Borrow

Case Study

Podcasts

Awards

About

With the Bank of England’s base rate at its highest level since 2008 and the Renters’ Reform Bill set to transform the private renting market, CrowdProperty reviews the impact of the latest economic and political measures on the property market.

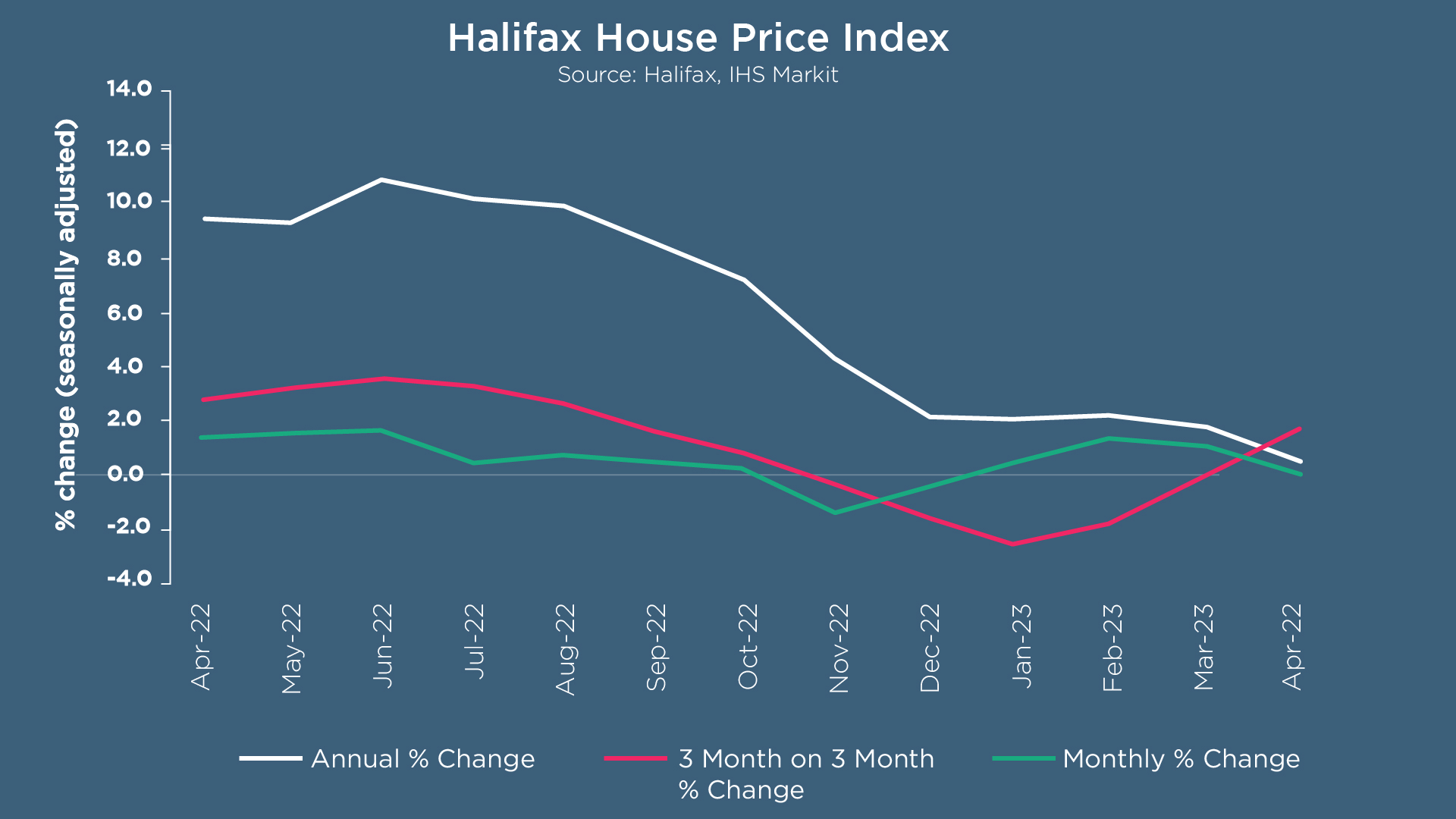

The annual rate of house price growth slowed to +0.1% last month, versus +1.6% in March, according to the latest Halifax House Price Index. With the average house price decreasing by -0.3% in April, following a +0.8% increase in the previous month, a typical UK property is now valued at £286,896. House prices in the south of England are under the greatest pressure, with the South East registering the sharpest decline at -0.6%. London remains the most expensive location for properties in the UK, with an average price of £538,409 (-0.2% annual growth rate). The West Midlands recorded the strongest annual growth at +3.1%; Northern Ireland (+2.7%), Scotland (+2.2%) and Wales (+1.0%) also witnessed an increase in average property prices on a year-on-year basis.

Kim Kinnaird, Director, Halifax Mortgages, said: "The economy has proven to be resilient, with a robust labour market and consumer price inflation predicted to decelerate sharply in the coming months. Mortgage rates are now stabilising, and though they remain well above the average of recent years, this gives important certainty to would-be buyers. While the housing market as a whole remains subdued, the number of properties for sale is also slowly increasing, as sellers adapt to market conditions.

“Alongside a market-wide uptick in mortgage approvals, these latest figures may indicate a more steady environment. However, cost of living concerns… combined with the impact of higher interest rates [lead us to] expect some further downward pressure on house prices over the course of this year."

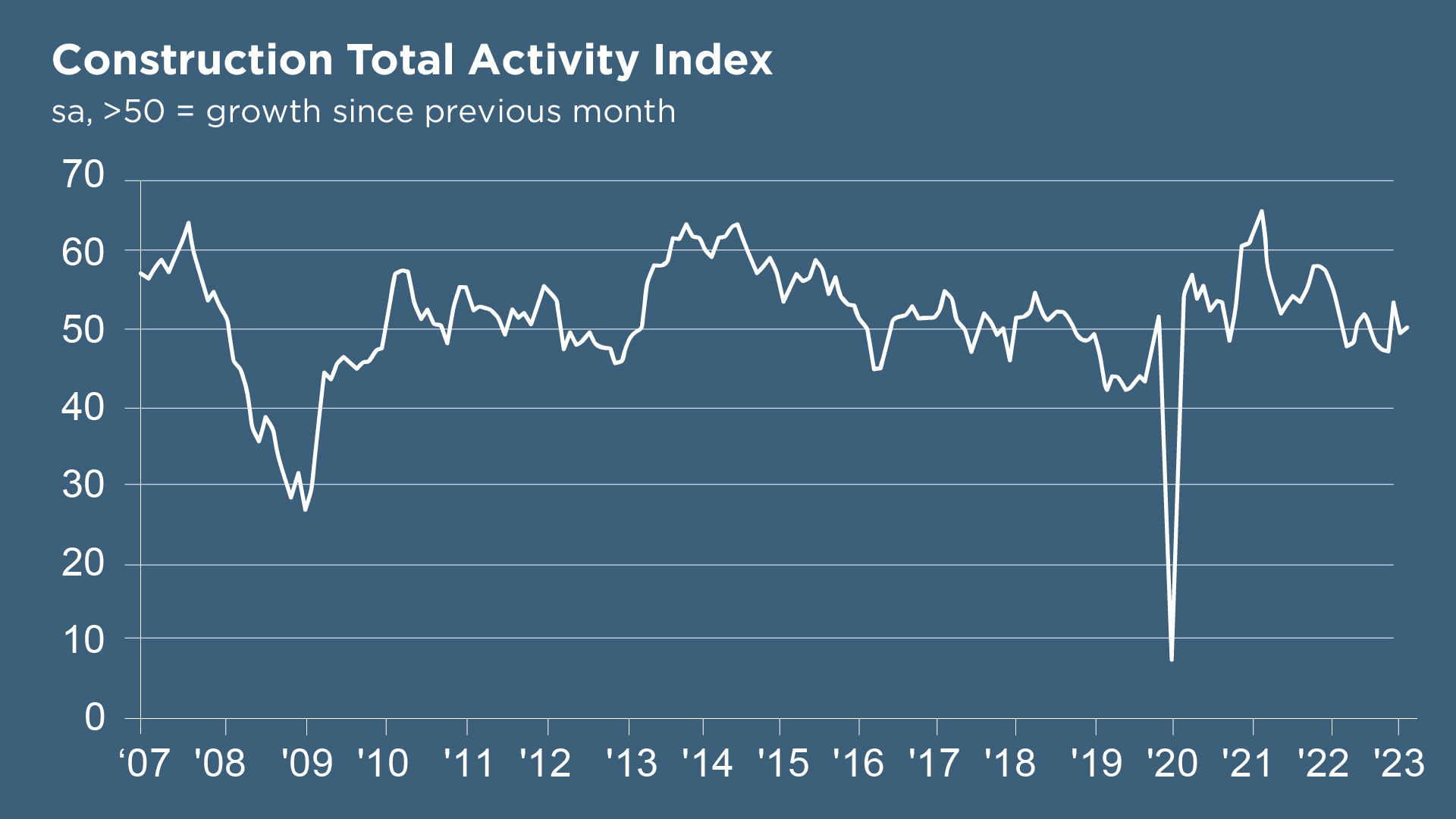

The S&P Global / CIPS UK Construction PMI reports a rise in total construction activity for the third month running. Commercial building (index at 53.9) was the fastest-growing area, with improving economic conditions helping to boost clients’ willingness to spend; civil engineering activity (index at 52.0) also increased, supported by resilient pipelines of work on infrastructure projects. However, house building (index 43.0) declined at the sharpest pace for almost three years with survey respondents commenting on delays to new house building projects, constraints on demand from softer market conditions and higher borrowing costs.

Supply chain performance continues to improve, with lead times among vendors shortened to the greatest extent for over 13.5 years. Efforts to reduce inventories reportedly constrained purchasing activity for some construction firms during the latest survey period. This combination of improved supply and relatively subdued demand helped to alleviate cost pressures, with the rate of purchase price inflations the slowest since November 2020.

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply (CIPS), said: “The mixed picture found in the UK construction industry in April is representative of an economy still trying to recalibrate after being buffeted by the manifold challenges of political instability, lockdowns and supply chain pressures.

“The sharp decline in UK house building… will be a cause for concern, as it becomes clear that the recent interest rate rises will continue to hamper consumer demand for some time to come. With a further rate rise… there will be concerns that things will get worse before they get better for UK house builders.”

Following an announcement in June 2022, the government has finally introduced its Renters’ Reform Bill to parliament – with plans for new legislation which it claims will see the biggest shake up of the private rented sector for 30 years. The bill aims to protect private rented sector tenants by ensuring they are able to access safe and secure living accommodation. Although the majority of renters live in homes that are safe, one in five people live in a property that is considered to be unfit – more than half of which pose a risk to renters’ health and safety. According to the latest English Housing Survey, the number of homes that are classed as being non-decent has fallen from 44% in 2018 to 23% in 2021. Despite this, nearly 1 million properties in the private rented sector are still classed as being non-decent.

The newly published bill sets out a 12-point plan that the government sees as areas of improvement for the private rented sector. According to Zoopla, the Renters’ Reform Bill will impact both tenants and landlords in the following ways:

- TENANTS

- Abolishing Section 21 evictions which result in tenants needing to find a new home, often at short notice

- Only allowing rent increases once per year; doubling notice periods for rent increases; making it easier to challenge unjustified rent rises and obtain refunds for poor quality living accommodation

- Making it illegal for landlords to have blanket bans on renting to families with children or those in receipt of benefits

- LANDLORDS

- Introducing a Decent Homes Standard which requires homes to be in a reasonable state of repair, have reasonably modern facilities and services, and provide a reasonable degree of thermal comfort; increasing penalties for sub-standard accommodation (6 out of 10 landlords support these new minimum standards)

- Empowering councils with more powers to challenge landlords who do not meet their obligations (74% of landlords feel that local authorities should take more action against rogue landlords)

- Making it easier to claim back property under certain circumstances, eg: when a tenant engages in antisocial behaviour

Despite the agreement cited by Zoopla, research by the National Residential Landlords Association (NRLA) reveals that 76% of landlords feel that their businesses are threatened by the Government’s proposals. 93% of respondents say the proposals will increase the financial risk of being a private sector landlord, while nearly 85% of landlords think the proposed reforms will have a negative impact on their cashflow. A combination of tax changes, increased regulation and higher interest rates have caused many buy-to-let landlords to exit the sector in recent years – and there are concerns that the bill could cause more landlords to sell, putting further upward pressure on rents. Zoopla’s latest research claims that rents have hit a 10-year high, increasing by 10.9% during the past year due to increasing demand and a shortage of available rental properties.

In spite of the challenge of raising a deposit and higher mortgage borrowings costs, purchasing a property is becoming increasingly cost effective due to escalating rental costs. According to Rightmove, demand from home-buyers looking to move is now higher than pre-pandemic levels - most notably in the typical first-time buyer sector. Lenders will try to remain competitive in order to help this segment of the market get on the property ladder, with some offering 100% mortgage products to address affordability challenges.

Fixed-rate mortgage rates have been slowly rising in anticipation of the Bank of England’s base rate increasing to 4.5%, the highest it has been for almost 15 years. The Bank keeps raising interest rates to tackle high levels of inflation; however, the Monetary Policy Committee’s analysis of the UK economy states that it expects inflation to fall quickly, to around 5% by the end of 2023, and continue to do so in order to meet the 2% target by late 2024.

Richard Donnell, Executive Director – Research at Zoopla, commented on the bank rate’s potential impact on house prices: “We think UK house prices will be 1% lower on average than today by the end of 2023. With mortgage rates set to remain higher than in the past, house price growth is going to be much lower than in recent years, with prices rising more slowly than earnings. If the outlook for the economy deteriorated rapidly and unemployment increased, there would be greater likelihood of larger house price falls.

“If you’re selling your home, you’re very unlikely to get the price you would have got a year ago. At the start of 2022 most sellers got 100% of the asking price. Today, buyers are negotiating harder and the average seller is having to accept 4-6% below the asking price. Many sellers have adjusted asking prices slightly lower in the last six months to reflect the reduction in buying power resulting from higher mortgage rates.”

At CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership. As such, our team of property experts continues to actively visit sites to discuss project progress and offer input on any barriers which need to be overcome:

CrowdProperty is a leading specialist property development finance business having funded over £685m worth of property projects to date. With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means that we understand what developers are looking to achieve and help those developers succeed. Apply in just 5 minutes at www.crowdproperty.com/apply - our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

As featured in...