Borrow

Case Study

Podcasts

Awards

About

Our monthly round-up of key property market updates and insights for small and medium-sized property developers.

Key takeaways at a glance:

Key takeaway 1: UK house prices hold steady.

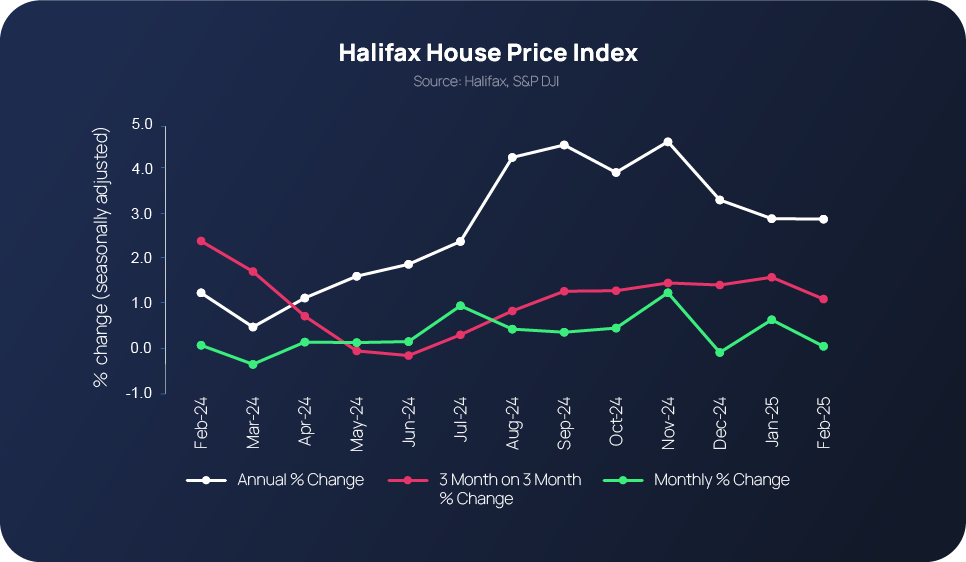

After hitting a new record high in January, average UK house prices ‘held steady’ in February, according to Halifax’s latest House Price Index findings. Average prices increased by +0.6% in January, then dipped slightly (by -0.1%) in February. This means the average price of a UK property has negligibly reduced – from £298,815 to £298,602.

As for annual growth, February’s marginal dip means the annual growth figure also stayed put at +2.9%. Halifax’s Head of Mortgages, Amanda Bryden, says February’s house price landscape reflects the delicate balance that currently exists within the UK’s housing market.

“While there’s been talk of a last minute rush on new mortgages ahead of the changes to stamp duty, inevitably we’ve seen some of the demand that was brought forward start to fade as the April deadline ticks closer, given the time needed to complete a purchase,” she explains.

“That may help to explain why growth in first-time buyer property prices eased in February, falling to +2.4%, in contrast to home-mover price inflation which accelerated, reaching +3.7%. While house price growth has slowed overall, market activity remains strong and comparable to pre-pandemic levels, demonstrating a resilience amongst buyers that’s been evident in the face of higher borrowing costs.”

Key takeaway 2: Bank of England keeps interest rates at 4.5%

After cutting interest rates for the first time last month (February), the Monetary Policy Committee (MPC) voted by a majority of 8–1 to hold interest rates at 4.5% at its most recent meeting on March 20. One member preferred to reduce the Bank Rate by 0.25 percentage points, to 4.25%.

The decision comes after inflation rose by more than anticipated in January to 3%. Geopolitical issues, including increased global trade policy uncertainty and tariff announcements from the US, as well as weak employment-related growth and subdued supply and demand performance, have been linked to the latest decision.

The MPC states: “Based on the Committee’s evolving view of the medium-term outlook for inflation, a gradual and careful approach to the further withdrawal of monetary policy restraint is appropriate. Should there be greater or longer-lasting weakness in demand relative to supply, this could push down on inflationary pressures, warranting a less restrictive path of Bank Rate. Should there be more constrained supply relative to demand and more persistence in domestic wages and prices, including from second-round effects related to the near-term increase in CPI inflation, this would warrant a relatively tighter monetary policy path.”

In its latest Residential Forecasts report, the CBRE predicts the MPC will make three Base Rate cuts throughout the course of this year. In turn, mortgage rates will continue to fall between now and December, boosting buyer budgets and house price growth in the process.

The MPC is next due to meet again on May 8, with speculation already mounting that this is when the next interest rate cut will be made.

Key takeaway 3: Buyer demand takes a tumble...

Looming stamp duty threshold changes coupled with geopolitical and international economic uncertainty has led to buyer demand weakening in recent weeks, says the Royal Institution of Chartered Surveyors (RICS). These factors have been highlighted in RICS’ most recent UK Residential Property report as being behind the ‘reduced momentum in the UK’s housing market in February.’ However, it is worth noting that once these clouds pass, brighter days are anticipated to follow.

Simon Rubinson, RICS’ Chief Economist, comments: “The UK housing market appears to be losing some momentum as the expiry of the temporary increase in stamp duty thresholds approaches. Some concerns are also being expressed by respondents about the re-emergence of inflationary pressures and the more uncertain geopolitical environment. That said, looking beyond the next few months, sales activity is seen as likely to resume an upward trend with prices also moving higher.”

An uplift in available stock, which is providing buyers with an increased range of options, has been earmarked in the report as being a market booster.

Key takeaway 4: ...And so does construction activity.

Steep declines in housing and civil engineering activity, new work and input buying falling (at the fastest pace in almost five years) and an acceleration in input cost inflation (the highest since March 2023) set the scene in the latest S&P Global UK Construction PMI update.

Published on March 6, the report makes for some sombre reading, starting with the headline: ‘Fastest downturn in construction output since May 2020’ and followed by the PMI reading for February of 44.6 - the lowest for nearly five years.

Key takeaways include:

Residential building - activity decreased for the fifth month in a row and was the weakest-performing area of construction activity in February. Index rating: 39.3.

Civil engineering activity - also registered a steep decline in February. Its index rating - 39.5 – was the lowest since October 2020.

Commercial construction - showed some resilience. This was reflected by a marginal reduction in output levels. Index rating: 49.0.

Read the full S&P Global UK Construction PMI report.

Key takeaway 5: ..Project spotlight – from derelict railway arches to a ‘once in a generation opportunity.’

Plans to transform a set of derelict railway arches in Walthamstow into a trendy shopping destination have been given the go ahead. The 16 railway arches in Courtenay Place will be turned into a series of shops, cafes and restaurants.

This forms part of the council’s wider Walthamstow Culture for All project and will be paid for using £17 million in Levelling Up funding.

Meanwhile, the proposed £4.2 billion redevelopment of Manchester United’s Old Trafford Stadium, which includes breathing new life into the western gateway of the city along banks of the Manchester Ship Canal, has reportedly received widespread positive feedback from local councillors.

Exact plans for the project are yet to be determined, but could potentially involve the stadium’s capacity being boosted from 87,000 to 100,000. An updated strategic masterplan is set to be prepared for the wider wharfside/Old Trafford Regeneration area subject to the necessary funding being secured.

Steve Deutsch, CEO of CrowdProperty comments:

“In a market defined by cautious optimism and shifting momentum, it's more important than ever for developers to remain agile and well-informed. While demand has softened and construction activity is slowing, we’re seeing real opportunity emerge for those who are prepared and proactive. At CrowdProperty, we’re committed to supporting developers not just with funding, but with the insight and expertise needed to navigate these market dynamics and unlock value in their projects.”

//

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team

We are a leading specialist property development finance business and have funded £894m worth of property projects to date.

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply and get an instant Decision in Principle. Within 30 minutes, our property experts will share their insights and initial funding terms, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding

As featured in...