Borrow

Case Study

Podcasts

Awards

About

An overview of the latest key property market updates and insights for small and medium-sized property developers.

Key takeaways at a glance:

- House prices continue to hold steady.

- Construction activity increases, but housebuilding drops.

- Interest rates stay frozen at 5.25%.

- Which? calls for major EPC overhaul.

- Interest rate cut tops UK housebuilders’ wish list.

Key takeaway 1: House prices continue to hold steady

The steady picture that’s been unfolding since the start of the year continued to be seen last month (April), with UK house prices plateauing.

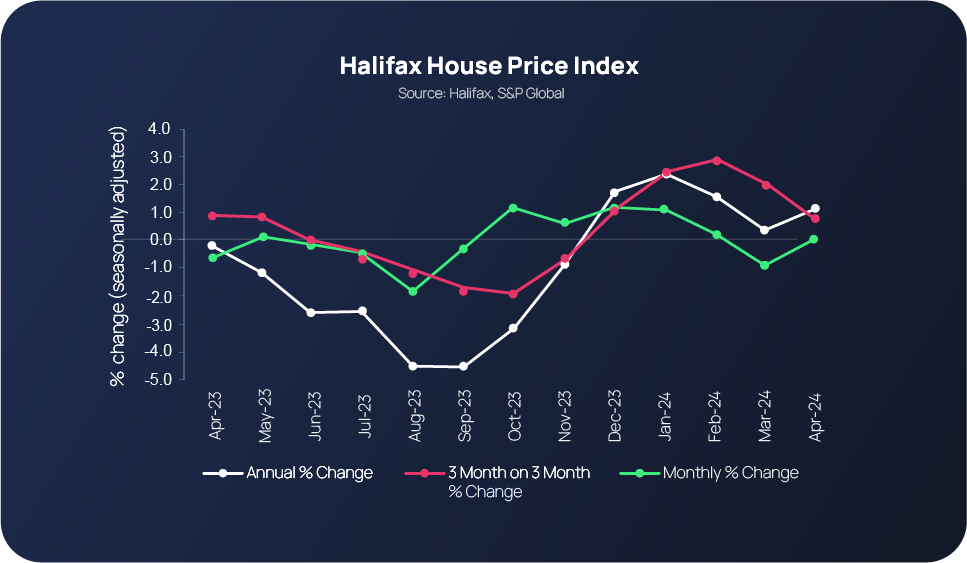

According to Halifax’s House Price Index, the average price of a house in the UK now stands at £288,949, +0.1% up compared to the previous month and +0.8% up from a quarterly perspective. Annually, this equates to a +1.1% change, with Halifax’s Head of Mortgages stating that the latest figures reflect ‘a housing market finding its feet in an era of higher interest rates.’. This statement is very much supported by the observation that 6 of the last 7 months have shown positive growth:

Meanwhile, buyer expectations are reportedly shifting to accommodate higher borrowing costs as buyers are increasingly turning their attention to targeting smaller properties. At the same time, affordability continues to cast a shadow over the UK property market due to mortgage rates creeping up through April as the cost of longer-term money (SONIA swaps) increased, although earnings growth adjusted for inflation is running at +1.7%. All eyes are on future bank rate activity, with any downward moves resulting in a drop in fixed mortgage rates - latest news reports say that several lenders, including Barclays, HSBC and TSB, are reducing their fixed rates, with Barclays cutting rates by 0.45%.

RICS’ UK Residential Survey for April leads with a headline that shares the same modestly positive sentiment, ‘Buyer demand cools although market keeps a steady flame as property listings increase in April.’

A mellowing in buyer demand - due to the slight mortgage rate rises through April – is among the key takeaways in the April survey. New buyer enquiries dropped throughout the month, from +6 to -1, signalling the end of three consecutive positive monthly results. Interestingly, the latest figure is the most positive since September 2020. It has been attributed to an increase in listings as sellers feeling more comfortable with listing their properties due to current market conditions continuing to improve following the pandemic.

Key takeaway 2: Construction activity increases, but housebuilding drops

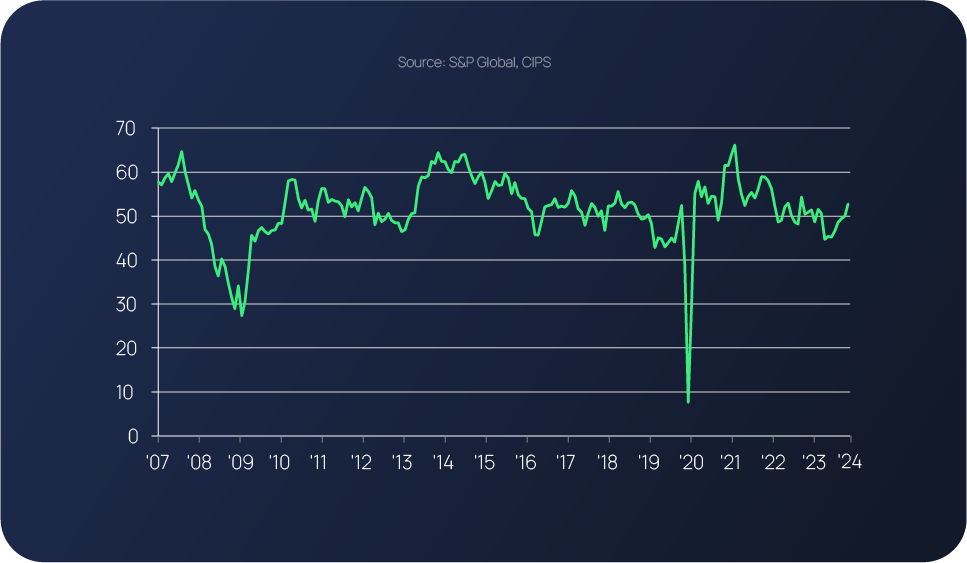

The S&P Global UK Construction PMI published on May 7 leads with the key finding that continued construction growth has been enabled by expansion within the commercial and civil engineering segments. This is further bolstered by reports of new work increasing for the third month in a row and domestic economic conditions boosting sales.

Supply lead times are now at their shortest since the start of this year, and the headline S&P Global PMI is in positive territory for the second month running and at its highest point of expansion since February last year.

However, residential housebuilding activity has taken a tumble (47.6 Index reading), which has been described as moderate. ‘Sluggish market conditions’ and elevated borrowing costs have been linked to the current situation.

Key takeaway 3: Interest rates stay frozen at 5.25%

As widely predicted, the Bank of England kept interest rates at 5.25% for the sixth consecutive time, a decision that was underpinned by three key factors: inflation falling due to the higher interest rates, making sure inflation drops to 2% and stays around this mark and the point of cutting rates not yet being reached.

Governor of the Bank of England, Andrew Bailey, has said he is expecting inflation to fall ‘close’ to the target 2% within the next couple of months. Trading Economics’ consensus (the average forecast from a representative group of economists) predicts April’s annual CPI inflation rate when released on 22nd May will come in at 2.1% (yes – two-point-one-percent), with their consensus forecasts proving pessimistic in 2 of the last 3 months and within 0.1%pt the last 2. With inflation continuing to fall, the Bank of England is reportedly expected to cut UK interest rates to 4.75% by the end of the year and to sub-4% in 2026.

The current situation is a sign that ‘the UK economy is on the mend’, says Ian Stewart, Deloitte’s chief economist: ‘”Barring external shocks, we expect growth to continue through the rest of this year and next year at around trend, or normal, levels. Falling inflation, rising real incomes and growth in the US and Europe should help to maintain the recovery.”

Looking further ahead, based on current market interest rates and slack within the economy, the Bank of England is projecting CP inflation to be 1.9% in two years’ time and 1.6% in three years.

Key takeaway 4: Which? calls for major EPC overhaul

Consumer advisory group, Which?, is calling for UK and Scottish authorities to overhaul their existing Energy Performance Certificate (EPC) models to better account for the performance of heating technologies and their emissions.

The appeal forms part of a new consumer-focused policy paper developed by Which? that is pushing for EPCs to be amended to fundamentally help home and building owners make the switch to lower carbon heat.

The policy paper contains three main recommendations: better information and advice, improved accessibility and improved accuracy and reliability, and leads with this stark reminder: ‘The UK and Scottish governments have targets for banning the installation of new fossil fuel heating systems, but awareness of these targets and the implications for households is very low. EPCs could help to fill this gap and point consumers towards the information they need.’

Key takeaway 5: Interest rate cut tops UK housebuilders’ wish list

According to Knight Frank’s Residential Development Land Index for Q1 2024, land values remained flat in the UK, despite more housebuilders looking to replenish their pipelines. While deals are taking place, the report states ‘there is still not much land changing hands’ and that a current increase in new sites should lift transactions later in the year.

Over 60% of respondents said that an interest rate cut is top of their wish list. When asked what would increase their appetite for land and new development the most, this ranked more highly than either planning reform (48%), a further fall in land pricing (29%) and more first-time buyer support (26%).

Office-to-residential opportunities, made possible by the amendment to Permitted Development, which allows commercial buildings of any size to be converted into new homes without going through the full planning process, have been highlighted as a positive against the backdrop of slow land transactions.

Meanwhile, respondents believe that planning delays, the short-term economic outlook and buyer sentiment are the top three factors set to have the greatest impact on the housebuilding sector. Half also said that land is limited, 69% said that land prices will stay the same and half expect start volumes to increase over the next three months.

Mike Bristow, CEO of CrowdProperty comments:

”The market continues to be affected by higher cost of capital, but the signs are positive, especially with the expected announcement that annual inflation was down to almost 2% in April, and buyers will enjoy lower rates on their mortgages through this coming year.

“With positive news for property developers that supply lead times continue to shorten, enabling faster progress on the building of much-needed homes, at CrowdProperty we are already seeing savvy developers ‘out shopping’ again. Following on from an all-time record of applications for finance on over £750m of projects in March, April went on to smash that with over £1bn.”

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team

We are a leading specialist property development finance business and have funded £843m worth of property projects to date

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply – our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding

As featured in...