Borrow

Case Study

Podcasts

Awards

About

Despite inflation and energy prices remaining high, leading to predictions of interest rates continuing to rise, the UK economy seems to be turning a corner. CrowdProperty reviews the latest market commentary and the outlook for both the property sector and wider economy.

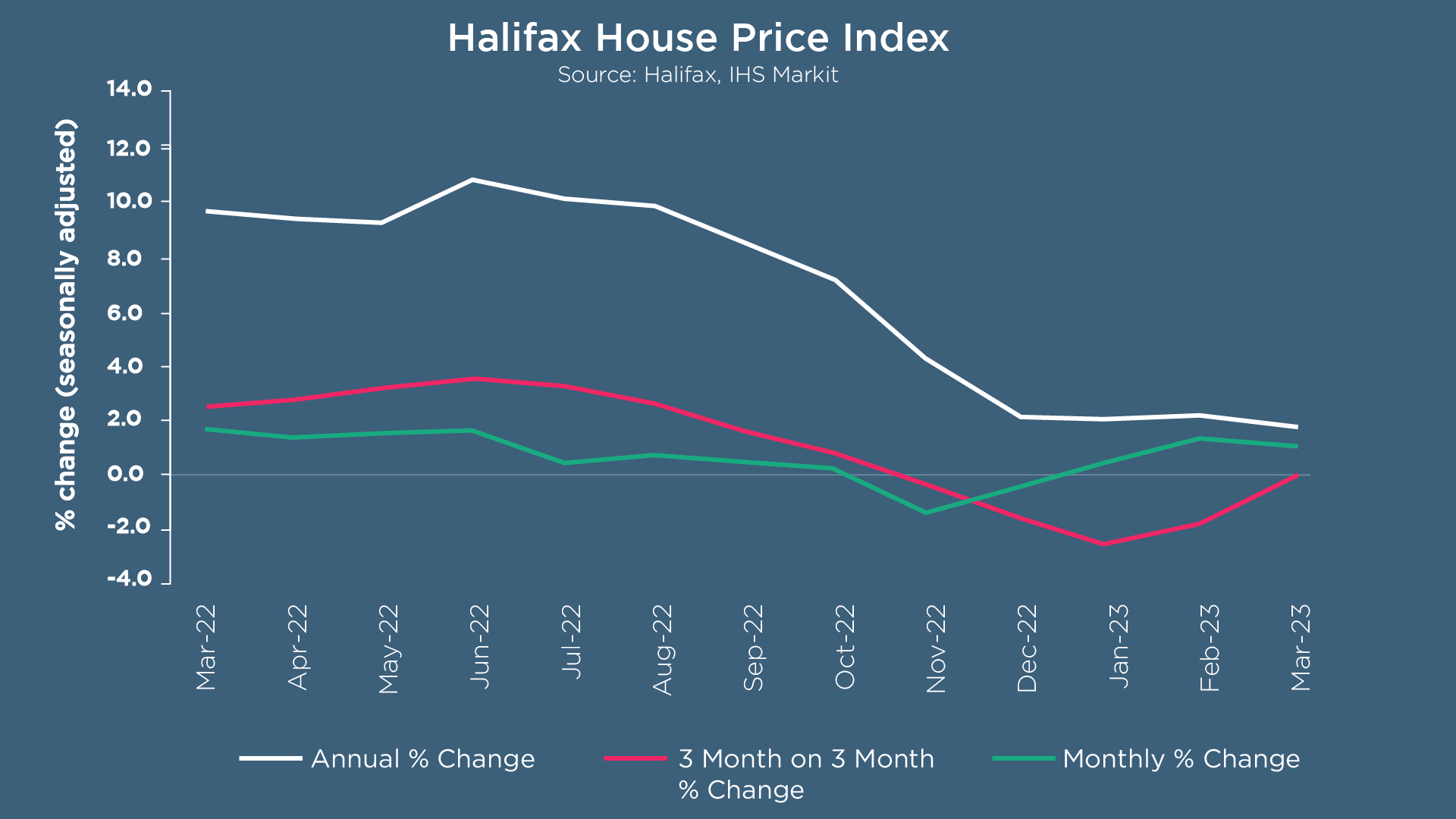

The most recent Halifax House Price Index reveals that the average house price increased by +0.8% in March, following a +1.2% rise in February. The typical UK property now costs £287,880, up from £285,660 in February, with house prices rising in all UK nations and regions last month. However, the annual rate of house price growth slowed to +1.6%, down from +2.1% for the previous three months.

The latest figures align with many other recent industry surveys and data which suggest relative stability in the housing market at the start of 2023. Kim Kinnaird, Director at Halifax Mortgages, attributes this to easing mortgage rates and a strong labor market - with historically low unemployment rates of 3.7%. Despite uncertainty around interest rates, Kinnaird predicts “mortgage costs are unlikely to get significantly cheaper in the short-term and the performance of the housing market will continue to reflect these new norms of higher borrowing costs and lower demand. Therefore, we still expect to see a continued slowdown through this year."

Spring traditionally marks the busiest season for the property market, with the highest number of homes listed for sale and average asking prices rising. Rightmove’s property expert, Tim Bannister, notes that sellers are becoming more competitive with their pricing to attract buyers in the current housing market. Stable conditions may encourage more sellers to enter the market after being deterred by recent uncertainty. The number of sales agreed recovered this month, following a post-mini-Budget slump in September, with demand from home-buyers up 8% on the same period in 2019. According to Bannister, “those who have now decided to make a move should not wait around too long to make an enquiry if they see the right home for sale, as not only is the number of sales agreed now back to pre-pandemic levels, but homes are also on average selling twelve days more quickly than at this time in 2019.”

In ‘real’ terms (adjusted for RPI), the Nationwide House Price Index puts price levels at the end of Q1 2023 at the same level as Q1 2014, and Q3 2003.

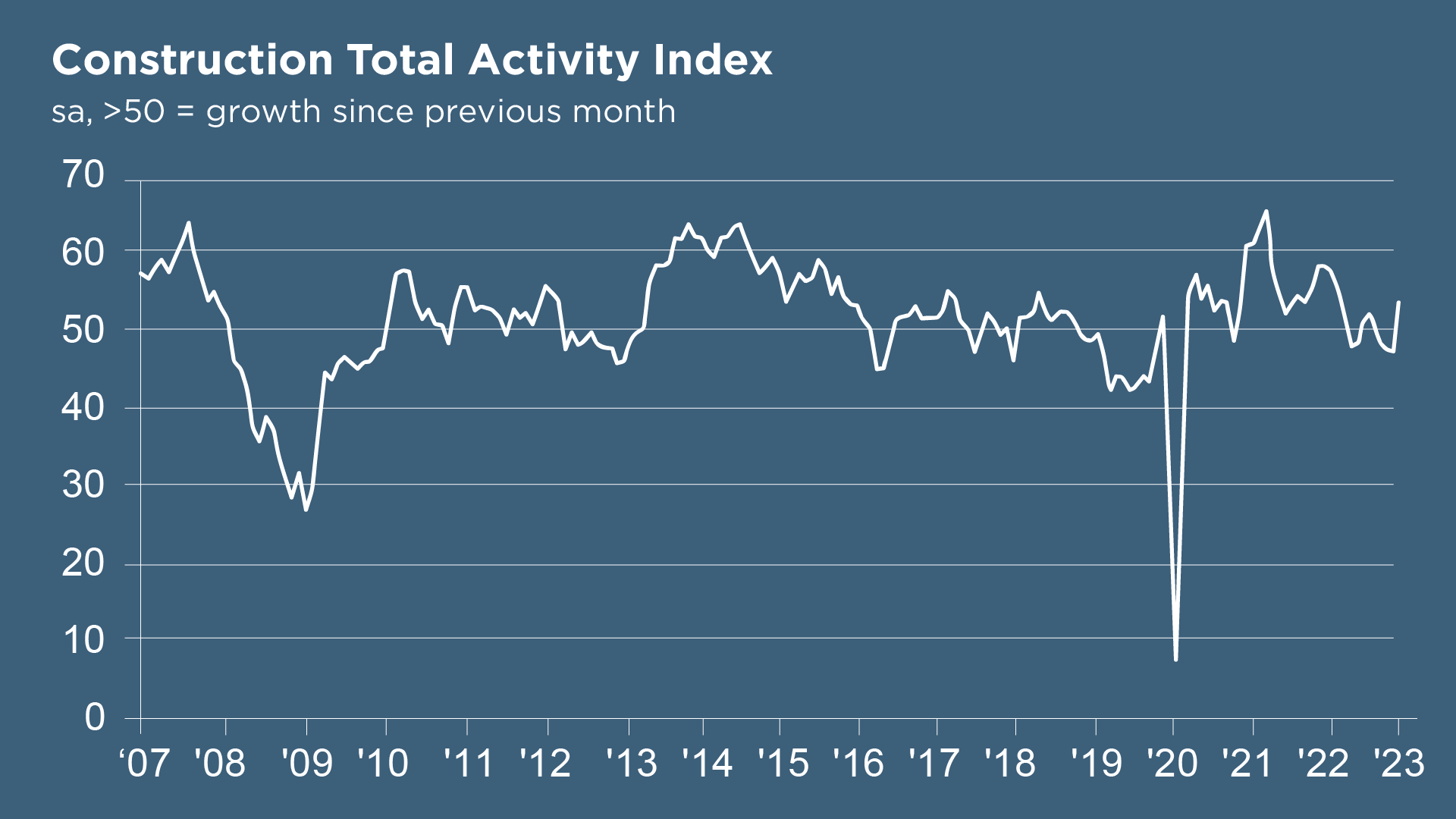

Data from the March S&P Global / CIPS UK Construction PMI highlighted another rise in UK construction output. It was the bigger projects like HS2, managed by the civil engineering sector, that added fuel to the engine of construction growth as housing activity (index at 44.2) declined at its fastest pace since May 2020. Tim Moore, Economics Director at S&P Global Market Intelligence, noted: “A sharp and accelerated decline in house building was the main area of concern in March. Cutbacks to new residential projects in the wake of subdued demand and rising interest rates contributed to the sharpest fall in housing activity across the construction sector for almost three years. Despite worries about the near-term outlook for housing activity, expectations for total construction output during the year ahead were relatively upbeat in March.” The increase in total new work received has led to a solid upturn in staff recruitment, with the rate of job creation accelerating to its fastest since October 2022. Improved supply conditions have led some construction companies to reduce inventories, as a result of the fastest improvement in suppliers’ delivery times in over 13 years last month. Input prices continued to rise, with suppliers attributing the increases to elevated energy costs and rising staff wages – however, the latest round of cost inflation was the second-slowest since November 2020.

Affordable housing was a significant focus in the media this month. The Scottish Government announced up to £25m of funds from the Affordable Housing Supply Programme will be made available from 2023 - 2028, in order to make best use of underused or empty properties by making them available for key workers and others in need in rural communities. A total of £3.5 billion in funding is being made available in this Parliamentary term towards the delivery of affordable homes in communities across Scotland. The new first minister also launched plans to raise council tax on second homes and empty homes in order to increase the supply of affordable housing.

In Ireland, the government is developing a new housing package to address rising construction costs and incentivise the development of affordable homes. Between €500 million and €750 million of funding is being set aside for the Cost Rental Subvention Scheme, which is expected to be announced without delay to avoid builders holding off on construction. Cost-rental housing is provided by local authorities, housing agencies and the Land Development Agency. Rents must be 25pc below the market rate and net household incomes must be below €53,000 to apply to the scheme.

Councils in Wales are also seeing a rise in affordable housing schemes, with the conversion of a vacant site of a former nursing home in Gwynedd into 18 affordable homes; plans for 24 affordable homes being approved in Powys; and Anglesey County Council committing to building 45 new council houses for the next 30 years to help meet the demand for social housing on the island, where it has become increasingly difficult for people to find affordable homes following the sharp rise in house prices on the Island in recent years.

Several affordable housing projects have also recently been reported across England, including 11 homes which are protected in value from the volatile property market as part of London’s first community land trust; a 94-unit project in Worcester on a currently vacant lot; and the development of 56 affordable homes in Devon.

The Office for National Statistics (ONS) has revealed that the Consumer Price Index (CPI) has dropped to 10.1% in the 12 months to March 2023, down from 10.4% in February. Following the first increase in February after three consecutive drops in the months prior, inflation has now returned to the level it was in January this year. The CPI including owner occupiers’ housing costs (CPIH) also fell to 8.9%, compared to 9.2% in February. According to Zoopla, inflation remaining stubbornly high suggests the Bank of England will increase interest rates further. With inflation still more than five times higher than the Bank’s 2% target, commentators are predicting the Bank’s Monetary Policy Committee (MPC) will increase the Bank Rate again when it meets in May, and possibly make further hikes later in the year. Despite rising interest rates, mortgage rates are continuing to fall - with best buy deals currently available with rates of less than 4%.

The EY ITEM Club, in its Spring Forecast (released 17 April 2023), now expects the UK economy to grow 0.2% in 2023, up from the -0.7% contraction projected in January’s Winter Forecast. The UK economy is expected to flatline and avoid two consecutive quarters of contraction before experiencing better growth later in 2023.

A downturn in the housing market is one factor behind the view that the UK economy will see only negligible growth this year. Stating that a major fall in house prices is unlikely, EY Item Club nevertheless expects average property values to fall by around 10% peak-to-trough over the next two years. This projected fall in prices will likely weigh on construction activity - particularly housebuilding - as well as affecting the sales of household goods. Falling property values risk initiating a negative feedback loop in which lenders respond by tightening credit supply, reinforcing the housing market downturn, and eroding borrowers’ confidence and credit worthiness. Lower property prices will squeeze builders’ margins, causing some projects to be increasingly unviable — or even shelved. However, the UK banking sector is far better capitalised now than in the run-up to the financial crisis and lenders have been stress tested by the Bank of England against a much bigger peak-to-trough fall in prices (31%) than EY Item Club forecasts. As a relatively cyclical industry, construction could be among the first to benefit from the economic recovery that the EY ITEM Club expects to become embedded in the second half of 2023.

The buy-to-let sector looks at a particular risk of distress, with leveraged landlords facing higher interest rates and the cost of complying with net zero energy efficiency targets. Changes in the structure of the overall housing market (a rise in the share of households who are outright owners and a fall in the share with a mortgage) and the mortgage market (the dominance of fixed-rate mortgages) mean higher interest rates should have less of an adverse impact than in the past. Pandemic-related savings held by households, in the aggregate, will also act as a buffer against the impact of higher mortgage payments and falling housing wealth.

Whilst historically high inflation has been a key challenge for the UK economy, the expectation is that falling energy prices, continued government support through the Energy Price Guarantee, and earlier price rises falling out of the calculations should all help pull inflation down this year. This period of inflation is not wage-driven.

Hywel Ball, EY’s UK Chair, says: “The UK economy seems to be turning a corner, albeit very slowly... While easing, the economy’s challenges haven’t gone away overnight: inflation is still in double-digits and energy prices remain historically high. However... the fact the economy has been able to outperform expectations could help stir a revival in business and consumer confidence. While subdued growth this year is far from ideal, falling energy prices and inflation, an end to rises in borrowing costs, and growing confidence, mean the economy has a chance to shed some of the gloom it has accumulated recently.”

If you are a SME property developer or investor, CrowdProperty is keen to hear what you think about the market. Have your say via the current CrowdProperty Property Developer & Investor Index survey at https://surveymonkey.co.uk/r/BJXDC6V

At CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership. As such, our team of property experts continues to actively visit sites to discuss project progress and offer input on any barriers which need to be overcome:

CrowdProperty is a leading specialist property development finance business having funded over £680m worth of property projects to date. With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means that we understand what developers are looking to achieve and help those developers succeed. Apply in just 5 minutes at www.crowdproperty.com/apply - our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

As featured in...