Borrow

Case Study

Podcasts

Awards

About

Russia’s invasion of Ukraine has abruptly transformed the world. The response to this human tragedy has seen global sanctions imposed on Russia and repercussions of this have directly impacted UK energy markets. Given this, CrowdProperty takes a look at the latest reports on this month’s news and what it will mean for the sector going forward.

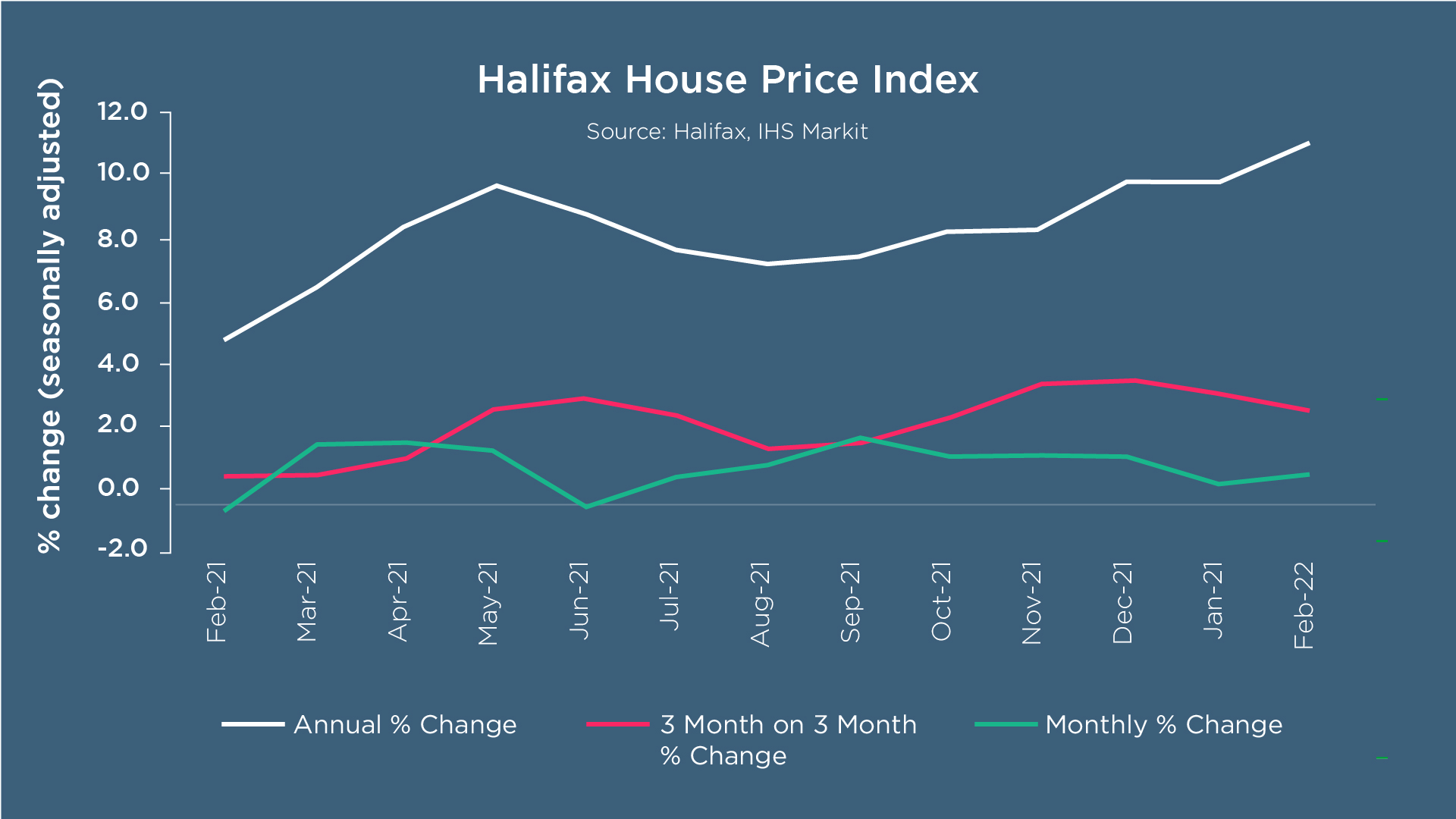

Despite the slow start to the year, the housing market has picked up the pace with average property prices growing by another 0.5% in February - equating to an additional £1,478 in cash terms. The latest figures from Halifax highlight that the average house price is now £278,123, another new record high.

Russell Galley, Managing Director at Halifax, commented that two years since the start of the pandemic, “average property values have now risen by £38,709 (+16%)… Over the last 12 months alone, house prices have gained on average £27,215. This is the biggest one-year cash rise recorded in over 39 years of index history.”

Furthermore, this continuation of price increases means that growth is outstripping earnings - with Nationwide noting that the typical price of a home is now 6.7 times the average earnings in the UK. These rising prices are underpinned by the lack of housing stock, which continues to be a key pain.

Areas that benefit from more rural, scenic living have proven themselves the most desirable locations such as the South West of England, Northern Ireland and Scotland, with Wales remaining the strongest region at an annual growth of 13.8%. The average price of detached properties has risen by £43,251 (+11%) which is more than four times the rate of flats (£10,463, +7%) in cash terms.

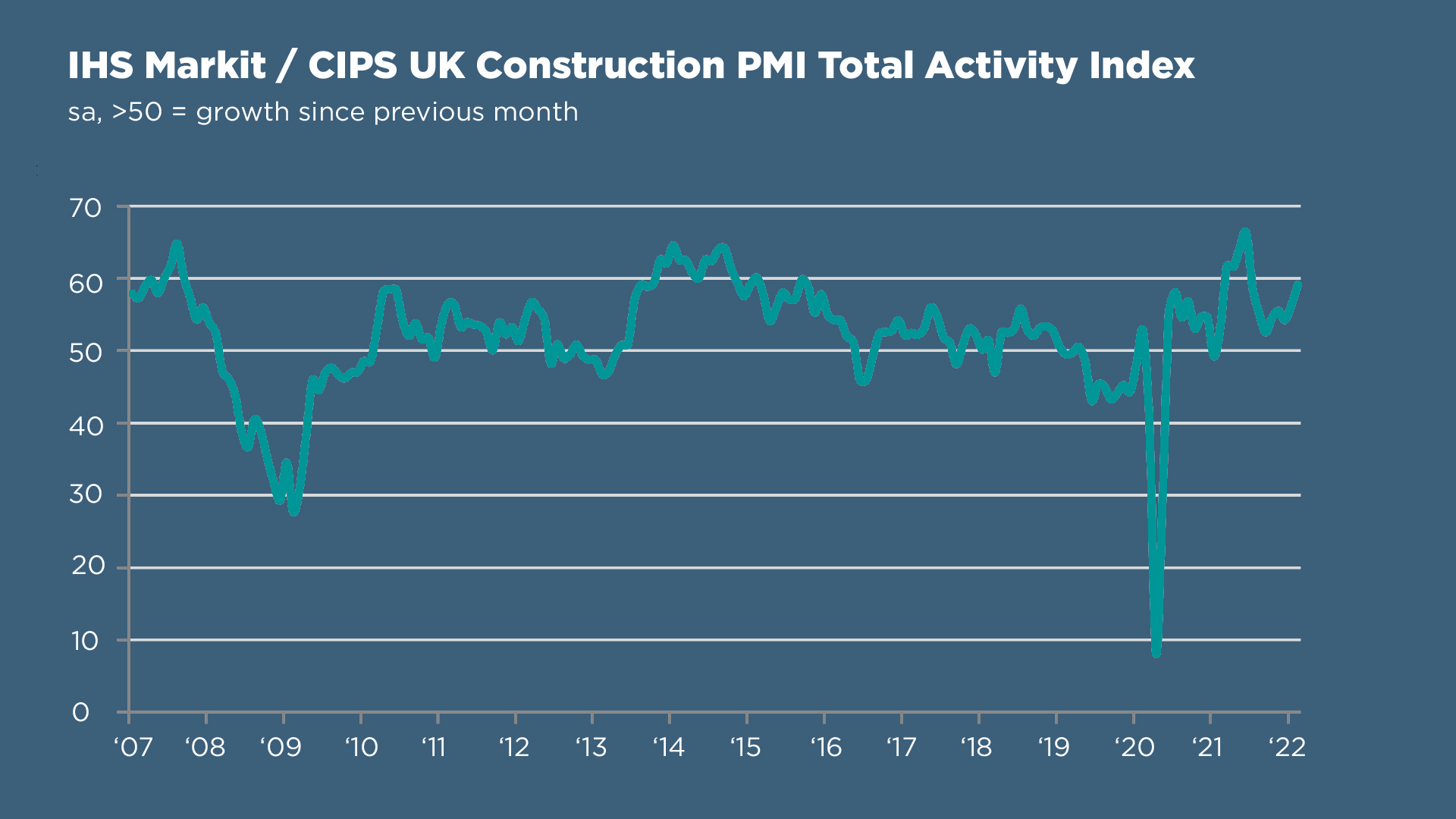

IHS Markit has reported the fastest rise in construction output for 8 months. The headline seasonally adjusted IHS Markit/CIPS UK Construction PMI® Total Activity Index registered 59.1 in February, up from 56.3 in January to signal a robust and accelerated rise in output volume.

Client confidence is growing month on month as economic activity recovers, causing a 4th consecutive month of new order growth acceleration. This strong pipeline of new work has also meant there has been a sharp increase in job creation - now at its 13th consecutive monthly increase.

Similarly, the uptake in new projects has meant that input buying has picked up at the start of 2022 in an attempt to accumulate stock for upcoming projects. Despite there being a spike in demand for materials, the supply pressures are continuing to ease.

It has been noted that the lack of drivers and material shortages has led to 36% of supply chain managers reporting that their stock is taking longer to arrive. Duncan Brock, Group Director at the Chartered Institute of Procurement and Supply, commented that “the highest rise in order books for six months didn’t do enough to improve future optimism as business expectations dropped to January 2021 levels.”

Undoubtedly, the tragedies happening in Ukraine will continue to have repercussions on the global markets. The world economy has seen prices for oil and gas surge as a consequence of the events that have been unfolding over the past few weeks.

These events have exposed the UK to new sources of uncertainty. Since Russia’s invasion of Ukraine on 24th February, unsurprisingly we’ve seen worldwide sanctions imposed on Russia - the UK is among many countries that have banned Russian ships from entering into their ports. The UK has also begun phasing out Russian energy imports which is in turn affecting the price of fuel nationally, with reports of gas prices looking to rise to around £5/therm and a barrel of Brent crude peaking at £90 ($119) earlier this month.

As of last week, diesel has been described as the new oil having now hit prices seen at the peak of 2008. From this, diesel supplies have emerged as a critical factor in production with potentially major consequences for the western economy. For businesses, managing supply chains will require closer attention and planning than has been necessary for the highwater years of the global economy.

The surging prices in fuel have directly impacted inflation rates. As of 17th March, the war in Ukraine is looking to push inflation to around 10%. In response, The Bank of England has raised interest rates to pre-pandemic levels of 0.75%. This is the first time in two decades that the Bank has raised rates at three successive meetings which is partly down to Russia’s invasion forcing a rethink of the forecast. It now stands that more than half (55%) of households expect an interest rate hike within the coming 3 months.

These post-pandemic complexities have caused a need for better economic management. Borrowing costs have started to creep up from all-time lows, leading to a significant weakening of consumer confidence. Russell Galley commented that “these factors are likely to weigh on buyer demand as the year progresses, with market activity likely to return to more normal levels and an easing of house price growth to be expected.”

In these times of economic pressure, property finance by property peoples makes so much sense – at CrowdProperty we work closely and productively with the developers we back, tackling market, site and situational challenges together in partnership. Having been developers ourselves, we are laser-focused on solving the pains of small and medium sized developers, which is why working with CrowdProperty increases the likelihood of success of projects.

CrowdProperty is a leading specialist development finance lender, having funded £430m worth of property projects. Apply in just 5 minutes at www.crowdproperty.com/apply and our passionate property experts will share their insights and initial funding terms for your project within 24 hours.

As featured in...