around 0.5%.

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership. As such, our team of property experts continues to actively visit sites to discuss project progress and offer input on any barriers that need to be overcome.

CrowdProperty is a leading specialist property development finance business having funded £810m worth of property projects to date. With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply – our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

As featured in...