Borrow

Case Study

Podcasts

Awards

About

In the week that the Prime Minister promised to "fix our broken housing market", we take a look at the latest developments in the UK property market and the forecast for being able to "build back better".

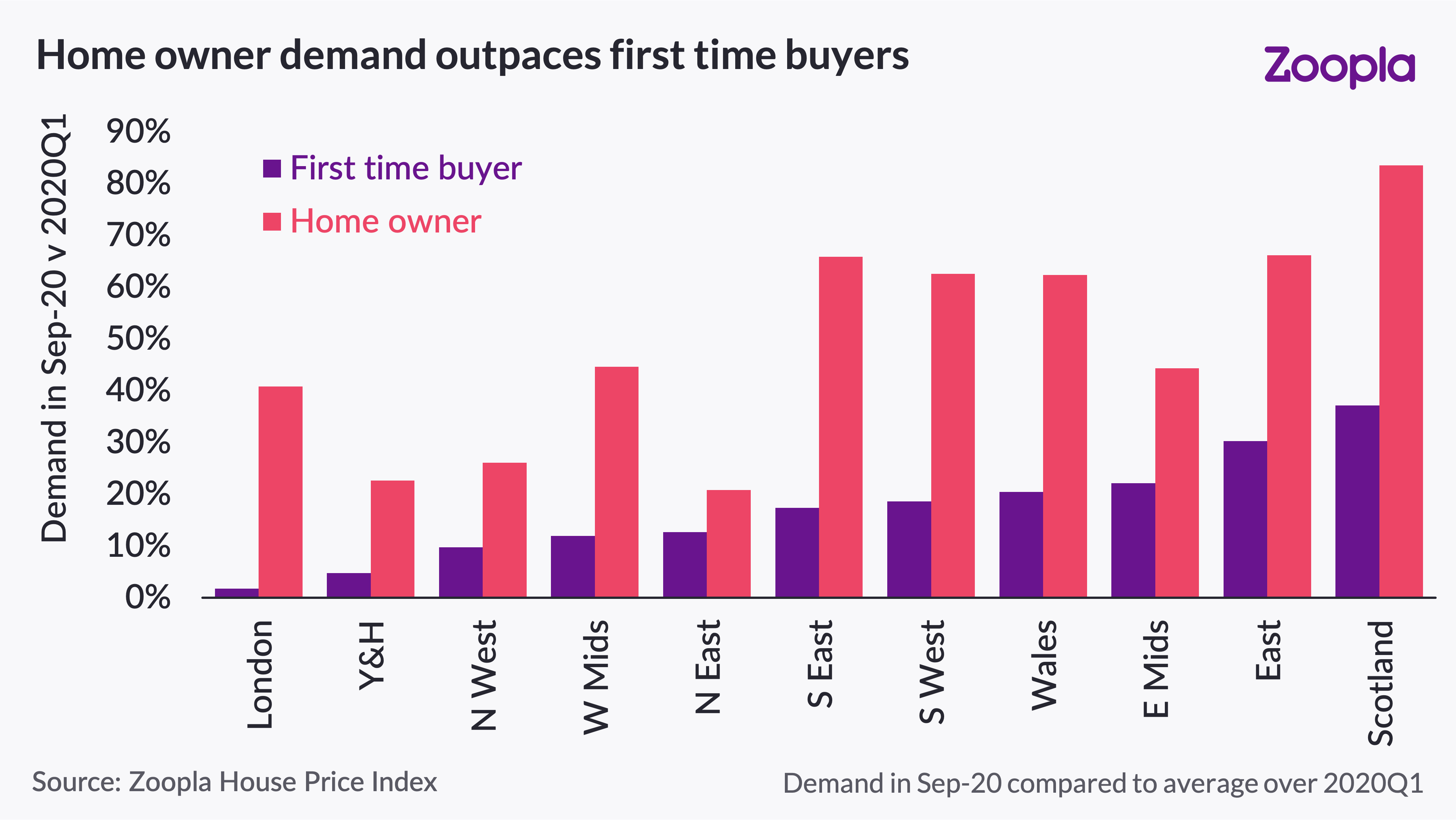

Whilst first-time buyers have been the driving force of the housing market for the last decade, Zoopla's latest House Price Index suggests that homeowners are becoming increasingly active in the market. This makes sense as "equity-rich homeowners seek more space and a change in location", while first-time buyers are being impacted by restricted mortgage availability, tighter lending criteria and growing economic uncertainty. In its analysis of the Prime Minister's speech, Rightmove suggests that the government could be looking to tackle this by bringing back 95% mortgages as part of the effort to "turn generation rent into generation buy".

As demand continues to outweigh supply, the market is seeing a 2.6% annual growth rate in UK house prices despite the economic backdrop according to Zoopla. Indeed, Nottingham and Manchester are recording annual house price growth of c. 4% alongside Leeds, Edinburgh, Leicester, Liverpool, Cardiff and Sheffield. Rightmove's data shows that searches across September increased 53% on average across the ten biggest cities, but there has also been an uplift in demand for smaller communities as buyers seek out larger spaces - analysts named nine areas where searches have doubled across Surrey, Somerset, Gloucestershire, Berkshire, Dorset, Kent and Suffolk which all have a population of under 11,000.

As mentioned in our July update, the government has announced a number of planning reforms and the Prime Minister has reiterated his promise to "transform" the planning system in order to make it faster and easier to build new homes - although no further detail was given as to how this will be implemented. The £2bn Green Homes Grant, which encourages homeowners and landlords to apply for a government-funded energy voucher to cover two-thirds of the cost (up to £5,000) of eligible improvements to make their properties more energy efficient, launched in September and will last until the end of March 2021 - by which time all work needs to be carried out. According to a Savills survey carried out earlier in the year, the environmental credentials of a property had become more important to clients as a result of the lockdown so this scheme could really add value.

According to Richard Donnell, Director of Research and Insight at Zoopla, the outlook for the housing market at the start of next year is set to be very busy due to the lag between sales being agreed and completion. Howard Archer, EY ITEM Club's Chief Economic Advisor, notes that "some temporary support in the first quarter will likely come from buyers looking to take advantage of the Stamp Duty threshold increase before it ends on 31 March".

As we noted in last month's update, both commentators also agree that continuing Brexit negotiations, the end of the furlough scheme and the prospect of rising unemployment are factors which will impact the months ahead. Despite this, the EY ITEM Club expects "housing market activity to gradually improve over the second half of 2021, allowing prices to stabilise and then start to firm as the labour market improves and the UK’s economic recovery continues. Very low borrowing costs should also help with the Bank of England unlikely to lift interest rates from 0.10% during 2021".

According to the Financial Times, the "UK economy grew less than expected in August despite a boost from the hospitality sector, adding to pressure on policymakers to do more to support the economy".

As shown in the graph below, growth in the services and industrial sectors has slowed. Construction recorded stronger growth, rising at a monthly rate of 3 per cent as the housing market picked up, but the sector was rebounding from a larger fall than other industries.

“The disappointing August growth adds to the evidence that the initial rebound in economic activity is running out of steam,” said Ruth Gregory, senior UK economist at Capital Economics. With the government's fiscal support unwinding, the expectation is that the Bank of England will expand quantitative easing by a further £250bn by the end of next year.

Despite a substantial bounceback in Q3 as a result of reduced restrictions and increased consumer spending, the EY ITEM Club believes that Q4 will be more challenging for the UK economy and growth may be limited due to rising unemployment, waning pent-up demand and increasing restrictions due to a rise in case numbers. Uncertainties over the future UK-EU trading relationship may also impact business caution and reluctance to invest.

CrowdProperty's continued exceptional performance has seen the business consistently rank in the Top 10 in Europe for lending volumes for the past five months. We are raising finance for quality projects that are ready and able to proceed with clear exit plans in liquid markets, with a quantum of units that is immaterial to proven demand levels and tighter criteria in a less competed development finance market. By empowering the multitude SME property development businesses which are key to delivering 'build, build, build', we are supporting the delivery of homes into the market and driving much-needed spend in the economy on labour, materials and services.

Find out more at www.crowdproperty.com.

View our statistics page: www.crowdproperty.com/statistics.

As featured in...