Borrow

Case Study

Podcasts

Awards

About

Article 13 in a series of 40 articles on P2P, property and CrowdProperty

The last article explained the application process for borrowers. Below, we analyse the importance of first-charge security for lenders, and next we explain why expertise in this business is so vital.

The first question to ask when making a loan is, what’s my security?

Those guys who email you from the departure lounge in the airport promising you $10m in exchange for your bank details and a paltry few thousand to get their friend the crown prince of somewhere-ville’s funds out of the country? We’ll take a wild guess and say the security on that deal isn’t great.

CrowdProperty is at the other end of the scale. Indeed, we’re on another scale entirely. All our loans are secured. This is important as such security provides a legally-binding assurance that in the event of a default on the loan contract, the property could be sold or refinanced to repay lenders.

First in line

However, it’s important to understand that all security is not created equal, which is why we insist that we take out first charge security against all our loans. First charge is the equivalent of the rights the mortgage company has over a home: if you are unable to service the loan, the keys go to the mortgage lender, and the house is their’s to dispose of as they choose in order to recoup their loan.

In more precise terms, the first charge holder is listed on the Land Registry as the primary senior debt holder against that asset, and are entitled to exercise their legal right to repossess the asset to protect the interests of that first charged secured loan.

If a loan does go into default, first charge means that we can step in and take control of the asset and anything else we have to ensure that our lenders get their money back. Our loans are at the very top of the capital structure, which means we are first in line to get our money back. The first charge holder can not only recover the capital, but also the interest owed, plus the recovery fees. Those with second charge loans will get what (if anything) is left, and equity holders… well, good luck equity holders.

In practice

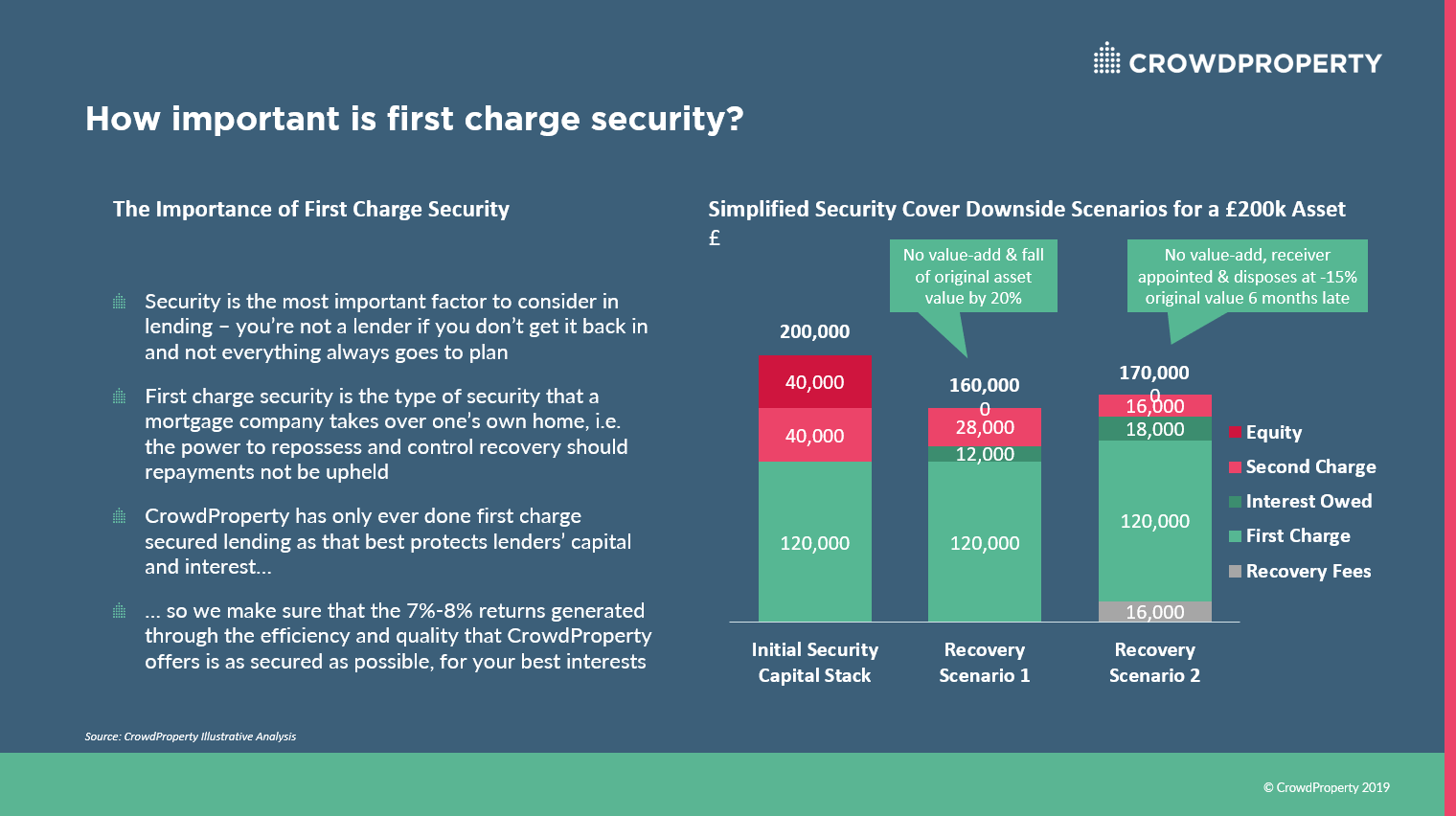

At this point, it’s worth looking at what these different layers in the capital stack mean in practice, and what each is likely to get back in some downside scenarios (as first and foremost you should protect your capital). In simplest terms, if the value of an asset is say £200k and the senior, first charge secured debt tranche is £120k, then the realisable value of that asset could fall 40%, or £80,000, and the capital be recovered. Second charge and equity tranches, which are clearly junior to the senior debt in terms of capital priority and control, would be wiped out entirely. But lending, especially to property development projects, is more complex than that. There’s the initial asset value, accruing interest, an end project value and progress against that end project value, amongst many other operational factors, to consider.

Let’s look at the two bearish scenarios shown on the right-hand side of the image below.

In scenario 1 (the second bar in the bar chart), it is assumed that no value is added on site due to inactivity, 1 year of interest accrues and the realisable asset value falls by 20% (the national average fall in 2008). If the asset is then sold to pay back the capital stack, the senior debt and interest can be repaid leaving only 70% of the second charge capital and entire equity portion is wiped out.

In scenario 2 (the third bar in the bar chart), it is again assumed that no value is added on site due to inactivity, after 1 year the site is repossessed (incurring insolvency fees), a further 6 months is taken to dispose of the site and the realisable asset value is 15% lower than the original value. After recovery fees, the entire recovery of the senior loan capital and entire recovery of senior loan interest owed, just 40% of the second charge capital is recovered and again the entire equity portion is wiped out.

In downside scenarios, equity capital is the most volatile but it must also be remembered that even second charge security is not only junior to the capital repayment part of the first charge holder’s claim, but also to the interest accrued on the first charge tranche and the cost of recovery. In other words, in the event of default, second charge loans become equity-like in terms of any claim on assets. First-charge security is critical, not only for capital recovery but also for control of the recovery process. If you’re looking at second charge lending, does the return really represent the significantly higher risk?

Strong security is of even greater importance at the moment, with investors becoming more jittery about economic prospects. Trends – whether geopolitical (trade wars, Brexit) or economic (growth, yield curve, PMI index – you name it) – are looking uniformly less certain, and now more than ever, you want to know that you’re investing your money on more than just a promise or even junior security. We ensure that the security we take is a lot more than a promise and is backed up with a solid legal claim on some very solid assets, with the control of the recovery handled on your behalf by the experts.

But it is also important to understand that peer-to-peer lending, no matter how secured, is not risk-free. It is an investment activity, capital is at risk and peer-to-peer lending is not covered by the Financial Service Compensation Scheme. Also, past performance, whilst useful to know the output of the business systems and processes to date, is not an indicator of future results.

We are very particular about who we lend to, so such interventions are very rare. Indeed, since CrowdProperty started in 2013, we’ve only had to step in once to take control of an asset. But the relevant point here is that lenders’ capital and interest were recovered in full when we intervened, so we have demonstrated that we know exactly what to do and that being on the first charge side is critical to protect your downside. While it’s something we don’t want to call on often, if ever, like a seatbelt and airbag in a car, it’s reassuring to know it’s there and that it works.

Learn how the CrowdProperty Shield safeguards your funds: www.crowdproperty.com/lenders#theShield

View our statistics page: www.crowdproperty.com/statistics

Read more about how investing works and investment options at www.crowdproperty.com/lenders

As featured in...