Borrow

Case Study

Podcasts

Awards

About

Traditionally, the summer period is the busiest time for the housing market. However, the approaching deadline of the Stamp Duty holiday combined with Boris Johnson’s aim to bring the UK back to normal operating levels by 21st June means the housing sector is currently seeing exceptionally increased levels of activity. With this in mind, we take a look at the latest market commentary and the potential outlook going forward.

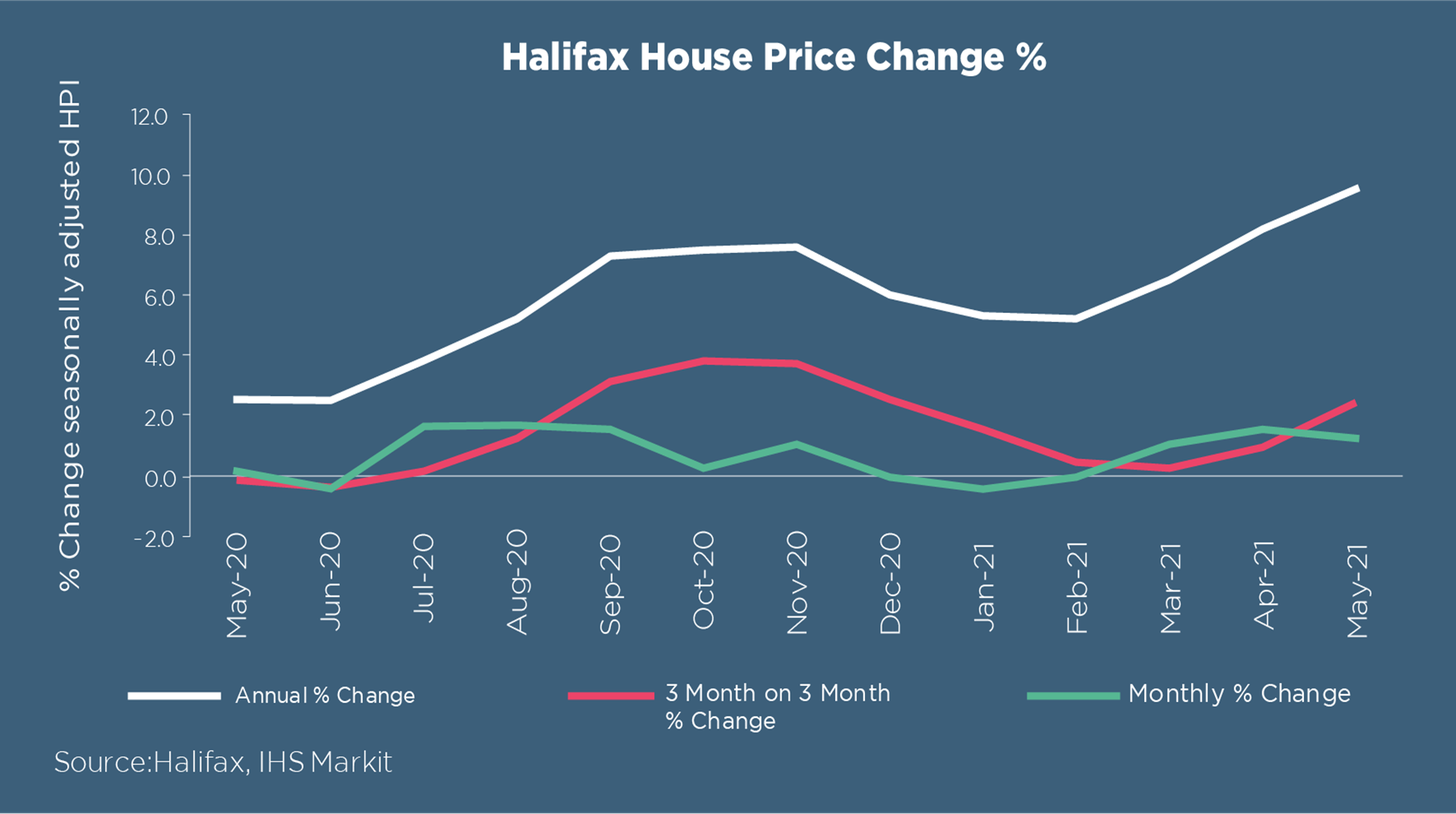

May was yet another month for record levels of activity with Halifax now stating that the average housing price is up to £261,743 - that’s an increase of 1.3% compared to last month, meaning the average UK home has risen in value by more than £22,000 over the past 12 months. Russell Galley, Managing Director of Halifax, commented that “the current strength in house prices also points to a deeper and long-lasting change as buyer preferences shift in anticipation of new, post-pandemic lifestyles.” Alongside this, the added pressure of securing a deal before the end of the stamp duty holiday has Savills defining this a “race for space” as many are looking to upsize to larger homes with gardens. This is supported by households having collectively built up around £160bn in savings since the start of the pandemic as a result of working from home and now finding that their homes no longer suit their working life.

This was also seen in Rightmove’s Housing Price Index which reported that most buyers are now looking to upsize to family homes of 3 beds or more - something that is now considered “gold dust.” Furthermore, 84% of people moving in the north are staying local with agents in the North East reporting 59% less available stock compared to the same period in 2019.

Also motivated by the need for bigger and more green space, it is now estimated that London’s population will fall by more than 300,000 in 2021, which will be the biggest decline in 30 years. Previously, market upturns have been led by London however the nature of the current housing boom means that the capital’s rate of price increase since March 2020 is now at a virtual standstill (+0.2%) compared to double digit price growth in areas further north. Nevertheless, the gap still remains very large, with average prices in London still 2.9 times higher than those in the north -however this ratio is now at its smallest since 2013.

Despite the approaching deadline of the stamp duty holiday, the housing market shows no signs of slowing yet as Zoopla predicts that 1.5 million homes are expected to change hands this year - that’s an increase of 45% compared to 2020, the highest number in 14 years. This has now led to economists predicting the total value of homes sold in 2021 will reach £461bn – up 46% or £145bn compared with 2020, and 68% compared with 2019.

Data from IHS Markit reports that the UK construction sector remains on a strong recovery path, with Tim Moore, Economics Director at IHS Markit, commenting that “despite severe challenges with materials availability, construction firms remain highly upbeat about their near-term growth prospects”. Fuelled by the scarcity of available homes, output growth reached its strongest since September 2014 with the total activity index registering at 64.2, up from 61.6 the previous month.

The rise in activity has increased pressure on purchasing managers to keep up by changing sourcing strategies to find depleting essential materials as well as building inventory in reaction to supply shortages and long delivery times. Consequently, the sector is now at its fastest buying rate since April 1997, despite the highest overall rate of input price inflation in over 24 years.

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, commented that the inflation of goods and raw materials has caused companies to be “concerned that much-needed profits will be eaten away as building projects take shape and could be held up by the longest delivery times on record.” With house building the strongest performing sector, IHS Markit now reports an additional problem in the form of skills shortages – talented labour is proving hard to find as “job creation was at robust levels and the threat of staffing cutbacks has become a distant memory”.

The job market across sectors has been largely stable with some early signs of recovery. The Office of National Statistics now reports that the UK unemployment rate is estimated at 4.8% - whilst still higher than pre-pandemic levels, this is a decrease of 0.3% compared to the previous quarter. The construction sector has seen a rise in employment figures as the increase in output across the sector this month has led to a rapid upturn in new business, causing the biggest surge in job creations since July 2014.

The economy as a whole is still on track to recovery faster than originally anticipated as EY ITEM Club suggested in April by raising their 2021 GDP growth forecast to 6.8% with predictions that it would expand even further over the course of the year.

The reopening of hotels, indoor hospitality and other businesses on May 17th means that business confidence is at a record high. Retail sales rose more than 10% above pre-pandemic levels, marking the biggest spending surge since 1988 with the Office for National Statistics reporting a 9.2% rise in the volume of retail sales in April (more than double the 4.5% expansion forecast by economists polled by Reuters). Chris Williamson, chief economist at IHS Markit, commented that the UK was “enjoying an unprecedented growth spurt” with a “record level of business optimism”, whilst Paul Dales, chief UK economist at consultancy Capital Economics, said the data supported his view that “the recovery would be fast and full” and the economy could return to its pre-Covid peak earlier than expected.

Whilst the outlook remains optimistic, the British Chambers of Commerce (BCC) notes that delays in lifting lockdown restrictions, alongside rising inflation, could be a big threat to the economic outlook – with predictions that the UK economy will grow by 6.8% this year, the strongest rate since official records began.

Empowering the multitude of small and medium sized property development businesses which are key to delivering 'build, build, build', CrowdProperty is tackling the fundamental barriers behind declining housing output from this segment by building the best property project lender in the market, attracting quality developers undertaking quality projects. CrowdProperty continues to raise finance for quality projects that are ready and able to proceed with clear exit plans in liquid markets, with a quantum of units that is immaterial to proven demand levels, at mainstream price points throughout the UK.

The business has funded over £270,000,000 of property projects by SME property professionals, funding the development of over 1,400 homes. This is still just the start of our mission to transform property finance to build more homes, increase spend in the UK economy and ever more efficiently and effectively match the supply and demand of capital for the benefit of all. Together we build a better future.

As featured in...