Borrow

Case Study

Podcasts

Awards

About

An overview of the latest key property market updates and insights for small and medium-sized property developers.

Key takeaways at a glance:

Key takeaway 1: 2024 house prices end on a high

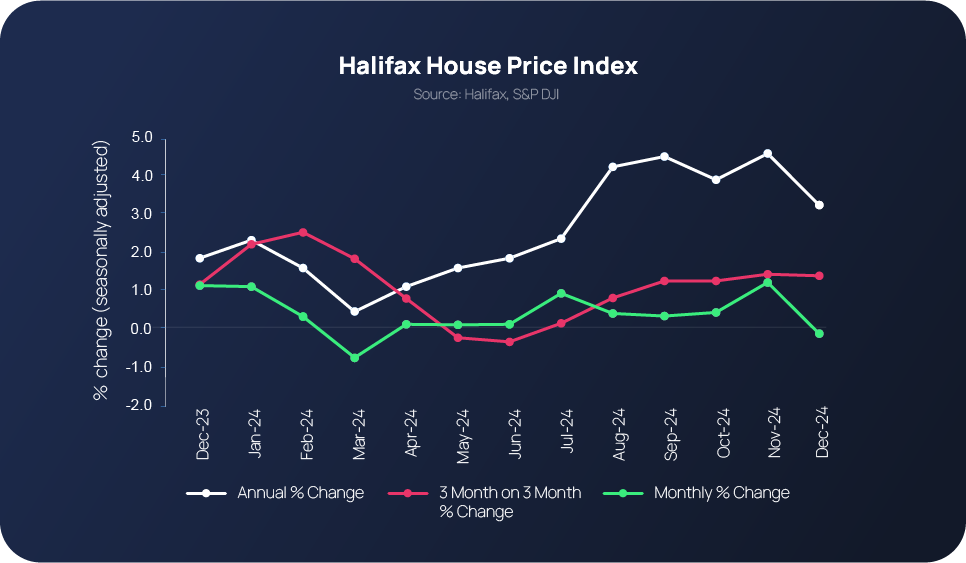

While average property prices may have slightly dipped by -0.2% in December after five consecutive monthly increases, the overall picture for 2024 was positive – up by 3.3% annually and +1.4% quarterly.

This means a typical property in the UK now costs £297,166. According to Halifax’s latest House Price Index report, last year’s growth, which gained traction post-summer onwards, was fuelled by the combination of mortgage rate decreases and income growth. Meanwhile, proposed Stamp Duty threshold changes, due to be implemented from April this year, are also believed to spur first-time buyers on to get their foot on the ladder sooner rather than later (more on this further below – see Key Takeaway 4).

“These elements meant mortgage demand picked up, hitting the highest level in over two years and going back to levels seen pre-pandemic,” explains Amanda Bryden, Halifax’s Head of Mortgages.

“In many areas across the country, house prices were also buoyed by demand outstripping supply, possibly further amplified by homeowners holding off putting their property on the market – perhaps in anticipation of mortgage rates reducing further.”

As for how UK house prices will fare this year, Savills predicts that the inflation risks experienced in 2024 will remain in force this year, especially given the fact swap rates are currently sitting at a higher level than they were before the latest Budget announcement. Declining mortgage rates and a base rate cut next month, at the earliest, are among the other predictions shared within Savills’ December 2024 UK Housing Market Update.

Key takeaway 2: Housebuilding is the ‘weakest-performing part of the construction sector'

Published on January 7, the latest S&P Global UK Construction PMI report revealed that overall UK construction output growth has slowed to a six-month low, with housebuilding highlighted as the weakest-performing category.

Housebuilding activity has decreased for three consecutive months - the latest reduction was the fastest decline to be reported since June last year. Subdued demand conditions, elevated borrowing costs and weak consumer confidence have been linked to contributing towards this latest position.

Construction companies reportedly experienced a ‘loss of momentum’ towards the end of last year, which is reflected by the fact total business activity expanded at its slowest pace since June. Meanwhile, new order growth remained moderate for the third month in a row.

From an overall industry activity perspective, December’s PMI reading was 53.3, which was a drop from November’s 55.2 reading, and the lowest reading for six months. However, the latest report does also reference the fact that readings have hovered above the 50.0 ‘no change’ value since March last year, and that the latest reading still demonstrates a ‘solid upturn in overall construction output.’

Speaking of upturns, commercial activity was the fastest-growing category in December (index at 55.0) followed by civil engineering (52.9). However, these latest results do still signify a slowing down in the rate of business activity expansion within both areas.

Key takeaway 3: Inflation unexpectedly dips for the first time in three months.

Latest consumer price inflation figures published by the Office for National Statistics have unveiled a surprise drop in inflation, which is generating widespread speculation around the possibility of an interest rate cut taking place next month (February).

At its last meeting on December 18, the Bank of England voted to keep interest rates at 4.75%, a decision that was influenced by continued economic challenges. At the same time, the Bank forecast growth of 0.3% in the final three months of the year, which it subsequently changed to 0%, and inflation rose for the second month running (putting it at its highest level in eight months).

But now, in an unexpected twist, inflation has dipped for the first time in three months. Prices rose by 2.5% in the year to December, down from 2.6% the month before, marking the first fall in inflation for three months. Easing restaurant and falling hotel prices and smaller increases in air fares are the key drivers behind the dip. Meanwhile, prices for tobacco products (cigarettes, pouches, vape refills and cigars) also increased at a slower pace.

Overall, the largest upward contributions to the annual CPIH inflation rate in December came from the housing and household services, restaurants and hotels, and recreation and culture divisions. They partially offset downward contributions from transport and furniture and household goods.

Encouragingly, core inflation (which excludes food and energy) has also taken a tumble, from 3.5 to 3.2%; 2% below the monthly forecast. Despite this, inflation is still sitting 50 basis points above the Bank of England’s 2% target. Core inflation could potentially fall even further this year due to a slower job market and National Insurance business contribution changes.

The EY ITEM Club predicts that inflation will rise again – to almost 3% - this year due to multiple factors, including energy price cap increases and a weaker Pound pushing up imported goods prices.

Key takeaway 4: Stamp Duty threshold changes to kick in this year.

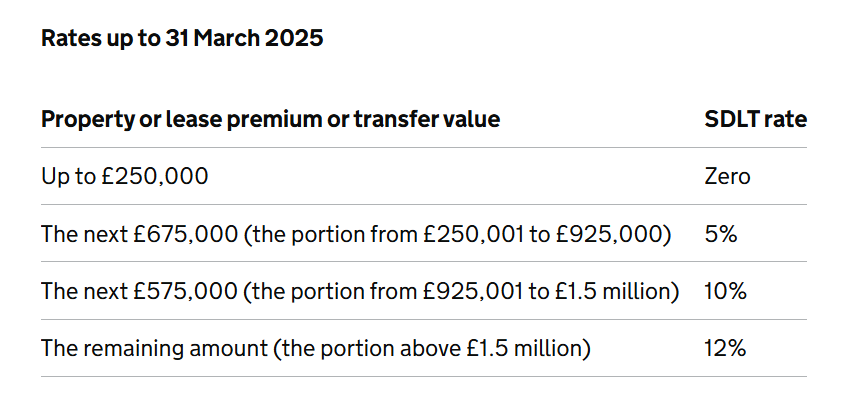

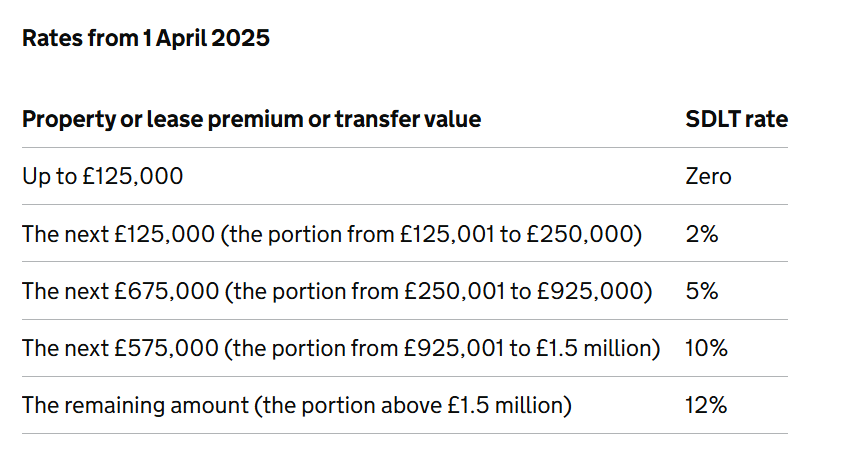

Unveiled by the Chancellor, Rachel Reeves, in the Autumn Budget, Stamp Duty thresholds are set to change this year (from 1 April).

In recent years, homeowners have benefited from a temporary increase in Stamp Duty thresholds, meaning the property tax has only applied to properties worth more than £250,000 (or £425,000 for first-time buyers).

What the Stamp Duty rates currently look like:

What they will change to from April 1:

Source: GOV.UK.

While the threshold changes are set to have unwanted financial repercussions for many property purchasers, they are reportedly anticipated to ‘motivate’ first-time buyers into getting their foot on the property ladder, according to Halifax. First-time buyers currently pay no stamp duty on homes up to £425,000, but this will soon drop to £300,000.

Key takeaway 5: Move away from remote working impacts UK housing market.

Back in 2020, 86% of employees specifically worked from home because of the pandemic. Fast forward to the here and now, and it would appear more-and-more employers are moving away from the remote working trend and calling on more employees to come into the office.

Amazon is among the employers to recently request for its employees to return to the office five days a week. Other employers include: AT&T and JPMorgan Chase.

The ripple effect of these decisions is widespread and yet to fully unfold. However, recent media reports have revealed that the move back to the office is set to see property-buying habits that were formed because of and during the pandemic (e.g. buying properties with outdoor space, bigger gardens and more rooms), are expected to start to unravel. Areas that were in demand at the height of COVID are no longer as desirable. The same applies to property types too.

Housebuilders are once again having to alter their inventories to align with buyer demand, with recent indicators suggesting that urban growth is on the rise once again and people are making buying decisions based on what they actually need, and can afford, right now.

Mike Bristow, CEO of CrowdProperty, comments:

“The property market in 2024 showcased its ability to adapt and thrive, despite economic headwinds, with annual house price growth and rising mortgage demand exceeding expectations. However, the sustained challenges in housebuilding, influenced by subdued demand, elevated borrowing costs, and shifting buyer preferences, emphasise the need for innovation and agility across the sector. The decline in remote working is further reshaping demand, with developers needing to reassess inventory to meet evolving preferences for urban living and affordability.

“At CrowdProperty, we are dedicated to empowering property developers by providing not just finance, but also expert guidance grounded in our extensive market understanding. Our ‘property finance by property people’ approach means we work closely with developers, tackling challenges collaboratively to ensure successful project delivery. In a rapidly changing market, such partnerships are critical in enabling developers to unlock opportunities, overcome obstacles, and contribute to addressing the UK’s housing needs effectively. By fostering sustainable growth, we aim to support a thriving property development sector that benefits both businesses and communities alike.”

//

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team

We are a leading specialist property development finance business and have funded £886m worth of property projects to date.

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply and get an instant Decision in Principle. Within 30 minutes, our property experts will share their insights and initial funding terms, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding

As featured in...