Borrow

Case Study

Podcasts

Awards

About

As we progress through 2021 with the easing of lockdown restrictions underway, we are seeing some schemes initially created to help against the difficult economic backdrop of 2020 - such as the Coronavirus Business Interruption Loan Scheme - coming to an end. With support being withdrawn as we move towards a new normal, we review what this means for the sector alongside the latest market commentary.

The Coronavirus Business Interruption Loan Scheme (CBILS), which launched on 23rd March 2020, gave financial support to SMEs in the UK that were losing revenue due to the coronavirus outbreak. The scheme was part of the Government’s support of UK businesses to help them stay financially afloat during the economic crisis.

The scheme issued loans of up to £5m to those businesses that had an annual turnover of less than £45m. On top of this, the Government also paid the interest on any CBILS loan. However, as this came to an end on 31st March 2021, CBILS has been replaced with the Recovery Loan Scheme (RLS) which offers businesses of any size the opportunity to apply for a loan of up to £10m from 6th April until the end of 2021.

The RLS loans will be subject to interest rates up to 15% which consequently means that the Government is now only guaranteeing 80% of the loan amounts. Subsequently, lenders that are offering the Recovery Loan Scheme will be more cautious to approve applications and applicants will be subject to affordability checks by the lenders. Consequently, some SMEs may find themselves unable to obtain a RLS due to this new criterion.

Therefore, it comes as no surprise that SME developers across the housing sector are worried about what the introduction of RLS could mean for them and whether they could obtain important finance to help fund their property businesses. Unlike traditional banks, CrowdProperty offers customised and reliable finance for property projects with no hidden fees - our Property Team works directly with developers to ensure the best outcome for everyone involved.

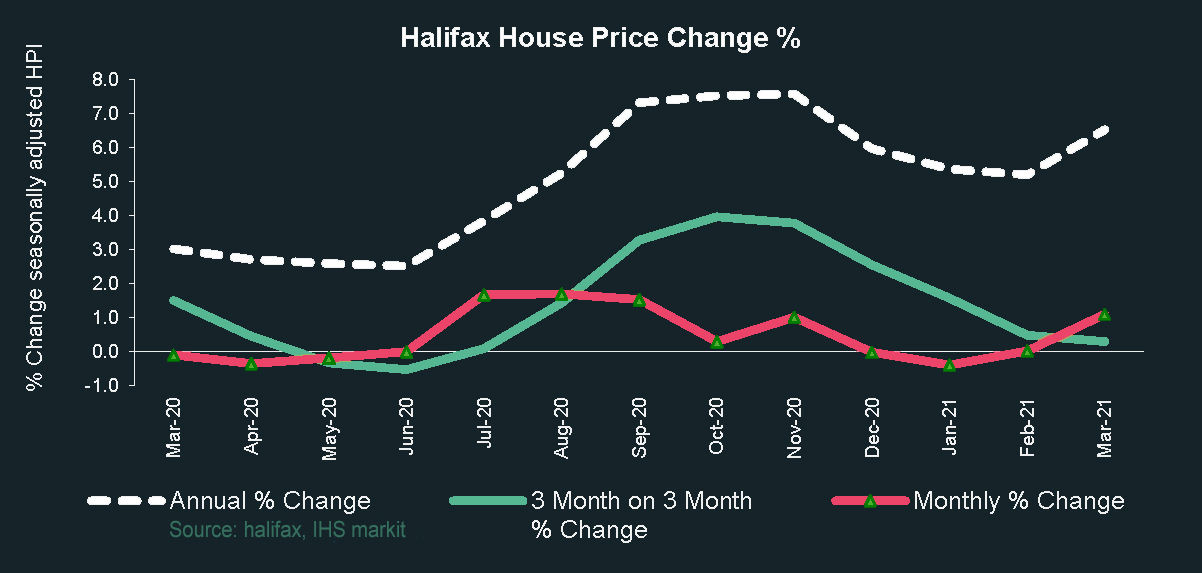

The continuation of the Government’s support has enabled the housing market to largely ride out the impact of the pandemic so far. Particularly following the announcement of Chancellor Rishi Sunak’s Budget, the housing market saw a surge in activity throughout March, with Halifax reporting that the average house price increased by 1.1% from the previous month - meaning that the average house price is at a record high of £254,606.

As for the months ahead, Spring appears to be the strongest the housing market has been in decades, with Tim Bannister, Rightmove’s Director of Property Data, commenting that “concerns of a cliff edge for the housing market at the end of March have dissipated, partly due to the tax deadline extensions in all of the UK bar Scotland." This activity is also partly down to the Government’s guarantees enabling lenders to return to a 5% deposit on mortgages which has further increased buyer demand. Zoopla reported that by the end of March, the demand for housing was 80% higher than the same time period over the previous four years.

Considering this, there is a widespread acknowledgement that there still remains a gap between the supply and demand of housing. However, Tim Bannister concludes that the data predicts a "rebalancing” over the coming months.

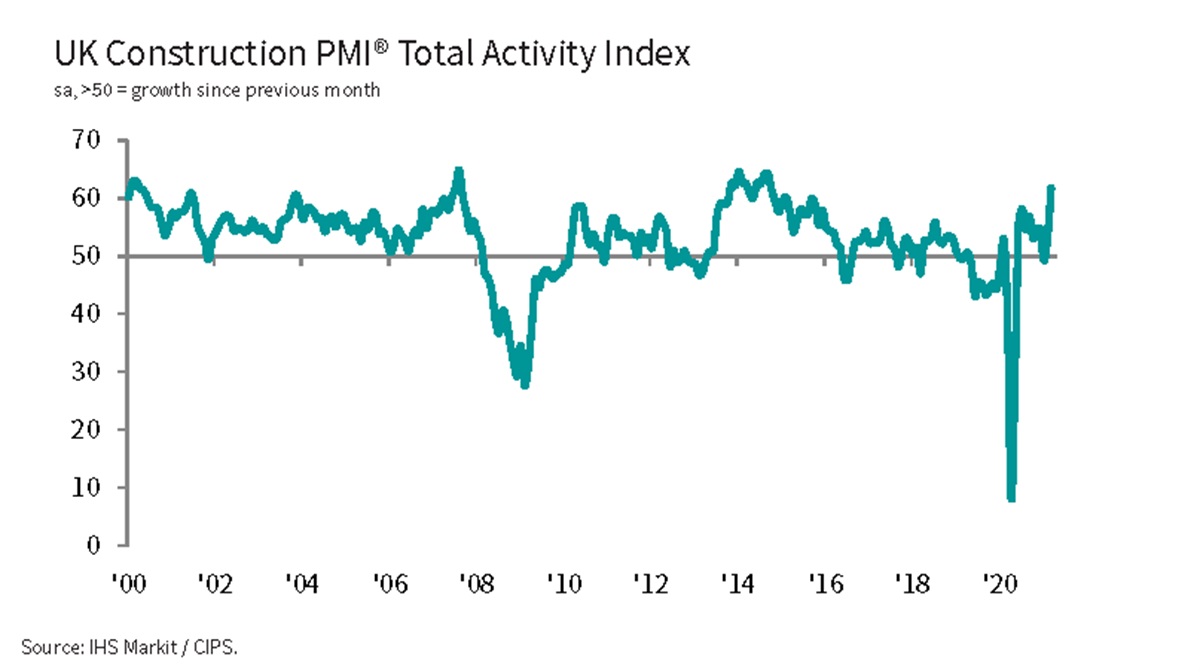

For the construction industry, the month of March saw a considerable increase in momentum which was supported by the rise in house building. IHS Markit’s latest UK Construction PMI data reported that the construction index registered at 61.7, up from 53.3 in February, demonstrating a surge in economic activity. The latest survey indicated a strong degree of confidence towards the year ahead outlook for construction activity, with Tim Moore, IHS Markit’s Economics Director, commenting on "the strongest growth projections across the UK construction sector since those reported during a post-election bounce back in June 2015", reflecting confidence in the UK economic outlook, the improving pandemic situation and pent-up demand.

EY ITEM Club noted that the significantly improved growth in the construction sector was encouraging news for the UK economy, with housebuilding the strongest growing sector in March as activity picked up to the highest level since July 2020. A rise in the household savings ratio - to “16.1% in Q4 2020 and a level of 16.3% over 2020” - suggests consumers overall are in a good position to spend as restrictions ease through Q2 2021, further supported by a lower than expected rise in unemployment due to the extension of the furlough scheme. The EY ITEM Club expects to raise its current 2021 GDP growth forecast of 5.0%, showing cautious optimism as Howard Archer, EY ITEM Club’s Chief Economic Advisor, noted that the economy “contracted by just over 1% quarter-on-quarter (q/q) in Q1, compared to the 3-4% q/q fall in GDP originally anticipated.”

This contraction has been reflected in the supply of raw materials and consequently, the inflation in prices is expected to apply pressure on supply chains in the near-term. But despite these concerns, IHS Markit’s Tim Moore says that these factors “did little to dampen confidence about the business outlook." As a result of this, there has been a significant boost in hiring levels across the construction sector - a 27-month high.

The construction and housing sector will therefore play a huge part in ensuring the UK gets back to its pre-pandemic activity as Russell Galley, Managing Director at Halifax, states that “we expect elevated levels of activity to be maintained in the coming months, with consumer confidence spurred on by the successful vaccine rollout, and buyer demand still fuelled by a desire for larger properties and more outdoor space, as work-life priorities have shifted during the pandemic.”

Empowering the multitude of small and medium sized property development businesses which are key to delivering 'build, build, build', CrowdProperty is tackling the fundamental barriers behind declining housing output from this segment by building the best property project lender in the market, attracting quality developers undertaking quality projects. CrowdProperty continues to raise finance for quality projects that are ready and able to proceed with clear exit plans in liquid markets, with a quantum of units that is immaterial to proven demand levels, at mainstream price points throughout the UK.

The business has now lent over £120,000,000 to SME property professionals, funding the development of over 1,200 homes worth over £240,000,000. This is still just the start of our mission to transform property finance to build more homes, increase spend in the UK economy and ever more efficiently and effectively match the supply and demand of capital for the benefit of all. Together we build a better future.

As featured in...