Borrow

Case Study

Podcasts

Awards

About

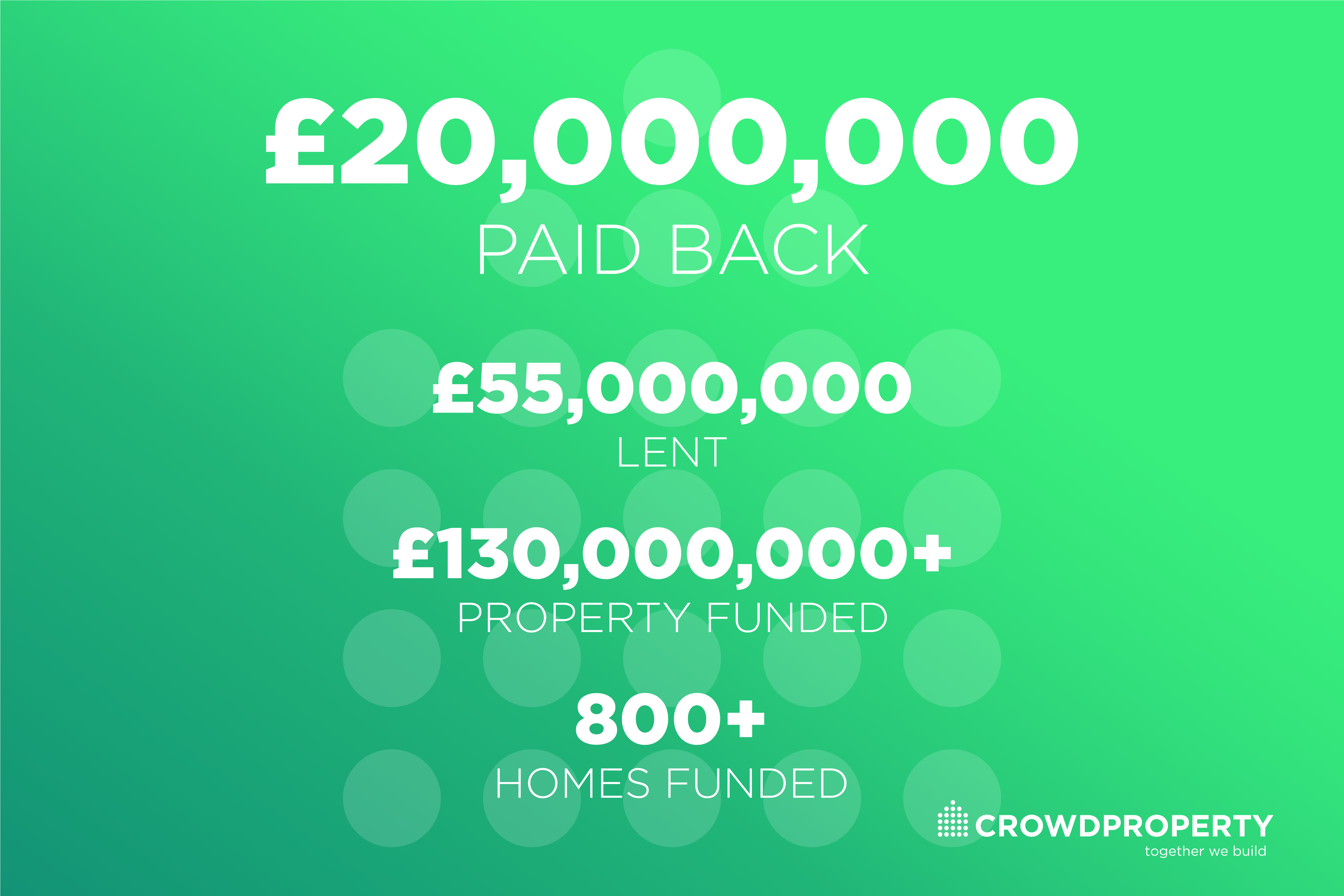

CrowdProperty passes £20,000,000 paid back, maintaining 100% capital and interest payback track record through over 5 years of lending

This news comes shortly after the announcement of passing the £50,000,000 lent landmark (now £55,000,000), with the business having funded the development of over £130,000,000 of property and 800 homes, unlocking much-needed housing supply and spend in the economy through enabling SME property professionals to deliver quality property projects. CrowdProperty has enabled over £40m of spend on labour, materials and services in the UK economy.

Mike Bristow, CEO of CrowdProperty, commented: “Recent milestones validate not only the power of the CrowdProperty solution in solving the fundamental pains evident in the sector for lenders and borrowers and the wider UK housing market / economy, but also crucially validate the efficacy of the CrowdProperty business. Our absolute focus on the fundamentals, articulated as the CrowdProperty Shield, of rigorous due diligence, first charge security and unparalleled, hands-on expertise in exactly the asset class we are lending against is now proven through over 5 years of lending and at an increasingly meaningful scale to materially contribute to the economy.

“The business is underpinned by in-house built technology for speed/efficiency and crucially deep expertise for effectiveness, becoming the lender of first resort for quality property projects being undertaken by quality property professionals, all meeting our specialist property team’s exacting standards, which have only ever tightened, from £2bn of funding applications per year.

“As peer-to-peer lending enters the next phase of maturity, the coming of age for the sector, greater regulation will unlock far greater potential for the best-in-class players commensurate to the proven value that can be delivered for all.”

As featured in...