Borrow

Case Study

Podcasts

Awards

About

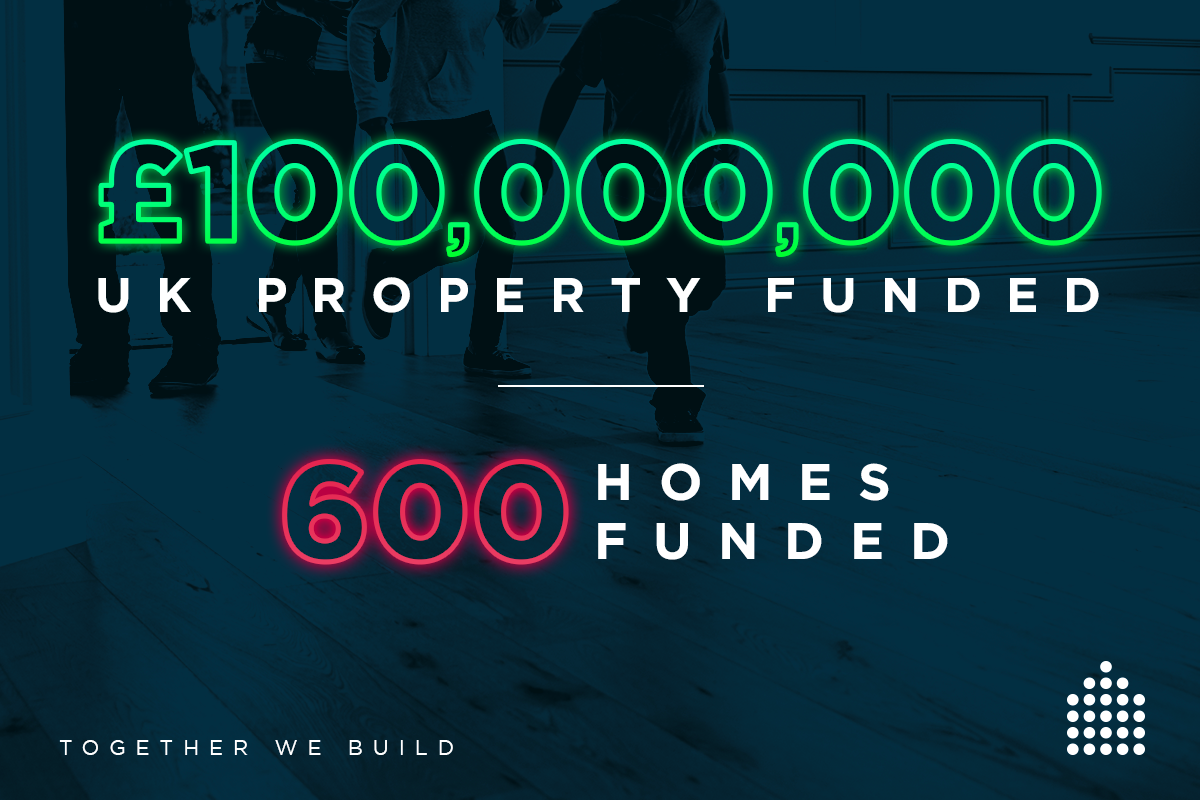

We are proud to announce that CrowdProperty has hit two more major milestones after fully funding the 92nd project on the CrowdProperty platform today. CrowdProperty has now funded the development of 600 Great British homes, worth over £100,000,000 having lent almost £40,000,000.

Hitting the 100-million-pound mark has bolstered the already overflowing CrowdProperty achievement roster. More importantly, this milestone has been hit whilst CrowdProperty maintains its 100% track record in repaying lenders’ capital and interest, with a total of £13,462,915 paid back to lenders.

This accomplishment comes shortly after the recent announcement of a major financial institution confirming a £100,000,000 loan capital backing, to be deployed in the next 12-24 months through CrowdProperty’s expertly curated projects, a testament to CrowdProperty’s best in class operating practice, perfect track record, deep expertise-led rigorous due diligence and uniquely disruptive operating model.

As we hit these important milestones, we stay true to our commitment to supporting SME property professionals grow their property businesses quicker by making funding for quality property projects more accessible, and as a result delivering significant economic benefit throughout the country (including Scotland and Northern Ireland where responsive and efficient SME property development lenders are even fewer and farther between).

Mike Bristow, CEO of CrowdProperty commented that “These landmarks are testament to the pains we are solving for both lenders and borrowers and also the wider need for housing supply in the UK. Since 2014 we have relentlessly focused on solving these pains and have built deep expertise-led and tech-enabled robust systems and processes, disrupting the traditional property funding value chain to a unique extent. This means we highly efficiently and highly effectively originate, match and secure the supply and demand of capital for quality property projects.

“These landmarks are just the start. We are growing a long-term, sustainable business at CrowdProperty. We proudly align to the very best operating practices, including award-winning transparency, election to the top table of the sector in the P2PFA and our commitment to be held to account for the performance of every loan we originate through complete openness to independent third-party verification by Brismo, the market leading provider of lending performance data. Our expertise-led, high quality lending and strongly secured positioning will ensure we continue to stand out in delivering a better deal to lenders and borrowers alike for many years to come.

In light of recent market developments, we believe it’s imperative to see increasing regulatory requirements coming into the peer-to-peer lending sector as it matures, furthering the UK's global leadership in this exciting sector. The spectrum of operating rigour will be forced to close, meaning many will need to significantly improve or exit, leaving the best practitioners to continue to shine on a global stage.”

As featured in...