Borrow

Case Study

Podcasts

Awards

About

An overview of the latest key property market updates and insights for small and medium-sized property developers.

Key takeaways – at a glance:

- Housing market uplift continues

- Mortgage rates fall and SONIA swap rates ease

- Improved inflation outlook

- Slower construction activity decline

- 99% mortgage scheme plans

Key takeaway 1: Housing market uplift continues

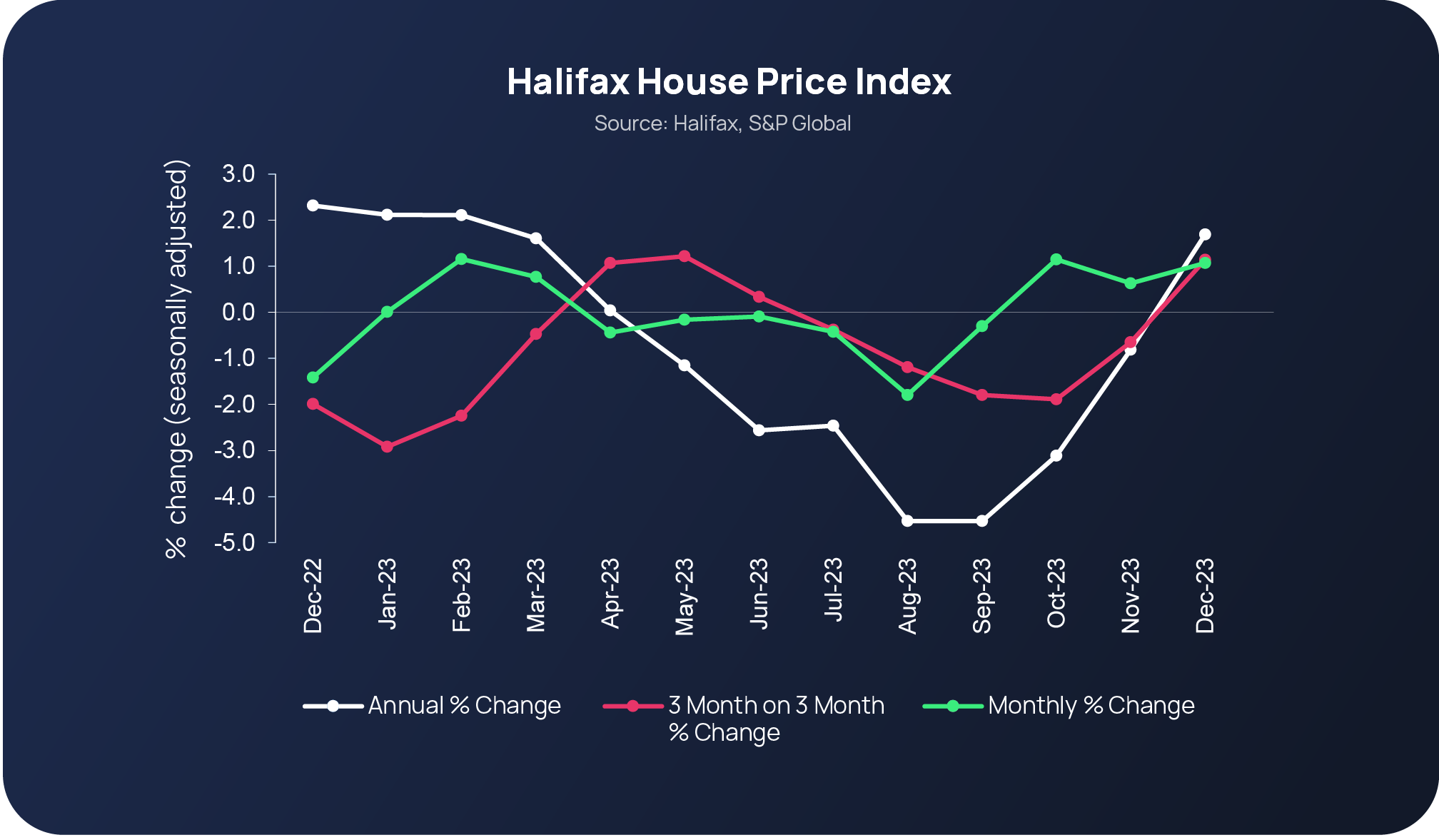

Industry commentary and reports continue to reflect another slight uplift in relation to UK house prices, with the Halifax House Price Index stating prices rose again in December 2023, the third monthly increase in a row. The latest +1.1% rise means the cost of an average property now stands at £287,105. Meanwhile, knowledge of December’s house price activity has enabled a full picture of last year’s activity to be painted, which equates to a +1.2% change from a quarterly perspective and a +1.7% increase from an annual perspective.

Halifax also reports that the average house price is now at its highest level since March last year, £4,800 higher than in December 2022. However, the increases have not been reported on a UK-wide scale. While insight from Halifax and Nationwide shows that Northern Ireland and Scotland were the only areas to report price rises in 2023, prices in the South East experienced the sharpest fall (-4.5%), putting average property prices at £376,804.

The continued gradual improvement in sales is further reinforced in the latest RICS UK Residential Survey, with observations including references to further gradual improvement in market sentiment and ‘the tide turning in respect to house prices, with contributors now envisaging a largely flat trend coming through at the 12-month time horizon’. Various market commentators have updated their forecasts for 2024 house price growth in January to be materially stronger, including Knight Frank (now expecting +3.0% vs their October 2023 forecast of -4.0%) and Capital Economics (+5%), both driven by expecting double-digit percentage increase in sales volumes in 2024 compared to 2023 with expected BoE base rate reductions.

RICS also reports house prices are anticipated to stabilise at national level (at a net balance of 0% vs. -10% previously). In the meantime, while tenant demand remained high within the lettings market in December, it has ‘noticeably softened’ in recent months from 59% in July to 17%, with Zoopla forecasting a major slowdown this year. However, despite this forecast, UK rental demand still remains 32% above the five-year average, which is anticipated to help balance the market for the first time in three years.

With demand anticipated to improve and transactions through November and December 2023 returned to pre-pandemic levels, a key lead indicator of housebuilding supply continues to decline. The Housing Pipeline report from the Home Builders Federation (HBF) reveals that the number of sites granted planning permission in the past 12 months in England was the lowest quarterly figure recorded since the report began in 2006. The 50,316 housing units granted permission in England during Q3 of 2023 was down 12% on the previous quarter and down 28% on Q3 2022. Annually, the 245,872 units granted permission was a 15% drop on the previous year and following this through to forecast 2024 housing supply, could mean fewer than 200,000 units per year, the lowest since 2014.

Key takeaway 2: Mortgage rates fall and SONIA swap rates ease

The positive trajectory is further evidenced with mortgage lenders entering into a reported ‘price war’, which has involved more than 50 lenders cutting their residential rates since the start of the year. As a result, the best five-year fixed rate has now fallen below 4%.

The news comes as Sterling Overnight Index Average (SONIA) swap rates, which help set home loan rates, have continued to ease since last summer, presenting new opportunities for the mortgage market for the year ahead. Data from Chatham Financial shows that the swap rate for one year is currently 4.808%, two years is 4.260% and three years is 3.971% (January 22, 2024 figures).

Despite the mortgage rates being higher than what people may be familiar with over the years, the filtering through of these more digestible rates, coupled with anticipation of inflation continuing to move towards its 2% target, could continue to paint more of an increasingly positive picture over the coming months.

As for annual inflation, latest stats show that it slightly increased in December to 4%, up from 3.9% in November, the lowest rise since October 2021. However, it still remained down on October 2023’s figure of 4.6%. UK consumer prices, as measured by the Consumer Prices Index (CPI), also stood at 4% in December; slightly up from 3.9% in November last year due to an increase in tobacco duty. On a monthly basis, over the last seven months CPI has cumulatively increased by 0.7%, pointing to further reported annual inflation rate falls in the months ahead.

Meanwhile, ‘core’ inflation, which excludes the volatile energy and food components of the CPI, was 5.1% in December, remaining unchanged from November, and down from 5.7% in October. Services inflation, seen as a measure of domestic inflationary pressure, rose slightly from 6.3% in November to 6.4% in December. Both measures were at 31-year highs earlier in 2023. Looking ahead to the inflation landscape for the rest of this year, it is expected to continue to fall at more of a gradual pace due to lower energy prices and reduced inflation in consumer goods and food.

Key takeaway 3: Improved inflation outlook

According to the EY ITEM Club Winter Forecast, the improved inflation outlook for 2024 should enable the Bank Rate to be significantly reduced this year. The EY ITEM Club is forecasting 100 to 125 basis points of cuts, up from the previous projection of 100 basis points in the Autumn Forecast. The EY ITEM Club continues to expect rate cuts to start in May.

Improving economic sentiment and labour market flexibility has been highlighted as potentially limiting the rise in unemployment levels to 4.7%. However, the delayed effect of last year’s interest rate rises, which is yet to be felt in full, looks set to pose financial challenges that could potentially result in some home repossessions. An additional 1.5 million households on fixed-rate mortgage deals are due to roll on to more expensive rates this year.

While high interest rates are anticipated to limit short-term activity, possible rate reductions look set to help reinvigorate business investment. The growing prominence of technology, such as Artificial Intelligence and green energy generation, is also set to spearhead UK business investment going forward.

Key takeaway 4: Slower construction activity decline

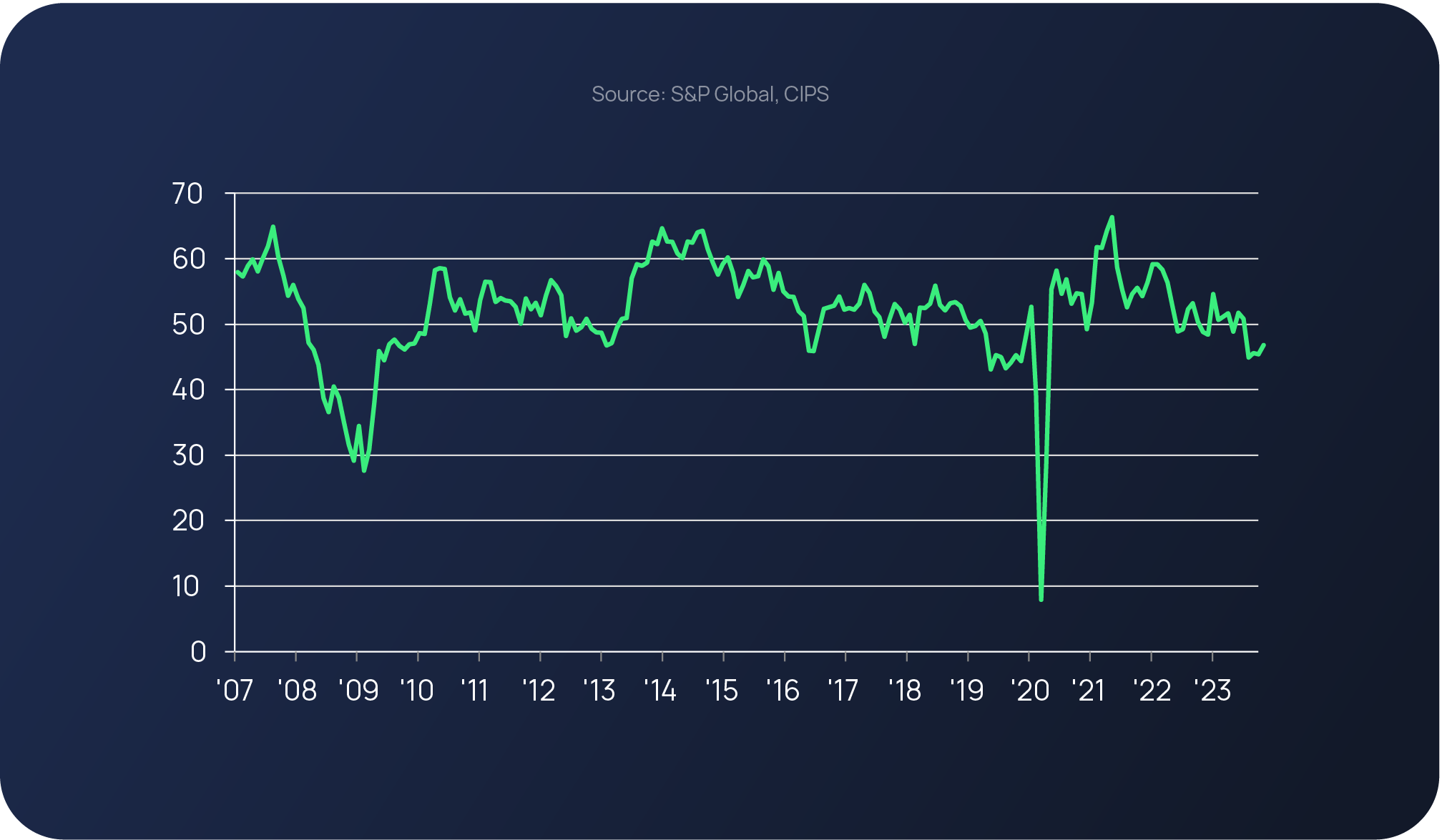

While December’s industry figures reflected a continued decline in overall construction industry activity across the UK market, the latest S&P Global UK Construction PMI update reports that the rate of decline eased to its slowest pace since September last year.

A sustained slump in housebuilding has been highlighted as being the main contributor towards holding back construction output, which has been attributed to elevated interest rates and subdued confidence among clients. Meanwhile, improving supply conditions were also observed in December, with delivery times for construction items shortening for the tenth month in a row. At the same time, supplier price discounts contributed to a moderate fall in average cost burdens across the entire construction sector at the end of 2023.

However, anticipated interest rate cuts throughout 2024 appear to have boosted sector-wide confidence. December’s figures showed that 41% of construction firms predict an increase in business activity over the course of this year, with only 17% expecting a decline. Overall, the current majority outlook presents a more optimistic view compared to the negative sentiment levels that were reported this time last year.

Key takeaway 5: 99% mortgage scheme plans

Plans to introduce a 99% mortgage scheme that will enable first-time buyers to purchase a property with a 1% deposit are reportedly being considered by the Government ahead of the anticipated autumn election.

Previously, first-time buyers were able to get their foot on the property ladder by providing a 5% deposit as part of the Government’s Help to Buy Scheme, which ended in March last year.

The latest proposals, which are set to be launched in the Spring Statement on March 6, have attracted widespread divided opinions. Some mortgage brokers say that the 99% mortgages would be similar to the 95% LTV mortgages that are currently available on the market, with others warning that the initiative could potentially expose buyers to negative equity and push house prices up further.

According to the National Association of Property Buyers (NAPB), the scheme is a short-term quick fix that could make it more difficult for future buyers to enter the market due to property supply not keeping pace with the additional surge in property demand generated by the scheme.

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team

We are a leading specialist property development finance business and have funded over £840m worth of property projects to date.

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply – our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding

As featured in...