Borrow

Case Study

Podcasts

Awards

About

The easing of public health restrictions announced by Boris Johnson in the Government’s 22 February Roadmap confirmed the widely held view that the rapid rollout of effective vaccines would offer hope of a swifter and more sustained economic recovery. Combined with Chancellor Rishi Sunak’s announcements in the Spring Budget, the recovery plans for the property market as well as the wider economy have largely been met with a positive reaction by market commentators. We take a look at the latest views in our monthly roundup.

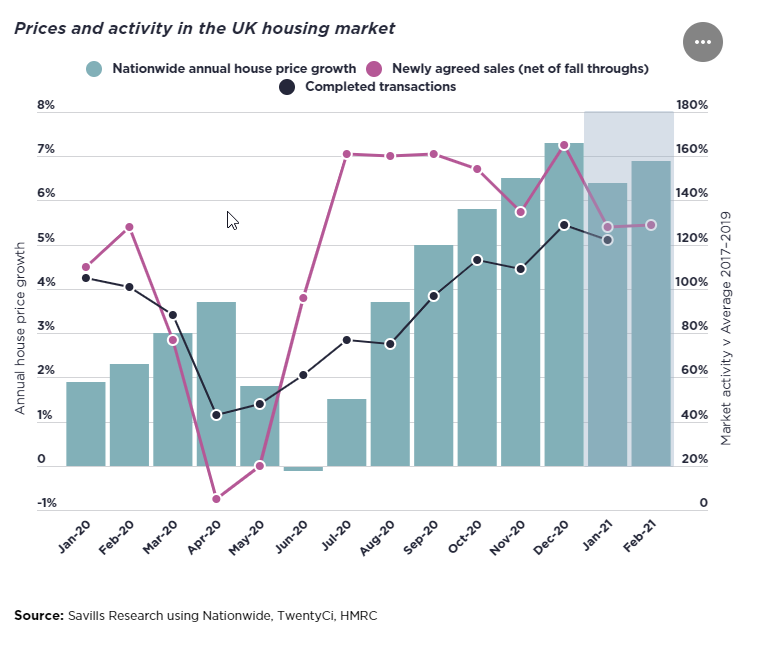

Following an unexpectedly resilient and strong performance throughout 2020, Savills has predicted strong growth in the UK housing market throughout the coming years, especially in the North and Midlands. Despite the economy contracting by -10%, house prices rose by 7.3% over the course of the year – driven largely by homeowners’ changing housing needs as a result of the pandemic and incentives such as the stamp duty holiday.

Adding to the resilient nature of the sector, Zoopla identified the post-Budget benefits to the housing market as:

- Stamp duty holiday extension - the deadline on this temporary saving for house purchases up to the value of £500,000 has moved from the end of March to 30 June, with a planned tapering off of the scheme to cover purchases up to £250,000 until 30 September and returning to the usual threshold of £125,000 on 1 October.

- 95% mortgage guarantee scheme – launching in April, this measure looks to support both first-time buyers and existing homeowners to purchase any type of property up to a cost of £600,000 to be their main home.

In addition, the extension of the furlough scheme sees financial support for those whose jobs have been impacted by the pandemic extended until the end of September. Tax thresholds have also been frozen for capital gains tax (CGT) and inheritance tax until April 2026. Strong house price growth means more people will be liable and will face larger tax bills – those benefiting from property capital gains will contribute, however not to the extent suggested by CGT reform rumours.

These measures demonstrate that the government remains committed to supporting the housing sector and bring increased confidence in the property market, with Savills citing ‘government support, the easing of restrictions and low interest rates’ as the factors which led to its revised forecast for house price growth in 2021 from 0% to 4%.

Tim Bannister, Rightmove’s Director of Property Data, comments: “Last year the market was unexpectedly buoyed by buyers’ determination to move and satisfy their new lockdown-induced housing needs. We may well be seeing a continuation of that this year. Rightmove’s early 2021 buyer data shows… all of the key buyer metrics are ahead of early 2020, itself an active period as the market was boosted by the post-election ‘Boris bounce’. As well as the current lockdown motivating buyer demand again, the restrictions have also been a factor in limiting new supply, leading to some modest upwards price pressure.”

The Treasury’s actions to encourage lenders to reintroduce low deposit mortgages were welcomed by Russell Galley, Managing Director at Halifax, who noted: “Whilst mortgage approvals have reached record highs in recent months, hitting levels not seen since before the financial crisis of 2008, raising a deposit continues to be the single biggest hurdle for first-time buyers to overcome.”

However, concerns around the impact of unemployment remain prevalent, with Robert Gardner, Nationwide’s Chief Economist, stating: “If labour market conditions weaken as most analysts expect, it is likely that the housing market will slow in the months ahead.” Indeed, the OBR expects a ‘rebound in consumption and output through this year, partially supported by the release of extra savings built up by households during the pandemic’ but predicts that unemployment will rise to a peak of 6.5% at the end of 2021 in its latest market overview (down from the 7.5% assumed in its November 2020 forecast).

For now at least, the market remains buoyant with Rightmove reporting high demand outstripping supply and pushing up prices. New seller numbers are down 21% on the previous year as owners of family homes delay coming to market – however, the number of new buyers continues to grow. “Now that we have some clarity on what the roadmap out of lockdown could look like we expect to see more people putting their home on the market. This should help open up more choice in the market to satisfy the strong buyer demand we’re seeing,” said Tim Bannister, Rightmove’s property data expert.

Construction will also have a part to play, with the latest data from the IHS Markit / CIPS UK Construction PMI showing a solid return to growth for UK construction companies in February. The Total Activity Index posted 53.3 in February, up from 49.2 in January – signalling a solid increase in overall construction output. “House building is still the engine of recovery for the construction sector,” according to Tim Moore, Economics Director at IHS Markit. Residential work remained the strongest area of growth in February, despite reports of temporary delays on site arising from adverse weather and supply chain issues.

Empowering the multitude of small and medium sized property development businesses which are key to delivering 'build, build, build', CrowdProperty is tackling the fundamental barriers behind declining housing output from this segment by building the best property project lender in the market, attracting quality developers undertaking quality projects. CrowdProperty continues to raise finance for quality projects that are ready and able to proceed with clear exit plans in liquid markets, with a quantum of units that is immaterial to proven demand levels, at mainstream price points throughout the UK.

The business has now lent nearly £120,000,000 to SME property professionals, funding the development of over 1,100 homes worth over £230,000,000. This is still just the start of our mission to transform property finance to build more homes, increase spend in the UK economy and ever more efficiently and effectively match the supply and demand of capital for the benefit of all. Together we build a better future.

As featured in...