Borrow

Case Study

Podcasts

Awards

About

Despite inflation rising and the prospect of further interest rate increases, the property market appears to be largely unaffected with continued price growth and persistent demand – but can this last? In this article, CrowdProperty reviews the latest market activity and predictions for the future of the sector.

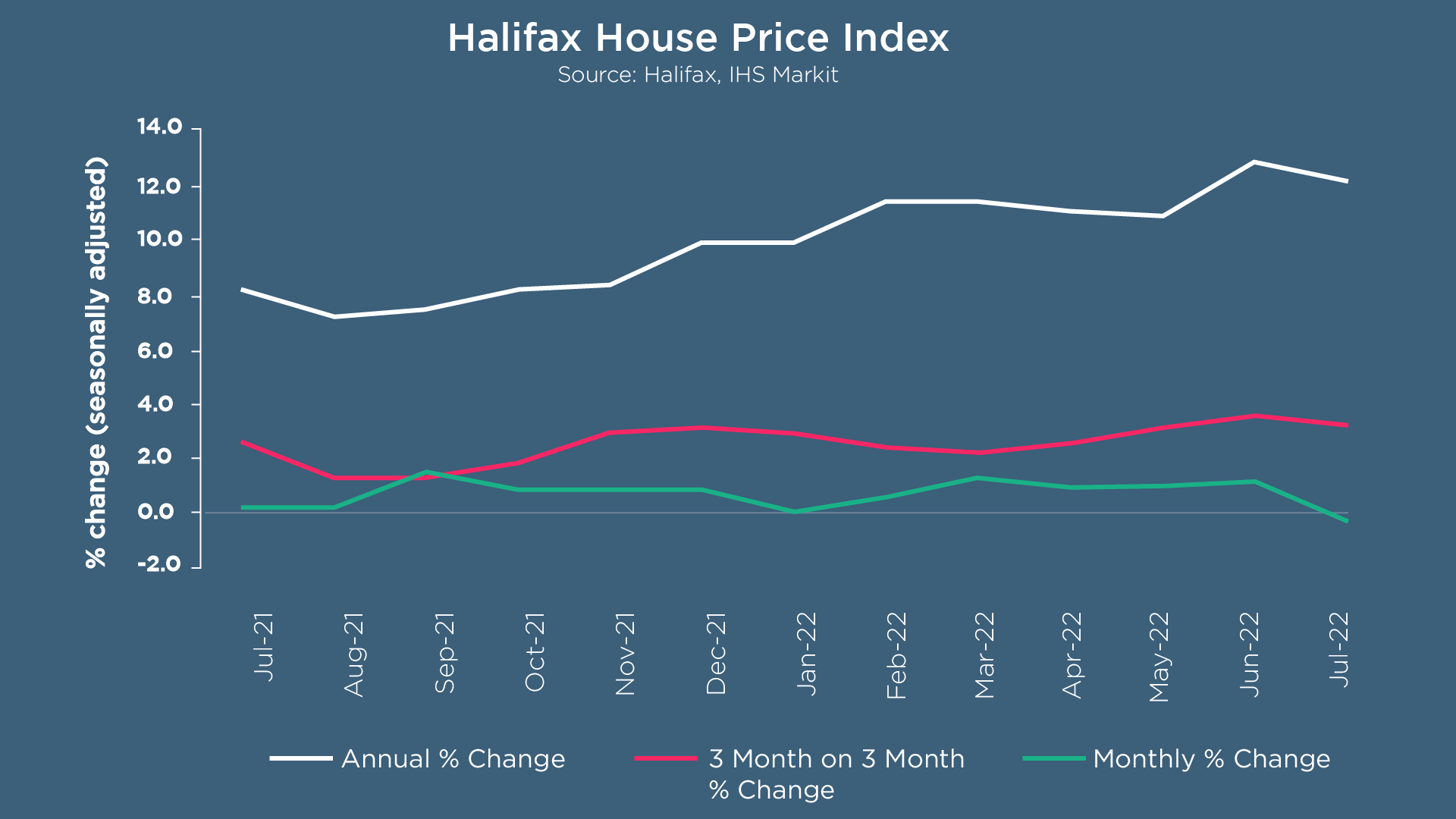

According to the latest UK House Price Index from the Office for National Statistics, UK average house prices increased by 7.8% over the year to June 2022. Indeed, this led City AM to claim that UK house prices and rents have defied inflation – with private rental rates growing by an average of 3.2% over 12 months, peaking at 4.3% in the East Midlands – despite this figure being less than the 12.8% growth reported in May.

Earlier in the month, Halifax reported that the average house price had fallen slightly to £293,221 which signified the first decrease since June 2021.

A slowdown in annual house price growth has been expected for some time according to Russell Galley, Managing Director at Halifax, with house prices likely to come under more pressure over the course of this year due to the rising cost of borrowing and decreasing consumer spending power. This opinion is widely shared by many market commentators, with Nick Leeming, chairman of Jackson-Stops, adding that “the Autumnal months will provide the market with a clearer indication of how buyers will respond to an increasingly uncertain financial environment.” Rightmove has a slightly different outlook, claiming that the recent drop in house prices has more to do with seasonality than the economy: this first price fall of 1.3% is on a par with the average August drop over the past 10 years, combined with distracted sellers putting their moves on hold to enjoy holidays without travel restrictions and more focused sellers offering favourable pricing to attract buyers quickly, possibly with a view to moving before Christmas bearing in mind the current average of 136 days to complete a sale. Tim Bannister, Director of Property Science at Rightmove, comments that “a drop in asking prices is to be expected this month, as the market returns towards normal seasonal patterns after a frenzied two years… Sellers who want or need to move quickly at this time of year tend to price competitively in order to find a suitable buyer fast.”

The mismatch between supply and demand remains the biggest factor influencing house prices, with Halifax MD Russell Galley stating “the drivers of the buoyant market we’ve seen over recent years, still remain evident… the extremely short supply of homes for sale is also a significant long-term challenge but serves to underpin high property prices.” Price gains for larger houses are significantly higher than for smaller homes, with the price of a detached house rising by £60,860 (+15.1%) over the last year compared to £11,962 (+7.7%) for flats. According to Zoopla, three bedroom houses have been the most in-demand properties in the last three months accounting for 44% of all enquiries on the platform – a legacy of the ‘search for space’ boosted by the pandemic.

Rightmove also claims the imbalance will prevent major price falls this year: despite the 12% increase in new listings coming to market compared with the same period last year, this is 6% lower than in 2019 and the number of available homes for sale is also 39% lower than in 2019. Buyer demand this month is 4% lower than in 2021 – in theory providing buyers with more choice – however, the figures are still 20% higher than in 2019.

Despite the attention-grabbing headlines, current prices are still 10% below the 2007/2008 peak and the same as 2004 levels (adjusting for inflation). Key factors suggest that there’s unlikely to be a major market correction as historically these are related to steep rises in unemployment, which is at its lowest rate for 50 years alongside the number of job vacancies being close to record highs according to Nationwide. Households also have a far greater savings buffer today to mitigate transitory inflation, due in part to extra funds saved during the pandemic. Additionally, the impact of interest rate rises will also be slower as there is a far higher proportion of homeowners without mortgages – according to Zoopla, half of all homeowners have a mortgage and 90% of these are on fixed rate deals for up to 5 years.

Although property prices looking set to remain high, UK property transactions saw significant annual growth of 32.9% in July according to HMRC – although this figure should be treated with caution as the rush to complete transactions ahead of the stamp duty holiday ending in June 2021 resulted in lower than usual transaction amounts taking place in July 2021. The number of residential transactions was still up by 7.2% compared to June 2022, with the stronger levels of activity being caused by buyers looking to lock in lower costs of mortgage debt as inflation impacts on mortgage rates according to Lawrence Bowles, Director of Research at Savills.

Nationwide notes that first time buyer mortgage completions have remained resilient despite growing affordability pressures and are now c. 5% above pre-pandemic levels – however, average monthly mortgage payments for new first-time buyers putting down a 10% deposit have now exceeded £1,000 for the first time, an increase of 27% compared to the start of the year. Cash transactions account for c. 35% of activity, which is partly a reflection of an ageing population in which more people own their homes outright although properties purchased for investment are also an important part of this market. Buy to let purchases involving a mortgage also remain higher than pre-pandemic levels – according to Robert Gardner, Chief Economist at Nationwide, “rental demand remains strong, with upward pressure on rents, which may be encouraging landlords to enter the market, particularly if they view property as a hedge against inflation.”

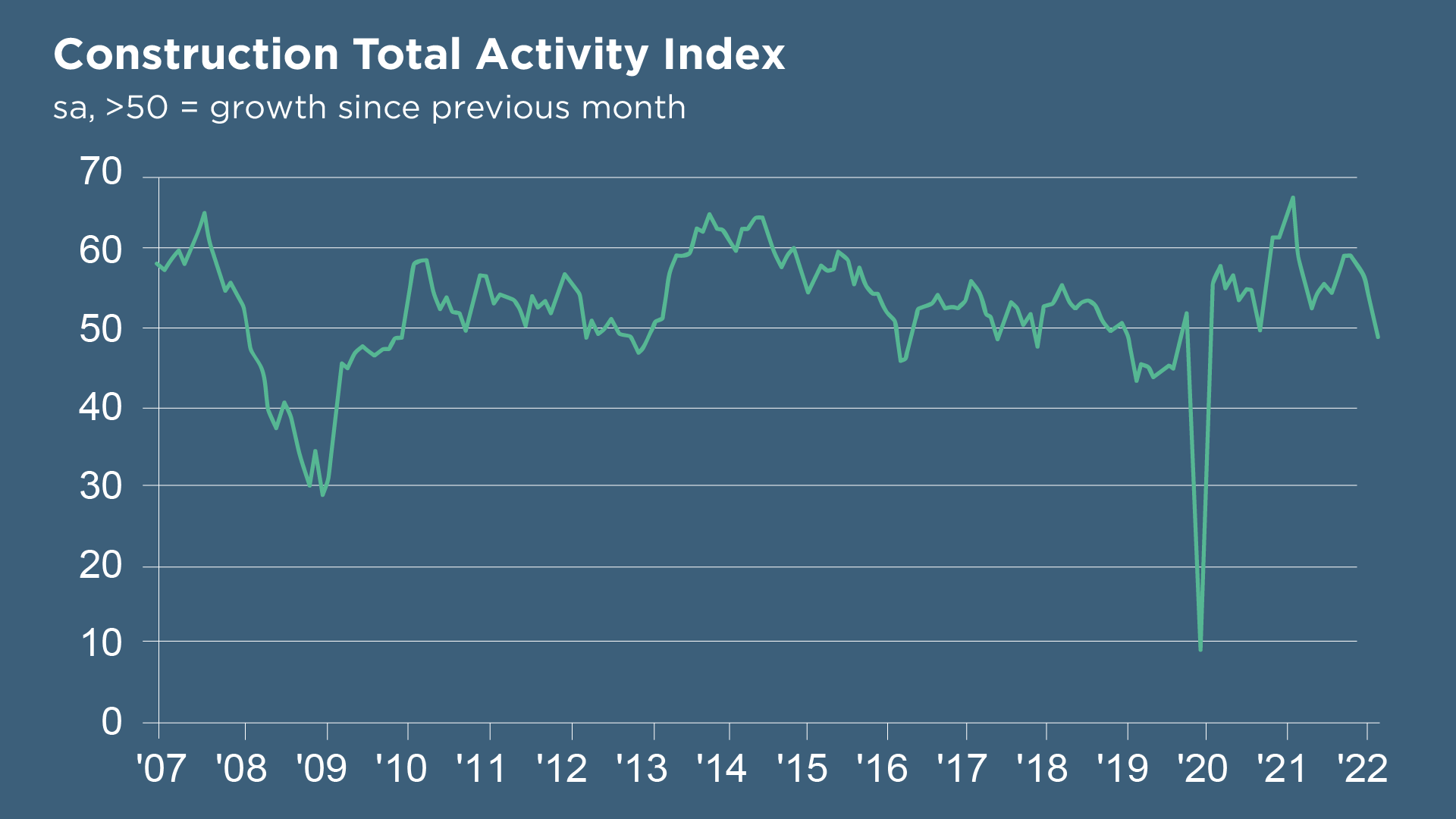

While moderately high house prices can drive more construction in the medium term in order to moderate the supply/demand balance and keep the market less volatile, the latest S&P Global / CIPS UK Construction PMI reports that house building declined for the second month running (index at 49.4). This comes in the same month that the headline seasonally adjusted Construction PMI index posted at 48.9, down from 52.6 in June and below the 50.0 no-change threshold for the first time since January 2021. Duncan Brock, Group Director at CIPS, commented: “This disappointing result was felt across all the sectors, including housing which had demonstrated more resilience over the last couple of years… Job creation was healthy to complete work in hand but the danger remains that should the UK economy turn unfavourable, this will affect job hiring and the development of key skills.” Data from The Office for National Statistics (ONS) shows that there are 244,000 fewer workers in the construction sector compared to 2018 due to workers retiring early or returning to the EU. This shortage is particularly concerning for SME builders as it takes a minimum of three years to train up a skilled tradesperson.

Purchase price inflation indexed at 78.1, down from 85.8 in June, with construction firms noting the easing in commodity prices (especially metals and timber) partially offsetting the rising business spend on higher energy, fuel and transport costs. As mentioned in our blog on The Rising Cost of Materials, prices for timber and joinery materials rose up to 50% and metal products such as Fabricated Structural Steel rose over 60% between 2020 and 2021 so this should be welcome news for those currently undertaking projects. However, the Construction Leadership Council (CLC) notes that whilst very high levels of inflation exacerbated by the Ukraine conflict have stabilised, the softening demand which has led price inflation to moderate for some products is unlikely to result in lower project costs in the short term. In fact, “the general view is that inflation will persist at a lower level across most product categories for the rest of the year.” Although inflation remains front page news, the US lumber futures market (a major lead indicator of construction material inflation) shows that prices are well down from the highs of earlier in the year:

Access to raw materials has also improved, with S&P Global / CIPS reporting supplier delays were the least widespread since the pandemic began. However, imported items continue to be the biggest area of concern, especially those from China and mainland Europe. The CLC supports this finding, noting that some major merchants suggest only 25% of goods from the Far East arrive on time, and advises developers to work closely with their supply chains and communicate requirements early. Our Property Team also has some recommendations for ways to protect projects from material cost inflation, including diversifying sources of supply, regularly reviewing the building schedule and remediating the cost plan as necessary; and factoring in a healthy contingency.

These times of economic uncertainty mean that it’s even more important to have a lender that intimately understands the intricacies of the market. At CrowdProperty, we work closely and productively with the developers we back - tackling market, site and situational challenges together in partnership. Having been developers ourselves, we are laser-focused on solving the pains of small and medium-sized developers, which is why working with CrowdProperty increases the likelihood of the success of projects.

CrowdProperty is a leading specialist property development finance business having funded over £560m worth of property projects to date. Apply in just 5 minutes at www.crowdproperty.com/apply - our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

As featured in...