Borrow

Case Study

Podcasts

Awards

About

Article 12 in a series of 40 articles on P2P, property and CrowdProperty

Previously, we explained how we provide end-to-end support for our borrowers. This article takes a detailed dive into the application process for borrower, and in the next piece we’ll look at the importance of first-charge security

Churchill – before the endless cycle of birth, death and rebirth saw him reincarnated as a plastic nodding dog flogging car insurance – once apologised to a correspondent that he’d not had time to write a short letter, so he’d penned a long one.

We all know what he means, certainly in the context of loan applications: the heart sinks with so many, as you survey the boxes that need your addresses over the past three years; names of pets; parents; names of parents’ pets… on it goes. You feel your eyeballs shrivel in your skull as you fill out screen after screen after screen. Until, sometime after you’ve lost the will to live, you press the submit button … and either the system crashes and you have to start again, or ‘computer says no’.

Minimal fuss

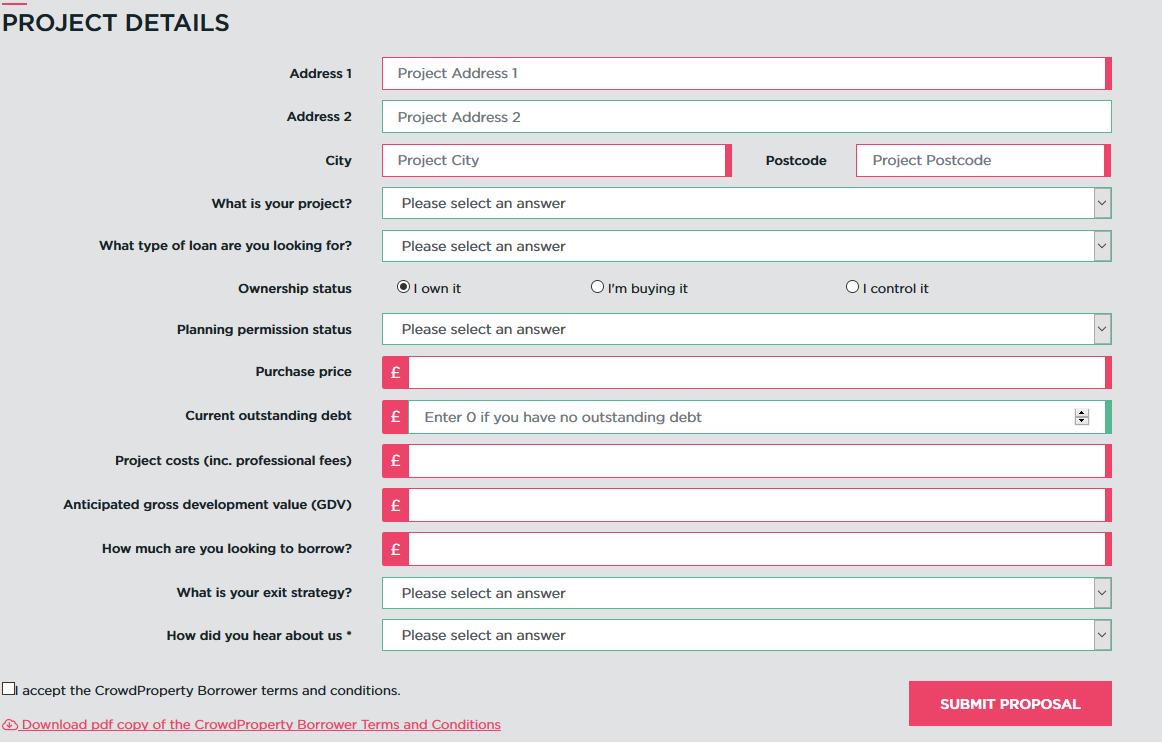

At CrowdProperty, we have spent a long time writing you the shortest letter we possibly could. Or, rather, writing the shortest application form. We’ve spent too long in the past filling out 20-page vanilla buy-to-let mortgage application forms asking for information that is not material to the lending decision. So we’ve made it as easy as possible for you get the meaningful information on your project to us for our experts to give you a view.

Why is this important? Because as property people ourselves, we always craved an expert view as early as possible when looking at a project – a second pair of eyes, a validation – which then gives confidence to proceed or the confidence to let go of a project because it’s unlikely to deliver the returns we needed.

A property project can consume 18 months of your life – not to mention burn through your capital if you’ve got the fundamentals wrong. Therefore, finding the right deal is critically important and we’re here to help you with a view on projects that you find, taking just five minutes of your time to fill in our short form here.

What this boils down to is a 12-box application form. Yes, just 12 boxes. That fires off our platform technology – gathering and analysing data on the locale and putting your project into our super-efficient workflow. We wouldn’t ask you to form fill if it wasn’t for your benefit of a super quick and easy answer.

Useful feedback

From the form, we’ll speak to you to understand your vision and within a few hours give you one of three answers (that we, when in your shoes, wish we could have got a number of years ago):

- Yes, we like it. Here is our illustrative lending amount, rates and fees. We’ll need a bit more information on a, b and c to get to final offer but in the meantime, proceed with confidence and we’ll help you secure the best deal possible

- No, we don’t do that type of funding (for example, pure commercial projects) – but lenders x, y and z are apparently good in that space (we don’t take a referral here: we’re just being helpful, and we know the space, so it may well be a good lead you’ve not thought of)

- No, we’re not sure about this project because of a, b and c. Let’s have a talk through these so we’re all aligned on them. You never know, you might have a solution to a, but may not have thought of b and c. A quick, expert view on a project that has flaws will enable you to drop it and find the next rapidly – and we’re happy to take a look at all you find to help you find the best to spend your time on

How useful is it to have our experts look over your deal and provide feedback? And for free at that. Not only will we get you a view, but we can also help you secure the best deal. One existing borrower came to us with another site, asking us to check it over. It was a great deal and they proceeded with said confidence. We suggested taking a letter of proof of funding to the negotiation table, which they did… which secured the site for a lower price than the highest offer. And that’s a win-win situation – not only did they get a better deal but it also meant that we got better security.

Work with an expert partner from start to finish. You’re worth it.

Apply in just 5 minutes at www.crowdproperty.com/apply

Hear from developers we've worked with: www.crowdproperty.com/case-studies

As featured in...