Borrow

Case Study

Podcasts

Awards

About

With the Bank of England Monetary Policy Committee (MPC) voting to raise the interest rate to 4% this month and bank to business lending forecast to contract sharply, CrowdProperty reviews the latest market commentary and the outlook for the property sector.

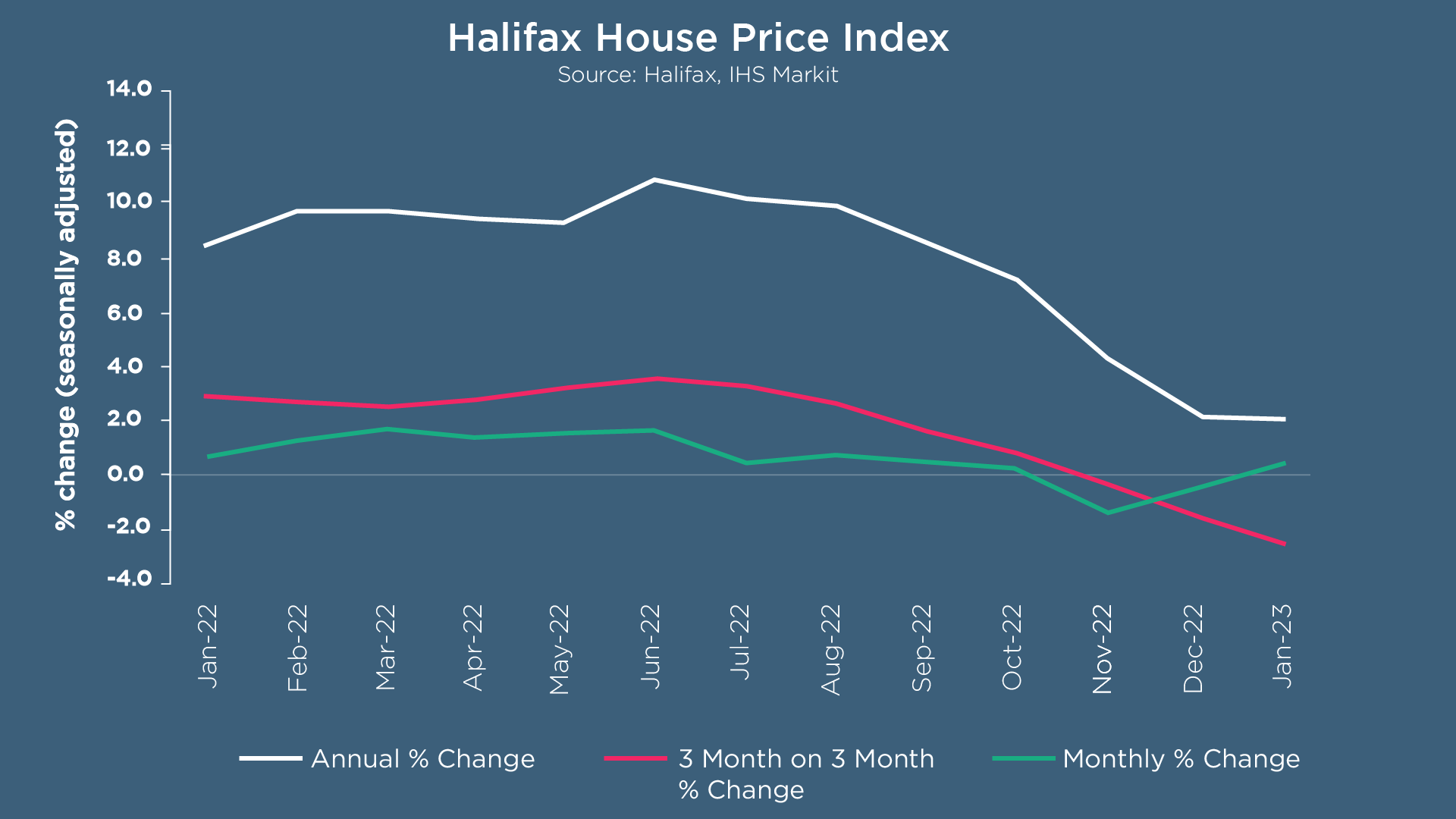

The annual rate of house price growth slowed to +1.9% in January (from +2.1% in December), which is the lowest level recorded over the last three years according to Halifax. UK house prices remain stable with a typical property now costing £281,684 compared to £281,713 last month.

The rate of annual house price inflation slowed across all nations and regions during January, with some considerable drops: Wales, which recorded some of the strongest rates of annual growth over recent years, saw growth rates fall to +2.0% (from +6.0% in December); similarly, the South West of England saw annual house price inflation slow to +2.7% (from +6.0% in December). Northern Ireland and Scotland have experienced a more gradual easing, with growth rates of +6.9% (from +7.1% in December) and +2.4% (from +3.3% in December) respectively. Whilst London has lagged compared to other areas of the UK for some time, house price inflation was flat (0.0%) compared to +2.9% in December.

Housing market activity weakened in December, with HMRC monthly property transaction data showing seasonally adjusted (SA) residential transactions in December at 101,920 - a decrease in UK home sales compared to November’s figure of 104,610 (down 2.6% on a non-SA basis). According to the latest RICS Residential Market Survey, new buyer enquiries came in at a net balance of -47%, agreed sales had a net balance of -39% and new instructions returned a net balance of -14% - an improvement on the -23% reported in December, which was the weakest since September 2021. Bank of England figures also show that the number of mortgages approved to finance house purchases decreased by 23% in December 2022 – to 35,612. Year-on-year, this figure was 51% below December 2021 and the lowest since May 2020.

Kim Kinnaird, Director at Halifax Mortgages, said: “We expected that the squeeze on household incomes from the rising cost of living and higher interest rates would lead to a slower housing market, particularly compared to the rapid growth of recent years. As we move through 2023, that trend is likely to continue as higher borrowing costs lead to reduced demand.”

The latest research from Zoopla reveals where homes are selling fastest in the UK. Several major cities are among the fastest moving markets as the pandemic-driven trend for buying in rural and coastal areas comes to an end. Homes in lower-cost and well-connected suburbs are also being snapped up as buyers seek affordability in the face of high mortgage rates.

It now takes an average of 29 days to sell a home in the UK, which is nine days slower than this time last year. Homeowners in Liverpool are enjoying the quickest sales in the UK, agreeing an offer just 12 days after putting their home up for sale on average. Homes in Birmingham, Manchester and Newcastle are selling in 15 days or less - all at least two days faster than last year on average. Homes in affordable and well-serviced commuter areas - like Salford and Bury near Manchester as well as Knowlesy near Liverpool – are also going under offer within 15 days.

Regarding the type of properties that are selling, the data shows that buyers have different requirements in different parts of the country. Two- and three-bedroom terraced homes are selling the fastest in the hot markets such as Dartford, Bristol and Cardiff; similarly, two- and three-bedroom semi-detached properties are popular in affordable commuter spots and smaller cities. One bedroom flats are moving quickly in Liverpool, Manchester and the South of England, perhaps as they are the most affordable property type to a wider range of buyers or sit at the cheaper end of local markets.

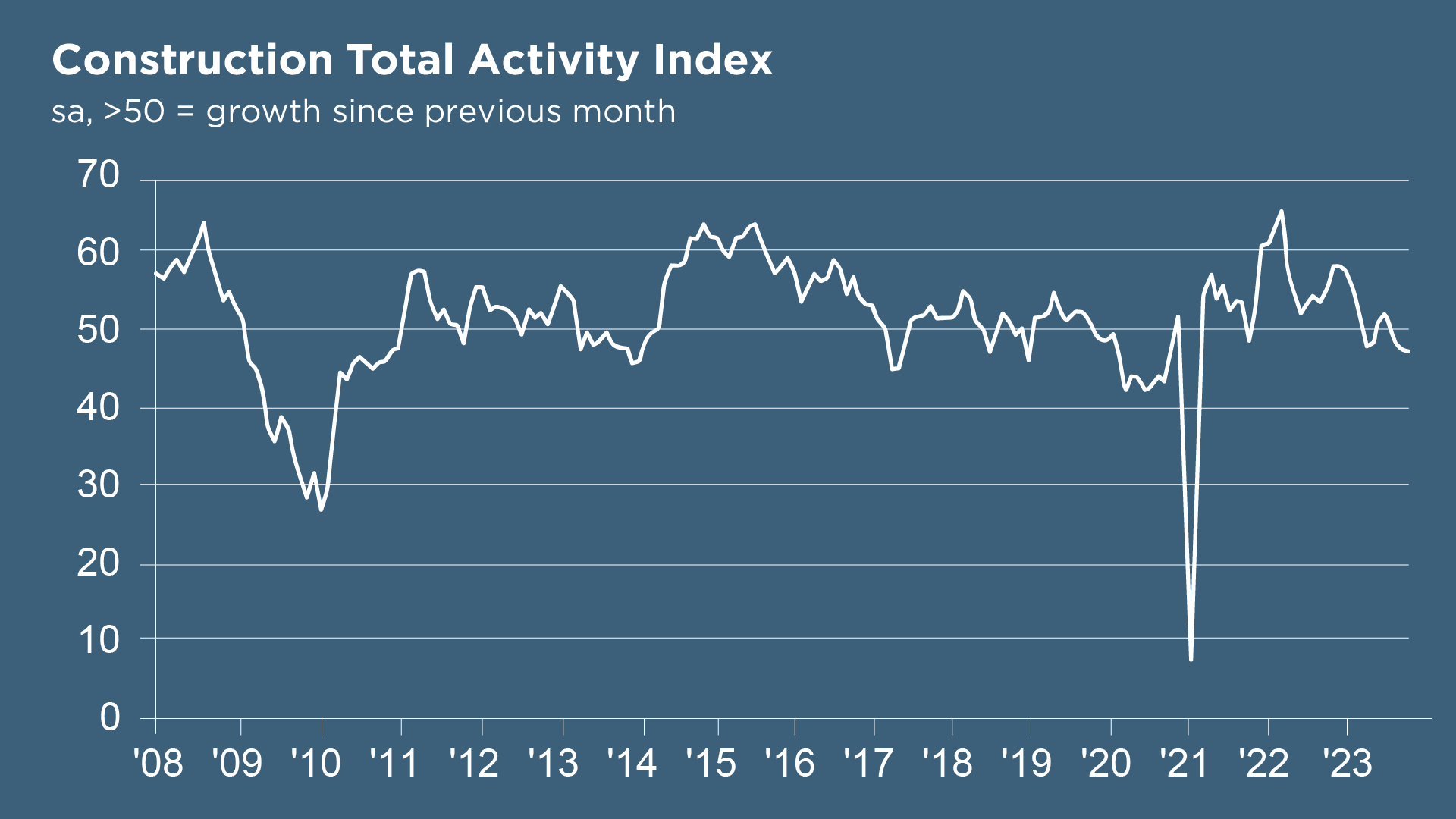

The S&P Global / CIPS UK Construction PMI reports that the sharp decline in house building has led to the steepest drop in residential work for 32 months. The headline seasonally adjusted UK Construction PMI posted at 48.4 in January, down from 48.8 in December. House building (index at 44.8) was the weakest-performing category of construction output, with lower volumes attributed to rising borrowing costs, unfavourable market conditions and greater caution among clients. Housing undersupply, significantly below Government targets, is set to continue. Commercial activity (48.2) decreased for the first time in five months, while civil engineering activity (49.7) was close to stabilisation.

Employment numbers decreased for the second consecutive month, with the rate of job shedding noted to be the fastest for two years. Construction companies cited softer demand as the reason for hiring freezes and the non-replacement of voluntary leavers.

January data also indicated the sharpest fall in purchasing activity in two-and-a-half years. Lower demand for construction products and materials helped to alleviate pressures on supply chains at the start of 2023, resulting in the least marked downturn in vendor performance for three months. Cutbacks in input buying and improved materials availability contributed to the slowest rise in purchase prices since December 2020. Where higher cost burdens were reported, this was mainly linked to increased energy prices.

Meanwhile, business confidence reached its highest level for six months – 43% of survey respondents anticipate a rise in business activity for the year ahead, with only 17% forecasting a decline. Some firms were optimistic that confidence would return to the housing market over the course of 2023, assisted by a stabilisation in borrowing costs.

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply, noted: “The wrecking ball of higher inflation and interest rates has knocked the UK’s residential building output to its weakest since May 2020 as stretched mortgage affordability impacted on the building of new homes… Builder optimism has risen to the highest for six months… This hopeful aspect could potentially be attributed to more enquiries filtering through… alongside the economy showing small, incremental improvements. Evidently, there are still roadblocks ahead, but we should have faith that the sector can see a path through for better outcomes in 2023.”

As widely reported, the UK narrowly avoided falling into recession in 2022 – despite a sharp 0.5% fall in economic output during December according to the Office for National Statistics. The decline in gross domestic product (GDP) was offset by increases in the two previous months to leave the economy’s performance in the fourth quarter at roughly the same level as the previous three months. Negative growth in the fourth quarter would have signalled a recession. However, the ONS revised up its figures for the July to September quarter to show that the economy shrank by 0.2% instead of the previous estimate of a 0.3% fall. Whilst Jeremy Hunt claims these figures underscore Britain’s resilience – as they show the economy was the fastest-growing in the G7 group of nations last year – many business groups said the situation remained difficult. Ben Jones, lead economist at the Confederation of British Industry, noted: “We may have avoided a technical recession late last year but we probably won’t avoid one this year. While we expect that the downturn will be shallow, if we act now, we can make the recession even shorter than predicted. All eyes are on the chancellor’s March budget, when businesses will be looking for a bolder approach to tackling labour and skills shortages and falling business investment.”

The EY ITEM Club Winter Forecast notes that the UK economy is now expected to contract 0.7% in 2023, up from the 0.3% contraction predicted in October’s Autumn Forecast. Key factors behind the downgrade include the reduction in the generosity of the Energy Price Guarantee, additional taxes on high-earners and unearned income coming into effect from the spring, and signs that the housing market is slowing faster than many had anticipated. While house prices are likely to fall further, the EY ITEM Club notes that average house prices rose a projected 10.5% in 2022 and is forecasting a decline of 2.4% this year, with another fall of c. 3% in 2024.

The growth forecast for 2024 has also been downgraded from 2.4% to 1.9%, as a result of the impact of tighter fiscal policy and a deeper downturn than previously anticipated. “The one silver lining is that, despite being a deeper recession than previously forecast, it won’t necessarily be a longer one,” says EY’s UK Chair Hywel Ball.

According to EY ITEM Club’s latest Financial Services Forecast, bank to business lending is expected to contract 3.8% net this year, representing one of the sharpest falls in a decade. The outlook is set to improve next year; however, only 0.9% net growth is forecasted as businesses, especially SMEs, continue to deal with the economic shocks of recent years.

As the housing market faces multiple headwinds, demand for mortgage lending is also set to be affected this year. Cost of living pressures, falling real household incomes, and rising interest and mortgage rates mean only 0.4% growth is forecast for 2023, which is the lowest rate of mortgage growth since 2011. At the same time as market demand wanes, banks are expected to tighten their mortgage lending criteria as a result of higher interest rates, a challenging outlook, and falling house prices. Whist the MPC has ongoing concerns about the inflationary risks of a tight jobs market, growing disinflationary forces and the economic slowdown mean monetary policy tightening should end early this year. According to the Winter Forecast (released in late January), the EY ITEM Club expects the Bank Rate to peak at 4% in February.

Anna Anthony, UK Financial Services Managing Partner at EY, comments: “The series of economic shocks in recent years and the current cost of living pressures are having a significant impact on both households and businesses. Those most affected are the vulnerable in society and small businesses which may have limited financial cushions of support to fall back on. Stretched affordability will affect loan demand across all fronts and banks should be preparing for low and, in some cases, negative lending growth rates. Banks also face the prospect of the number of loan defaults rising amid the economic downturn. However, default rates are expected to be much lower than recorded after the financial crisis.”

At CrowdProperty, we work closely and productively with the developers we back - tackling market, site and situational challenges together in partnership. As such, our team of property experts continues to actively visit sites to discuss project progress and offer input on any barriers which need to be overcome:

CrowdProperty is a leading specialist property development finance business having funded over £640m worth of property projects to date. With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means that we understand what developers are looking to achieve and help those developers succeed. Apply in just 5 minutes at www.crowdproperty.com/apply - our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

As featured in...