Borrow

Case Study

Podcasts

Awards

About

An overview of the latest key property market updates and insights for small and medium-sized property developers.

Key takeaways - at a glance:

- House price recovery continues alongside improving mortgage rates

- Construction activity declines and purchasing costs reach a 14-year low

- Workforce numbers drop for the first time in a decade while supply chain pressure eases

- Government fails to meet annual housebuilding target

- UK economic growth will remain slow for the next two years

- The market’s view on 2024

Key Takeaway 1: House price recovery continues alongside improving mortgage rates

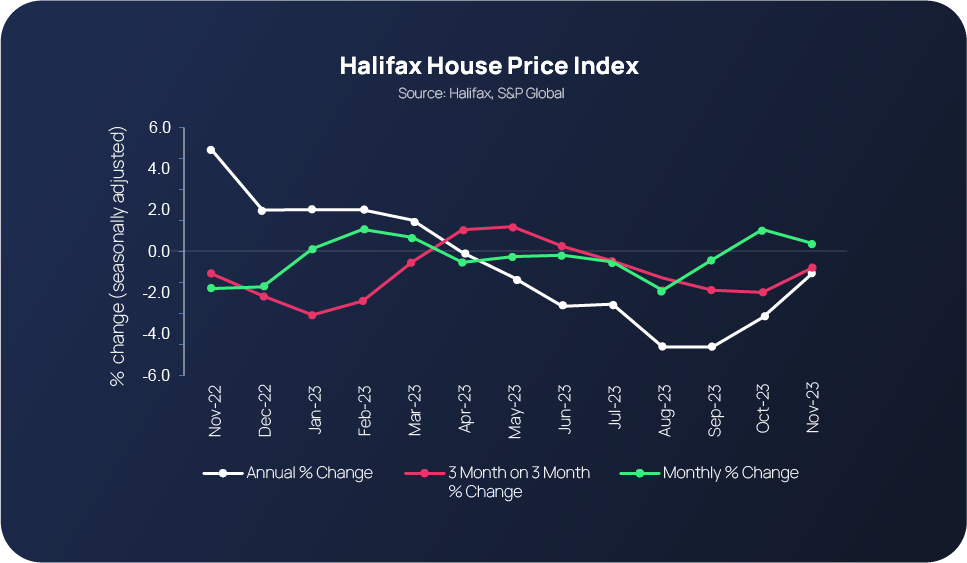

The Nationwide House Price Index reports that UK house prices rose for a third consecutive month in November, despite a Reuters poll of economists forecasting a 0.4% fall. This marks the first time that homeowners will have seen the value of their property rise for at least three months in a row since Summer 2022.

Prices rose 0.2% month-on-month in November, resulting in the annual rate of house price growth increasing from -3.3% in October to -2.0% last month - the strongest improvement since February 2023. These latest figures provide further evidence of a resilient property market despite broader economic considerations. Nationwide notes this improvement follows the view that the Bank of England’s move to hold the base interest rate once again means soaring mortgage costs will start to drop, fuelling more activity in the housing market.

The Base Rate has remained at 5.25% since August 2023, a decision made possible through previous increases in interest rates working successfully to bring inflation down according to policymakers. Inflation has fallen from over 10% in January 2023 to c. 4.5% towards the end of 2023, however Bank of England Governor Andrew Bailey has highlighted the need to keep interest rates high for a while longer in order to “get inflation all the way back to 2%”. Despite indications that the Base Rate is unlikely to drop until well into 2024, the rate freeze has been enough to encourage a more competitive mortgage market with an easing in mortgage rates already visible over recent weeks and lenders expected to offer further reductions in the new year. In turn, the number of sales agreed in November were at pre-pandemic levels, making it the strongest month for activity since March 2023.

With the average house price now at £283,615, Halifax reports that property prices have held up better than expected – falling by a relatively modest -1.0% on an annual basis and still £40,000 above pre-pandemic levels. The resilience in hour prices this year continues to be underpinned by a shortage of available properties, rather than a significant strengthening of buyer demand. Recent mortgage approvals figures show an increase in activity levels, thought to be the result of improving affordability conditions for homebuyers. With mortgage rates easing, buyer confidence is expected to increase – resulting in people being more inclined to progress their purchases.

Key Takeaway 2: Construction activity declines and purchasing costs reach a 14-year low

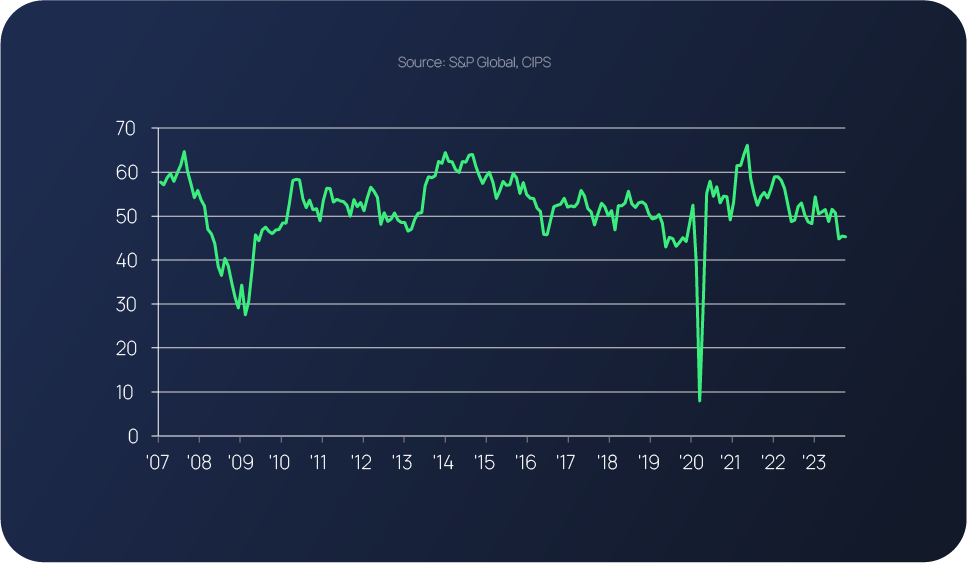

According to the December edition of the S&P Global/CIPS UK Construction PMI, UK construction companies reported a decline in business activity in November for the third consecutive month. The decline follows another sharp fall in residential building activity, with elevated borrowing costs and subdued demand for new housing projects also being cited among the main construction activity barriers.

At the same time, purchasing costs significantly dropped, resulting in the largest sector-wide reduction in 14 years. Lower raw material prices and increased competition among suppliers combined with a backdrop of continued falling demand have all been linked to the purchasing cost downslide.

As for overall industry activity, the latest figures show that total activity stood at 45.5 in November, slightly down from October’s 45.6, remaining below the 50.0 no-change value for the third month in a row.

Meanwhile, housebuilding in November (index at 39.3) was identified as being the weakest-performing segment followed by civil engineering (43.5). Residential development project cutbacks and a general slowdown in overall activity due to unfavourable marketing conditions have been linked to the latest index rating, which will exacerbate the bigger-picture housing undersupply challenge.

Key Takeaway 3: Workforce numbers drop for the first time in a decade while supply chain pressure eases

Concerns relating to near-term demand not only led to lower purchasing activity, but also a reduction in construction worker employment for the first time in ten months (S&P Global/CIPS UK Construction PMI).

With workforces being scaled down in order to reflect current activity levels, the continuous downward drift in input buying over the last six months also reflects reduced workloads and a lack of new project starts. Increased price competition among suppliers and falling raw material costs are said to be the two main areas fuelling the input price decrease. Despite this, November figures show that the sector emerged from a period of intense supply chain pressure, with average lead times among vendors shortening for the ninth successive month.

Falling prices for materials, particularly steel and timber, spare capacity among suppliers and weaker demand for construction inputs have all contributed to these latest indicators. However, transportation delays still continue to hamper some supply chains.

Key Takeaway 4: Government fails to meet annual housebuilding target

Plans to build 300,000 homes a year in the UK by the mid-2020s are yet to be achieved by the Government following reports of it falling well short of its annual housing target for the last 12 months, yet again (the UK hasn’t built 300,000 homes for decades).

New housing supply statistics released by the Department for Levelling Up, Housing and Communities have revealed 234,400 net additional dwellings were built in England in 2022/23, a similar figure to the previous year (there were 234,462 new dwellings 2021/22). New builds, houses that are converted into flats and commercial buildings that are converted into residential buildings are all classed as ‘net additional dwellings.’

In 2022/23, there were 212,570 new-build homes, 22,160 gains from change of use between non-domestic and residential, 4,500 from conversions between houses and flats and 640 other gains (caravans, house boats, etc.), offset by 5,470 demolitions. Data from The Office for National Statistics shows 202,820 permanent dwellings were started in 2022/23; 210,320 homes completed in the same period, with Q3 boasting over 60,000 completions for the first time since Q3 2007.

The Government has said it is on track to meet its target of delivering one million more homes by the end of this Parliament, a target that was pared back to what might be possible, rather than what is needed.

Key Takeaway 5: UK economic growth will remain slow for the next two years

Inflation is anticipated to remain higher for longer and take until the second quarter of 2025 to return to the 2% target, more than a year later than forecast in March, according to the Office for Budget Responsibility’s latest Economic and Fiscal Outlook.

In spite of this, the Bank of England has held rates at 5.25% in its latest announcement with many believing that the Bank Rate has now peaked and will be lowered to c. 3.5% in the years ahead. This is a change from mid-August 2023 when investors had expected rates to peak at 6% and reduce modestly to c. 4% over the next five years. This shift is important as it has led to a decline in the longer-term interest rates that underpin fixed rate mortgage pricing, with SONIA swaps currently at 4.3% for 2 year rates (vs 4.7% in November) and 3.6% for 5 year rates (vs 4.1% in November). If sustained, this will help to ease the affordability pressures that have been stifling housing market activity in recent quarters.

The UK is set to grow by 0.6% this year. This forecast presents a considerably better outlook than what was expected last autumn - the economy falling into recession and shrinking. However, the overall UK growth outlook has been lowered to 0.7% in 2024 and 1.4% in 2025, which is down from the previous OBR forecast of 1.8% and 2.5%.

Meanwhile, projections shared in the November Monetary Policy Report (MPR) indicate that global growth over the next year is due to remain below its 2010-19 average, reflecting tighter monetary and financial conditions.

Key Takeaway 6: The market’s view on 2024

Last quarter’s CrowdProperty Developer & Investor Index survey results showed a slight drop off in sentiment vs earlier in the year, but 65% of Developers and 86% of Investors still planned to do the same or more in the upcoming year. It’s clear many more developers are looking to hold what they build for long-term growth, and Planning Policy has grown to be the greatest current concern for Developers. 12 months on from our first PDII, Developers are winning the property market forecasting competition, with Investors next and Economic Forecasters last.

How will this play out this quarter? Our Winter 2023 Survey closes next week - please do join the conversation and stay tuned to find out the sentiment of small and medium sized developers and investors just like you, and how that’s changing quarter on quarter, in the new year.

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team

We are a leading specialist property development finance business and have funded £819m worth of property projects to date

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply – our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding

As featured in...