Borrow

Case Study

Podcasts

Awards

About

Now that the Christmas period has come to an end, the UK is experiencing record numbers of COVID-19 infections. Boris Johnson’s statement to impose no further restrictions has placed many questions on how 2022 is going to pan out. In this latest roundup, we look at the latest commentary on activity over the past month and predictions for the outlook of the UK going into 2022.

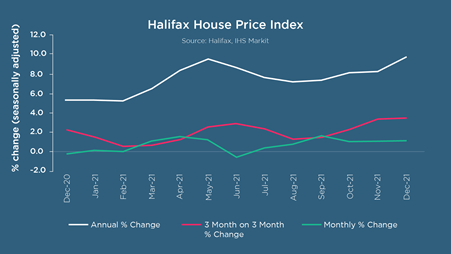

Despite the many constraints in place throughout 2021, housing prices reached record highs on more than eight occasions and last month was no exception. The most recent figures from Halifax reveal that housing prices have climbed yet again for the sixth consecutive month in a row. The average house price is now at £276,091 which, when compared to December 2020, is an increase of more than £24,500 - the strongest year on year rise since March 2003. Wales remains the strongest performing region in the UK with an annual price increase of 14.5%, meaning the average house price in the region is £205,579. Northern Ireland also experienced significant growth with an annual increase of 10.6% and average prices now at £170,946.

The quantity of housing stock has been a sustained issue throughout 2021, with Rightmove reporting that the number of properties coming to market had slumped in December - although it was noted that this is an expected trend for this season. Tim Bannister commented that “while the 2022 property market will continue to be busy, we forecast it to be less frenzied than 2021, especially as more owners decide to come to the market in the first half of the year.”

Already Rightmove has noted a 19% increase in the number of people requesting home valuations, compared to the same period last year. It is therefore expected that more homes will come to the market for buyers to choose from, stabilising the market to “bring fresh opportunities”.

2022 is looking to be “a normal though still busy market” - Halifax predicts that house prices will likely maintain their high levels but growth will be at a slower pace in comparison to that of the previous two years. Similarly, Rightmove has predicted that price growth will increase by a further 5% on account of the number of people that are still trying to move home which is likely to create imbalance and again drive up prices.

As people continue to seek homes with more space and in rural areas, the most popular regions for buyers are Scotland, the West Midlands, the South West and Yorkshire and the Humber. Rightmove predicts that these areas will see a higher rate of 7% price growth this year. The more urban areas such as London are only expected to see a 3% price growth increase which is due to the varying ‘hotspots’ throughout the capital.

The lack of spending opportunities throughout 2021 meant home buyers were able to boost household cash reserves. This is likely to come under threat over the coming year as the pressure increases around price of energy and rising interest rates in an attempt to tackle inflation. Conversely, Tim Bannister added that “whilst a rise is often regarded as unhelpful to the market, a slowing of the fast pace of sales, and associated pace of price rises, will help the return to more normality that will suit many movers.”

Unsurprisingly the rise in cases of the new Omicron variant means that economic activity has slumped. Record numbers of Covid cases and those in isolation caused a deterioration in the usual intense consumer activity that is seen around the Christmas period. This has led to the services sector in particular feeling the blow in the past month. With this being the most dominant sector in the economy, it has had significant impact with EY ITEM Club stating that December has set growth up for a weaker starting point for 2022. There is concern from economists that a sustained hit would lead to a fall in GDP in the first few months of 2022. The OECD predicts that the Omicron variant will cause the economy to slow from 6.9% in 2021 to 4.7% in 2022.

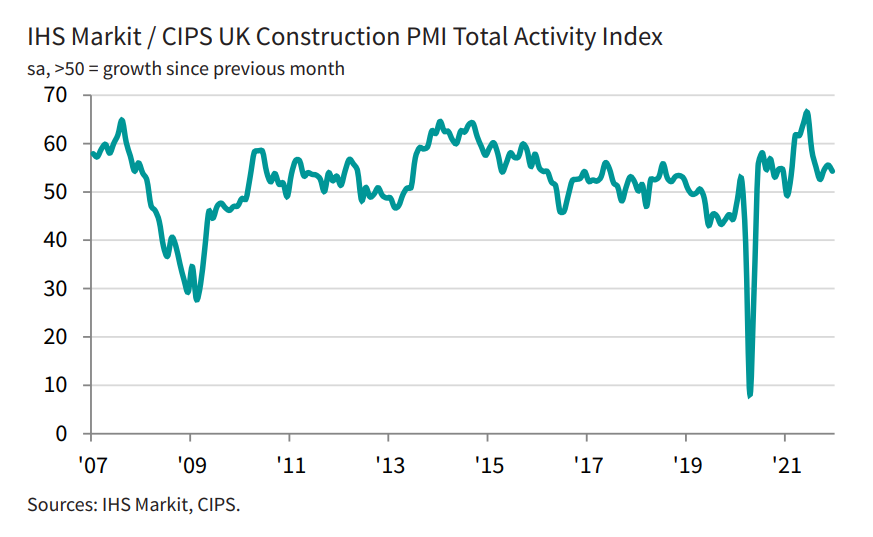

Both the construction and manufacturing sector have stood up well against the threats that Omicron has posed. December’s construction PMI fell to a 3 month low - now the seasonally adjusted IHS Markit/CIPS UK Construction PMI® Total Activity Index is at 54.3, which is crucially still firmly within the growth territory. Residential construction activity saw the strongest growth (index at 55.3) and was the only category to gain momentum in December, having performed well every month since June 2020.

IHS Markit’s latest survey reported that companies maintained a positive outlook at the end of 2021, with 63% predicting that production will increase over the next 12 months. This optimism is a reflection of the expectation that global economic growth will be renewed and a hope of less disruption caused by COVID-19, Brexit and supply chain issues. However, Martin Beck, Chief Economic Advisor to the EY ITEM Club, stated that the threat that Omicron poses means that there is uncertainty around what global restrictions will be put into place, which is likely to slow the rate at which the supply chain pressure is relieved.

Furthermore, purchasing by supply chain managers was at a 4-month high to keep up with demand and to mitigate against the persistent issues recently experienced in the supply chain. On a positive note, EY ITEM Club do expect that the manufacturing bottleneck will ease during the second half of 2022. A strong pipeline of new work has meant that employment levels have been driven up yet again in order to keep up with demand. This, coupled with the resumption of many projects, is likely to set manufacturers up for a decent 2022.

Whilst the market remains optimistic, there are still some factors to consider which could decide the success of the housing and construction sector: there are concerns around how the pandemic will play out and what the economic response to this will be in terms of imposing further restrictions; furthermore, how people respond to the issues surrounding supply of materials going into 2022 will impact activity in the construction sector. That’s where property finance by property peoples makes so much sense – at CrowdProperty we work closely and productively with the developers we back, tackling market, site and situational challenges together in partnership. Having been developers ourselves, we are laser-focused on solving the pains of small and medium sized developers, which is why working with CrowdProperty increases the likelihood of success of projects.

CrowdProperty is a leading specialist development finance lender having funded £370m worth of property projects. Apply in just 5 minutes at www.crowdproperty.com/apply and our passionate property experts will share their insights and our offer of funding for your project within 24 hours.

As featured in...