Borrow

Case Study

Podcasts

Awards

About

An overview of the latest key property market updates and insights for small and medium-sized property developers.

Key takeaways at a glance:

Key takeaway 1: Average property prices hit new record high.

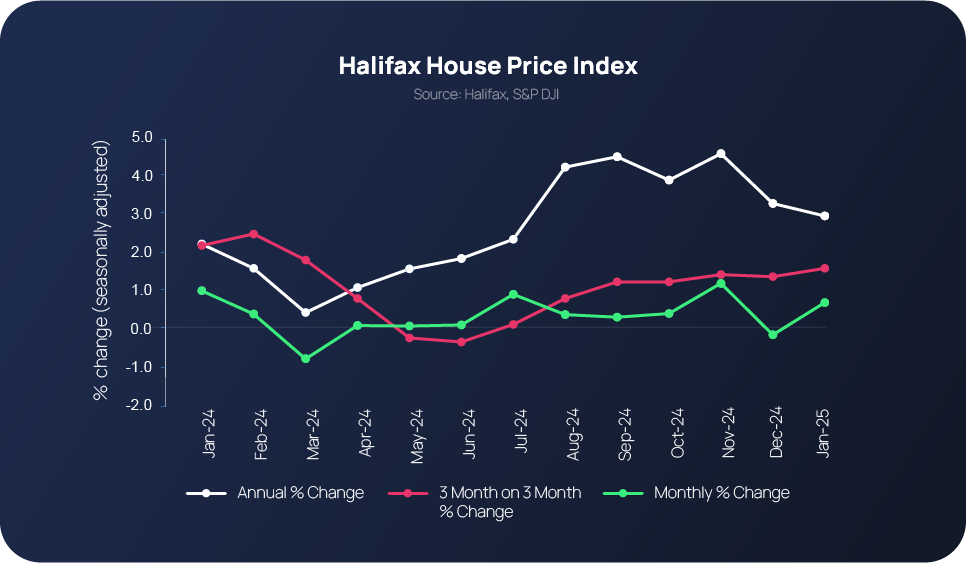

The average price of a UK property has continued to generate positive headlines after house prices soared by +0.7% January. According to Halifax’s latest House Price Index, the average property price stands at £299,138 – a new record high. This represents a monthly change of +0.7% and a quarterly change of +1.6%.

Latest figures reinforce the market’s continued resilience, which is underpinned by strong demand for mortgages and spurred on by lending growth. Overall, the outlook for this year is ‘fairly positive’, which Halifax’s Head of Mortgages, Amanda Bryden, also attributes to wider factors, including the Bank of England’s first base rate cut of the year (see Key Takeaway 2) and rising household earnings.

The same level of positivity is echoed in Savills’ February 2025 Housing Market Update, which also highlights that overall transaction volumes increased last year (1.1 million in total), putting sales almost back in line with average pre-pandemic levels. Meanwhile, plans for the Financial Conduct Authority to potentially review and relax current mortgage regulation has also been mooted as another route that could possibly improve access to the housing market.

Key takeaway 2: Bank of England makes first interest rate cut of the year.

At its meeting at the start of the month (February 5), the Monetary Policy Committee voted by a majority of 7–2 to reduce interest rates by 0.2%, bringing them down from 4.74 to 4.5%. All nine members of the MPC voted to cut the base rate - seven members voted to cut by 25 basis points, while two members voted for a larger cut of 50 basis points.

The eagerly-anticipated decision is the first of a number of cuts predicted to be made by the committee throughout the course of this year. The latest follows reductions in August and November last year, gradually bringing rates down from their 16-year high of 5.25%.

According to the MPC: “There has been substantial progress on disinflation over the past two years, as previous external shocks have receded, and as the restrictive stance of monetary policy has curbed second-round effects and stabilised longer-term inflation expectations.

“That progress has allowed the MPC to withdraw gradually some degree of policy restraint, while maintaining Bank Rate in restrictive territory so as to continue to squeeze out persistent inflationary pressures.”

What’s in store for interest rates over the coming months? Read this article for further insight and predictions.

Key takeaway 3: Latest interest rate cut leads to flurry of lower mortgage rates.

The latest interest rate reduction has been welcomed by the mortgage industry and borrowers, with some lenders lowering their rates in anticipation of the 5 February announcement.

At the time of writing, Barclays had just unveiled a five-year fixed deal at 3.99% for people with a 40% deposit or equity behind them. TSB is also set to cut rates on its fixed deals by up to 15%, while Santander has launched two and five-year fixed rate deals at 3.99% (60% Loan To Value) – making it the only lender to be offering below 4% rates on two-year fixes. For the full details, read this article).

With further cuts forecast over the coming months (potentially between one and three further reductions), all eyes are on whether the cuts will filter down to fixed-term mortgage deals. Overall, the most recent activity has been recognised as a positive step forward, particularly in relation to attracting a new wave of buyers and investors to the market.

Key takeaway 4: Government reinforces its commitment to building more houses

Labour’s Election Manifesto promise to build 1.5 million new homes before the next General Election in 2029 has been brought to the fore in recent days by Deputy Prime Minister, Angela Rayner.

Despite challenges posed by the current skills shortage, it has been widely reported that Ms Rayner is determined to turn Labour’s vision into reality and that it is possible for the target to be met.

Read more from the following sources:

Key takeaway 5: ..And unveils planning reform next step

Since our last update, the Chancellor came forward and announced further details of how the Government intends to deliver its Plan for Change targets, which include building 1.5 million homes and making 150 major infrastructure-related decisions.

An overhaul of the National Planning Policy Framework is among the changes, which include streamlining a set of national policies for decision-making to guide planning decisions made by local authorities and promoting housebuilding.

As part of these plans, developers will be able to submit applications for acceptable types of schemes in key areas, i.e. high potential locations near commuter transport hubs, and receive default approval.

Read the full Government news story.

Steve Deutsch, CEO of CrowdProperty comments:

“This month’s State of the Market highlights the resilience of the UK property sector and evolving opportunities within it. With house prices reaching new highs and interest rates beginning their anticipated downward trajectory, we are seeing renewed momentum in the market. Lower mortgage rates are already stimulating demand, reinforcing the importance of accessible and well-structured property finance.”

“At CrowdProperty, we welcome the Government’s commitment to housebuilding and planning reform, as these measures are crucial for addressing the supply-demand imbalance and unlocking development potential. By supporting SME developers with fast, efficient, and specialist finance, we remain dedicated to driving much-needed housing delivery in this dynamic landscape.”

//

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team

We are a leading specialist property development finance business and have funded £889m worth of property projects to date.

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply and get an instant Decision in Principle. Within 30 minutes, our property experts will share their insights and initial funding terms, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding

As featured in...