Borrow

Case Study

Podcasts

Awards

About

Now two years on from the start of the pandemic, the UK is facing new uncertainties around the war in Ukraine impacting energy prices and the rate of inflation. Looking at the latest reports for April, CrowdProperty reports on what this will mean for the sector going forward.

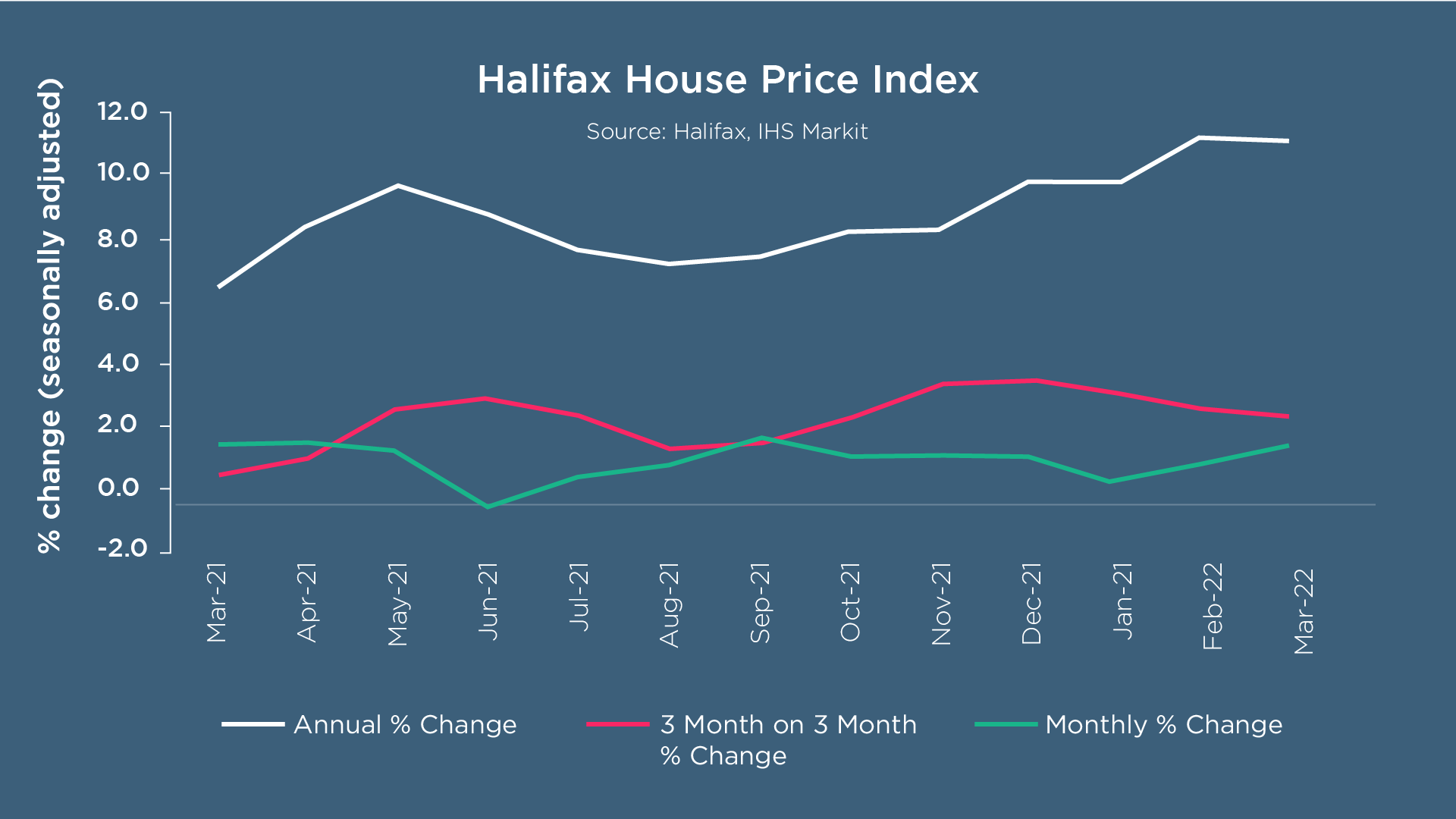

Halifax has reported that the average UK house price has increased by 1.4% this month (£3,860) which is the 9th consecutive month - the biggest jump since September. On average, the price of houses continues to be at +11% which is around its highest level since mid- 2007. The average house price is now £282,753 which is an addition of £28,113 compared to last year which is not far off the average UK earnings. In nominal terms, average house prices are 41.6% above the 2007 peak but in real (inflation adjusted) terms, this is 8.4% below the 2007 peak, according to the Nationwide House Price Index latest release covering the market to the end of March 2022.

The causation of this nominal price growth trend remains the same – limited supply and strong demand. Although this month Halifax has noted that they have seen more homes coming to the market, but nothing of any substantial impact to alter the trends we have seen so far. Russell Galley, Managing Director at Halifax summarised as “too many buyers are chasing too few properties.”

Reflecting on the two years since the pandemic, the housing market has proven far more resilient than was originally anticipated. Since March 2020, the average house price has risen by 18.2% over that period (£43,577) going from an average of £239,176 in March 2020 to £282,753 in March 2022.

The pandemic had shifted buyer demand placing a premium on those properties with greater space, both indoor and outdoor. Flats have increased by 10.6% or £15,404 over the last two years in comparison to the price of detached houses which has increased by 21.8% or £77,717.

Differing from last month’s report, the South West has overtaken Wales as the strongest performing region in the UK, hitting a new record of 14.6% annual growth rate. Wales is closely second with a rate of 14.1%. Alongside these new records, buyers are dealing with higher interest rates, which in combination with a higher cost of living is expected to slow down house price inflation over the next year.

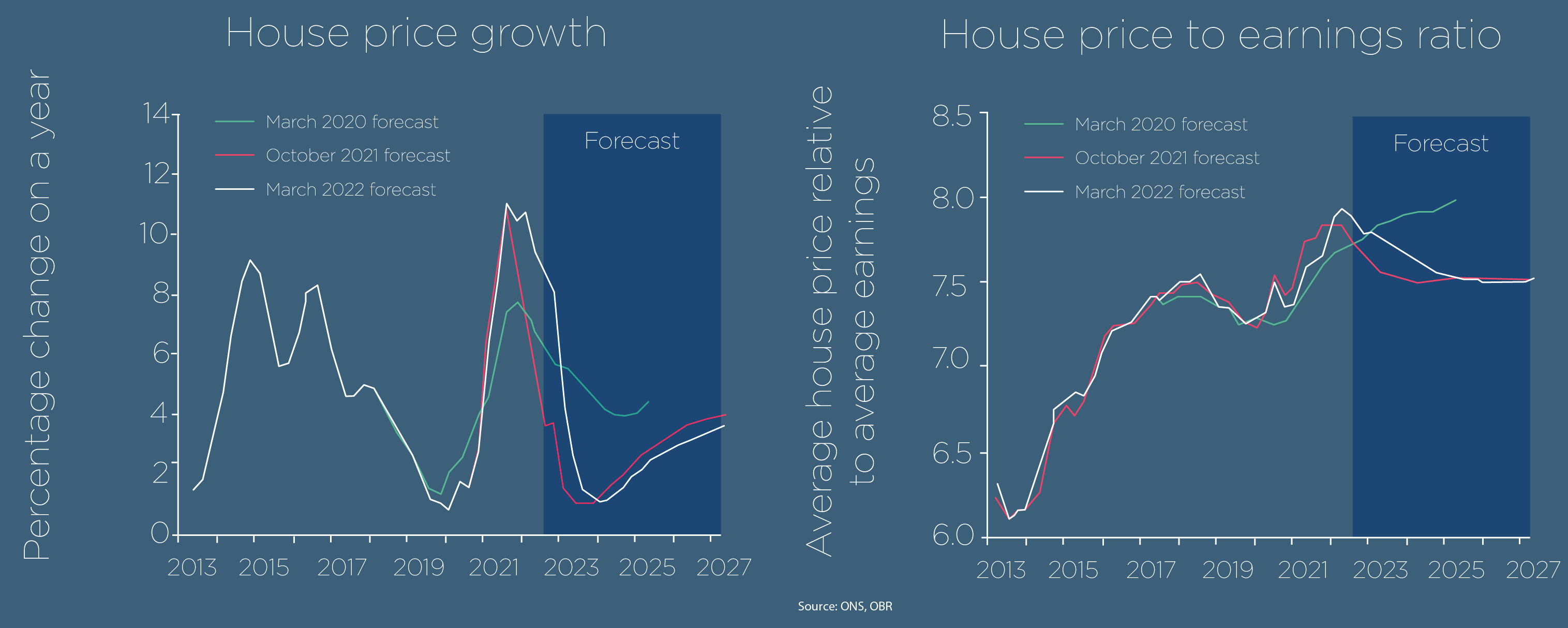

In Chancellor Rishi Sunak’s Spring Statement, measures have been put in place to reduce a hike in National Insurance contributions as well as cuts to fuel duties. However, Zoopla has commented that these savings will be small and will do little to offset the rising cost of living. It has now been said that a large majority of those looking to get onto the property ladder will stay put in their existing homes due to the rising cost of mortgages which in turn will increase the demand for rental properties. In response to the Spring Statement and the economic headwinds, The Office for Budget Responsibility expects the annual rise in house prices will fall from 10% to 1% by 2023.

Russell Galley commented: “in the long-term, we know the performance of the housing market remains inextricably linked to the health of the wider economy. There is no doubt that households face a significant squeeze on real earnings, and the difficulty for policy-makers in needing to support the economy yet contain inflation is now even more acute because of the impact of the war in Ukraine.”

Looking at the wider economy, Silvia Rindone, EY UK&I Retail Lead has called this a period of a “new mindful consumer” with the latest EY ITEM Club Consumer Index reporting that consumerism is shifting as shoppers look to ‘buy less and do more’ - 40% of survey respondents say they are now spending more on experiences. From this, it has been reported that consumers are prioritising sustainability with ‘Planet First’ being the largest identified segment within the consumer index.

Secondly, affordability remains key to purchasing decisions as households are experiencing less disposable income. Consequently, in EY ITEM Club’s special Interim Forecast, the 2022 UK GDP growth forecast has been downgraded amid the diminishing consumer confidence due to rising commodity and energy costs. The latest predictions are now 4.2% down from 4.9% meaning that the forecasted GDP growth for 2023 is 1.9%.

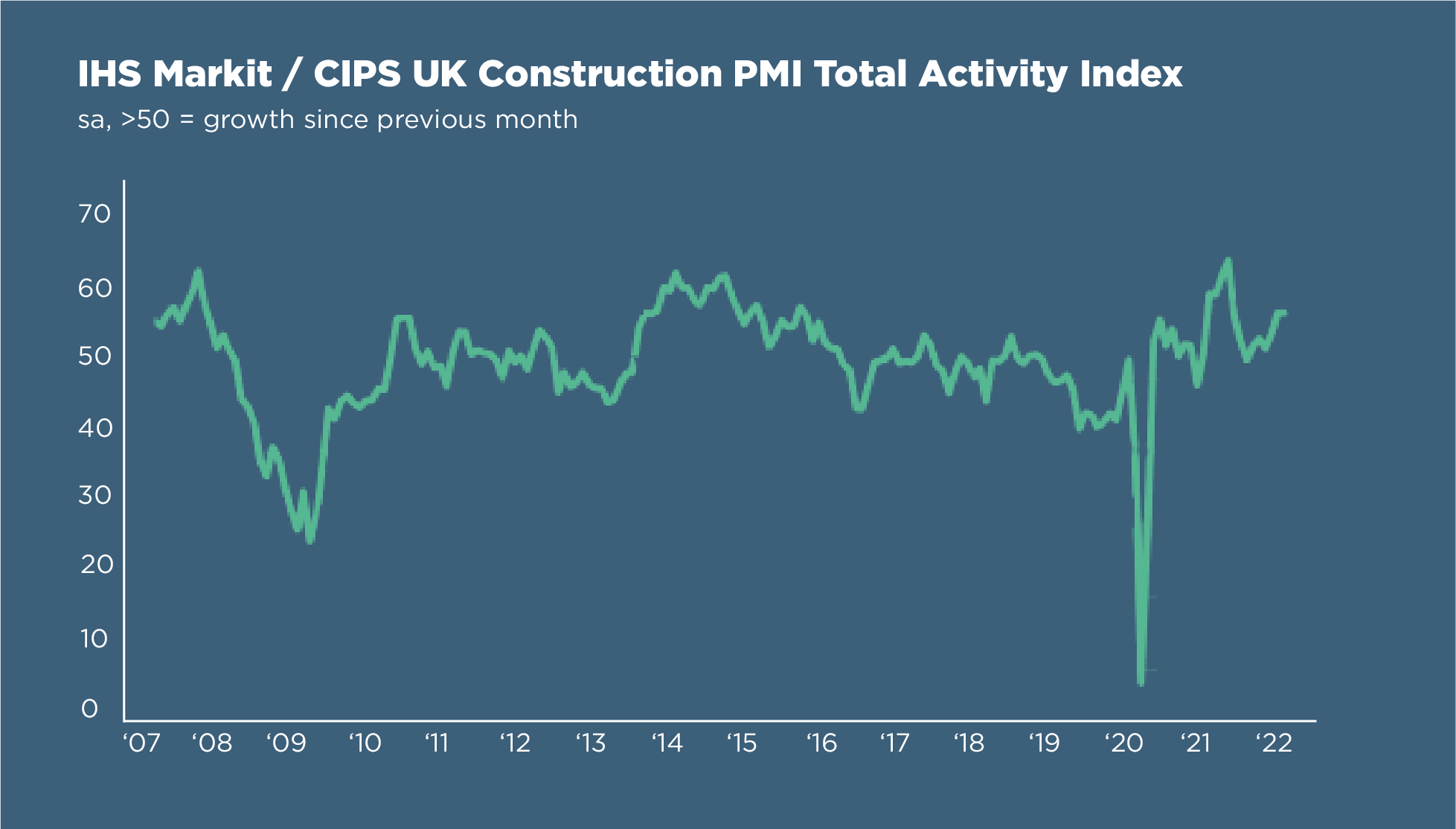

IHS Markit has noted that the construction output has continued to rise. However, business optimism has dropped to the weakest since October 2020 as a result of the concerns surrounding the war in Ukraine and inflationary pressures. Construction companies have said that there has been resilient customer demand despite the economic uncertainty. Yet again this month’s new orders outperformed the previous meaning output has increased every month since August 2021. The headline S&P Global / CIPS UK Construction Purchasing Managers’ Index ® (PMI ®) registered 59.1 in March, unchanged from February and well above the 50.0 mark that separates expansion from contraction.

Reflecting this strong demand, input buying rose at the steepest pace since July in an effort to accumulate stock. This effort is also in response to capacity restraints, a lack of haulage availability and ongoing logistics difficulties. These obstacles, as well as the widespread issue of the cost of fuel, have created an acceleration in input prices. In addition, Duncan Brock, Group Director at the Chartered Institute of Procurement and Supply commented that: “Construction companies are braced for more disruption on the horizon as a result of the Ukraine conflict…With these severe challenges, it is no surprise that business optimism for the months ahead has been affected and fell to levels last seen in October 2020. The sector is facing several roadblocks.”

The economic and geopolitical uncertainty has meant that diminished optimism is widespread across many sectors. This is why in these times of economic pressure, property finance by property people makes so much sense – at CrowdProperty we work closely and productively with the developers we back, tackling market, site and situational challenges together in partnership. Having been developers ourselves, we are laser-focused on solving the pains of small and medium-sized developers, which is why working with CrowdProperty increases the likelihood of the success of projects.

CrowdProperty is a leading specialist development finance lender, having funded over £450m worth of property projects. Apply in just 5 minutes at www.crowdproperty.com/apply and our passionate property experts will share their insights and initial funding terms for your project within 24 hours.

As featured in...