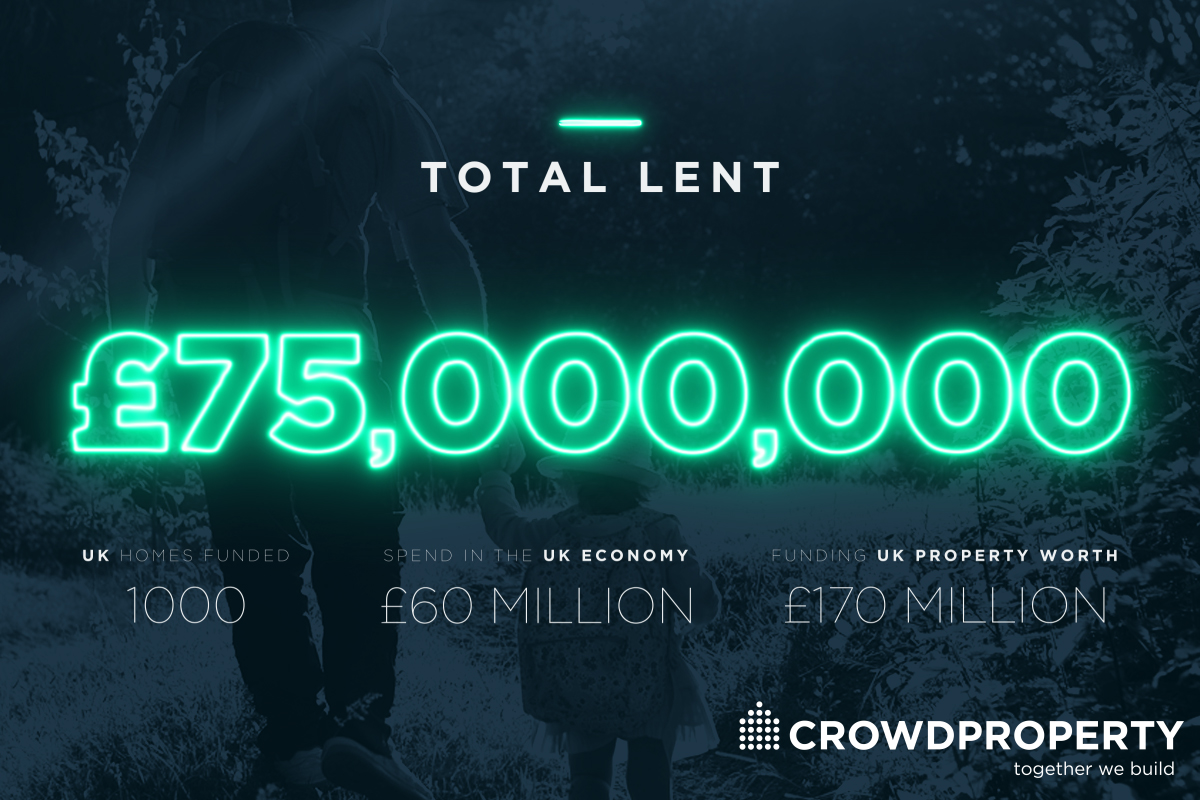

Leading specialist property peer-to-peer lender CrowdProperty (www.crowdproperty.com) is proud to announce that the business has now lent over £75,000,000 to SME property professionals, following exceptional performance throughout Covid-19 lockdown, with CrowdProperty ranked 8th in Europe for lending volumes across all P2P lending sectors in May (https://www.p2p-banking.com/).

CrowdProperty has now funded the development of 1,000 homes worth almost £170,000,000, enabling over £60m of spend on labour, materials and services in the UK economy. CrowdProperty has a 100% capital and interest payback track record through 6 years of lending.

As the Covid-19 situation eases, there is no doubt that a key part of economic recovery will be to build, in terms of both infrastructure and chronically under-supplied housing as this drives spend on materials, labour and services throughout the building and construction ecosystem. Throughout the past few difficult months, CrowdProperty has been open for business, helping developers navigate the situation and continuing to fund quality projects being undertaken by quality property professionals quickly and reliably, maintaining the single-minded focus of expertly curating lending opportunities with first charge security at modest Loan-to-Value levels serving domestic under-supplied demand in liquid markets at mainstream, affordable price points where there is enduring demand, funded by diverse sources of capital.

The business is seeing record levels of direct applications for funding, including from those who have had funding offers reneged upon by other lenders who have just stopped lending and even receiving applications from projects where drawdowns have been refused by other lenders due to their lending constraints rather than project issues. Furthermore, the proactive property professionals, who are staring down the barrel of onerous (and often devious) penalty rates, fees and hidden fees due to experiencing delays on site or in exiting through sale or refinance, are coming to CrowdProperty for our ‘Development Exit’ and ‘Development Finish & Exit’ products to give themselves time to exit without excessive costs.

CrowdProperty’s ‘Development Exit’ and ‘Development Finish & Exit’ products are designed to help developers to bridge the period between finishing (or almost finishing) and exiting a development project, releasing the commitments of an expiring development finance loan and providing breathing space to achieve the most successful exit for their project (whether a sale or a refinance onto term finance). This takes the stress of recourse from the existing facility away, and with CrowdProperty, developers are able to pay back early at no cost – meaning that CrowdProperty can grant property professionals a facility that provides plenty of breathing space, enabling them to focus on the project. As one of the only lenders lending through the Covid-19 lockdown, we’re best placed to help these situations.

Mike Bristow, CEO of CrowdProperty, commented: “More than ever, property professionals need a reliable, knowledgeable, responsive and speedy source of capital that behaves and acts like a long-term funding partner, which is exactly how CrowdProperty is positioned. We’re a true, long-term funding partner and become a valued part of the developer’s team, adding value throughout their projects as a lender who really understands developers' needs – our customer-focused property finance by property people positioning and disintermediating model is truly game-changing and helps property professionals grow their property businesses quicker.

CrowdProperty’s last 18 projects have been funded in 41 seconds on average, due to the 100% capital and interest payback track record and trusted brand we have built over 6 years of quality lending supported by deep property expertise, rigorous due diligence, first charge security, best-in-class operating practices and market-leading transparency. We have a strong pipeline of projects ahead, all meeting our specialist property team’s exacting standards, which have only ever tightened through 6 years of lending. We see billions of pounds of applications and very carefully select the best to fund as a lender of first resort.

These milestones validate the power of the CrowdProperty solution in solving the fundamental pains evident in the sector for both lenders and borrowers, as well as the wider UK housing market and UK economy. Property professionals come to CrowdProperty not because it’s a peer-to-peer lender but because we’ve built the best property project lending business in the market to serve their needs best as expert property people offering property finance. The business is underpinned by powerful, purpose-built, in-house developed technology for speed and efficiency as well as deep expertise for effectiveness, becoming the lender of first resort for quality property projects being undertaken by quality property professionals.”