Borrow

Case Study

Podcasts

Awards

About

An overview of the latest key property market updates and insights for small and medium-sized property developers.

Key takeaways at a glance:

- House prices rise for the third month in a row.

- Inflation drops below 2% target.

- Construction activity continues to ramp up.

- Bank Rate remains at 5%.

- New Wildlife Trusts report champions nature-first housebuilding.

- ‘A tight grip on public finances is necessary on 30th October.

Key takeaway 1: House prices rise for the third month in a row.

According to Halifax’s latest House Price Index, UK house prices rose by 0.3% in September; equalling the increase that was reported in August. From a quarterly perspective, prices have moved up by 1.2%, which represents an annual increase of 4.7% - the strongest rate since November 2022.

The latest activity puts the average UK house price at £293,399 (compared to £292,540 in August) - the highest cost since June 2022. Meanwhile, the average amount paid by first-time buyers currently stands at around £1,000 less than two years ago.

Halifax has emphasised the importance of viewing the figures in context – the market is continuing to recover while strong wage growth and falling interest rates have boosted buyer confidence.

“While improved mortgage affordability should continue to support buyer activity – boosted by anticipated further cuts to interest rates – housing costs remain a challenge for many. As a result, we expect property price growth over the rest of this year and into next to remain modest,” says Amanda Bryden, Halifax’s Head of Mortgages.

As for mortgage rates – they are expected to rise over the next few days leading up to Chancellor, Rachel Reeves’, first Budget on 30th October. Currently at their lowest level in 15 months, mortgage rates have contributed to a rebound in sales activity across the UK, with new sales agreed being 25% higher than a year ago.

Key takeaway 2: Inflation drops below 2% target

Inflation dropped further than anticipated last month (September), falling below the 2% target for the first time since April 2021. Latest figures published by the Office for National Statistics (ONS) show that the Consumer Prices Index went from 2.2% in August to 1.7% in September, despite widespread predictions the fall would be more around the 1.9% mark.

Lower air fares and petrol prices were the two main contributors to the reduction, which was slightly offset by increases in food and non-alcoholic drinks. At the same time, services inflation eased more rapidly than expected, dropping to 4.9% from 5.6%. Economists had anticipated services inflation to fall to 5.2%.

The latest set of inflation figures were revealed hot on the heels of the ONS also confirming that UK wage growth had eased to 4.9% in the three months to July – the lowest level for more than two years. (See Key Takeaway 4 for further details).

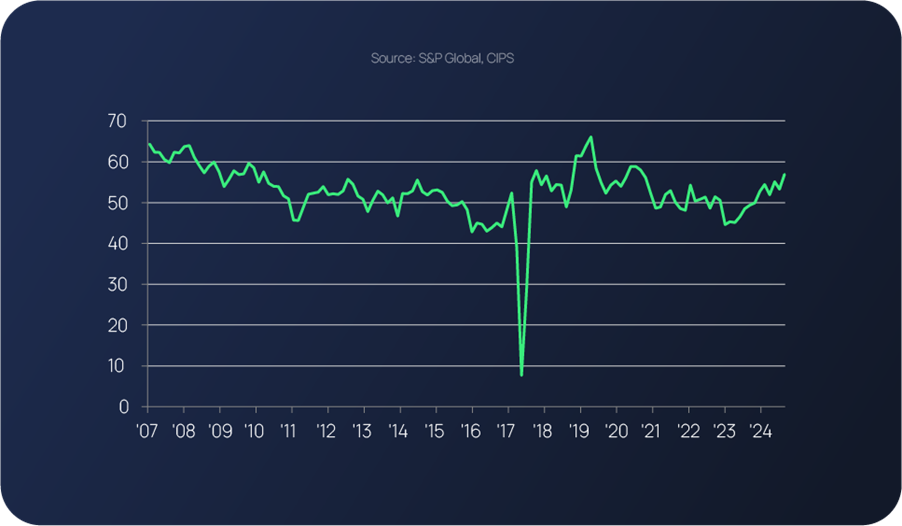

Key takeaway 3: Construction activity continues to ramp up

The most recent S&P Global UK Construction PMI update leads with the headline: ‘Fastest upturn in construction output since April 2022’, with other key soundbites from the October 4 update including:

Faster rates of output growth were reported in all three sub-sectors that were monitored by the survey in September. Civil engineering (index at 59.0) was the best-performing category. Robust demand for a renewable energy infrastructure and a general uplift in major project work was also highlighted.

New orders growing at the strongest pace for two-and-a-half years

Higher workloads generated additional staff recruitment, despite some firms reporting that cost pressures had led to a delay in the replacement of voluntary departures. Overall construction employment levels have increased during four out of the five past months.

Cost pressures intensifying in September

Demand for construction products and materials solidly increased. The latest expansion of input buying was one of the fastest seen since early-2022. Suppliers' delivery times nonetheless shortened again in September, fuelled by rising stocks among vendors. Concerns relating to future steel prices and supply conditions due to the recent closures of domestic blast furnaces were flagged by suppliers.

Key takeaway 4: Bank Rate remains at 5%

The Monetary Policy Committee voted (by a majority of 8-1) for interest rates to stay put at 5% at its last meeting, which took place on 18th September. Interest rates have been described by the Bank of England Governor, Andrew Bailey, as ‘now gradually being on the path down’ however, further evidence of inflation remaining low will be required before rates are cut again.

As for when another rate reduction will happen, it’s a question that continues to attract widespread speculation. Recent reports of wage growth slowing to its lowest pace for more than two years has been mooted as a possible trigger for the Bank Rate being reduced by the MPC to 4.75% on 7th November.

But before 7th November comes, Rachel Reeves will, of course, announce her first Budget on 30th October. The Government plans to reportedly change its fiscal rules in an effort to unlock up to £50billion in additional borrowing. However, it’s a move that could potentially increase interest rates by as much as 1.25%, according to analysis published by the Treasury. Speculation on the Budget’s substance is widespread, although markets will appreciate that context becoming clear, swiftly followed by November’s MPC meeting, and a clearer macro environment ahead.

Key takeaway 5: New Wildlife Trusts report champions nature-first housebuilding

A new report published by The Wildlife Trusts has called for the government to put nature recovery first in a bid to nature-proof UK housebuilding.

Swift and Wild: How to Build Houses and Restore Nature Together explores how planning reforms can help address challenges of climate change, nature loss, housing and public health, but only by placing nature recovery at the heart of new developments.

The report also highlights numerous approaches to development that can have positive impacts for nature, climate and communities, including community energy schemes, urban habitat creation, sustainable drainage systems, wildlife-friendly lighting and local food growing opportunities.

Read the full report: https://www.wildlifetrusts.org/sites/default/files/2024-10/24SEP_Planning_Report_HR-DIGITAL.pdf

Key takeaway 6: A tight grip on public finances is necessary on 30th October.

Economists at Capital Economics say a tight grip on public finances in the Budget later this month is needed given recent fiscal deterioration. This is among the key messages to have been shared within Capital Economics’ review of ‘The post-election UK economic landscape.’

The review also predicts that the Government will maintain existing plans for fiscal policy to be tightened, but with higher spending fully funded by higher taxes. The review also reveals expectations for interest rates to hit 3% in early 2026. Previous predictions anticipated the reduction to take full effect by the end of next year

Mike Bristow, CEO of CrowdProperty, comments:

“Our latest report reflects a resilient property sector, with house prices rising for the third consecutive month and inflation dropping below the Bank of England’s target. While improving mortgage affordability supports buyer confidence and transaction levels significantly above 2019 ‘norms’, affordability challenges remain.

“The increase in construction activity, particularly in renewable energy projects, underscores the sector’s adaptability and aligns with the recent Wildlife Trusts report advocating nature-first housebuilding—a vision we fully support at CrowdProperty. Sustainable development is crucial not only for environmental preservation but also for building resilient communities.

“As we approach the Budget, a balanced approach to fiscal policy is essential. Smaller developers require accessible funding to thrive and at CrowdProperty, we’re committed to delivering flexible financing solutions to support them through every stage of their projects.”

//

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team

We are a leading specialist property development finance business and have funded £880m worth of property projects to date.

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply and get an instant Decision in Principle. Within 30 minutes, our property experts will share their insights and initial funding terms, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding

As featured in...