Borrow

Case Study

Podcasts

Awards

About

An overview of the latest key property market updates and insights for small and medium-sized property developers.

Key takeaways at a glance:

- House prices reach record peak.

- Construction growth eases & optimism dips.

- Bank of England cuts interest rates to 4.75%.

- Gas boilers set to be banned in new builds.

- The long-term outlook Savills.

Key takeaway 1: House prices reach record peak

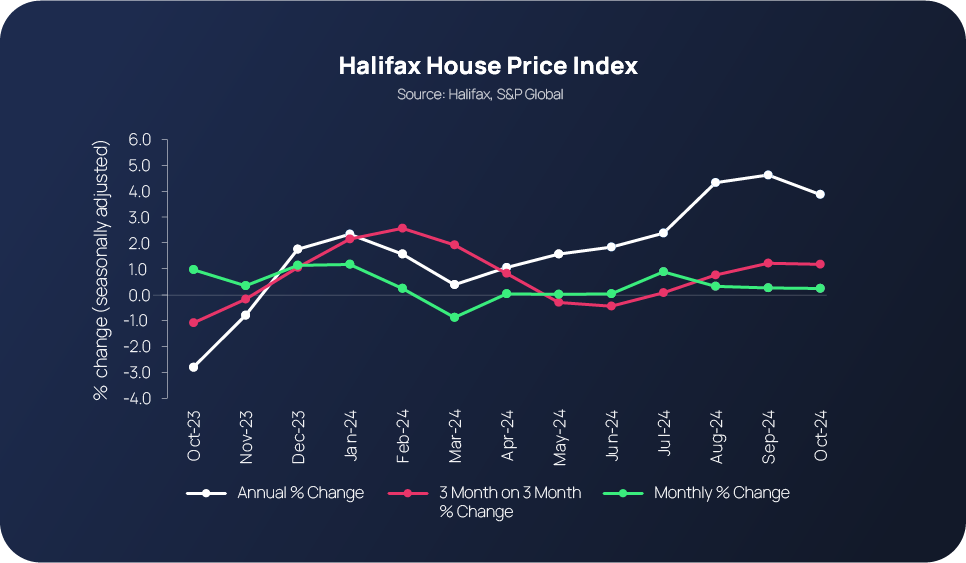

Average UK house prices are now at a record high, according to Halifax’s most recent House Price Index report. Prices increased by 0.3% in October; and for the fourth consecutive month in a row too.

This means homebuyers can now expect to pay £293,999 for a typical property in the UK, which is slightly higher than the last reported peak (in June 2022) of £293,507. From a year-on-year perspective, prices have gone up by 3.9%. However, the growth rate has actually eased from +4.6% in September due to strong monthly growth rates in 2023 (Oct 23 +1.2%) dropping out of the 12-month period, with this impact on the 12-month figure likely to continue in the coming months (Nov 23 +0.6%, Dec 23 +1.1% and Jan 24 +1.2%), reducing the year-on-year rate, irrespective of any current market growth, which is likely to be modestly positive.

Halifax’s Head of Mortgages, Amanda Bryden, says that the latest figures signal an end towards the ‘race for space’ that was experienced during the pandemic and, that despite the affordability factor being a key challenge, market activity is improving at a modest rate that is set to continue for the foreseeable.

“The number of new mortgages agreed recently reached its highest level in two years. This aligns with average mortgage rates dropping steadily since spring - now over 160 basis points lower than in summer 2023 – coupled with continued positive income growth,” she explains.

“Looking ahead, borrowing constraints remain a challenge for many buyers. Following the budget, markets expect the Bank of England to cut rates more slowly than previously anticipated, which could keep mortgage costs higher for longer. New policies, like higher stamp duty for second home buyers and a return to previous thresholds for first-time buyers, might also affect demand.”

RICS reports that house prices will continue to drift higher over the next three months; up to +20% from +12%. Virtually all parts of the UK are expected to see a rise in house prices in the year ahead.

From an agreed sales and new buyer enquiries perspective, the headline net balance for new buyer enquiries stood at +12% in October (slightly down from +13%). While an aggregate net balance of +9% respondents reported an increase in sales volumes over RICS’ latest survey period, up from +5% the previous last month - the third successive positive reading.

Key takeaway 2: Construction growth eases & optimism dips

While UK houses prices continue to steadily climb, it was a completely different picture for construction sector growth. The latest set of S&P Global UK Construction PMI figures show that output growth considerably slowed sector-wide after hitting a 29-month high in September.

The headline PMI registered 54.3 in October compared to 57.2 in September. However, it is also worth highlighting that the Index still remains above the 50.0 no-change threshold for the eighth month-running.

Civil engineering (56.2) was the best-performing area in October, with rising demand being reported across various energy infrastructure projects, particularly renewables. Commercial work (52.8) also increased during the same period however, the increase wasn’t as strong as it was between April and September.

As for housebuilding, it is the only area that reported an overall decline last month. Key observations include the fact that residential activity marginally reduced for the first time since June and that elevated borrowing costs and Autumn Budget-related uncertainties had negatively impacted demand.

In the meantime, total new work increased, and so too did additional staff recruitment, with the rate of job creation reaching a three-month high. Interestingly, this surge in staff recruitment was reported, despite industry professionals not being particularly optimistic about their growth prospects for the year ahead.

Key takeaway 3: Bank of England cuts interest rates to 4.75%

As anticipated, the Bank of England cut interest rates for the second time this year. This means the rate currently sits at 4.75%.

The Monetary Policy committee (MPC) voted (by a majority of eight to one) to reduce rates in a bid to help relieve households and businesses from the pressure of high borrowing costs. As a result of the recent 0.25% reduction, rates are now at their lowest point in more than year. The last time they were below 5% was June 2023.

Speculation is now mounting that further – gradual - cuts are coming, with the Bank’s Governor, Andrew Bailey, saying that the ‘path is downward from here.’ As forecast by the Bank, inflation spiked up to 2.3% in October (up from 1.7% in September), fuelled by higher energy prices and food and drink costs. While this spike may mean that UK inflation has now jumped above the Bank of England’s 2% target, the increase was widely anticipated by economists.

At the time of writing this update, a handful of UK mortgage lenders had just announced they were increasing their rates, despite the Bank’s recent interest rate cut. Santander, TSB, HSBC, Virgin Money and Nationwide Building Society have all announced prices across their fixed rate mortgage deals will rise. Meanwhile, some lenders, including TSB and Santander, plan to reduce their mortgage rates across their tracker and variable rate deals.

Key takeaway 4: Gas boilers set to be banned in new builds

Gas boilers are reportedly due to be banned in most new homes by 2027, as part of legislation to cut residential carbon emissions. As part of the Future Homes Standard brought in by the previous Government, developers will be required to make sure new build properties are only fitted with electric heat pumps or non-gas alternatives.

The ban, which is expected to be unveiled in May next year, is aimed at making sure that the carbon emissions of new homes are 75% lower than current levels. The legislation is anticipated to be implemented in 2026 and involve an initial 12-month transitional period.

Learn more: https://www.propertywire.com/news/gas-boilers-to-be-banned-in-new-builds/

Key takeaway 5: The long-term outlook – Savills

Earlier this month (November), Dan Hill, an Associate and Retail Analyst at Savills, published his views on what lies ahead for real estate from a long-term perspective. The crux of the research piece is that stability is on the horizon, thanks to the relatively stable political and macroeconomic backdrop that both Savills, and we, have reported and commented upon over the last couple of years in our State of the Market updates.

Looking ahead, reduced external noise and medium-term house prices look set to be dictated by demand, supply and affordability. And with the base rate starting to be cut by the MPC and inflation being on-target, the future landscape, as stated in Savills’ article, is starting to look more promising.

Read the full article: https://www.savills.co.uk/research_articles/229130/368933-0

Mike Bristow, CEO of CrowdProperty, comments:

“As we navigate an evolving property market, this latest update underscores both challenges and opportunities for small and medium-sized developers. The record-high house prices reflect sustained demand, yet affordability and borrowing constraints remain significant hurdles, despite real wage growth and generally falling mortgage costs. The easing of construction growth and cautious optimism in the sector highlight the need for strategic planning and adaptability.

“The Bank of England’s interest rate cut to 4.75% is a welcome step, but its mixed impact on mortgage costs shows that the journey to affordability is far from linear. Meanwhile, the upcoming ban on gas boilers in new homes is a clear call for innovation and sustainability in development practices.

“At CrowdProperty, we see these trends as signals to stay agile and forward-thinking. By fostering collaboration, leveraging technology and prioritising efficiency, we can empower developers to succeed in this shifting landscape while delivering much-needed homes. Stability may be on the horizon, but as always, proactive action will determine long-term success."

//

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team

We are a leading specialist property development finance business and have funded £881m worth of property projects to date.

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply and get an instant Decision in Principle. Within 30 minutes, our property experts will share their insights and initial funding terms, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding

As featured in...