Borrow

Case Study

Podcasts

Awards

About

With the majority of the UK currently under lockdown or enhanced restrictions, the prime minister has clearly stated that the building and construction industry should continue to operate. We review the latest market commentary on what this means for the sector and the economy as a whole.

On 2 November, Boris Johnson told MPs that he had "no alternative" but to enforce a new national lockdown in England in an attempt to control the impact of coronavirus. Whilst reassuring his critics that these measures are necessary and "time-limited", many businesses expressed concerns over the economic consequences - understandably so, as UK GDP plunged 19.8% in the second quarter and is likely to perform worse in 2020 than in any year for more than a century.

According to the Financial Times, the swift implementation of these lockdown measures - earlier in the upswing of Covid-19 than in March - is likely to cause less economic pain than earlier in the year. Economists think the effects will be serious but far less damaging than in the first wave — or than if nothing was done to tame the virus.

With restrictions due to end in December, the expectation is that consumers are more likely to postpone rather than cancel spending plans. This more positive outlook is thanks in part to the extension of the Coronavirus Job Retention Scheme (CJRS) which will now run until the end of March 2021, as well as increased support for the self-employed through the Self-Employment Income Support Scheme (SEISS) and the extension of government loan schemes for businesses to the end of January 2021.

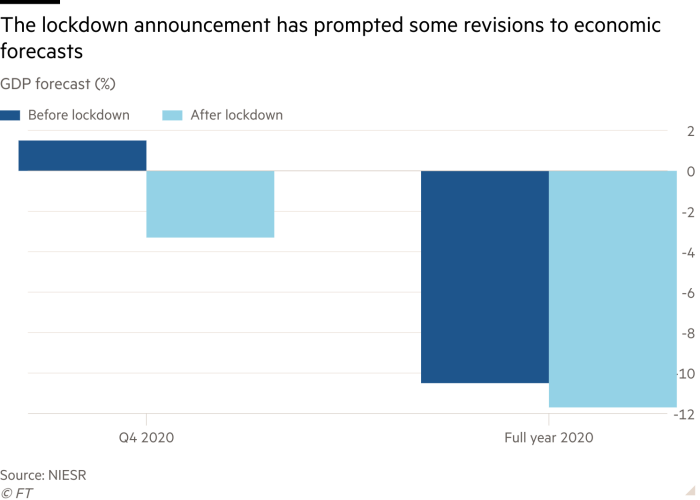

The National Institute of Economic and Social Research forecast a 3.3% hit to GDP in the fourth quarter - relatively good news compared to the much larger drop in Q2 2020 - and figures from the EY ITEM Club in mid-October expected the economy to contract 10.1% in 2020, an improvement from the 11.5% contraction forecast in the summer. However, Chief Economic Advisor to the EY Item Club Dr. Howard Archer urges caution in this volatile environment as failing to achieve an FTA with the EU poses a significant risk and, despite government intervention, "many of the factors that supported the pick-up in growth in Q3 are now beginning to fade, notably the release of pent up demand".

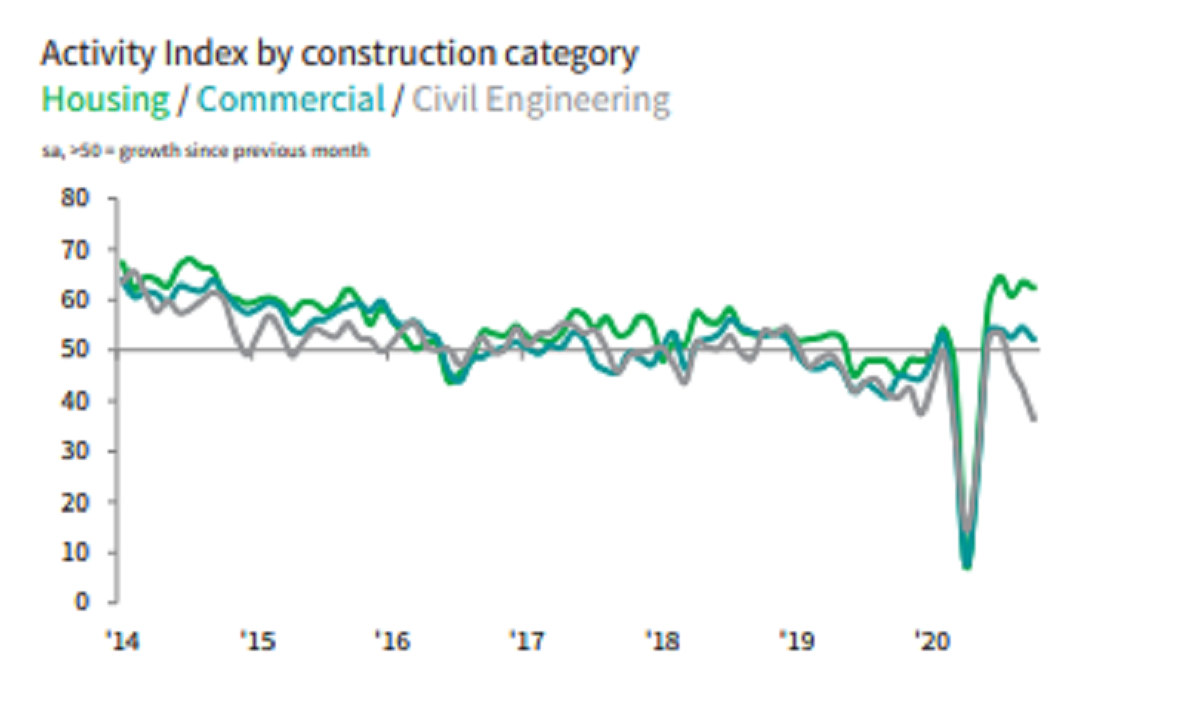

The government has actively supported sectors such as construction, education and manufacturing during the pandemic in an effort to maintain economic stability. Indeed, according to The Guardian, the construction sector is one of the few bright spots in the UK economy as home builders pushed ahead with new projects during October. However, construction industry managers are warning that the backlog of work that kept many workers in full-time employment during the summer is beginning to wane. The IHS Markit/CIPS UK Construction Total Activity Index fell to 53.1 last month, from 56.8 in September - although any number above 50 signals growth, so the industry is still performing well having registered above 50 in each month since June. The fall in the latest figures is attributed to the contraction in civil engineering and a dip in growth in commercial office building - the outlook for residential home builders remained positive, with house building the strongest performing area with a reading of 62.4.

Duncan Brock, CIPS' Group Director, commented: “The strength of the pipeline of new work especially from a robust housing market means the sector is moving in the right direction and hopeful of getting through the winter unscathed.”

With the housing market to remain open for business despite the latest restrictions, Gráinne Gilmore, Zoopla's Head of Research, expects sales progression to continue as most agents, conveyancers and mortgage lenders are well prepared to work remotely if necessary. This should please sellers as high buyer demand continues to push up house prices, with Zoopla's House Price Index reporting a two-and-a-half year high of 3% growth in September; the latest Halifax House Price Index also noted the annual rate of change, with the increase of 7.3% the strongest since mid-2016.

The September RICS Residential Market Survey results also show housing market activity continuing to advance at a strong pace, with increases in both demand and supply leading respondents to expect the upturn in sales to continue over the coming three months. As mentioned in our previous update, annual house price growth continues to be strongest in the north of England with Nottingham, Manchester and Leeds registering growth of 5.1%, 4.6% and 4.5% respectively. Both Zoopla and Halifax report exceptionally strong regional house price growth in the North East, East Anglia and Yorkshire & Humber where the increase in supply has been slower.

.jpeg)

.jpeg)

According to Zoopla, the number of homes for sale at a national level is 18% higher than this time last year - although RICS notes that stock levels remain relatively low in a historical context. Much of this sales inventory is at higher average asking prices than a year ago and buyer appetite is expected to moderate due to market seasonality.

Richard Donnell, Research and Insight Director at Zoopla, noted: "The strength of the market nationally is masking weakness in parts of the market where sales are slowing in areas where households are typically on lower incomes and more sensitive to economic uncertainty and more restricted credit availability.

This market polarisation is set to become a growing feature of the market as we move into 2021.”

CrowdProperty's continued exceptional performance has seen the business consistently rank in the Top 10 in Europe for lending volumes for the past six months. We are raising finance for quality projects that are ready and able to proceed with clear exit plans in liquid markets, with a quantum of units that is immaterial to proven demand levels, at mainstream price points throughout the UK. Empowering the multitude of SME property development businesses which are key to delivering 'build, build, build', CrowdProperty is tackling the fundamental barriers behind declining SME developer housing output, unlocking the much needed delivering of new homes and spend in the UK economy.

The business has now lent over £100,000,000 to SME property professionals, funding the development of more than 1,100 homes worth £200,000,000, enabling over £80m of spend on labour, materials and services in the UK economy. Our strong pipeline of quality projects by quality professionals continues to grow, even as our criteria become even tighter during these unprecedented times.

As featured in...