The frenzied activity of the housing market means that affordability is a growing concern among house buyers. As the Russia-Ukraine conflict progresses and inflation continues to be a key threat to households, CrowdProperty reviews the latest market commentary and what this will mean for the sector going forward.

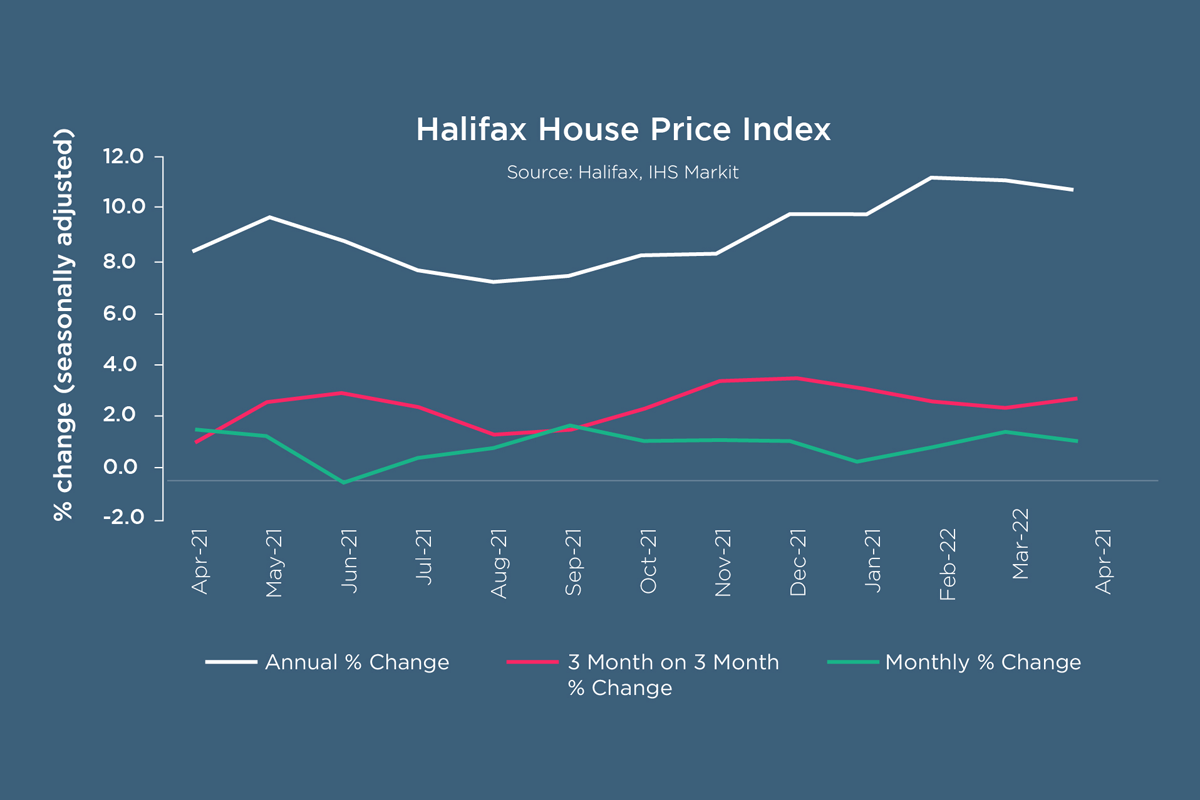

Last month, Halifax reported that housing prices are now at £286,079 which is up £47,568 since the start of the pandemic. This is now the 10th consecutive month prices have risen and the longest run of continual gains since the end of 2016 (1.1% this month). However, the prediction remains that growth will slow as we progress through the year. In nominal terms, average house prices are 41.6% above the 2007 peak but in real (inflation adjusted) terms, keep in mind that this is 8.4% below the 2007 peak, according to the Nationwide House Price Index latest release covering the market to the end of March 2022.

The growth in new buyer enquiries suggests that activity will remain heightened in the short term, partly down to the number of properties coming to the market remaining insufficient for the demand, particularly those properties that are more spacious. Halifax has noted that the net cash increase for detached properties has risen nearly £50,000 in the past year – 5 times the amount of flats.

Northern Ireland has overtaken the South West of England as the UK’s strongest performer in terms of annual price house inflation - now at 14.9%, leading to a house price average of £182,565. Notably, though, this is still some way short of the country’s record high of £230,931 which was in the build-up to the financial crisis in the summer of 2007. Although no longer the strongest, Wales remains close behind with a growth rate of 14.2% - an average house price of now £214,396 which is yet another all-time high for the country.

In other areas, six English regions have hit double-digit annual house price inflation during April with the South West of England continuing to experience the biggest increase of 14.8% meaning that for the first time, the average house price has surpassed the £300,000 barrier (£301,632). The rate of annual house price inflation in London continues to lag behind the rest of the UK, with prices now up by 6.2% year on year.

Rightmove has reported a third consecutive price record of 1.6% (+£5,537) to £360,101 with Tim Bannister, Rightmove’s Director of Property Data, commenting that “price rise momentum is even greater than during the stamp-duty-holiday-fuelled marker of last year.”

The buying activity of last year has carried over to this year and combined with the tradition of spring moving, Rightmove is witnessing the quickest selling market they have ever seen with buyer enquiries still 65% above the market seen in 2019. This frenzied activity means that 53% of properties that sell are now selling at or over their final advertised asking price, the highest percentage ever measured.

In the month that it officially opens, it’s worth reflecting on the ‘Crossrail effect’ as an indicator of how infrastructure development impacts the housing market. Houses in the areas surrounding Crossrail have experienced skyrocketing prices of up to 215% since the project was first announced. In an interview with City AM, Marc von Grundherr, director of Benham and Reeves, described this as ‘the gift that keeps on giving for homeowners living in arm’s reach of a Crossrail station.’

In July 2008 the average property price was just £725,603 but has since risen to almost £2.3m and it is predicted that these prices will continue to climb until the project has finished and homebuyers know completely where they stand with the service. Many places have experienced over a 100% price increase such as the Woolwich CR station at 128%, Seven Kings at 116%, Manor Park at 103%, Tottenham Court Road at 163%, and Bond Street at 121%.

In some areas, Crossrail has caused a complete transformation. Acton went from a semi-rural village into a thriving Victorian suburb. The £800 million investment into the South Acton Estate created 3,300 homes in the now Acton Gardens as well as the Old Town Hall which has been converted into flats. With work due to finish in 2029, the regeneration of this area has already seen average house prices go from £404,388 in 2012 to £644,994 in 2022, a growth of 59%. This is partly due to Crossrail now making it possible to get to Paddington in 9 minutes and Heathrow in 21 minutes.

It is clear that commute times are still a key factor in house buying, an increasing sign that life is returning to pre-COVID times. More and more office workers and students are making their way back into city centres, which has led to a shortage of properties to rent. Zoopla has reported that the average rent is now £995 after rising 11% in the past year, the fastest in 14 years. Similarly, Savills has reported that Buy-to-Let loan grants were 37% above the average in February.

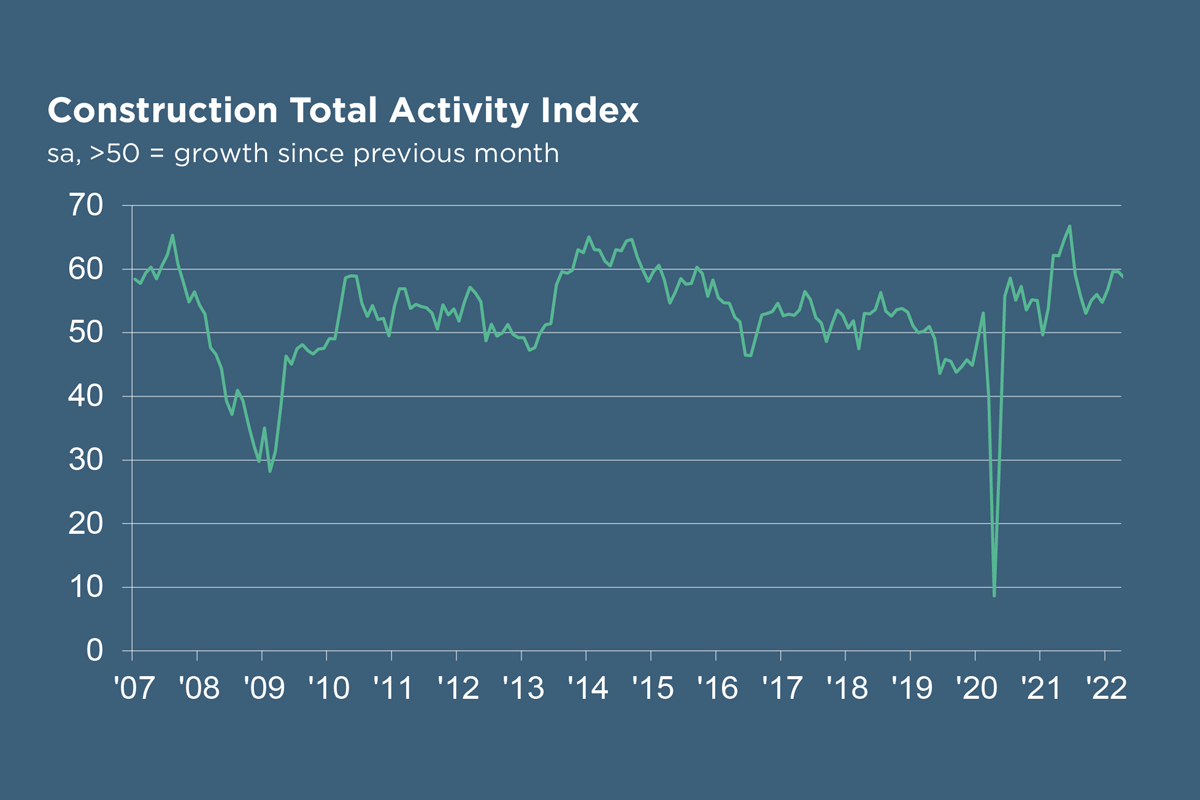

Switching to construction activity, IHS Markit has reported the price of raw materials, geopolitical uncertainty, and higher borrowing costs are creating barriers to the demand for more construction work. Therefore, worries about the economic outlook led to the largest drop in optimism since September 2020. The headline S&P Global / CIPS UK Construction Purchasing Managers’ Index® (PMI®) now stands at 58.2, down from 59.1 in March – the weakest rate of output growth since January.

Commercial work remained the strongest performing sector having reported a backlog of demand due to COVID-19 recovery plans. Civil engineering also remained robust due to the progression of HS2. Whilst opportunities have decreased compared to previous months, the need to deliver these upcoming projects has contributed to yet another round of job creation.

With supply chain disruptions remaining a prominent issue, supply chain managers are having to keep an eye on the future by attempting to build up stock levels. Consequently, Duncan Brock, Group Director at the Chartered Institute of Procurement and Supply, commented that this has “led to a relatively gloomy outlook amongst builders for the year ahead.”

According to the Office of National Statistics, for the first time since records began, there are fewer unemployed people than job vacancies meaning that 75.7% of the total population (29.5 million people) are now employed.

The EY ITEM Club stated that this record low level of unemployment could encourage consumers to spend more which could offset factors inhibiting growth. Secondly, some consumers may be able to draw upon savings accumulated through the pandemic – a total that is now estimated to be £180bn.

Geopolitical uncertainty and the rise in prices of capital goods means that business investment is not expected to return to its pre-pandemic levels until the end of 2022. From this, the EY ITEM Club now predicts GDP growth of 4.1% in 2022 (down from the previous forecast of 4.9%) and in 2023, this is predicted to slow further to 1.9%. However, EY ITEM Club concluded that “a recession for the UK is not inevitable” despite inflation being at a multi-decade high (although beware that inflation data should have a big ‘danger of averages’ health warning with an imperative for deeper digging before drawing conclusions from headlines).

Given these uncertain economic times, property finance by property people makes so much sense – at CrowdProperty we work closely and productively with the developers we back, tackling market, site and situational challenges together in partnership. Having been developers ourselves, we are laser-focused on solving the pains of small and medium-sized developers, which is why working with CrowdProperty increases the likelihood of the success of projects.

CrowdProperty is a leading specialist property development finance business having funded over £470m worth of property projects to date. Apply in just 5 minutes at www.crowdproperty.com/apply and our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.