Borrow

Case Study

Podcasts

Awards

About

An overview of the latest key property market updates and insights for small and medium-sized property developers.

Key takeaways at a glance:

- UK house prices and mortgage approvals reach two-year high.

- Housebuilding activity accelerates at fastest pace for two years.

- Further interest rate cut speculation continues.

- Property investors brace themselves for EPC pressures and rising costs.

- Interest rates won’t reduce mortgage costs much’ – Capital Economics.

Key takeaway 1: UK house prices and mortgage approvals reach two-year high

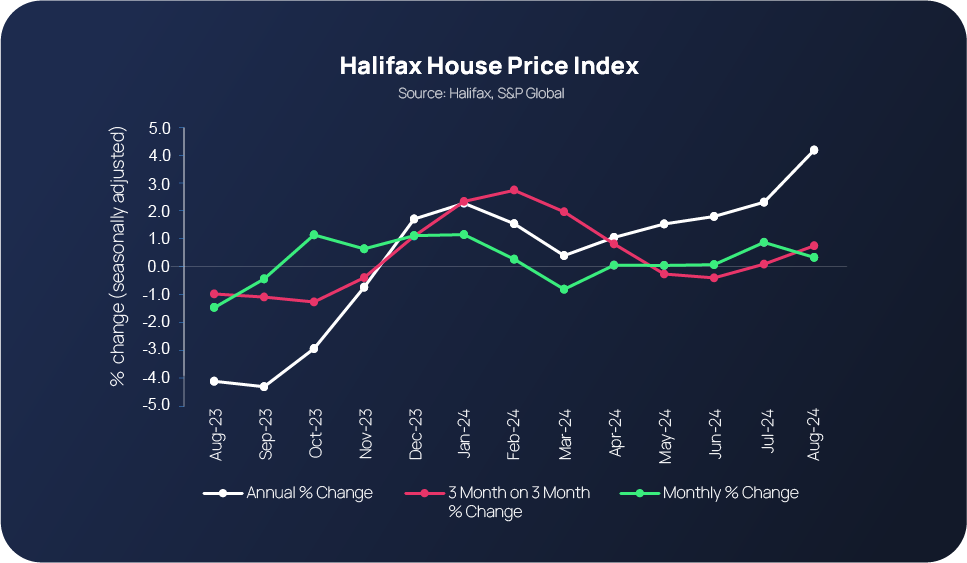

House prices across the country have continued to steadily increase, so much so, they reached a two-year high in August, generating widespread reports about how the UK housing market is at its strongest. This now means that the average property in the UK costs £292,505. Percentage increase-wise, this equates to a +0.3% monthly, +0.8% quarterly and a +4.3% annual change (the strongest rate since November 2022).

Halifax says that the summer has been largely positive for the UK housing market, which is also on track for an awesome autumn, with the recent interest rate giving prospective buyers a real confidence boost. According to Zoopla, two-bedroom terraced houses are the fastest-selling homes in the UK – six in ten sell within 30 days.

The housing market’s summer high doesn’t just apply to house prices either, mortgage approval figures are currently at their highest level in two years too. The Bank of England recorded 62,000 approvals for house purchases in July, the highest total since the 65,100 recorded in September 2022 and up from 60,600 in June. Meanwhile, approvals for remortgaging fell to 25,100 in July, from 27,300 over the same period.

Key takeaway 2: Housebuilding activity accelerates at fastest pace for two years

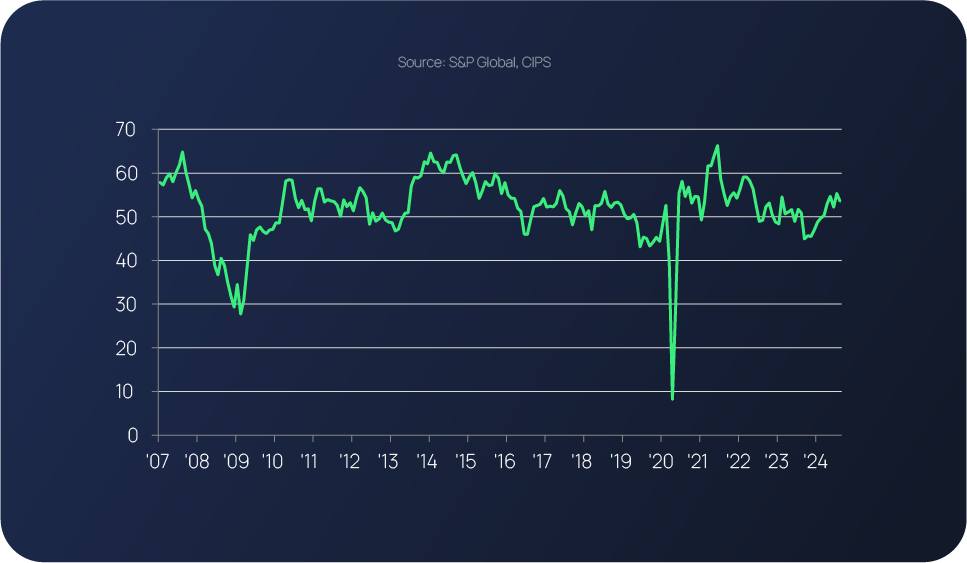

House prices and mortgage approvals aren’t the only areas to have experienced two-year uplifts; housebuilding activity has risen at its quickest pace since November 2022. This is one of the main headlines from the latest S&P Global UK Construction PMI report, which also leads with there being a robust upturn in total new orders and upbeat sector-wide optimism.

The PMI sat at 53.6 in August, which may have been lower than July's 26-month high of 55.3, but still signals a solid expansion of overall construction output. According to S&P Global Market Intelligence Economics Director, Tim Moore: “The UK construction sector appears to have turned a corner after a difficult start to 2024, with renewed vigour in the house building segment the most notable development in August. Residential work expanded at the fastest pace for almost two years as lower borrowing costs and a gradual recovery in market conditions helped to boost activity.”

But while residential activity may have been strong, it was actually commercial outputs that excelled in August (index at 53.7). Numerous companies reported a boost from rising sales enquiries and the release of new orders following the General Election.

Key takeaway 3: Interest rate cut speculation continues

The MPC cut the Base Rate to 5% at its meeting last month (August 1), putting an end to months of widespread discussion and debate.

The committee is due to meet again on September 19 when it is anticipated that interest rates will be held at 5%. The meeting is also expected to set the scene for future quantitative tightening, making it yet another highly anticipated and pivotal MPC meeting for a number of reasons.

As for if and when there are going to be any further interest rate cuts before the year is out, this is a matter that the MPC was careful not to divulge too much about during its last meeting. But since that meeting, speculation has mounted, with several industry commentators saying there is most likely going to be another reduction in November, however there will inevitably be many property sector eyes on the September decision which will be announced at midday on Thursday 19th September.

Key takeaway 4: Property investors brace themselves for EPC pressures and rising costs

Landlords will need to make sure their rental properties have a minimum Energy Performance Certificate (EPC) rating of C by 2030. The new requirement is part of the government’s Warm Homes Plan, which was originally outlined within its election manifesto.

The news has reportedly been met with concern by UK property investors, with recent survey findings revealing that 76% of UK property investors are worried about escalating costs due to inflation, while 71% are concerned about the impact of rising energy prices.

Almost two-thirds of all BTL properties in the UK currently have an EPC rating of D or below. Failure to comply with the new standards could result in severe restrictions, including the potential for properties to be classed as ‘unrentable’ and landlords facing hefty fines.

Read the full story: https://www.propertyreporter.co.uk/uk-property-investors-braced-for-rising-costs-and-new-epc-rules.html

Key takeaway 5: ‘Interest rates won’t reduce mortgage costs much’ – Capital Economics

This outlook, which has been shared by Andrew Wishart, Senior UK economist at Capital Economics,

is based upon the fact the shift to fixed-rate mortgages (typically five-year deals) in recent years has resulted in Bank Rate increases taking considerably longer to raise households’ mortgage interest costs.

The share of borrowers on floating mortgage rates, which adjust in line with the Bank Rate, has dropped from 70% in 2012 to just 12%. As a result, 40% of borrowers are still on low fixed rates secured before the Bank of England started raising interest rates in December 2021.

Capital Economics estimates that the change in the structure of mortgage debt over the last eight years has more than halved the increase in mortgage interest costs compared to what would have occurred under the previous structure.

Read the full story: https://www.capitaleconomics.com/publications/uk-housing-market-focus/interest-rate-cuts-wont-reduce-mortgage-costs-much

Renewed market commentary about a mortgage price war and the competitive rates now on offer, partly fuelled by funders’ desires to put dry powder capital to work and significant falls to near 2-year lows in the market cost of longer-term money (SONIA swaps currently standing at 3.74% for 2 years and 3.39% for 5), also suggests that expected base rate cuts are already priced into the cost of finance for buyers, contributing to the evident upswing in buyer demand.

Mike Bristow, CEO of CrowdProperty, comments:

“As our latest report illustrates, the current dynamics of the UK property sector offer both opportunities and challenges.

“The consistent rise in house prices and mortgage approvals, reaching a two-year high, signals strong consumer confidence, which is promising for small and medium-sized developers. This momentum, paired with increased housebuilding activity, offers a significant opportunity to capitalise on renewed market enthusiasm.

“However, some pressures, including the new EPC regulations, will demand that developers remain agile, leveraging the current market upswing while preparing for regulatory and financial shifts.

“With so many years of property experience within CrowdProperty, spanning several decades and market cycles, we’re well placed to offer the support and guidance that SME developers need to achieve continued profitability in the short and long term.”

//

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team

We are a leading specialist property development finance business and have funded £871m worth of property projects to date.

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply and get an instant Decision in Principle. Within 30 minutes, our property experts will share their insights and initial funding terms, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding

As featured in...