Borrow

Case Study

Podcasts

Awards

About

An overview of the latest key property market updates and insights for small and medium-sized property developers.

Key takeaways at a glance:

- UK house price growth continues to sit at +1.6%.

- Construction activity rises, but housing activity declines.

- Bank rate stays put at 5.25%.

- First-time buyers won’t be mortgage-free until they’re 63.

- Resilient residential market will continue to outperform.

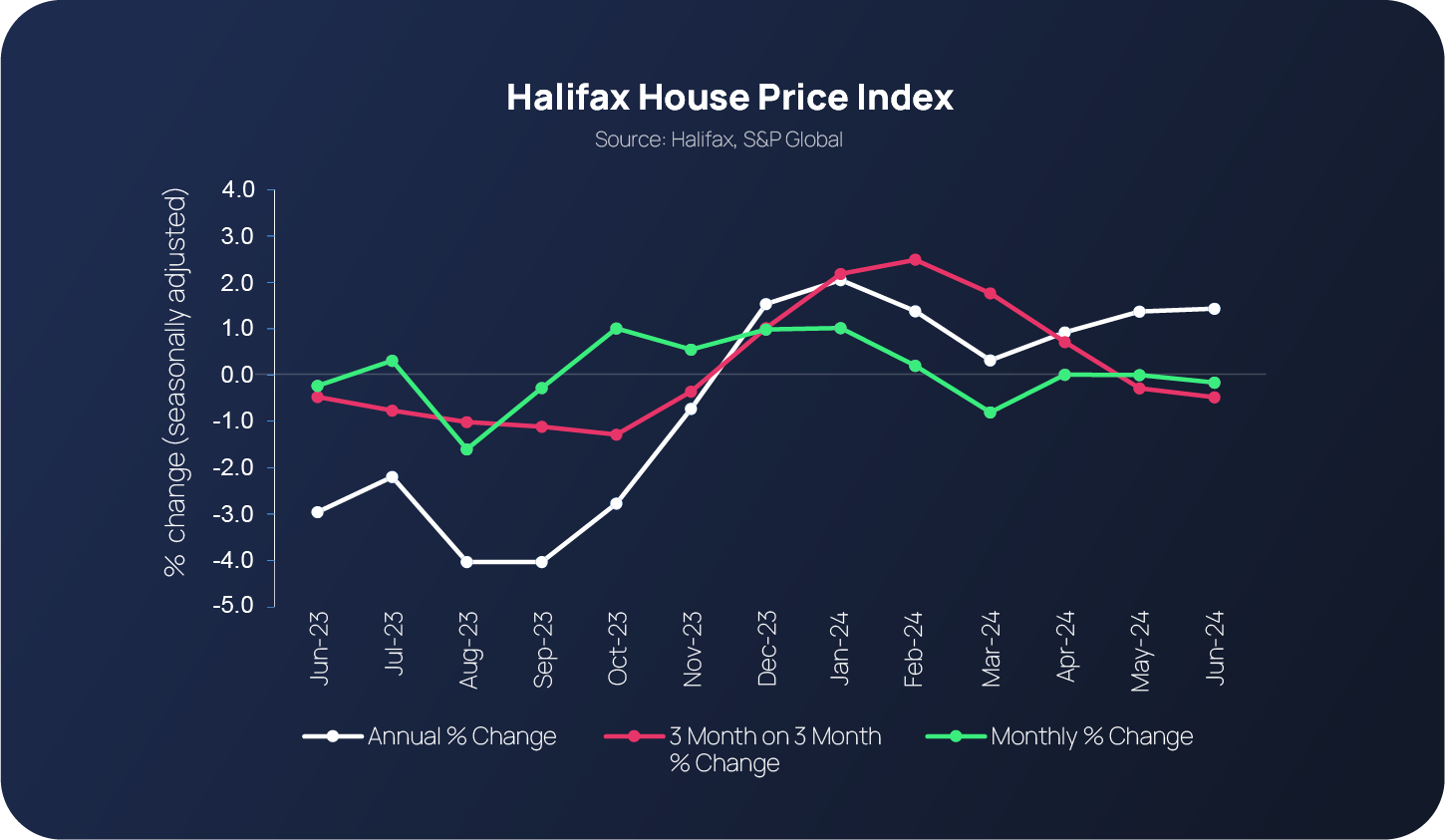

Key takeaway 1: UK house price growth continues to sit at +1.6%

UK house prices continued to present a similar picture as they did in May, with the annual rate of house price growth remaining unchanged at +1.6%. According to Halifax’s latest House Price Index, the average cost of a property in the UK now costs £288,455, -0.2% down on May’s average house price figure.

This is the third successive month that UK house price activity has remained relatively flat. However, from an overall annual perspective, house prices have steadily risen for the seventh month-in-a-row on a nominal basis, which grows equity value, especially for leveraged investors. Amanda Bryden, Halifax’s Head of Mortgages, comments that while the market may appear subdued, it is recovering when you review overall activity.

While this is promising to see and hear, challenges in housing still remain - mainly the shortage of available properties, which is contributing to higher prices staying higher, and mortgage affordability for homebuyers and existing mortgage-payers whose current fixed-term deals are ending. These dynamics, alongside less macro uncertainty and post-election clarity, are attractive for capital providers, with competition in the morgage market hotting up.

As for the outlook, RICS observes that respondents’ near-term sales activity expectations have turned ‘a little more optimistic.’ A total of +20% of respondents (10% more than in May) anticipate residential sales volumes recovering over the next three months. Respondents in the June UK Residential Market Survey also indicated the most positive forward price expectations since 2022 – a net balance of +5% on the three-month horizon and +41% on the 12-month – contributors expect to see increases in house prices throughout the coming year.

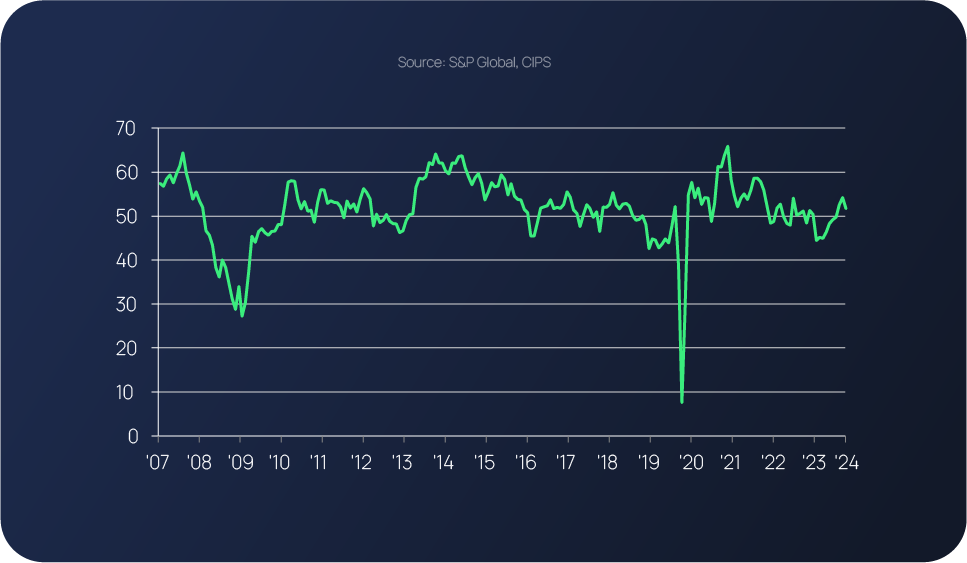

Key takeaway 2: Construction activity rises, but housing activity declines

Published on July 4, the latest S&P Global UK Construction PMI report revealed a tale of two halves – total construction output continuing to rise against the backdrop of a renewed decline in housing activity.

The latest stats show that total industry activity was down on May’s 54.7 reading, registering at 52.2 in June. This is the fourth consecutive month the figure has stayed above the 50.0 no-change mark, signalling a sustained improvement in overall UK construction activity, which was largely fuelled by commercial activity.

While commercial activity may have increased, it was a modest increase, with the rate of expansion easing off for the first time since May’s two-year high. All categories, including civil engineering, recorded modest output increases. Housing was the only area to report a solid dip in activity, which has been linked to uncertainty generated by the General Election.

Interestingly, job-related activity showed a positive surge – the rate of job creation increases is currently at its sharpest since August last year. At the same time, companies expanded their use of sub-contractors at a solid pace, extending the current sequence of growth to three months.

Key takeaway 3: Bank rate stays put at 5.25%

At its last meeting on June 19, the Monetary Policy Committee (MPC) overwhelming voted once again to keep the bank rate at 5.25% (7 votes for and 2 against; the same voting pattern as May) for the seventh time in a bid to meet its 2% inflation target.

Twelve-month CPI inflation finally fell to 2% in May from 3.2% in March. However, CPI inflation is expected to rise slightly in the second half of this year as declines in energy prices last year fall out of the annual comparison. The consensus for June’s print, which is to be released this week, is that CPI remains static at 2%.

According to the MPC, UK GDP appears to have grown more strongly than expected during the first half of this year. Business surveys, however, remain consistent with a slower pace of underlying growth; at around ¼% per quarter.

As for what the MPC’s latest decision means for existing borrowers, those on variable and tracker mortgages will be pleased to see their rate isn’t going to rise, but will also be disappointed it isn’t going to go down either.

This puts the current average standard variable rate at 8.18%; down by just 1% since last November. And while mortgage-payers, who are fixed in for the foreseeable won’t be impacted at this moment in time, it’s widely reported that those whose deals have ended or are about to end could wind up spending up to 60% more on their mortgage repayments going forward (HomeOwners Alliance).

Key takeaway 4:First-time buyers won’t be mortgage-free until they’re 63.

According to recently-released research, the average first-time buyer will not pay off their mortgage until they’re 63-years-old.*

The insight, published by Mojo Mortgages, is based on: people paying a 10% deposit; the current average mortgage rate being 6.03%; the total cost of an average-priced house sitting at £264,500 and the average mortgage term being 30 years.

The research findings do vary from region-to-region, with Londoners taking the longest time to become mortgage-free (at the age of 66 years and 8 months old). This is based on the average Londoner buying their first home at 36 years and 8 months old over a 30-year mortgage term.

Interestingly, the research also found that first-time buyers are facing the toughest conditions in the last 70 years and that the national average age of a first-time buyer in the UK is 33 years and 8 months.

You can read the full research findings here.

*Age slightly varies according to region.

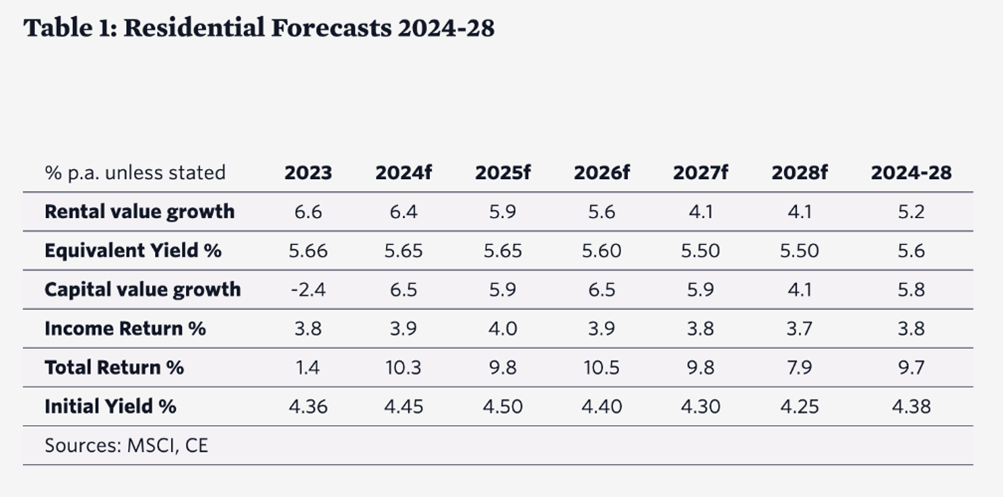

Key takeaway 5: Resilient residential market will continue to outperform

Capital Economics reports that residential ‘has outperformed all of the all-property benchmarks since 2000.’ And while the UK residential institutional market remains small compared with the informal Buy to Let (BTL) sector, supply, activity and investor interest are growing.

Independent advisor, Andrew Burrell, observes that: “The fundamentals point to further strong growth in occupier demand in future, which, with BTL supply likely to stagnate, is set to further fuel investment opportunities. While it will be many years before the UK rivals the scale of the US market [for institutional investment], all the evidence points to a continuation of the healthy outlook for residential transactions.”

Looking ahead to the next five years, residential is anticipated to outperform by an even wider margin compared to recent years, returning 9.5 to 10% p.a. compared with the current all-property mean of just over 7% p.a.

Mike Bristow, CEO of CrowdProperty, comments:

“Against the backdrop of a General Election, the relative stability of the market recently is positive. A slight stall in housing activity is unsurprising, as some developers held fire on new projects while they awaited the outcome of the election.

“That said, we’ve experienced a run of record-breaking months with £1.3bn worth of finance applications in the last quarter. We’re busy getting these through the pipeline and are encouraging developers to get cracking on progressing their finance applications, as surveyors, solicitors and other property professionals are going to get very busy soon.

“Developers should get ahead of the September rush to avoid delaying their project start dates. Plus, the post-summer surge could also see valuation quotes and solicitors’ fees go up as demand outstrips supply of these services. Progressing things as far as they can be progressed now will serve developers well come the end of the summer.”

//

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team

We are a leading specialist property development finance business and have funded £840m worth of property projects to date

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply and get an instant Decision in Principle. Within 30 minutes, our property experts will share their insights and initial funding terms, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding

As featured in...