Borrow

Case Study

Podcasts

Awards

About

The heightened confidence in the property market from July has shown no signs of slowing, but how long will the boom last? In this update, we share some highlights of the latest industry news and views.

According to Zoopla’s latest House Price Index report, the post-lockdown housing market rebound shows few signs of slowing despite the UK going into recession. It appears that the lockdown has encouraged buyers to re-evaluate what they want from a home and created pent-up demand - in combination with the stamp duty holiday, this has resulted in the strongest housing market activity since 2015: the number of new sales agreed on Zoopla in August is 76% ahead of the 5-year average, with buyer appetite now 34% higher compared to 2019 and the supply of homes up 50% on this time last year.

This upswing in activity is seconded by Rightmove, whose data analysts have calculated that more homes are now selling within a week than at any point over the past decade - 1 in 7 properties were sold within a week of being listed on the site, with just under one-third selling within two weeks of listing.

There is further good news for sellers as the Nationwide House Price Index revealed that house prices reached an all-time high in August - a 2% month-on-month rise (after taking account of seasonal effects) which is the highest monthly rise since February 2004. As a result, annual house price growth accelerated to 3.7%. "The bounce back in prices reflects the unexpectedly rapid recovery in housing market activity since the easing of lockdown restrictions," said Robert Gardner, Nationwide's Chief Economist.

As widely reported, buyers' attitudes have changed in light of Covid-19: research by Savills shows that 74% of survey respondents have reconsidered their work-life balance as a result of the pandemic. With 38% of respondents significantly more inclined to work from home, the demand for properties which can offer more indoor space (potentially to accommodate a home office) has risen. With 62% of respondents considering a garden or outdoor space to be more important, it is no surprise that the interest in rural living is also increasing. While activity in London initially lagged due to this focus on outdoor space and greenery, Knight Frank reports that the capital has come back strongly over the summer with the number of offers accepted in London hitting an all-time high last month.

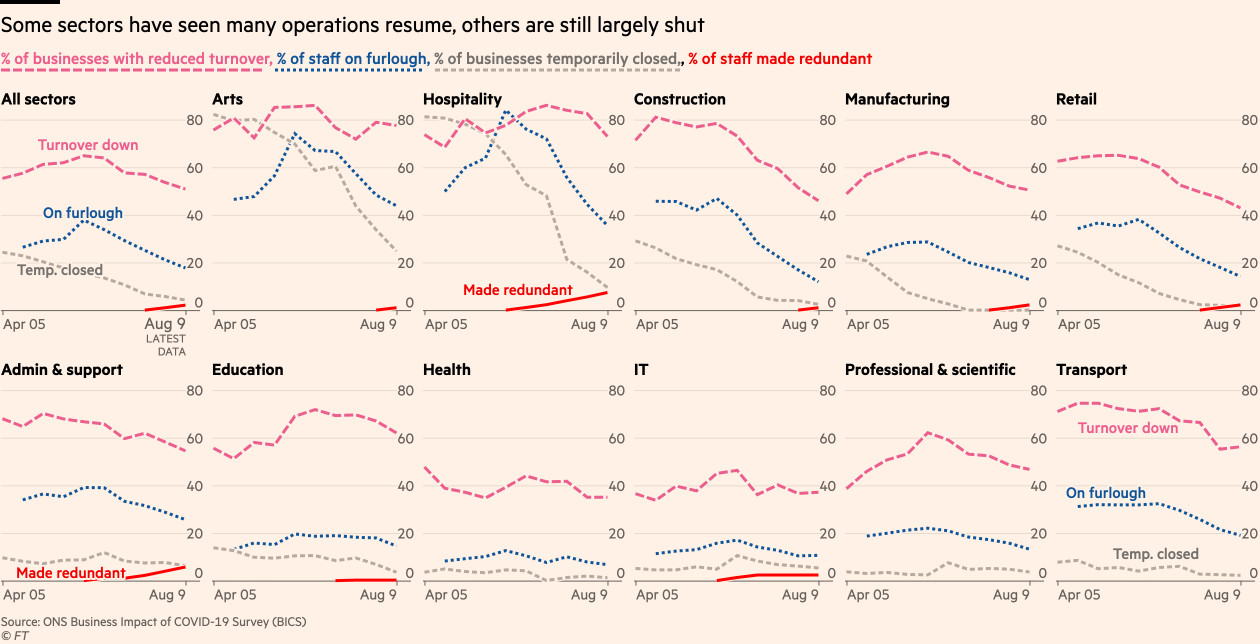

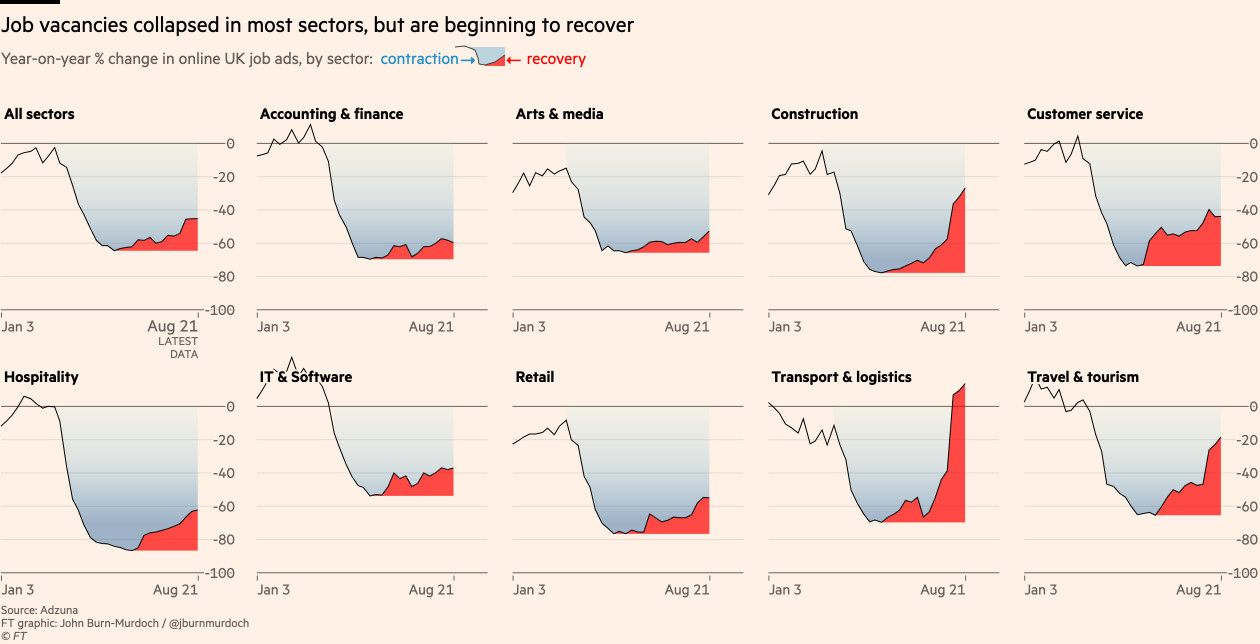

According to the Financial Times, "UK economic activity improved over the summer months as coronavirus restrictions eased and government support measures underpinned consumer spending". Experimental statistics from the publication's UK economic recovery tracker show positive indications for the construction sector - the percentage of construction businesses with reduced turnover, staff on furlough or temporarily closed has decreased, accompanied by a boost in hiring as shown by the charts below:

Capital Economics proposed that the UK could see a c. 5% boost to GDP as schools reopen this week, enabling the education sector to return to normal and parents who were providing childcare to return to work. However, the UK Economic Sentiment Indicator suggests that the economic recovery may be starting to dwindle.

Howard Archer, EY ITEM Club's Chief Economic Advisor, also commented that "the current pick-up in activity... will prove unsustainable due to challenging fundamentals for consumers" with the housing market "likely to come under pressure over the final months of 2020 when there is likely to be a significant rise in unemployment as the furlough scheme draws to a close in October". Despite this, the EY ITEM Club anticipates "housing market activity to gradually improve from early-2021 as the labour market stabilises then starts to improve and the UK’s economic recovery continues".

CrowdProperty's continued exceptional performance during Covid-19 has seen the business consistently rank in the Top 10 in Europe for lending volumes for the past four months. We are funding projects as quickly and reliably as ever - since lockdown, our platform has seen 48 projects funded in 44 seconds on average. We recognise this can be frustrating for those who miss out and we do target longer funding times to cater for everyone who might not be available at 10am, but we will only list carefully curated, quality lending opportunities, which we evaluate, secure and monitor with decades of expertise in order to protect our investors’ funds. Our strong pipeline of quality projects by quality professionals continues to grow, even as our criteria become even tighter during these unprecedented times.

As featured in...