Borrow

Case Study

Podcasts

Awards

About

The month of June has started to see signs that the housing market boom is fading. The issue of rising prices for both fuel and everyday items persists, which is dampening the outlook for many businesses. In response to the latest commentary, CrowdProperty looks at what this will mean for the sector going forward.

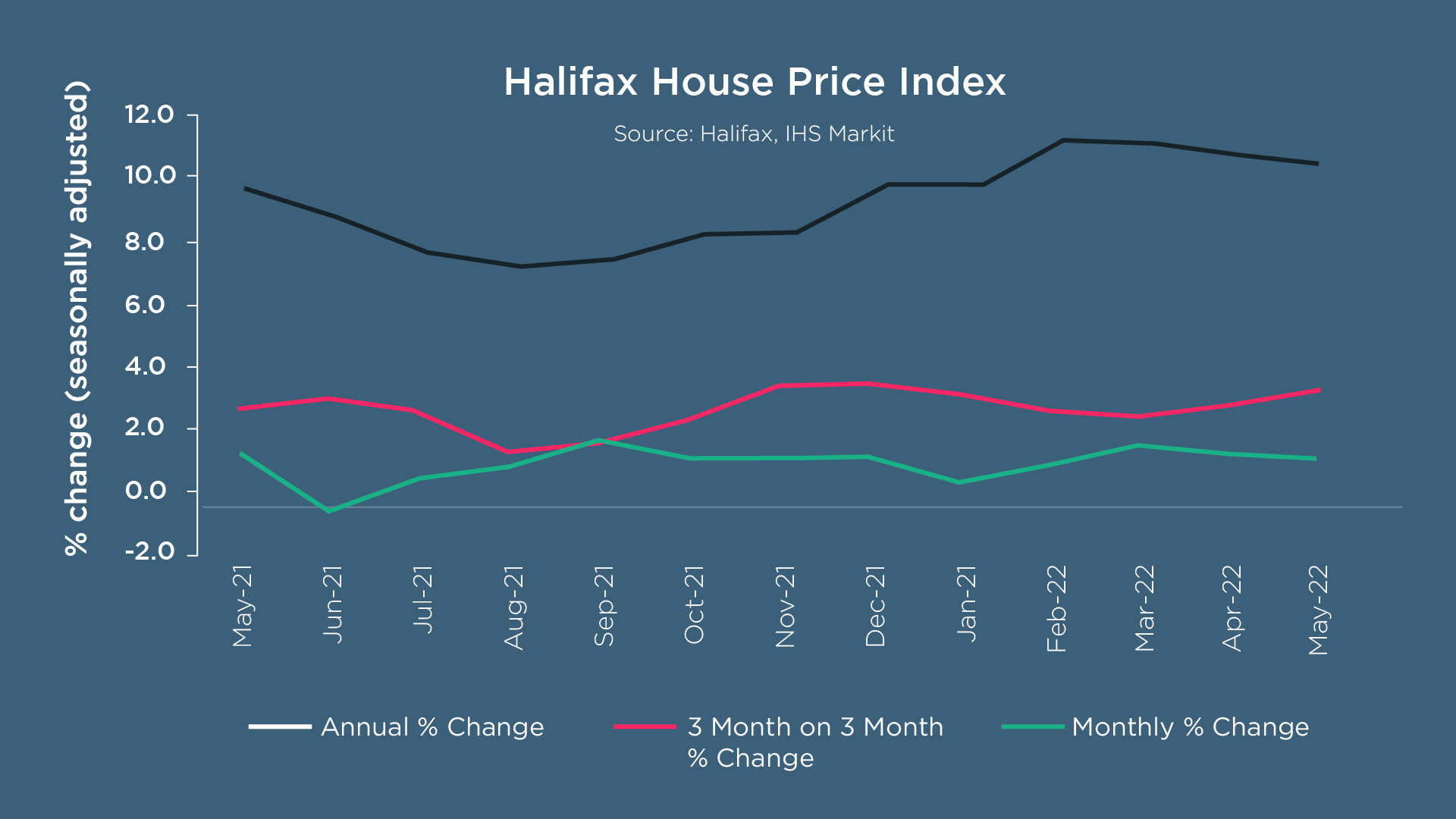

Halifax has reported that the average house price has risen again for the 11th consecutive month. The average house price is now £289,099, a further increase of £2,857 (1%). Russell Galley, Managing Director at Halifax, commented that although this is another rise, “this is the slowest rate of growth seen since the start of the year”.

Over the past decade, the cost of a home has risen on average by 74% (£123,016). The strongest regions have been London (84.2%), followed by the East of England (84.0%) and the East Midlands (82.1%). Comparing this to previous years, London is underperforming. In May 2012, the capital was performing better than anywhere else in the UK with annual house price inflation of 4%, with the next best performers being the South East (2.5%) and East of England (1.7%). These latest figures highlight the effects of the pandemic as people’s priorities have shifted to favour areas with more rural surroundings, causing them to experience competitive inflationary prices.

This month, Northern Ireland was yet again the strongest performing region for annual house price inflation – rising 15.2%, equating to £185,386. The South West of England closely followed with a 14.5% increase and Wales with a 13.7% increase.

For house buyers, the impact of property price inflation is linked to the type of home they are seeking. Compared to May last year, the amount of money required to buy a detached house is now five times more than that required to buy a flat – with buyers now requiring around £10,000 more to purchase a flat, but £50,000 for a detached property. This is becoming ever-more more problematic for first-time buyers as Russell Galley summarises that “the rungs on the housing ladder have become increasingly wider”.

Whilst it is not a ‘one-size fits all’ when it comes to the effects for first-time buyers, the latest reports have been speculating what the impact is on this group of buyers. Since the start of the year, the Bank of England has raised their interest rates five times - rising from 0.1% to 1.25%. Property Reporter states that the effects on repayments will be dependent on what type of mortgage buyers have and whether mortgages will be affected by the Bank of England’s base rate changes. It’s now even more important that research is done so buyers are able to put themselves in a more favourable position when trying to get on the property ladder. However, Halifax has reported that the market is beginning to cool, as the overall buyer demand is down compared to last year, which will work in the favour of first-time buyers.

The balance of supply and demand in the market continues to shift: Zoopla notes that the number of potential buyers is currently 61% higher than the five-year average, while the level of homes for sale is 37% lower than normal - however, the number of properties being put up for sale is beginning to increase with new listings in the four weeks to 22 May being 7% higher than the five-year average. Similarly, Rightmove claims that the number of sales agreed is up by 12% in the year to date compared to 2019 even with restricted choice, though down 17% compared to the exceptional market of the same period last year.

The rental market is also experiencing strains. With demand outstripping supply, Property Reporter has revealed this month that average rent in the UK has hit a new high of £1,103 pcm, up 10.6% from the same time last year, with more extreme figures reported in cities such as London. It should however always be remembered that growth rates say as much about today’s market as last year’s market.

These latest figures show that 31% of the rental market is now classed as ‘unaffordable.’ The Office for National Statistics defines a rental property as affordable provided the cost of renting doesn’t exceed 30% of the household's income. Across England and Wales, the average annual rent is £12,763 with the average annual household income being £43,341. Therefore, rent accounts for 29% of the average household income which is pushing the boundaries of affordability within the sector. Elsewhere, in regions such as the East, South East, and South West of England, rent equates to 30% of household income and London rents consume roughly 40% of income, with an average annual bill of £21,439.

Heightened economic uncertainty continues to impact consumer spending. The Office for National Statistics reports that looking at retail output figures in the three months to April 2022, sales volumes fell by 0.3% when compared with the previous three months - continuing the downward trend since summer 2021. Affordability concerns will be weighing on the mind of consumers, in particular potential house buyers, as people grapple with escalating costs for everyday items. This includes the rising price of fuel which is a huge burden to many consumers. EY ITEM Club has revealed that in response to this, 49% of all UK car buyers are now considering electric vehicles - an increase of 28% since the start of the pandemic. Overall, it is looking likely that households will refrain from making larger purchases until the UK economy shows more resilience.

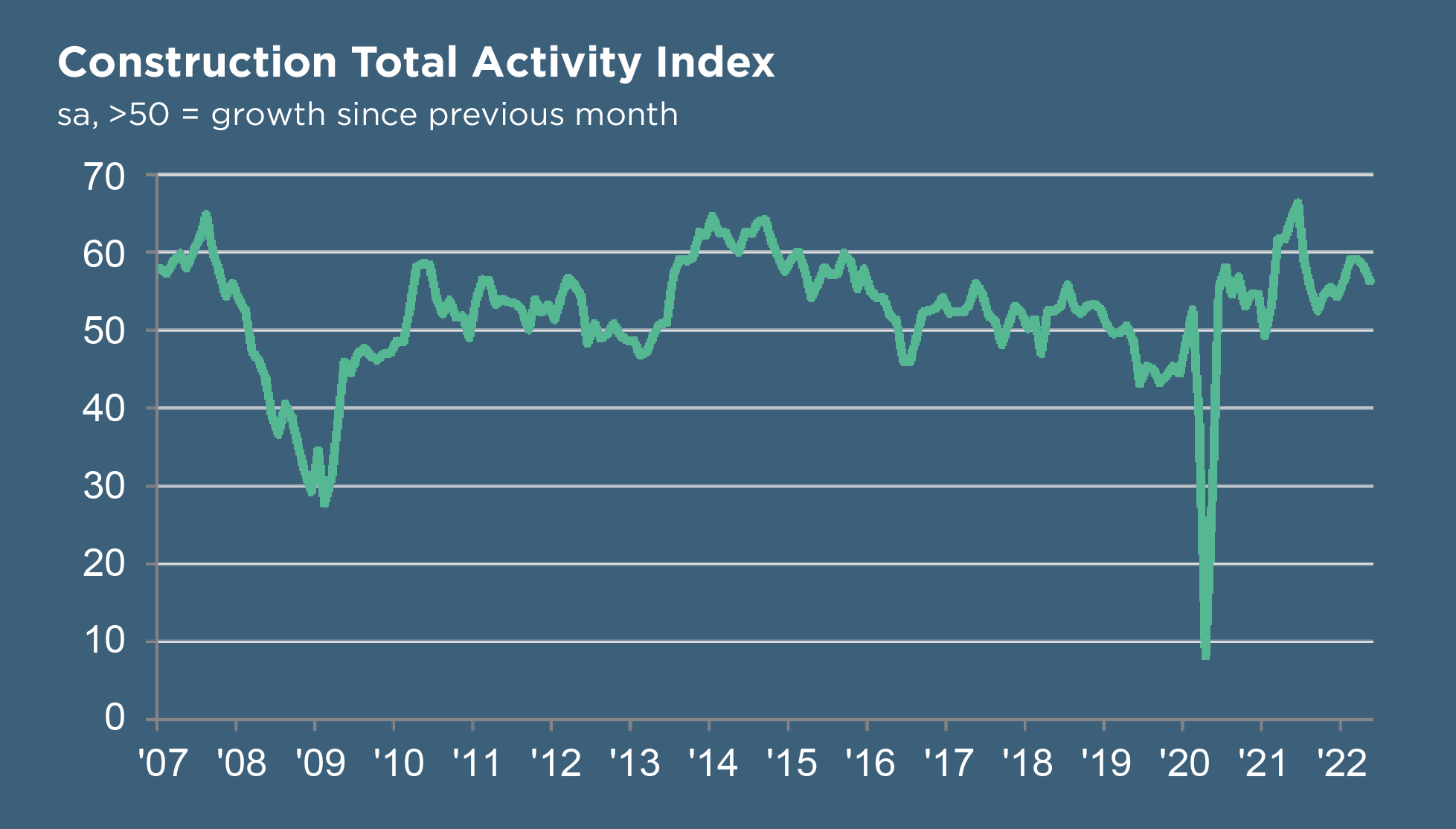

The construction sector has also experienced a slowdown in growth as new order volumes rose at the slowest rate since the end of 2021. Duncan Brock, Group Director at the Chartered Institute of Procurement and Supply, added that “the housing sector, in particular, showed further signs of fragility with the worst performance since May 2020 and moving closer to the danger of negativity territory".

IHS Markit reported that the headline S&P Global / CIPS UK Construction Purchasing Managers’ Index® (PMI®) registered 56.4 in May, down from 58.2 in April and the lowest reading for four months. Higher borrowing costs and intense inflationary pressures have constrained demand and will continue to do so throughout the next 12 months. Therefore, the latest reports indicate that business expectations are the lowest since August 2020.

These times of economic uncertainty mean that it’s even more important to have a lender that intimately understands the intricacies of the market. At CrowdProperty, we work closely and productively with the developers we back - tackling market, site and situational challenges together in partnership. Having been developers ourselves, we are laser-focused on solving the pains of small and medium-sized developers, which is why working with CrowdProperty increases the likelihood of the success of projects.

CrowdProperty is a leading specialist property development finance business having funded over £500m worth of property projects to date. Apply in just 5 minutes at www.crowdproperty.com/apply - our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

As featured in...