Borrow

Case Study

Podcasts

Awards

About

An overview of the latest key property market updates and insights for small and medium-sized property developers.

Key takeaways – at a glance:

- Property prices rise again and stabilise regionally.

- Housebuilding decline continues.

- UK economy shows ‘distinct signs of recovery.’

- Brownfield land redevelopment accelerated by Government plans.

- Analysis sheds new light on housebuilding shortfall.

Key takeaway 1: Property prices rise again and stabilise regionally

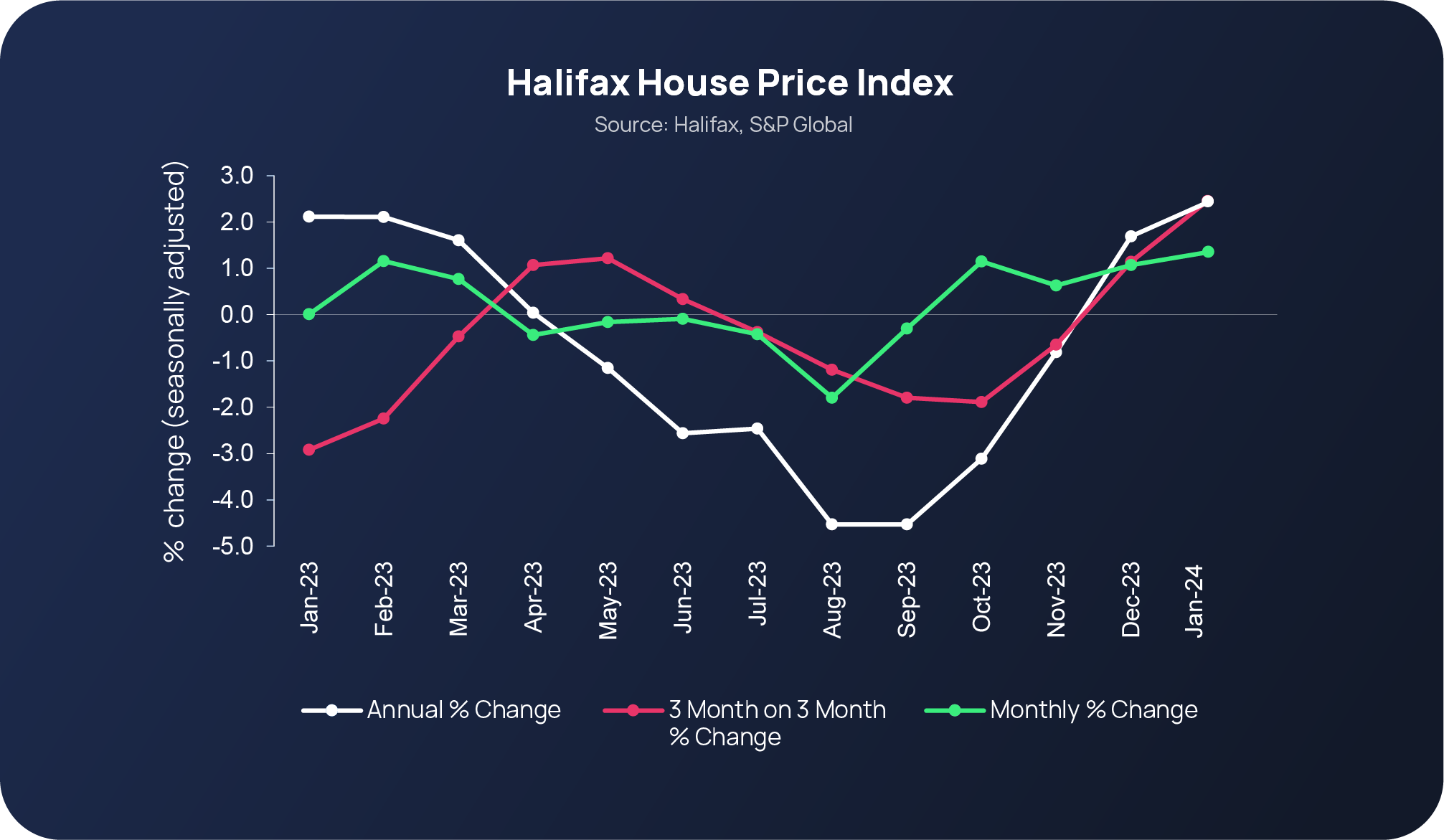

House prices across the UK continued to creep up during January, putting the average cost at £291,029. The rise equates to a 1.3% (£3,785) increase compared to the previous month’s figures (Halifax House Price Index).

The latest increase means property prices have now risen for four months-in-a-row, resulting in a +2.5% quarterly and annual change. The trend has been attributed to a number of factors, including reduced mortgage rates being passed on by increasingly competitive lenders and easing inflationary pressures. Collectively, these factors reinforce the positive start many industry sources have been reporting since the beginning of the year.

This positive sentiment is also reflected in RICS’ UK Residential Market Survey for January, which opens with the prediction that ‘Sales volumes are expected to recover further over the coming months.’ The latest survey findings also reveal that new buyer enquiries surged from -3% to +7% in January – the most positive reading since February 2022. Meanwhile, the agreed sales indicator also rose, from -5% to +5%, with new instructions currently standing at +11% after being stuck in negative territory since March 2021.

From a regional perspective, London reported more stable prices in January, with a similar situation also being seen in Scotland and the North West of England. According to Knight Frank’s UK House Price Forecast for January, the current momentum could continue until the general election takes place. Pre-election giveaways in the March Budget are also predicted to potentially boost market activity.

Key takeaway 2: Housebuilding decline continues

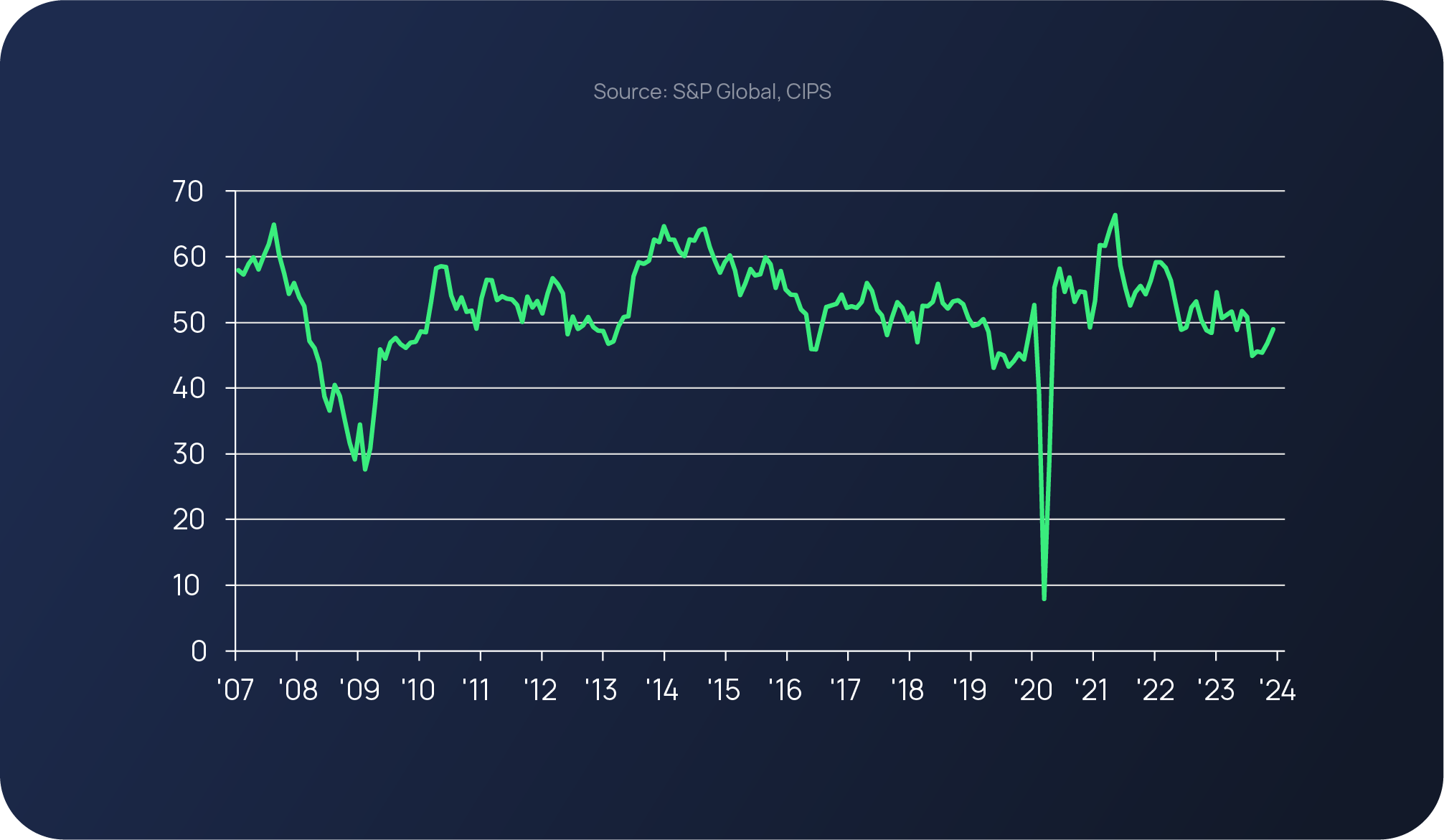

While house prices and demand for properties has risen, S&P Global’s UK Construction Purchasing Managers’ Index paints a contrasting picture, particularly in relation to the sector’s housebuilding activity. Housebuilding continued to fall sharply at the start of 2024, with survey respondents pointing a finger at subdued demand and a lack of work to replace completed projects.

Again, subdued market conditions in relation to housebuilding, as well as decision-making delays were cited as being the main factors behind the slowdown. However, the Monetary Policy Committee reports that existing large infrastructure projects remain stable and contacts are ‘less gloomy’ than six months ago. Despite this, the MPC remains cautious about the future outlook and expects the secondary housing market to remain flat this year; an improvement compared to last quarter.

Key takeaway 3: UK economy shows ‘distinct signs of recovery’

Meanwhile, the annual consumer price inflation rate remained unchanged at 4% in January, with core inflation also remaining at 5.1%. The latest CPI figures from the Office for National Statistics came as a surprise to some economists, who had predicted an increase up to 4.2%. With high monthly increases in February (1.1%), March (0.8%) and April (1.2%) 2023, the annual measure of consumer price inflation will fall quickly over the coming months, and likely hit the Government’s 2% target, paving the way for the Bank of England to start cutting borrowing costs from their 16-year high.

Services inflation, which is seen as a measure of domestic inflationary pressure, rose slightly from 6.4% in December to 6.5% in January. Both measures were recorded as being at 31-year highs in spring 2023.

In recent news reports, the Bank of England’s governor, Andrew Bailey, said Britain is showing ‘distinct signs of recovery’ from its mild recession and will be boosted when interest rates start to drop over the coming months. He also stated that the annual inflation rate is expected to temporarily reach the 2% target, but is also likely to bounce back to c.2.75% before the year is out.

The Bank’s latest inflation forecast is based on the predicted path of interest rates within the financial markets, which assume the first cut in borrowing costs to take place in June or August this year. This prediction has somewhat been reinforced by Goldman Sachs, who believe there will be five consecutive 25 basis point interest rate cuts this year, starting in June.

Key takeaway 4: Brownfield land redevelopment accelerated by Government plans

The building of homes on brownfield land looks set to be accelerated by new planning rules that have been proposed by the Government in a bid to boost housebuilding and protect the Green Belt.

As part of its long-term plan for housing, the Government announced earlier this month (February) that every council in the UK will be told it will need to prioritise brownfield projects and take more of a flexible approach to applying policies that put a stop to brownfield land developments.

Under the new rules, planning authorities in the UK’s 20 largest towns and cities will be made to follow a ‘brownfield presumption’, if housebuilding drops below expected levels. It is anticipated that this approach will make it easier to obtain permission to build on previously-developed brownfield sites, helping more young families find a home.

The proposed planning rules are currently being consulted on until March 26, with the Government reportedly setting its sights on changing national planning policy as soon as possible.

Key takeaway 5: Analysis sheds new light on housebuilding shortfall

Analysis published by the Financial Times has revealed that ‘England needs half a million new homes a year to keep pace with the country’s rising population.’

According to the insight, based on migration projections for 2023 to 2036, 421,000 new homes are needed annually during the 13-year period. And if current net migration levels hold, the number could rise to 529,000.

Analysts reported that an unexpected increase in migration to the UK in recent years had substantially increased the number of houses needed to meet demand. The backlog of unbuilt homes has also been highlighted as a key factor – delivery peaked at 248,591 homes in 2019 before falling to 234,400 last year.

Latest ONS data corroborates the supply concerns with data on private housebuilding output in England. The latest 12-month period reported (to end September 2023) shows housing completions down 8% year-on-year, but despite the lagged reporting date, housing starts, which is still a lead indicator of completions, was down 11%. Stepping back even further, planning approvals were down 18% by number of units. Supply issues will persist for the foreseeable, especially in the context of the demand analysis.

The analysis was based on methodology from a 2018 report by Heriot-Watt University, commissioned by the National Housing Federation and homelessness charity, Crisis, and updated with latest ONS population data and net migration projections from Oxford University’s Migration Observatory.

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team

We are a leading specialist property development finance business and have funded £840m worth of property projects to date

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply – our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding

As featured in...