Borrow

Case Study

Podcasts

Awards

About

An overview of the latest key property market updates and insights for small and medium-sized property developers.

Key takeaways at a glance:

- Inflation hits 2% for the first time in almost three years.

- UK house prices remain static.

- Construction activity accelerates at fastest pace in two years.

- UK interest rate cut yet to transpire, despite other country-wide cuts.

- Interest rate cuts won’t reduce mortgage costs much.

- Election: Builders not the blockers & brownfield presumption.

Key takeaway 1: Inflation hits 2% for the first time in almost three years

News of inflation falling to the 2% target for the first time in three years dominated the news headlines earlier this week following the publication of the Office for National Statistics’ monthly Consumer Price Index (CPI) report that showed CPI inflation dropped from 2.3 to 2% in May.

Published on June 19, the ONS’ May report revealed that the slight decrease was triggered by a slight fall in food and soft drink prices, as well as slower cost increases for recreation and culture and furniture and household goods. Meanwhile, petrol prices continue to rise and food prices remain 25% higher than they were at the start of 2022.

These ONS figures are the last set of official economic statistics to be released before the General Election and, as a result, have sparked significant debate among the main parties – the Conservatives say they restored economic stability while Labour say pressure on household finances remain acute.

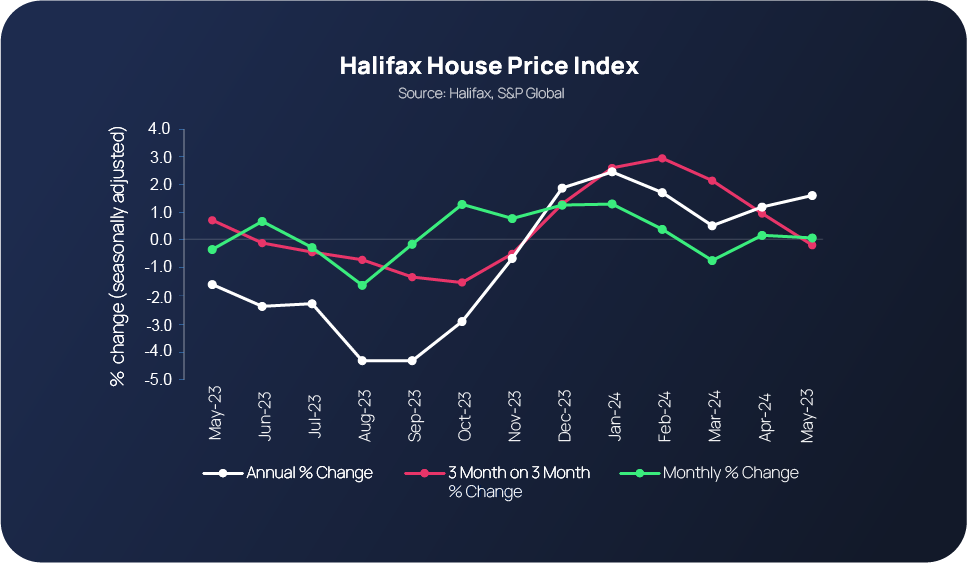

Key takeaway 2: UK house prices remain largely static

UK house prices remained largely static in May, putting the average cost of a house in the UK at £288,688 in May compared to £288,862 in April. This slight decrease represents a -0.1% monthly, -0.3% quarterly and +1.5% annual change.

According to Amanda Bryden, Halifax’s Head of Mortgages, market activity remained resilient during the spring. This is mainly due to the fact it was underpinned by strong nominal wage growth and rising confidence in the overall economic outlook. She predicts that the activity levels experienced to date are set to continue for the rest of the year, helping boost all-round confidence along the way:

“A period of relative stability in both house prices and interest rates should give a degree of confidence to both buyers and sellers.

“While homebuyers and those remortgaging will continue to respond to changes in borrowing costs, set against a backdrop of a limited supply of available properties, the market is unlikely to see huge fluctuations in the near-term.”

As for regional house prices, the North West is currently the strongest-performing region - house prices rose by +3.8% (annually) in May. The average property price currently stands at £232,258.

Other housing activity key observations: UK seasonally-adjusted residential property sales rose by 4.6% in April to 90,430 (HMRC); the number of approved mortgages fell slightly in April by 0.2% (Bank of England), new listings reached a three-year high of +25% in April, the highest score since October 2020 (RICS) and the number of sales agreed through 2024 year-to-date have been 7% above pre-pandemic norms (TwentyCI).

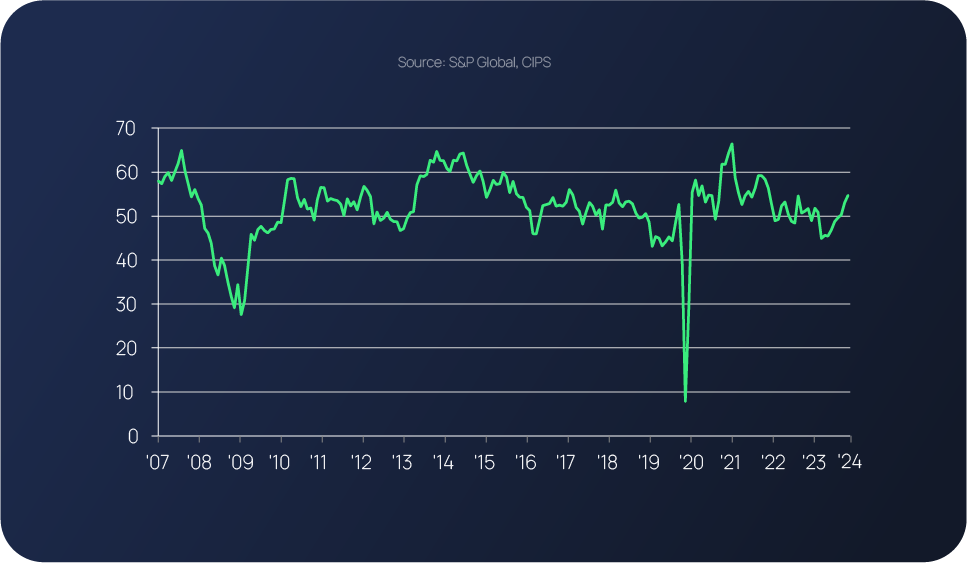

Key takeaway 3: Construction activity accelerates at fastest pace in two years

According to the latest S&P Global UK Construction PMI published on June 6, construction activity in May grew at its fastest pace in two years. Increases were seen across all sector-wide activity and new business which, in turn, fuelled a rise in purchases, employment and business confidence. At the same time, supply chain conditions continued to improve amid reports of good vendor stock availability.

This industry-wide positive outlook resulted in the index rising to 54.7 from 53.0 in April. And for the first time since May 2022, all three monitored categories (housing activity, commercial activity and the Civil Engineering Index) reported increased outputs as housing activity returned to growth.

Residential project growth was marginal and civil engineering activity remained solid. However, commercial activity reported a sharp increase, putting it at a two-year high. (For details of future housebuilding activity/General Election plans, read key takeaway 5).

Key takeaway 4: UK interest rate cut yet to transpire, despite other country-wide cuts

As was widely anticipated, at its meeting on 20th June the Monetary Policy Committee (MPC) kept interest rates at 5.25% as part of continued efforts to bring down the UK’s inflation rate. This marks the 11th consecutive month rates have been at this level.

Meanwhile, the European Central Bank announced its first interest rate cut (from 4% to 3.75%) earlier this month (June). The move followed in the footsteps of several other countries, including Canada, Sweden, Switzerland, Brazil and Mexico and has been interpreted by analysts as ‘a new phase in the global battle sparked by the pandemic against inflation.’

Several forecasters are now predicting at least one, if not more, rate cuts in the US, eurozone and the UK later this year, with more to follow in 2025.

Key takeaway 5: ‘Interest rate cuts won’t reduce mortgage costs much’, so just crack on

Even when the Bank of England does decide to cut interest rates, aggregate mortgage interest rate costs will stay elevated for the foreseeable. Capital Economics reports that while borrowers on tracker and two-year fixed rate deals will soon see their mortgage payments drop, those on five-year fixes will still face higher repayments when they refinance.

As a result, aggregate mortgage interest costs are set to stay elevated even as the Bank Rate falls as the SONIA swap rates, the bellwether for finance costs, already have rate reductions priced in. This suggests the Bank of England may need to be bolder if there comes a point when it needs to stimulate the economy. The Capital Economics team predicts that:

“Just as fixed mortgage rates slowed the increase in mortgage costs on the way up, they will slow the fall in households’ interest costs as interest rates are lowered.

“While the small proportion of borrowers with a tracker mortgage will see their mortgage rate decrease from the summer, and those coming to the end of a two-year fix will move on to a lower rate next year, their savings will be offset by other borrowers coming to the end of a five-year fix experiencing a significant rise in mortgage rates.”

Read the full report: https://www.capitaleconomics.com/publications/uk-housing-market-focus/interest-rate-cuts-wont-reduce-mortgage-costs-much

Key takeaway 6: Election 2024: Builders not the blockers & brownfield presumption

Housebuilding features widely within the manifestos of both Labour and the Conservatives.

Knight Frank reports that Labour has positioned itself as the ‘builders not the blockers’ and has set itself a mandatory target of building 300,000 homes per year. Its housing policy also includes several other measures, such as making 40% of housing affordable within new towns, developing grey belt land and creating ‘planning passports’ for brownfield developers.

Like Labour, the Conservatives have also set themselves a target of providing 300,000 homes, but by the mid-2020s. A Planning Skills Delivery Fund aimed at reducing backlogs and enhancing sector skills and a new 10-week planning service for major commercial applications, as well as plans to protect greenbelt land, are among the other housing-related pledges within their manifesto.

Mike Bristow, CEO of CrowdProperty, comments:

“Inflation has, as expected, fallen back to target levels. The next Bank of England interest rate move will be down (the ECB has already moved theirs down). UK’s GDP growth, albeit still low, is currently the strongest in the G7, and forecasters expect ongoing strengthening.

“These factors have led to a shift in confidence in the UK housing market, with sales agreed in each month of 2024 above pre-pandemic normal market levels.

“Whilst the perception is that the cost of property finance falls with BoE rates, outside of base rate tracker mortgages, the market’s expected rate reduction trajectory is priced in (SONIA swap rates drive multi-year finance costs). This is one of a number of supporting arguments for pressing forward on transactions for development and investment now, whilst much of the market competition for sites waits for BoE rates to fall.

“Renewed appetite, alongside less uncertainty about the market prospects for property sales in 12 to 24 months’ time, has contributed to CrowdProperty receiving record levels of applications in the last three months – over £1.3 billon’s worth of applications – which is positive for our investors and developers alike as we continue with our mission to support the building of much-needed homes in the UK.”

Read our SOTM Election Special update where we delve into what the proposed policies of the main political parties could mean for housebuilding and SME property developers over the coming months and years.

//

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team

We are a leading specialist property development finance business and have funded £843m worth of property projects to date

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply and get an instant Decision in Principle. Within 30 minutes, our property experts will share their insights and initial funding terms, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding

As featured in...