Borrow

Case Study

Podcasts

Awards

About

An overview of the key property market updates and insights from November 2023 for small and medium-sized property developers.

November’s key takeaways – at a glance:

- House prices rise for the first time in six months, but remain lower than last year;

- Housebuilding contracts for the 11th successive month and puts the construction sector under further pressure;

- Inflation drops sharply to the lowest rate in two years;

- Plans for ‘no-fault’ evictions are put on hold;

- Expectations for the UK economy;

- 67% of developers intend to maintain or increase project plans in the coming 12 months.

Key takeaway 1: House prices rise for the first time in six months, but remain lower than last year

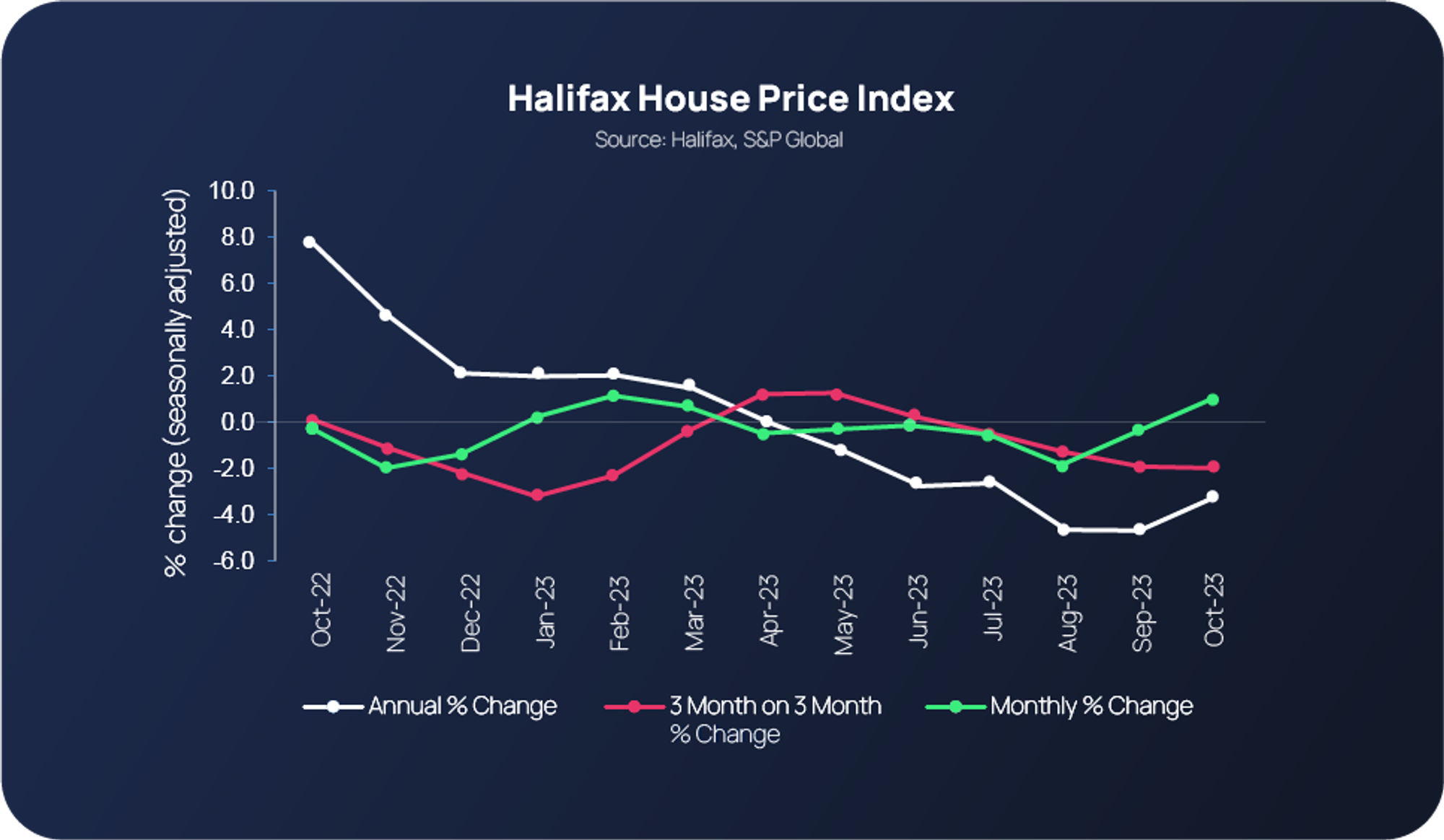

According to October’s Halifax House Price Index, UK house prices rose by 1.1% last month, breaking the run of six consecutive monthly falls. The average house price now currently sits at £281,974, which represents an increase of almost £3,000 compared to September. However, despite house prices slightly increasing from a monthly perspective, they are down compared to last year’s figures - house prices last month (October) were 3.2% lower than the same month a year ago.

- South East England reported the largest fall - prices decreased by -6.0% over the last year (average house price now £374,066);

- Scotland’s annual house price was the most resilient - down just -0.2% annually, with the average cost currently standing at £202,608;

- In Northern Ireland – there was a decline of -0.5%, putting the average house price at £183,922;

- London continues to have the highest average house price in the UK - £524,057, falling -4.6% over the last year.

Meanwhile, the combination of cautious prospective sellers and low supply of homes for sale has reportedly strengthened house prices in the short-term. Buyer demand remains weak overall – a fifth lower than the same period last year and 25% below the five-year average for October – reducing its impact as a driver of prices.

Halifax also notes that financial markets are not expecting the base rate to reduce any further anytime soon, and house prices, which remain around £40,000 above pre-pandemic levels, are not expected to return to growth until 2025. On the subject of predicted growth, Savills anticipates annual transactions will return to around 1.16 million by 2026, and remain at that level until 2028, with only mortgage buy-to-let activity remaining muted.

A continued downturn, albeit slightly less downbeat than previous weeks, is reported in the latest RICS UK Residential Survey alongside negative territory demand and sales metrics. Overall, RICS says the market remains subdued, despite the minor pockets of positive uplifts (as reported above).

Agreed sales figures produced a national net balance of -25%, which remained consistent with generally weak activity levels seen during October. However, while the levels may be weak, they were an improvement on the -45% and -35% recorded in August and September, respectively. Looking ahead to the next 12 months, a broadly stable outlook of 0% is expected in relation to sales market activity.

Across the lettings market, a headline net balance of +33% contributors noted a comfortably positive increase in tenant demand in the three months to October – the most modest reading for the tenant demand series since Q2 2021. At the same time, landlord instructions continue to fall (net balance -18%), with most UK areas seeing a further reduction in such listings. Over the next 12 months, rents are projected to rise by around 4% on average across the UK.

Key takeaway 2: Housebuilding contracts for the 11th successive month and puts the construction sector under further pressure

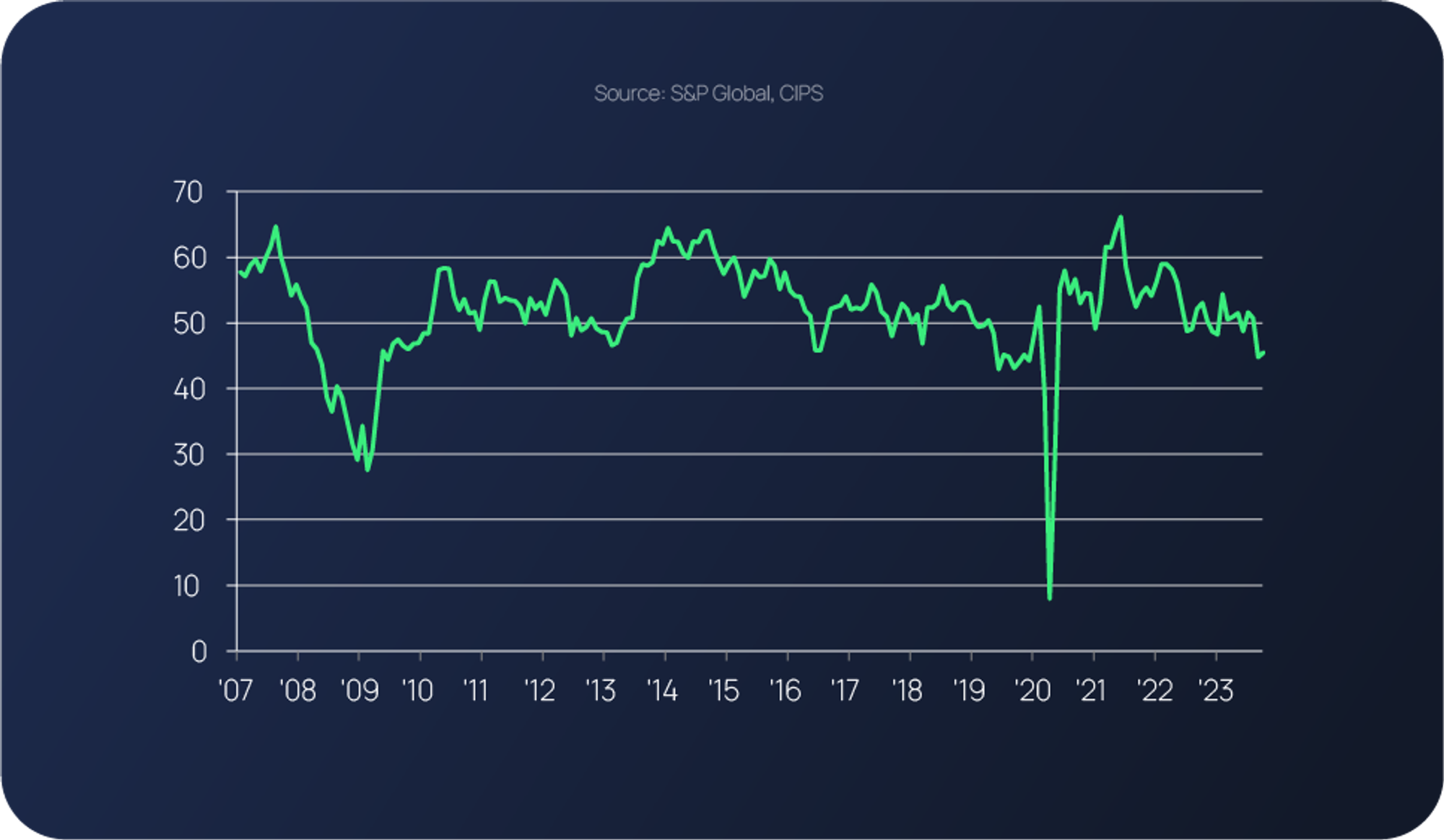

Falling house-buying demand, coupled with high interest rates and elevated borrowing costs, were among the key challenges highlighted by UK construction companies in the November edition of the S&P Global/CIPS UK Construction PMI.

Improving supply conditions and falling demand contributed to a renewed decline in purchasing prices, with the latest input costs decline being the steepest since August 2009. Reduced workloads also led to a decline in subcontractor charges for the first time in more than three years.

Total industry activity sat at 45.6 in October - a marginal increase from September’s 45.0 recording. However, despite the slight increase, October’s reading is the second-lowest reading since May 2020, signalling a marked decline in overall construction activity.

Another key takeaway from the latest update is that housebuilding decreased for the eleventh successive month in October at a much steeper pace than elsewhere in the construction sector (index at 38.5). Falling work on residential construction projects has been widely linked to a lack of demand and subsequent cutbacks to new projects.

Meanwhile, the volume of new work reduced for the third-month-running in October, putting the rate of contraction at its joint-sharpest since May 2020. A lack of tender opportunities and lengthier decision-making among clients are among the contributing factors.

Fundamentally, the current UK housebuilding picture is weighing heavy on the overall construction sector, with several companies highlighting the weakness of the housebuilding sector and the pressure of higher interest rates within their feedback. It’s clear that housebuilding will be a key 2024 election battleground, as the major political parties have already signalled.

Key takeaway 3: Inflation drops sharply to the lowest rate in two years

The latest set of monthly figures released by the Office for National Statistics show that UK inflation dropped sharply in October, from 6.7% to 4.6%, the lowest rate in two years. Last year’s step rise in energy costs followed by a reduction in the energy price cap this year is being cited by economists as the main reason behind the fall. Although gas and electricity prices have slightly eased, they still remain at a higher level than two years ago. This was a slightly greater drop than markets expected.

According to the ONS, housing and household services prices fell by 0.3% between September and October 2023, compared with a rise of 3.4% between the same two months a year ago. This resulted in an easing in the annual rate to 1.9% in October 2023, down from 5.7% in September and a peak of 11.8% in January and February. The decrease in the rate between September and October 2023 reflected downward effects from gas and electricity. However, prices are still high in comparison to recent years: the price of gas in October 2023 was around 60% higher than in October 2021, while the price of electricity in October 2023 was around 40% higher.

As inflation rates are predicted to decrease further over the coming months, the main justification for a high base rate is due to be eliminated. However, the Bank of England’s decision at the start of November to hold interest rates at 5.25% for the second consecutive month is unlikely to have an immediate impact – historical trends indicate that interest rates that have increased over time tend to stabilise for a period before beginning to decline. Financial markets are not anticipating a decline in the base rate immediately.

Having peaked at the end of July, mortgage rates have fallen over the last three months and are expected to reduce further. Indeed, Morgan Stanley expects interest rates to be cut by May next year, with the base rate falling to 4.25% by the end of 2024; similarly, Capital Economics has previously predicted that that the base rate will fall to 3% by late 2025. These forecasts will be welcome news for mortgage borrowers – however, changes to the broader economic environment could cause the situation to shift at any moment with financial experts noting that the latest ONS labour market overview could prove inflationary in the short term.

Key takeaway 4: Plans for ‘no-fault’ evictions are put on hold

Plans to implement a ban on ‘no-fault’ evictions in the UK have been delayed by the Government. The news comes after the Renters’ Reform Bill, which these plans fall within, passed its second reading in the House of Commons in October.

The proposed law, which will see no-fault Section 21 evictions being banned, was first published in May this year. However, the legislation cannot reportedly be implemented until a series of improvements are made to the UK court system first.

Under current legislation, landlords can evict tenants who are not on fixed-term contracts without giving a reason, under housing legislation known as Section 21. After receiving a Section 21 notice, tenants have two months before their landlord can apply for a court order to evict them.

Under the Renters’ Reform Bill, all tenancies would be classed as ‘rolling’ contracts with no fixed end date. After six months, landlords would be able to evict tenants in certain circumstances, for instance, if they wanted to sell the property. The new legislation would also reportedly make it easier for landlords to repossess their properties in cases of anti-social behaviour or where the tenant repeatedly failed to pay rent.

The Bill will now progress to Committee stage. A date has not yet been set however; it is anticipated to be completed by December 5 this year.

Key takeaway 5: Expectations for the UK economy

The UK economy remains stuck between weak growth and the risk of persistently high inflation, according to the Institute for Fiscal Studies. As for the country’s economic outlook, the IFS says it hinges on three primary factors – the unwinding of adverse terms of trade; tighter monetary policy and greater inflationary persistence, particularly in relation to wage-setting. The IFS also predicts that even with modestly positive real wage growth, real household disposable income is likely to continue to shrink in 2024 due to higher interest rates and ongoing tax rises. And it expects household consumption to stagnate through 2024 and 2025.

As for labour market dynamics, a shift has started to take place - unemployment has increased from 3.5% in 2022 through to 4.3% now. The IFS expects to see this figure climb to 5.8% by the end of 2024. As for inflation, further reductions are expected, which will see it dropping to 4% over the coming weeks, meeting the Prime Minister’s overall goal to reduce it by half before the year is out.

Key takeaway 6: 67% of developers intend to maintain or increase project plans in the coming 12 months

In terms of forecasts for the property sector, the results of our Autumn Property Developer & Investor Index uncovered key trends to date and market expectations, including:

- Planning continuing to be a challenge for developers, with 30% citing planning policy as a concern;

- Both developers and investors having a cautiously optimistic outlook, with expectations of significantly increased activity by 2025;

- Government policy being a major concern for both investors and developers (42% and 26% respectively).

Download a copy of the full report here.

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team.

We are a leading specialist property development finance business and have funded £818m worth of property projects to date.

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply – our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding.

As featured in...