Borrow

Case Study

Podcasts

Awards

About

An overview of the latest key property market updates and insights for small and medium-sized property developers.

Key takeaways at a glance:

- Property market continues to take positive steps forward.

- Housebuilding stabilises and boosts construction activity.

- Interest rates stay put—for now.

- UK mortgage arrears double to seven-year high.

- Regional economic growth gap expected to widen.

Key takeaway 1: Property market continues to take positive steps forward

The outlook for the UK property market continues to follow a more positive path, which has been evidenced for the second month-running by RICS’ UK Residential Market Survey. An uplift in buyer demand as well as new listings is reported in RICS’ February report, which also predicts that house prices will continue to stabilise while current 12-month projections suggest a return to growth. RICS reported a net +36% of respondents expecting house price growth in coming year, which is the strongest since Oct 22.

New buyer enquiries remained at +6%, the same level as last month (February). At the same time, near-term sales expectations have also been reported as ‘marginally modest’ with a current net balance of +6%.

But it’s the new sales figures that have really spearheaded the current positive sentiment, with a noteworthy number of instructions coming on to the market in February. According to RICS, the latest net balance is +21%, the strongest reading since October 2020. Overall, sales transaction levels through the last 4 months have averaged out at pre-pandemic levels, significantly stronger than 2023.

However, for all the positivity, an undercurrent of caution does still remain in relation to the near-term outlook. More specifically, it is anticipated that the easing of mortgage rates could potentially stall due to ongoing uncertainty in relation to the timing and speed of interest rate reductions.

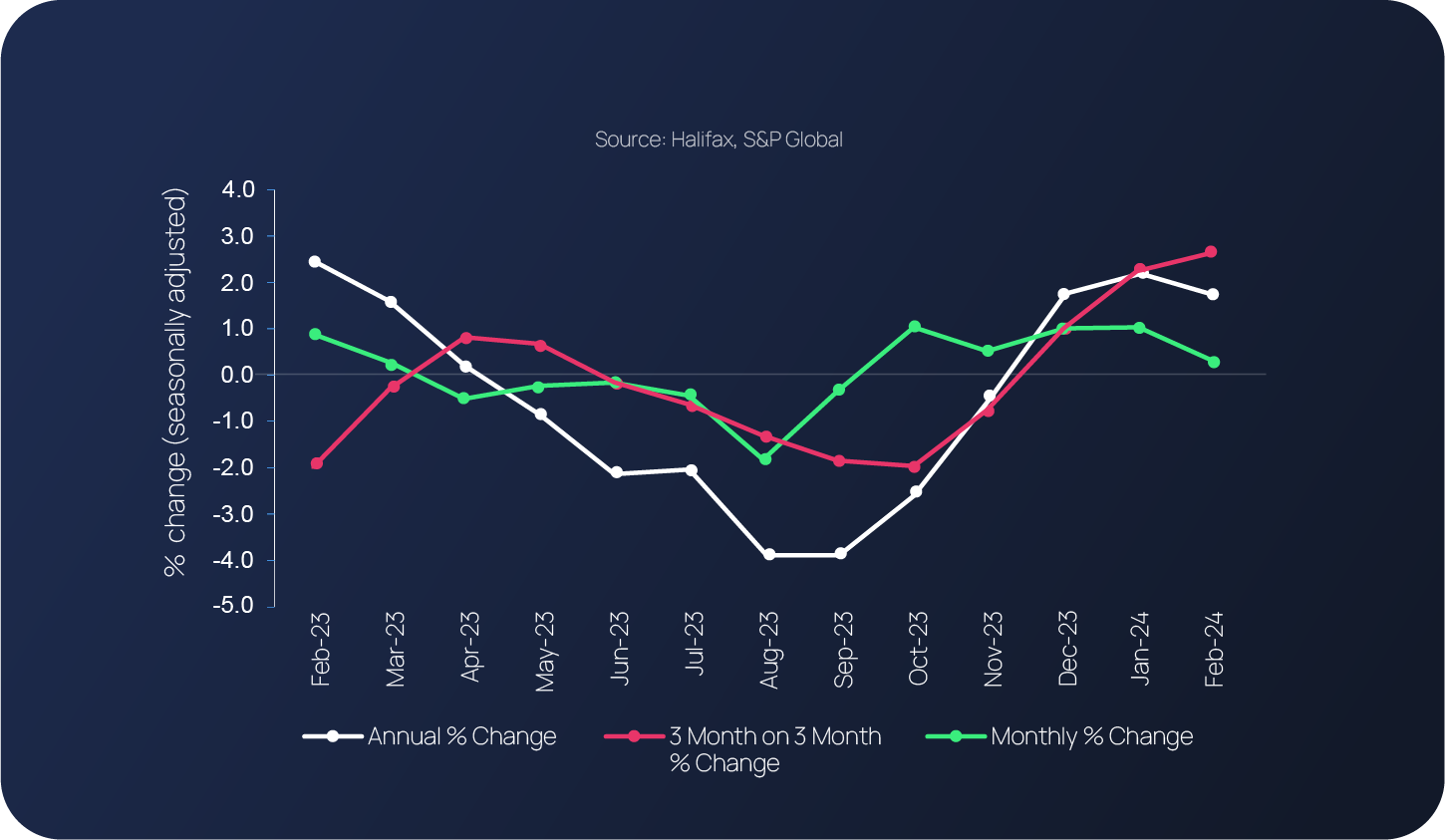

As far as UK house prices are concerned, Halifax’s House Price Index for February reports that they rose by +0.4%, and for the fifth consecutive month, putting the cost of a typical UK home at £291,699, just over £1,000 more than the previous month.

From an annual perspective, house prices are now +1.7% higher than they were a year ago. And while they may have slowed from +2.3% in January, Halifax’s Mortgages Director, says that: “These figures continue to suggest a relatively stable start to 2024 and align with other promising signs of increased housing activity, such as mortgage approvals.”

Key takeaway 2: Housebuilding stabilises and boosts construction activity

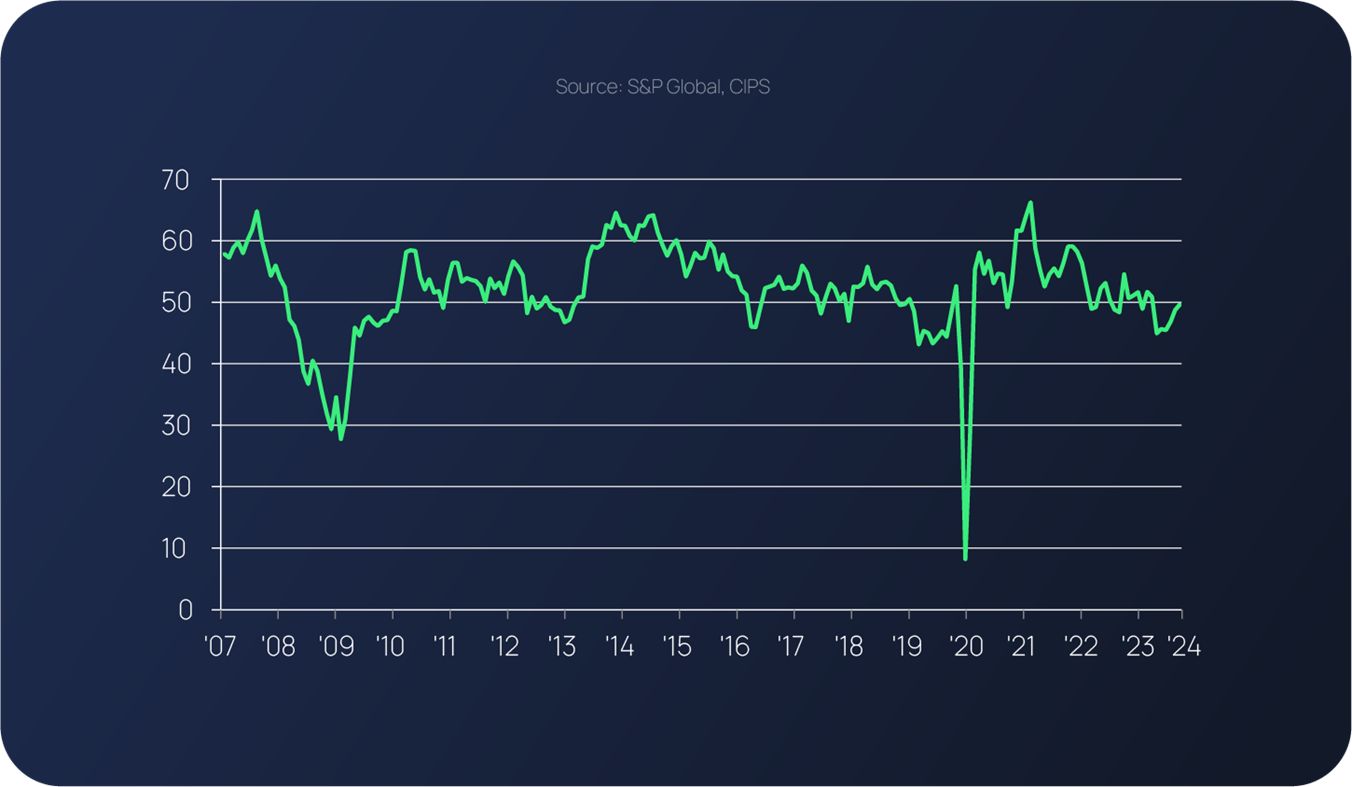

Construction activity during February also painted more of an upbeat picture – the latest S&P Global UK Construction PMI update reports that total activity fell, but only fractionally, which has been attributed to housebuilding stabilising.

According to Tim Moore, Economics Director at S&P Global: “This was the best performance for the construction sector since August 2023 and the forward-looking survey indicators provide encouragement that business conditions could improve in the coming months.”

The positive picture was further reinforced by the fact new work rose for the first time since July last year, and business optimism remains the most upbeat since January 2022. Hopes of a sustained upturn in customer demand, as well as a more favourable economic and financial conditions over the course of 2024 have been widely echoed by construction companies. At the same time, more than half of the survey panel (51%) anticipates a rise in business activity over the year ahead, while only 6% forecasts a reduction.

Key takeaway 3: Interest rates stay put-for now

Despite positive inflation news (see below), the Bank of England kept interest rates at 5.25% for the fifth time, with Governor, Andrew Bailey, stating that ‘we are on the way’ to interest rate cuts, and that “We do need to see further progress, and do want to give this message very strongly.”

Having declined through the second half of last year, UK GDP and market sector output are expected to start growing again during the first half of this year. It is also anticipated that fiscal measures in the Spring Budget are set to lead to a GDP increase of around ¼% over the coming years.

Meanwhile, the rose by 3.4% in the 12 months to February 2024 (down from 4% in January) which was better than the 3.5% consensus forecast. And from a monthly perspective, CPI increased by 0.6% in February compared to 1.1% in February last year. High monthly inflation figures from March 2023 (0.8%) and April 2023 (1.2%) mean that the headline measure of inflation is expected to fall significantly over the coming 2 months when they drop out of the annual rate.

The largest downward contributions to the CPIH and CPI figures were from food, and restaurants and cafes, while the largest upward contributions came from housing and household services, and motor fuels.

Key takeaway 4: UK mortgage arrears double to seven-year high

The number of UK mortgages that have fallen into arrears were at a seven-year high in the last quarter of 2023, according to the Bank of England’s Mortgage Lenders and Administrators Statistics.

One of the headline key findings was the fact that the value of outstanding mortgage balances with arrears increased by 9.2% from the previous quarter, to £20.3 billion, and was 50.3% higher than the previous year.

The statistics also showed that the share of gross mortgage advances with Loan-To-Value (LTV) ratios over 90% increased by 0.5pp from the previous quarter to 5.5%. This is the highest level since 2019 Q4 and 0.4pp higher than a year ago. To add to this, the share of mortgage advances with LTVs over 95% has increased from the previous quarter to 0.4%. This is the highest since 2016 Q4.

Directionally affordability is improving - according to Savills’ analysis, the average monthly costs for the average house price using the most recent Nationwide mortgage rates are now back to levels not seen since before the Mini-Budget back in September 2022. Furthermore, average prices as a multiple of annual earnings is now at the lowest since 2020 (and London 2014).

Key takeaway 5: Regional economic growth gap expected to widen

Economic momentum is anticipated to return to all parts of the UK over the next three years, say Ernst & Young. But it’ll be London and the South East that will report faster GVA growth than the UK average.

Overall, the UK is expected to see annual average GVA growth of 1.9%, triggered by factors, including lower inflation, a strong labour market and proposed interest rate reductions. Meanwhile, London and the South East are forecast to achieve annual GVA growth of 2.1% and 2%, respectively, while the South West is expected to see 1.9% growth.

Despite ongoing efforts to address the UK’s regional economic disparity, London and the South East accounted for 39% of the UK’s overall GVA in 2023, compared to 36% in 2005. This is anticipated to ramp up to 40% by 2027.

“Savvy developers will look at these latest figures and see indications of potential, with interest rates anticipated to fall and a possible increase in repossessions bringing competitively-priced property onto the market.

“It’s the ideal time for developers to open a conversation and build a relationship with their finance provider, so they are well-placed to grasp the opportunities the market could offer them this year.” – Mike Bristow, CEO, CrowdProperty

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team

We are a leading specialist property development finance business and have funded £840m worth of property projects to date

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply – our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding

As featured in...