Borrow

Case Study

Podcasts

Awards

About

Earlier this month, the Chancellor set out his plan to halve inflation, grow the economy and get debt falling with the Spring Budget. However, the collapse of two US banks and rescue of Credit Suisse plus an unexpected rise in inflation which prompted the Bank of England to further raise interest rates to 4.25% mean the economic outlook remains changeable. CrowdProperty reviews the latest market commentary and the outlook for both the property sector and wider economy.

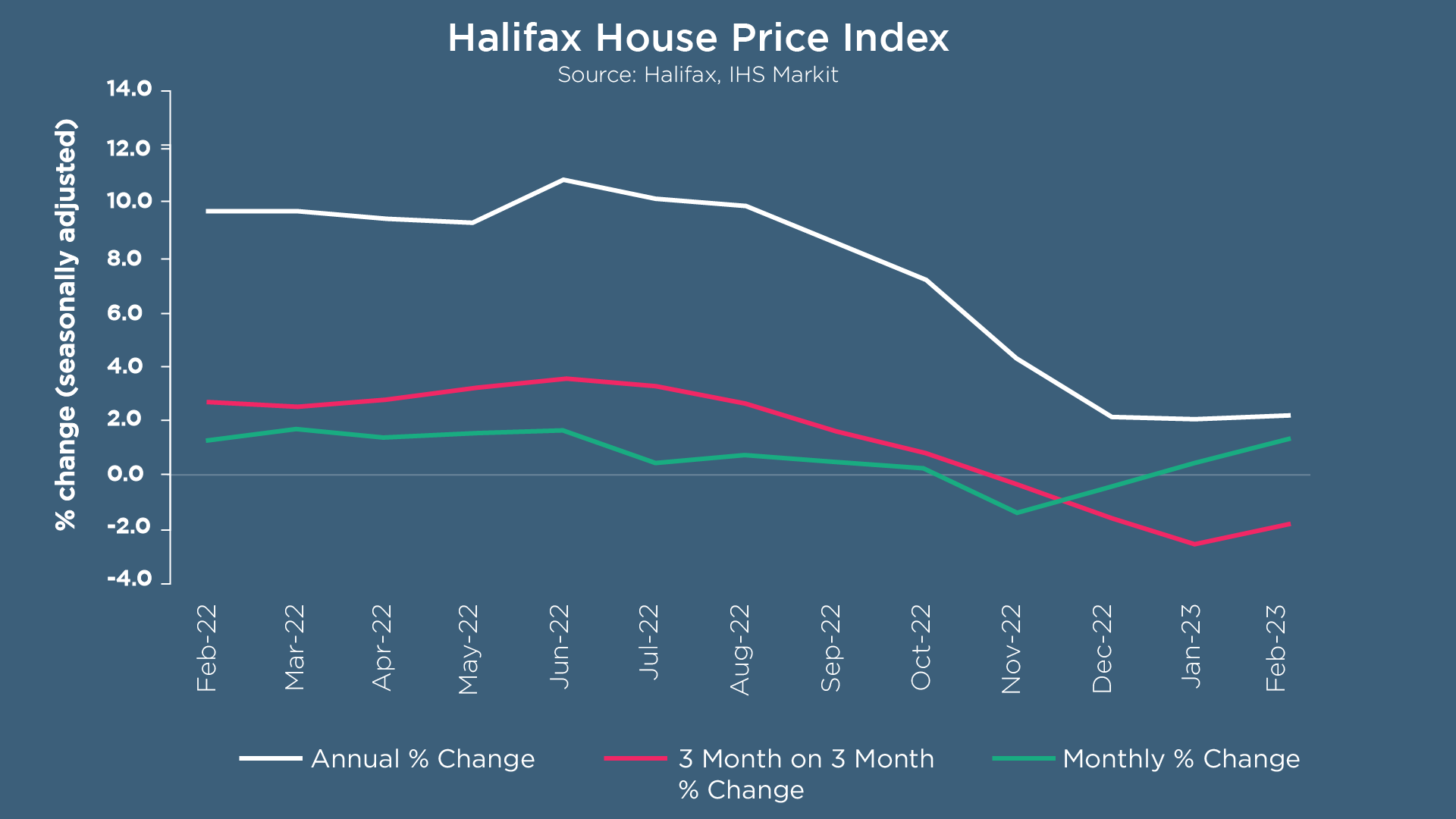

The latest Halifax House Price Index reports that the rate of annual growth slowed across all nations and regions again during February. The most significant reduction was seen in the North East whilst house prices in Scotland were least affected. The price of flats has fallen into negative territory (-0.3% annual growth) with detached properties not doing much better, showing an increase of +1.5% over the year which is the lowest rise since the end of 2019. Despite this, the annual house price growth rate remains at +2.1% for a third month with a typical UK property costing £285,476.

Housing activity has generally decreased, with HMRC suggesting the increases in mortgage and interest rates at the end of 2022 are now starting to impact statistics. Seasonally adjusted (SA) UK residential transactions in February 2023 were 4% lower than January 2023, with year-on-year SA transactions down by 18%.

The Bank of England’s monthly statistics show the number of mortgages approved to finance house purchases decreased by 2.2% in January 2023, a figure 46% below that of January 2022. This is alongside the ‘effective’ interest rate on new mortgages increasing by 21 basis points to 3.88% in January, with the rate on outstanding mortgages increasing 4 basis points to 2.54%.

Meanwhile, the February UK Residential Market Survey from RICS states that whilst key activity metrics remain negative, this is less so than in previous reports. Indeed, new buyer enquiries rebounded to a net balance of -29% (SA) compared to -45% the previous month. Whilst this still signals a decline in demand (the tenth consecutive negative monthly reading), it is also the least negative result since July 2022. The newly agreed sales indicator improved from a net balance of -36% to -26% in February, however the time taken to complete continues to rise and is now approaching 19 weeks. In the mainstream market (up to £500k), 60% of survey respondents suggested that sales were being agreed at below the asking price; 70% of contributors reported a similar view for properties in both the £500k to £1m bracket and those priced above £1m. The majority of feedback indicates that the agreed price was within 5% of the asking price. Rental growth continues to be driven by a significant demand and supply imbalance, with +32% of respondents reporting an increase in tenant demand (non-SA) whilst landlord instructions return to a net balance of -13% - leading to headline rent expectations remaining at a relatively elevated level of +45%.

Kim Kinnaird, Director at Halifax Mortgages, said: “Recent reductions in mortgage rates, improving consumer confidence, and a continuing resilience in the labour market are arguably helping to stabilise prices following the falls seen in November and December. With the cost of a home down on a quarterly basis, the underlying activity continues to indicate a general downward trend… With average house prices remaining high, housing affordability will continue to feel challenging for many buyers.”

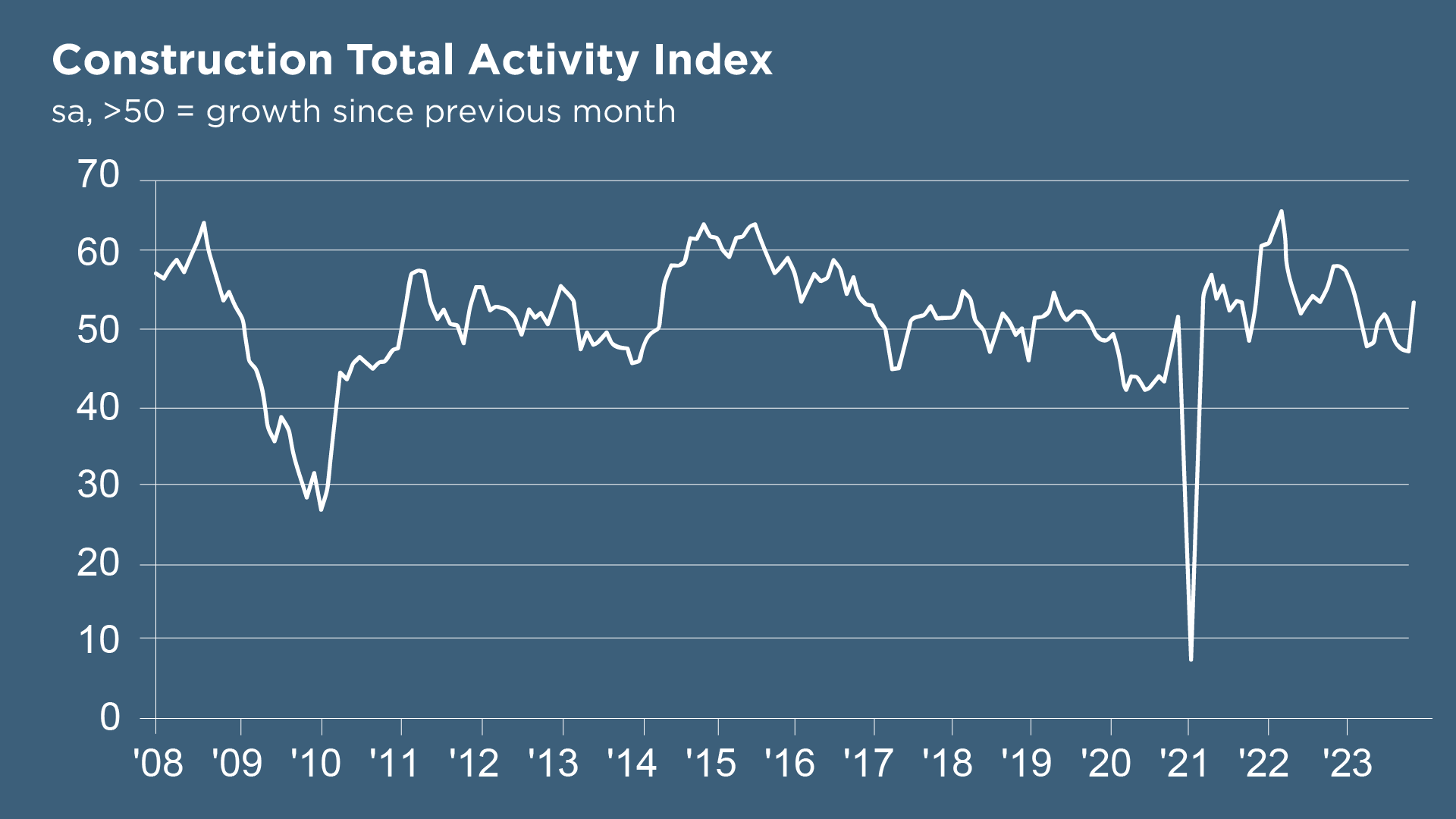

The S&P Global / CIPS UK Construction PMI notes that February data highlighted a robust increase in overall business activity across the UK construction sector, ending a two-month period of decline. The rate of growth was the strongest since May 22, registering at 54.6 (up from 48.4 in January). Commercial construction was the best-performing area (index at 55.3), offsetting the drop in residential building work (index at 47.4) which saw a decrease for the third consecutive month. The subdued market conditions are thought to be a result of elevated interest rates and cutbacks to new house building projects in anticipation of weaker demand, which if sustained would only further constrain supply.

Despite rising demand for construction products and materials (as commercial and civil engineering activity saw renewed expansion), survey respondents reported the least widespread supplier delays since January 2020. Better alignment of demand and supply helped to bring down overall input price inflation, which was the lowest for 27 months in February. Cheaper transportation costs helped to offset rising energy costs and salary inflation which would impact on supplier pricing.

The latest data indicates a modest increase in employment numbers across the construction sector, however efforts to cut costs continued to hold back recruitment. Business expectations for the year ahead improved further from the 31-month low seen in December 2022, with c. 46% of the survey panel anticipating a rise in construction activity over the year ahead.

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply, said: "The overall figure paints a bright picture of progress in the construction sector with a robust jump in output last month. Residential building…was the odd one out with a third month in contraction as mortgages rates put a dampener on the number of house purchases and buyers were unwilling to commit.

"Builders themselves remained cheerful as optimism rose sharply and almost half of the survey’s respondents believed business would improve in 2023.”

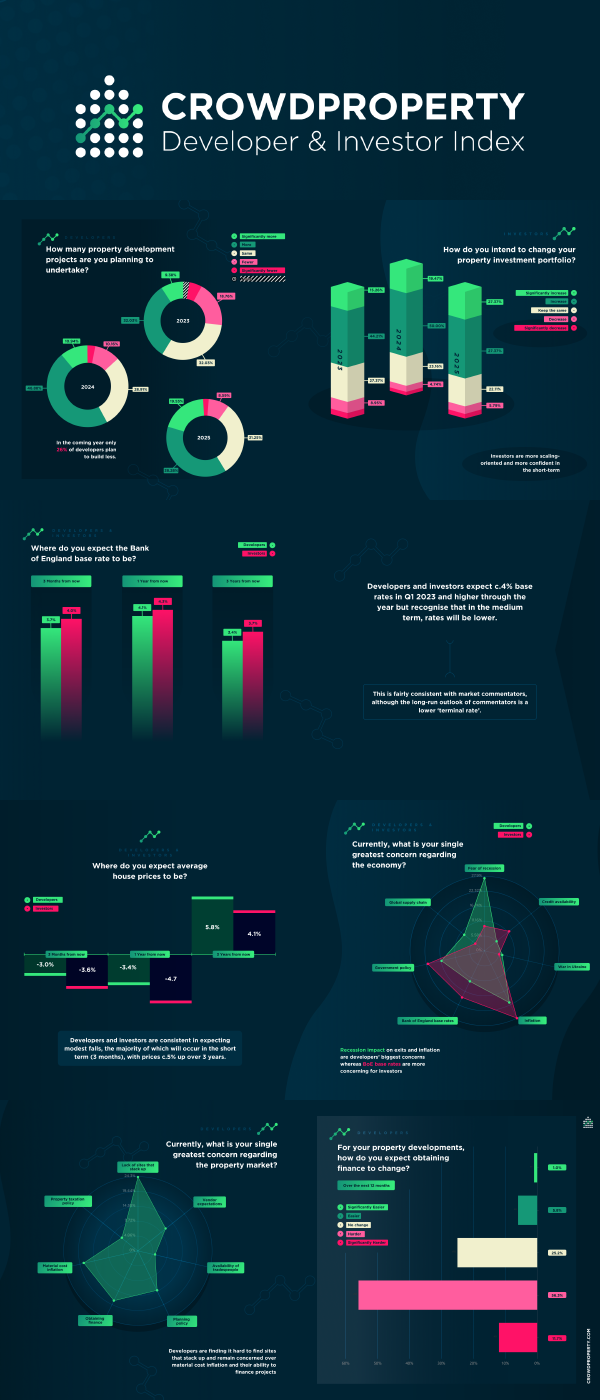

In our own survey of the market, the latest CrowdProperty Property Developer and Investor Index shows developers are planning to develop more over the next three years in spite of the headwinds – with only 26% of developers planning to build less in the next 12 months. Investors are more scaling-oriented and confident in the short-term, with 59% of respondents expecting to increase or significantly increase their investment portfolio over the next year. The top three concerns for developers are finding sites that stack up, obtaining finance, and material cost inflation. More insights and analysis to follow in the full CrowdProperty PDII report, and look out for this quarter’s survey which will be released shortly:

Despite the Chancellor claiming inflation has peaked in his Spring Budget, the Office for National Statistics (ONS) has since reported an unexpected rise in the Consumer Prices Index (CPI) – increasing by 10.4% in the 12 months to February 2023, up from 10.1% in January. Economists polled by Reuters had forecast that the annual consumer price inflation rate would drop to 9.9% in February from January's 10.1% and move further away from October's 41-year high of 11.1%.

Nevertheless, the Chancellor cited the Office for Budget Responsibility’s (OBR) latest forecast which states that the UK will not enter a technical recession this year. The expectation is that inflation in the UK will fall from 10.7% in the final quarter of 2022 to 2.9% by the end of 2023, with the economy growing by 1.8% and 2.5% in 2024 and 2025 respectively.

With cost of living pressures continuing to squeeze household budgets, the Chancellor’s focus on childcare costs, employment and pensions would have been welcome news to many, with plans to increase economic activity of parents by introducing 30 hours of free childcare a week from September 2025; plans to encourage the 3.5m people of pre-retirement age who are not currently in the labour force back to work; and a 50% increase in the annual tax-free allowance for pensions alongside abolishing the lifetime allowance. Other highlights of the Spring Budget included the announcement that energy price guarantee will remain at £2,500 for the next three months, ahead of an expected fall in energy prices in July; the postponement of the 11p rise in fuel duty – the government will maintain the 5p cut and freeze fuel duty for a further 12 months; and a further £8.8bn set to be invested in sustainable transport.

The Spring Budget also set out new Levelling Up Partnerships, providing over £400 million of investment in 20 areas across England. The government is providing additional funding for local projects to encourage growth and support communities, including over £100 million of support for local charities and community organisations; £200 million for local authorities to repair potholes and improve roads; and over £200 million for 16 high quality regeneration projects. Referencing Canary Wharf and Liverpool Docks as “two outstanding regeneration projects that transformed the lives of thousands of people”, the Chancellor announced 12 new investment zones in England (covering West Midlands, Greater Manchester, Liverpool City, North East, South Yorkshire, Tees Valley and West Yorkshire) as well as 4 zones in Scotland, Wales and Northern Ireland. That said, the Budget had little direct impact on the housing market: stamp duty remains unchanged and there were no major changes for landlords other than a lower level of tax free gains before paying capital gains tax. Richard Donnell, Executive Director of Research at Zoopla, commented: “Focusing on economic growth and jobs ultimately supports the housing market as the health of the housing market is directly linked to the health of the economy. Housing sales and prices tend to stagnate and fall when the economy is doing badly and unemployment is rising, while the opposite is true when the labour market is strong and post-tax household incomes are rising.”

According to the EY ITEM Club, this was a “Budget for growth” which should improve the economy’s prospects. The economy is now expected to shrink 0.2% in 2023, versus the 1.4% fall forecast in November 2022, and the return to growth expected in 2024 is now stronger, at 1.8% compared to 1.3% previously.

EY ITEM Club remarked that the Chancellor announced two supply-side reforms which are of particular macroeconomic relevance: firstly, encouraging business investment by temporarily allowing firms to fully offset investment spending against taxable profits in the first year with increased tax breaks for investments in specified ‘investment zones’. The second focused on expanding the size of the workforce against a backdrop of a fall in the supply of workers since 2020, including imposing greater requirements to look for work and training for those in receipt of out-of-work benefits. However, the policies announced to raise investment are balanced against headwinds created by April’s significant rise in the corporation tax rate (from 19% to 25%) and the end of the super-deduction tax incentive. It was also noted that boosting the economy’s supply capacity will only raise growth if extra supply is met with stronger demand. This prospect could be hindered by the fact that the tax burden is still headed for a 70-year high, overall public spending will fall in real terms from the mid-2020s and spending on growth-enhancing public investment is frozen – all while the economy deals with the most significant tightening in monetary policy in over 30 years.

Martin Beck, Chief Economic Advisor to the EY ITEM Club, commented: “The net fiscal loosening of around £20bn per year (0.7% of GDP) over the next three years means the near-term growth outlook has improved. And the OBR has become less pessimistic on the economy’s longer-run potential… Well-publicised issues in the US banking sector and a subsequent substantial fall in government borrowing costs and market interest rate expectations came too late for the OBR forecast. The net effect, if those moves had been included, would have been to mechanically improve the fiscal outlook. But the latest market challenges present economic risks and add an extra degree of caution around the OBR’s latest projections.”

At CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership. As such, our team of property experts continues to actively visit sites to discuss project progress and offer input on any barriers which need to be overcome:

CrowdProperty is a leading specialist property development finance business having funded over £670m worth of property projects to date. With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means that we understand what developers are looking to achieve and help those developers succeed. Apply in just 5 minutes at www.crowdproperty.com/apply - our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

As featured in...