Borrow

Case Study

Podcasts

Awards

About

The decreasing number of Covid-19 cases confirms that the Government’s road map, along with rapid vaccine roll-out, is slowly bringing the UK back to normality. As other sectors were allowed to reopen this month, the construction and housing sector has been maintaining its momentum throughout the month of April. Considering this, we review the latest market commentary and what this means for the sector as a whole.

There is growing optimism in the long-term for the UK housing market, as Nationwide reported that April saw average housing prices rise by 2.1% compared to March, the biggest monthly increase in 17 years, meaning the average price now stands at £258,204 - almost £20,000 more than a year ago, in cash terms.

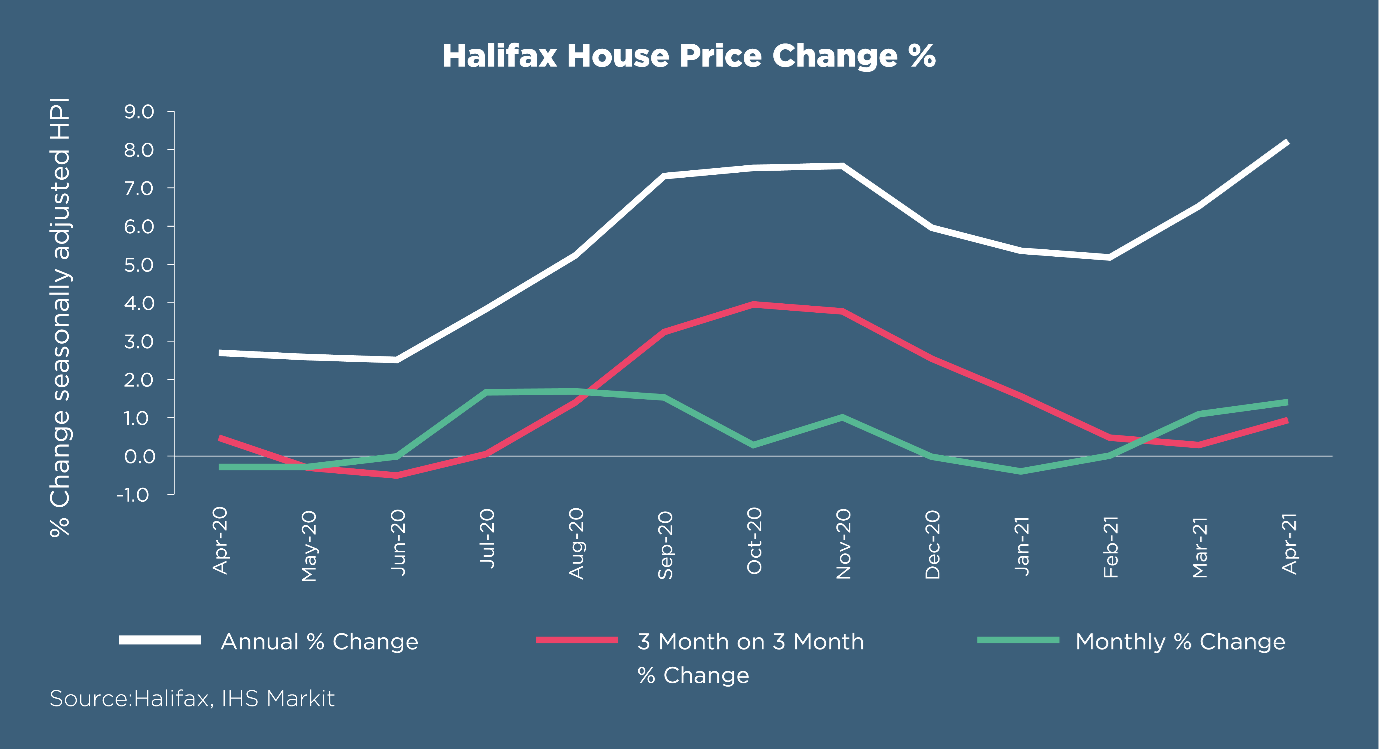

Halifax further commented that the surge in market activity has been underpinned by the influence of the stamp duty holiday, however this is expected to decrease in the coming months as the holiday tapers off from June. Despite these predictions, it has been said that the imbalance of supply and demand of housing as well as low interest rates will likely keep housing prices up.

Russell Galley, Managing Director at Halifax, stated that “savings built up over the months in lockdown have given some buyers even more cash to invest in their dream properties, while the new mortgage guarantee scheme may have eased deposit constraints for some prospective homebuyers who previously thought their first step on the housing ladder was a few years away.”

Not only are we seeing increases in house values, but Rightmove reported that houses were selling at the fastest rate ever recorded, averaging 45 days to be marked as sold by an agent. Furthermore, 23% of properties that had an agreed sale in March had been on the market for less than a week. Nationwide predicts that if the imbalance of housing supply and demand is sustained, this could fuel a ‘housing super boom’ with double-digit percentage growth being a possibility by June. Tim Bannister, Rightmove’s Director of Property Data, commented: “The stars have aligned for this spring price surge, with buyers’ new space requirements being part of the constellation alongside cheap mortgages, stamp duty holiday extensions in England and Wales, government support for 95% mortgages and a shortage of suitable property to buy. There’s also growing optimism due to the vaccination roll-out, which is helping drive the momentum for a fresh start in fresh surroundings.”

Following the lifting of more lockdown restrictions, Tim Moore, Economics Director at IHS Markit, noted that the construction sector saw a spike in activity -“its strongest growth phase for six-and-a-half years” - which is largely down to many commercial development projects resuming after previously being delayed. The rise in building new homes has contributed to “the steepest rate of job creation across the construction sector since December 2015… signalling sustainable growth in the sector this summer." Consequently, the overall growth rate of new business strengthened to the fastest since September 2014.

The rise in activity has again put increased pressure on the supply of raw materials which has been exacerbated by Brexit. The Construction Leadership Council reports that “products are available, but lead times have lengthened. Current demand is such that it is proving difficult for manufacturers and suppliers to build up stock levels.” The worst affected product areas continue to be timber, roof tiles and roofing membranes. It’s unlikely there will be any improvement in timber supplies this year with little or no timber currently coming into the UK that is not already pre-sold and global demand outstripping supply, however it is predicted that roofing products are expected to improve in the second half of the year. Alongside these materials shortages, IHS Markit reports that “the overall rate of input cost inflation reached its fastest since data collection began 24 years ago.”

EY ITEM Club’s Spring Forecast stated that “the economy seemingly showed greater resilience than had looked likely in Q1 2021, with GDP probably contracting by just over 1% q/q rather than by 3%- 4% q/q as projected in January.” The surge in consumer activity following further lifting of lockdown restrictions on 12th April means “the economy is seen returning to its Q4 2019 level in Q2 2022, six months earlier than previously expected.” The resilience of the labour market, the Chancellor’s extension of the furlough scheme to September and expected decent recovery developing from Q2 2021 means the rise in unemployment looks to be considerably less than was feared, with EY ITEM Club reducing their expected peak in the unemployment rate to 5.8% from 7.0%.

Whilst the change in predictions around unemployment is positive news, one thing that hasn’t changed is buyers’ preferences for more space in locations outside of city centres as the population continues to spend more time at home. Grainne Gilmore, head of research at Zoopla, explains: “Demand will remain strong as the ‘search for space’ among homeowners has further to run, especially as some office-based businesses are now confirming how their working practices will change in the longer-term. More flexible working arrangements open up new opportunities for homeowners to move to a further-flung location.”

Empowering the multitude of small and medium sized property development businesses which are key to delivering 'build, build, build', CrowdProperty is tackling the fundamental barriers behind declining housing output from this segment by building the best property project lender in the market, attracting quality developers undertaking quality projects. CrowdProperty continues to raise finance for quality projects that are ready and able to proceed with clear exit plans in liquid markets, with a quantum of units that is immaterial to proven demand levels, at mainstream price points throughout the UK.

The business has funded over £250,000,000 of property projects by SME property professionals, funding the development of over 1,400 homes. This is still just the start of our mission to transform property finance to build more homes, increase spend in the UK economy and ever more efficiently and effectively match the supply and demand of capital for the benefit of all. Together we build a better future.

As featured in...